ANZ reported their 1H19 results today. Their “shrink to greatness strategy” did work to an extent, but their results were flattered by higher than expected Institutional performance, which offset the pressure on the Australian retail bank from lower mortgage growth and margins, and higher customer remediation costs. They are well capitalised, which is a good thing, given the higher and building mortgage delinquency. They foresee tough times ahead. Tricky times to be a banker.

The results are also muddied by the many business exits and restatements and a significant reduction in staff. But among the big four, they are probably the best placed, but will be hit if mortgage delinquency continues to rise (as we suspect they will) as the Australian economy stalls.

They announced a Statutory Profit after tax for the Half Year ended 31 March 2019 of $3.17 billion, down 5% on the prior comparable period.

Cash Profit for its continuing operations was $3.56 billion, up 2%. The return on equity was 12% compared with 11.9% 1H18, while the return on average assets fell 2 basis points from 0.79% in 1H18 to 0.77% 1H19.

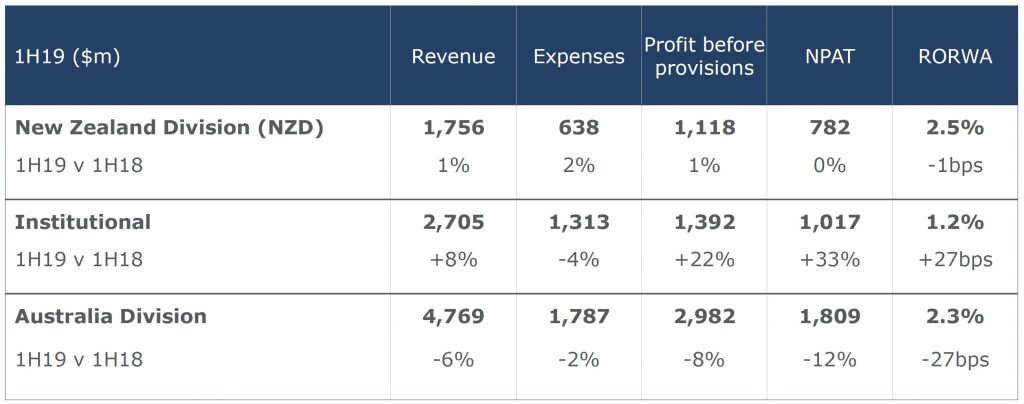

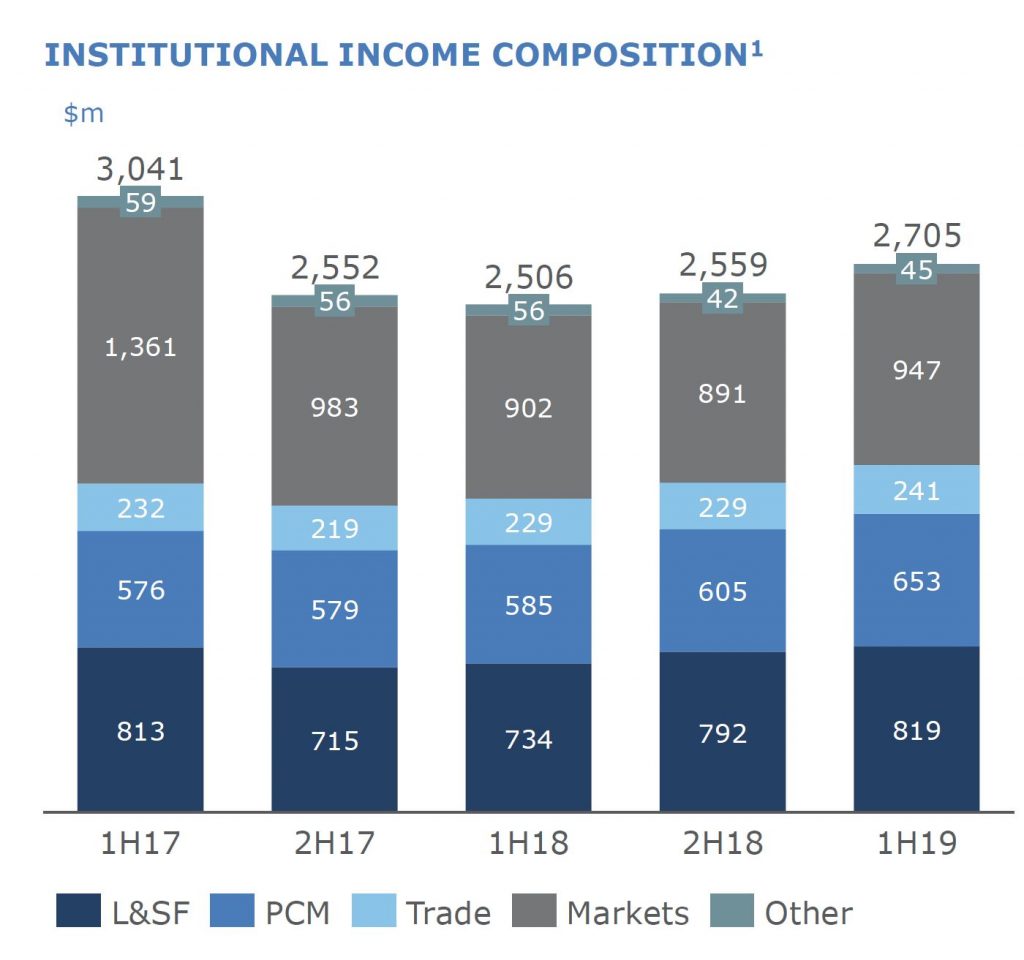

Institutional delivered a higher than expected income (but that may not be sustainable), while other sectors were under more pressure. Institutional profit was up 33%.

