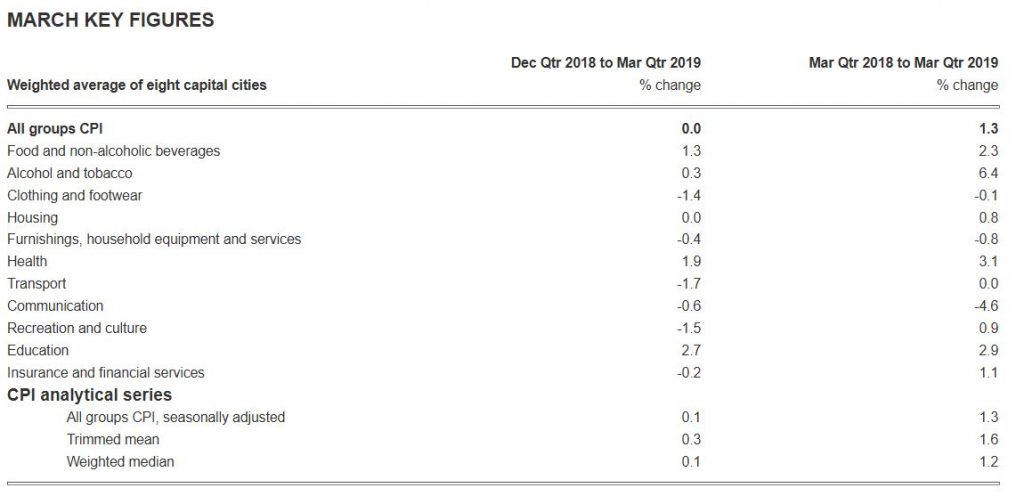

The Consumer Price Index (CPI) recorded no movement (0.0 per cent) in the March quarter 2019, according to the latest Australian Bureau of Statistics (ABS) figures. This follows a rise of 0.5 per cent in the December quarter 2018.

This just shows how far the real economy is from the CPI calculations, and the RBA is way off in its policy settings, and expectations!

The March quarter 2019 CPI was a result of price rises in a number of goods and services being fully offset by a number of price falls. This was consistent across most of the capital cities.

The most significant rises in the March quarter were vegetables (+7.7 per cent), secondary education (+4.2 per cent) and motor vehicles (+2.4 per cent). Drought and adverse weather conditions continue to reduce the supply of a selection of fruits and vegetables.

These rises were offset by falls in automotive fuel (-8.7 per cent), domestic holiday, travel and accommodation (-3.8 per cent) and international holiday, travel and accommodation (-2.1 per cent). Lower world oil prices at the end of 2018 saw automotive fuel prices fall 6.1 per cent in January, before rising in February and March, 4.2 per cent and 5.2 per cent respectively.

The CPI rose 1.3 per cent per cent through the year to the March quarter 2019, after increasing 1.8 per cent through the year to the December quarter 2018.

SYDNEY (-0.1%)

The main contributors to the fall in Sydney are automotive fuel (-8.6%),

domestic holiday, travel and accommodation (-4.5%) and international

holiday, travel and accommodation (-2.6%). Rents (-0.2%) also fell this

quarter due to higher vacancy rates reflecting an increase in the supply

of rental properties. The fall is partially offset by rises in

vegetables (+9.1%), secondary education (+5.6%) and motor vehicles

(+3.0%).

MELBOURNE (+0.1%)

The main contributors to the rise in Melbourne this quarter are

vegetables (+7.5%), secondary education (+4.0%) and motor vehicles

(+2.5%). The rise is partially offset by falls in automotive fuel

(-9.1%) and new dwelling purchase by owner-occupiers (-1.2%). The fall

in new dwelling purchase by owner-occupiers is due to increased

competition as demand declines in the detached dwellings market.

BRISBANE (+0.1%)

The main contributors to the rise in Brisbane are vegetables (+8.1%),

motor vehicles (+2.2%) and medical and hospital services (+1.8%). The

rise is partially offset by falls in automotive fuel (-8.1%), domestic

holiday, travel and accommodation (-6.0%) and international holiday,

travel and accommodation (-2.0%).

ADELAIDE (+0.1%)

The main contributors to the rise in Adelaide this quarter are

vegetables (+6.1%), pharmaceutical products (+4.2%) and fruit (+3.7%).

The rise is partially offset by falls in automotive fuel (-7.8%) and

domestic holiday, travel and accommodation (-3.1%).

PERTH (-0.1%)

The main contributors to the fall in Perth this quarter are automotive

fuel (-8.8%) and domestic holiday, travel and accommodation (-5.5%). The

fall is partially offset by rises in medical and hospital services

(+1.4%), pharmaceutical products (+5.2%), vegetables (+4.8%) and

secondary education (+2.6%).

HOBART (-0.2%)

The main contributors to the fall in Hobart this quarter are automotive

fuel (-10.2%) and domestic holiday, travel and accommodation (-3.4%).

The fall is partially offset by rises in rents (+1.6%), pharmaceutical

products (+6.5%) and vegetables (+4.5%).

DARWIN (-0.8%)

The main contributors to the fall in Darwin this quarter are automotive

fuel (-14.3%) and domestic holiday, travel and accommodation (-11.2%).

The fall is partially offset by rises in vegetables (+7.5%),

pharmaceutical products (+5.0%) and other financial services (+1.6%).

The fall in domestic holiday, travel and accommodation is due to the low

tourist season in Darwin.

CANBERRA (+0.1%)

The main contributors to the rise in Canberra this quarter are

vegetables (+8.4%), medical and hospital services (+2.2%) and secondary

education (+4.6%). The rise is partially offset by falls in automotive

fuel (-9.4%) and domestic holiday, travel and accommodation (-4.1%).