The ABA says there is some great news for Australian small businesses who are now paying $9 billion less in interest on current loans than compared to the same time in 2011, with the average interest paid the lowest in 20 years.

According to RBA data, the past six years have seen significant falls in interest rates for small business, with average rates paid on their loans now at the lowest levels since RBA data commenced in 1993.

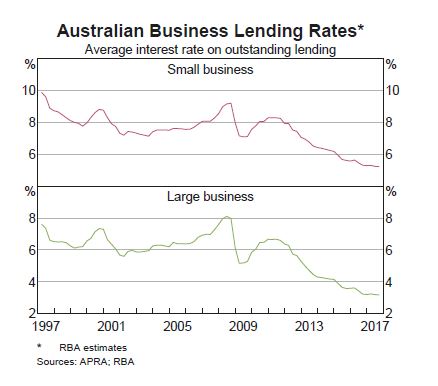

We assume this is the chart the ABA is referring to – larger business are getting better rates by far!

But it is not that simple, as this chart also from the RBA shows. Advertised rates from both term residential security and overdraft are rising (despite no change to the cash rate). So the ABA is choosing the chart to fit their narrative.

But it is not that simple, as this chart also from the RBA shows. Advertised rates from both term residential security and overdraft are rising (despite no change to the cash rate). So the ABA is choosing the chart to fit their narrative.

Australian Bankers’ Association Chief Economist Tony Pearson said small businesses are a significant driver of the Australian economy, so anything that assists them is good news.

“Less interest paid by small business on their loans will help drive economic growth, create new jobs and tackle unemployment,” Mr Pearson said.

“The average interest rate paid on all current loans held by small businesses has fallen in the past six years from 8.40 per cent in 2011 to 5.30 per cent now. Based on a loan of $100,000 that equates to an interest saving of around $3,000 per year.

“When you look at the bigger picture the story is even more positive. As of September, there were a total of $282 billion in outstanding loans to small businesses in Australia, and based on the lower rates, they’re now paying almost $9 billion less a year in interest compared with the same time in 2011.

“With two million small businesses in Australia, employing nearly five million people, we need to ensure this sector continues to flourish,” Mr Pearson said.

Kevin Taylor runs ProActive Chartered Accountants and says for himself, and his 200 plus small business clients, low interest rates are good for the bottom line.

“Every dollar saved means extra profits or a chance to help the business grow by reinvesting in new equipment or hiring more staff,” Mr Taylor said.

“Additional cash flow, through low interest rates, means you can pay down the loan sooner, or put it away for a rainy day. Whatever you choose to do it’s a positive for the business and the economy.

“While business interest rates are at record lows, electricity prices are at the other end of the scale. Higher electricity prices are a double negative for businesses, as they have to pay the bills and their clients have less money to spend on other things,” Mr Taylor said.

For larger businesses, the average interest rate has fallen from 7.10 per cent to 3.40 per cent over the past six years. As of September, there were a total of $747 billion in outstanding loans to large businesses. The amount of interest being saved annually, when compared with six years ago, is a staggering $27.6 billion.

“That’s a lot of extra money that can be invested into growing a business and creating jobs,” Mr Pearson said.