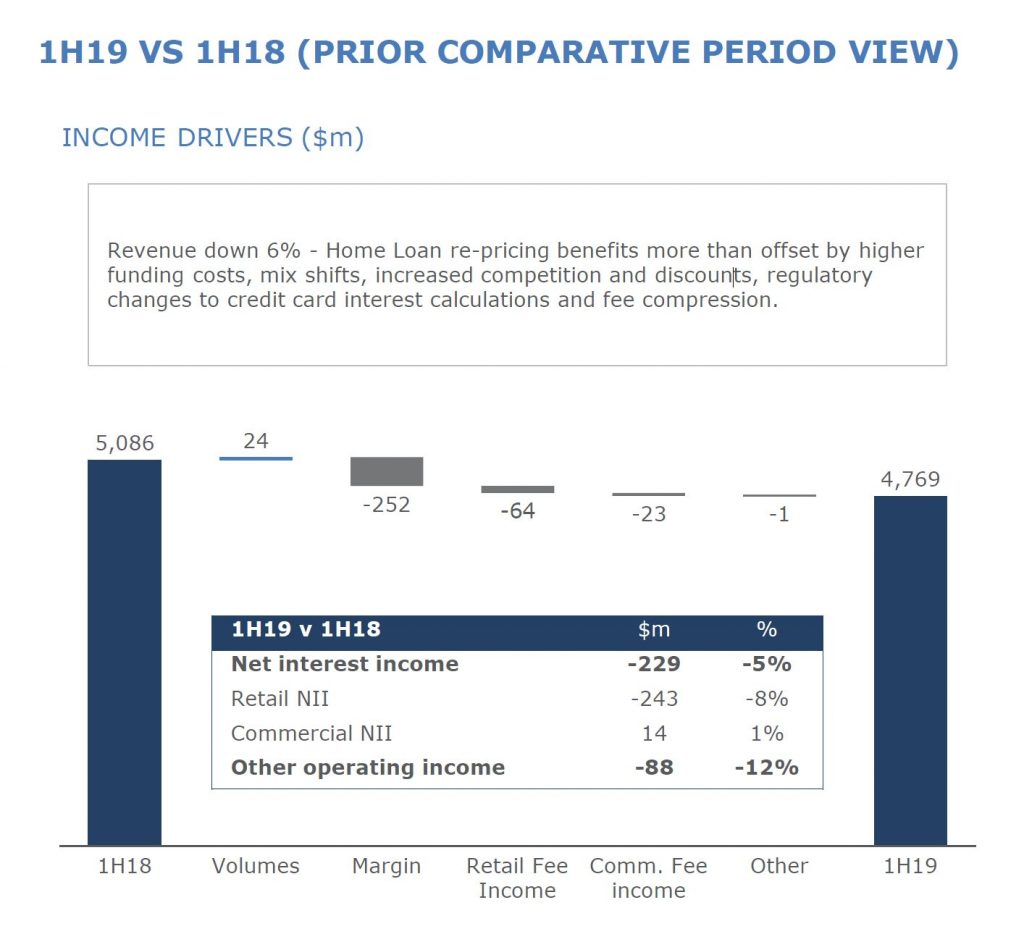

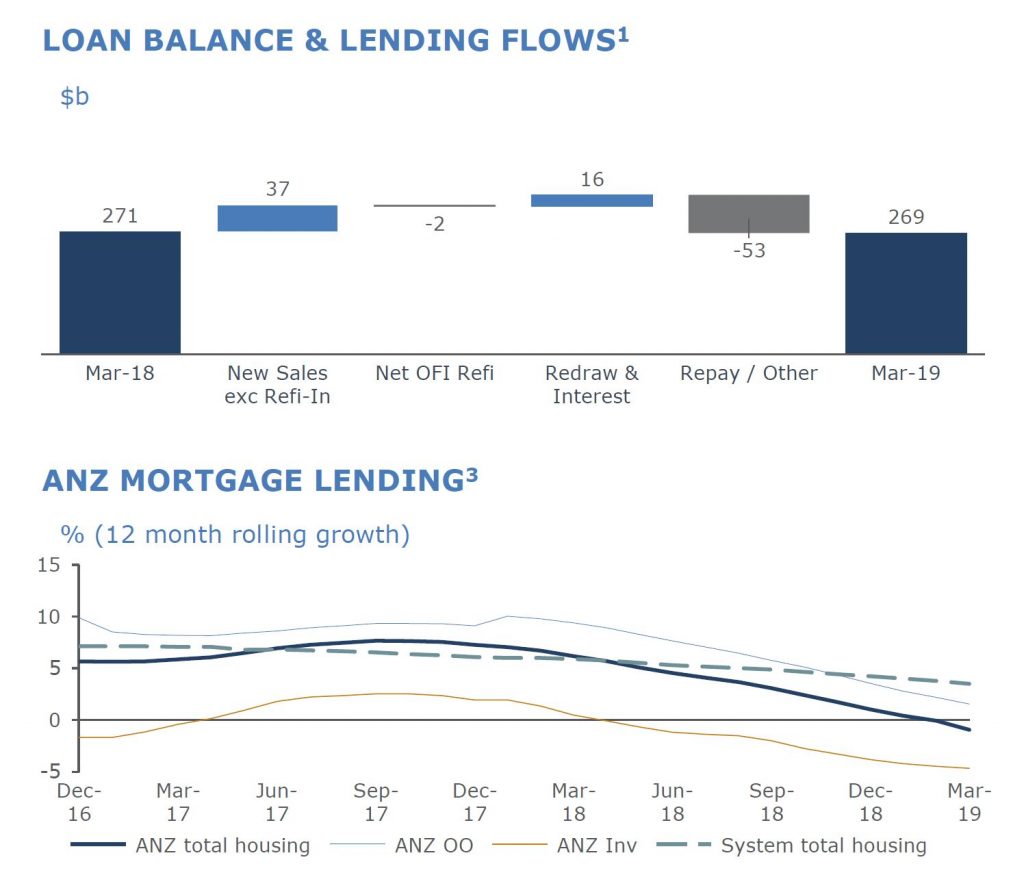

Slower credit demand put pressure on the retail bank, through lower volume growth and reduced fee income. Australian revenue was down 6% as home loan repricing benefit was more than offset by higher funding, increased competition, discounts and regulatory changes.

