HIA released its quarterly economic and industry outlook report today.

They plea for weaker lending standards to revitalise the residential construction sector. In other words let the debt bomb get ever bigger!

The State and National Outlook Reports include updated forecasts for new home building and renovations activity for Australia and each of the eight states and territories.

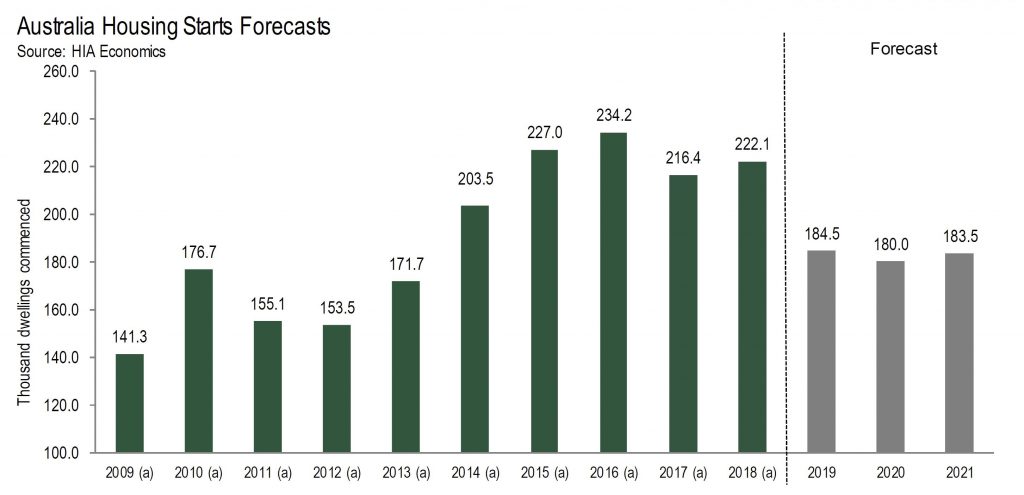

Preliminary data suggests that the housing market has adjusted from a strong annualised rate of home building of around 220,000 homes per year this time last year, to around 183,000 at the start of 2019

“The low number of building approvals in the first three months of 2019 are of concern. With this poor quarter of results, the number of new homes being built has fallen by 15.2 per cent this year and a further decline in activity through this calendar year of around 11.0 per cent is expected,” stated HIA’s Chief Economist, Tim Reardon.

“We had anticipated that this correction to new home building would take two years, not six months.

“Market confidence fell away in the later part of 2018 as dwelling prices corrected, adversely impacting all segments of the market. Investors and owner occupiers are delaying purchase decisions and foreign investment has also fallen dramatically due to a range of government restrictions.

“At the start of 2019 the most encouraging news for the building industry was that a strong national economy would be sufficient to pull the home building industry through this downturn. These hopes fell away as GDP slowed.

“The RBA has repeatedly stated that it is looking for a deterioration in the labour market before it moves to lower interest rates further. There is a risk that if they wait for this trigger, it might be too late for the home building industry which will adjust employment levels for this lower level of activity.

“Unfortunately, a cut to interest rates in 2019 will not have the same positive impact on new home building as in previous cycles.

“Banks are assessing borrowing capacity against a minimum floor of a 7.25 per cent mortgage rate and for ‘Interest Only’ loans to be assessed on a Principal and Interest basis for the term of the loan. An easing of APRA’s lending restrictions would have a more significant impact on home building and the broader economy, than a further cut to interest rates alone.

“Regardless of the timing of a cut to interest rates or the repeal of regulatory restrictions in the housing market, the impact of a slowing economy and the ongoing impact of the credit squeeze will continue to force new home building lower.

“As a consequence, there is a need to downgrade our expectations of the speed of the current downturn in the housing market further,” concluded Mr Reardon.