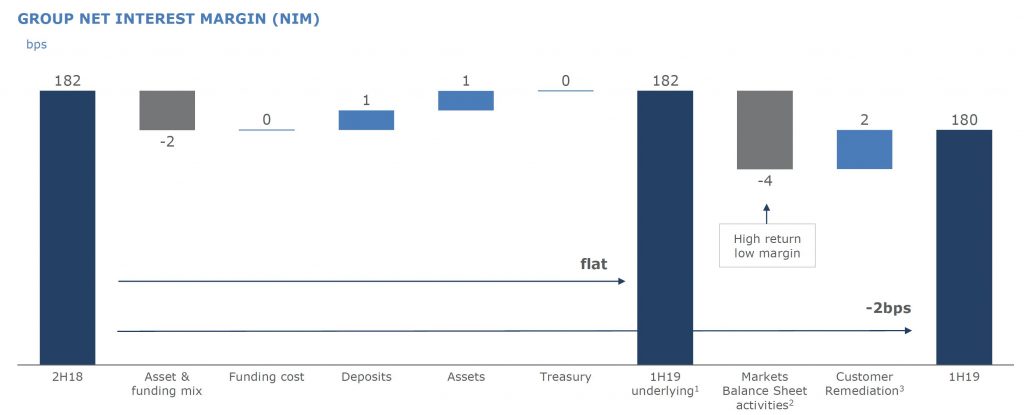

Net interest margin (continuing operations), dropped 2 basis points from 2H18, impacted by funding and asset mix, and markets. Customer remediation added 2 basis points, weirdly. Management, in their briefing said that underlying NIM pressures will persist into 2H19.

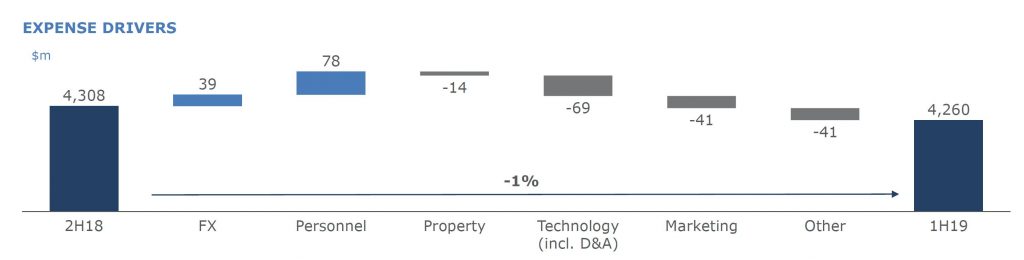

ANZ’s programme of asset sales and restructure benefited the business, and staff (FTE) fell 5% from 41,580 1H18 to 39,359 1H19. Costs were cut as a result, reducing the cost of running the bank by approximately $300 million and they absorbed ~$550m inflation.

However the customer remediation programme is up to $926m ($657m post tax) since 1H17, $698m on Balance Sheet at 31 March 2019. They are currently resolving issues with more than 2.6m customers across retail a commercial lines.

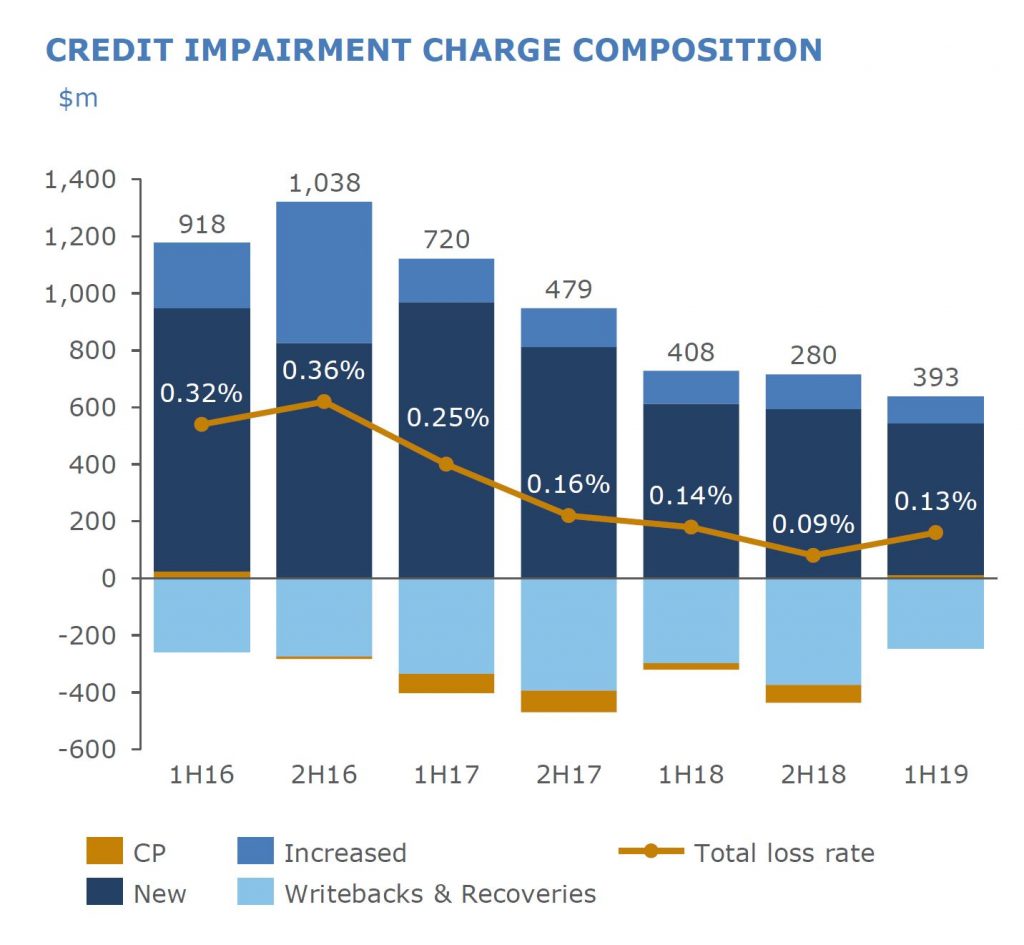

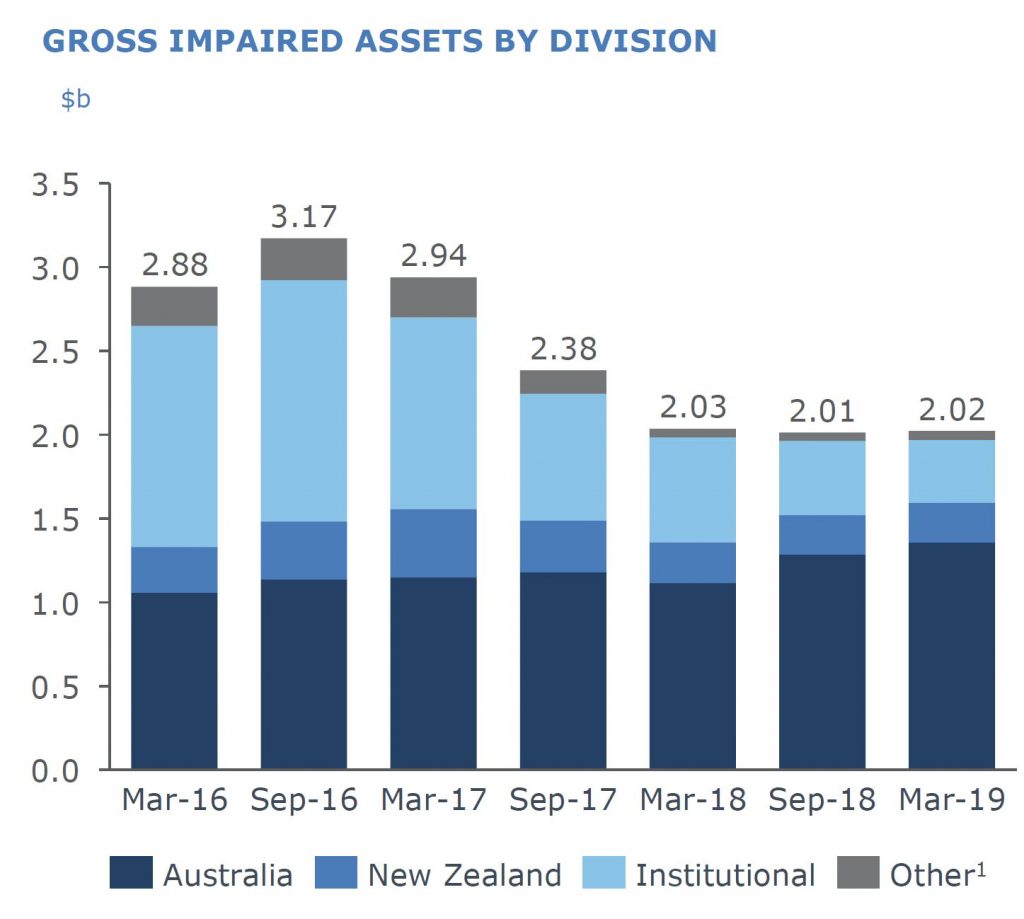

The total provision charge for the half was $393 million, down 4% from this time last year. The Group Loss rate decreased marginally to 13bps for the half (from 14bps in the first half of 2018). New Impaired assets declined to $890 million, down 8% compared to this time last year with Gross Impaired Assets broadly flat over the same period.

Australian gross impairments have rise from a low of March 2018, offset by lower provisions from Institutional.

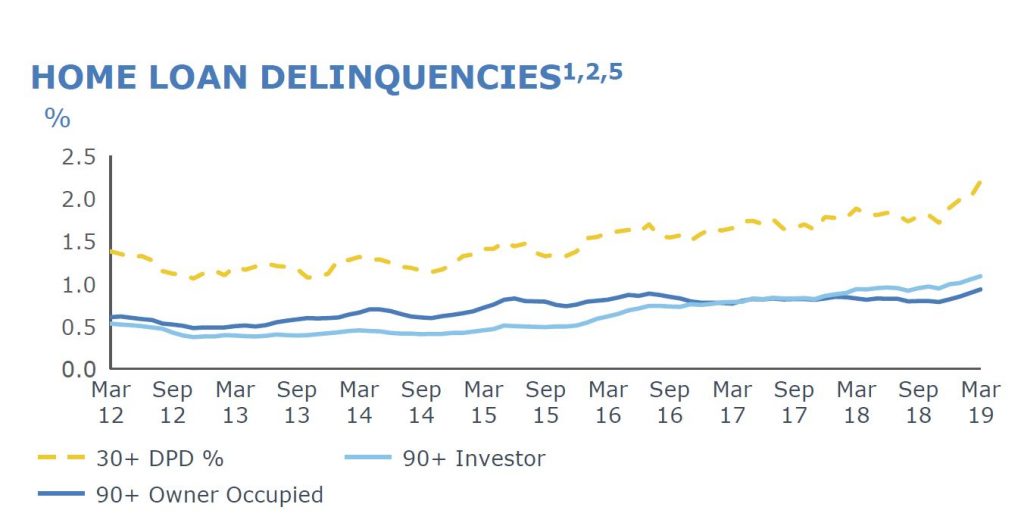

Mortgage arrears in Australia rose quite significantly, despite below system mortgage growth by ANZ. In their briefing, ANZ said its Australian mortgage book will shrink further 2H19, because their strategies which are aimed at improving momentum in this business will take time to flow through.

30 day and 90 delinquencies (missed payments) are rising, with property investors higher than owner occupied borrowers. 90+ day past due is at 100 basis point compared with 89 basis points prior, as well as the hike in 30+ day past due.

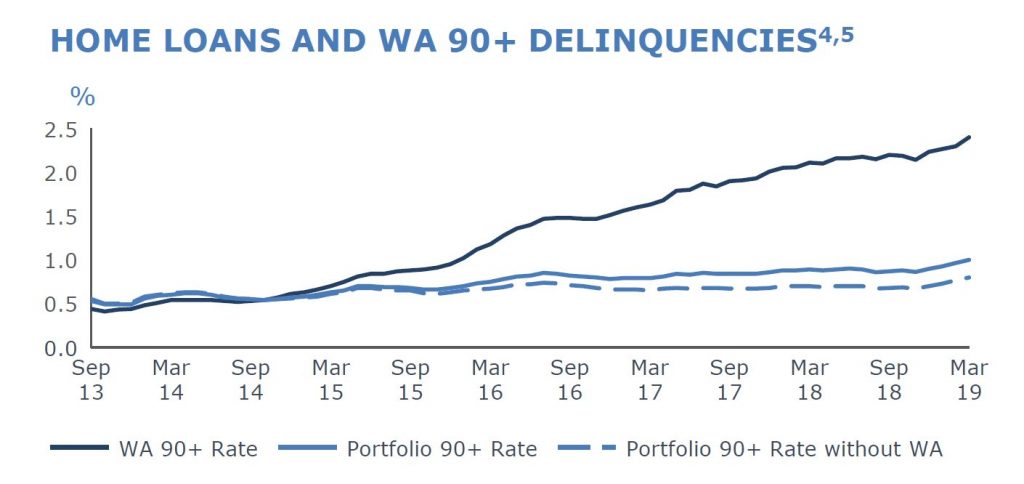

WA delinquency comprise 30% of 90 day plus delinquency, despite being just 13% of the portfolio, and 65% of losses come from WA. Whereas NSW/ACT makes up 32% of the portfolio but 23% of 90 day plus past due.

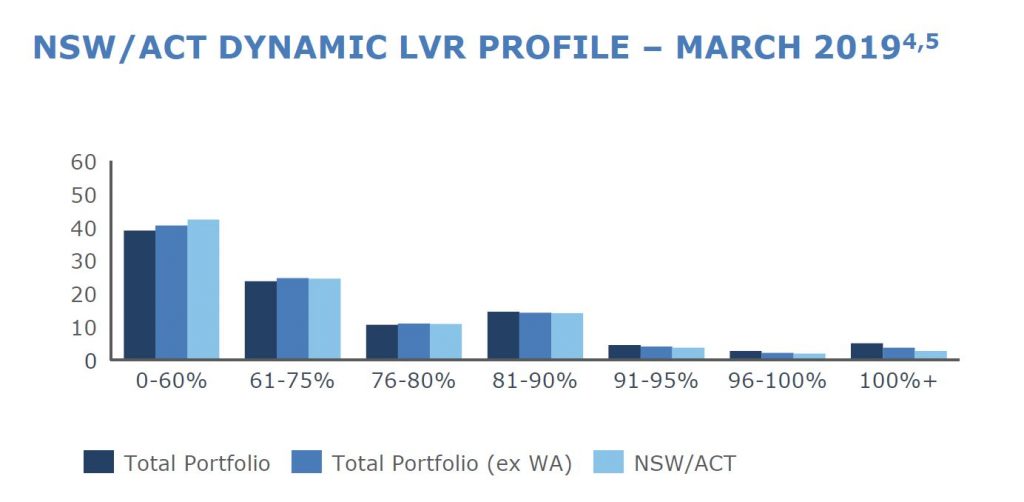

The NSW “dynamic LVR” includes 8.2% of loans above 90% (but note they say “valuations updated to February 2019 where available”, so this is understated in my view – what share of the portfolio is marked to market?. Given falling prices in NSW, more loans will drop into negative equity. And remember this is LOANS not HOUSEHOLDS. Losses in Australian mortgages housing was 4 basis points in 1H19, up from 2 basis points prior.

In the briefing, they attributed the rise in mortgage delinquencies to:

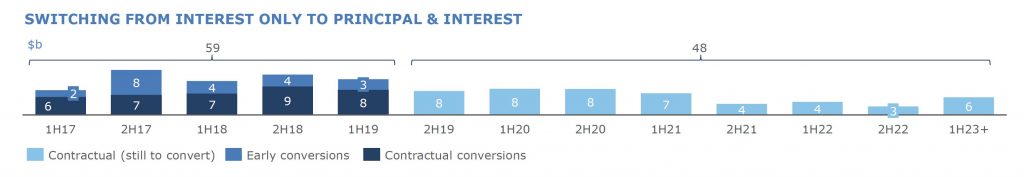

- the shift from interest-only to principal and interest loans, demanding higher repayments

- subdued wage growth putting more financial pressure on households

- the trend in falling house prices

- a longer cure time-frame, as delinquencies are now taking a longer time to cure thanks to extended property sale time-frames

- the “denominator effect” of lower loan growth and shrinking mortgage book

None of this is going to change anytime soon.

Switching from IO to PI will continue.

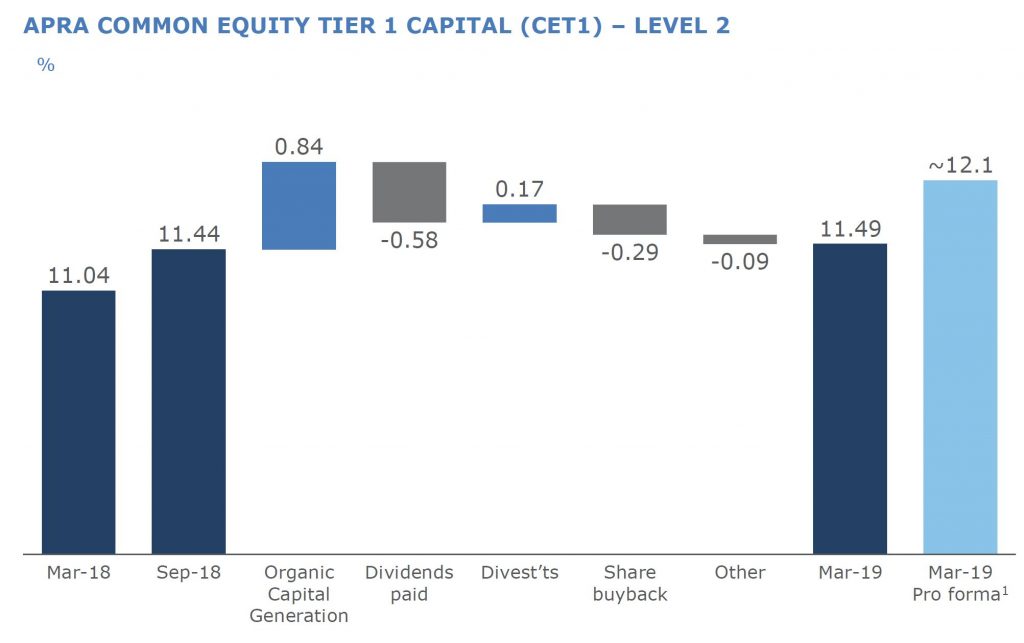

ANZ’s Common Equity Tier 1 Capital Ratio increased to 11.5%, up 45 basis points (bps). Return on Equity increased 13 bps to 12.0% with Cash Earnings per Share up 5% to 124.8 cents.

The Group’s funding and liquidity position remained strong with the Liquidity Coverage Ratio at 137% and Net Stable Funding Ratio at 115%.

The Interim Dividend is 80 cents per share, fully franked. This equates to $2.27 billion to be paid to shareholders. The 3.7% reduction in shares due to the completion of the $3 billion buy-back assisted.

The CEO said :

Retail banking in Australia will remain under pressure for the foreseeable future with subdued credit growth, intense competition and increased compliance costs impacting earnings.

“New Zealand is performing well, however it is starting to share similar characteristics with the Australian market due to strong competition and a slowing Auckland housing market. The major concern in New Zealand remains the impact of the proposed capital changes on the broader economy.

“Institutional banking is performing well and positioned to provide positive earnings diversification, which will partially offset the headwinds in other parts of the Group