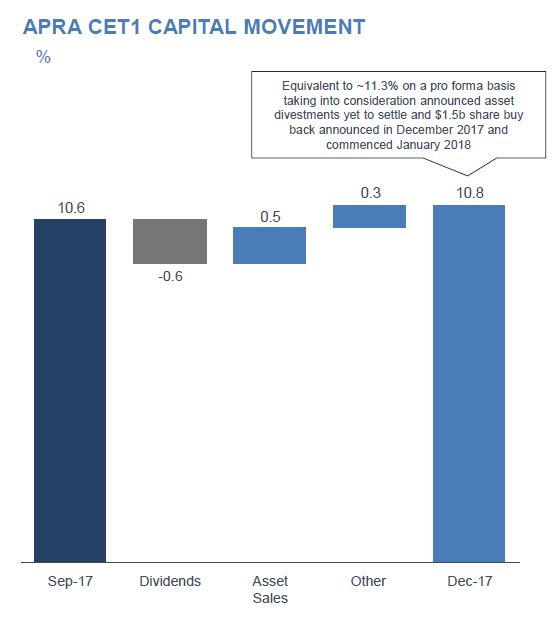

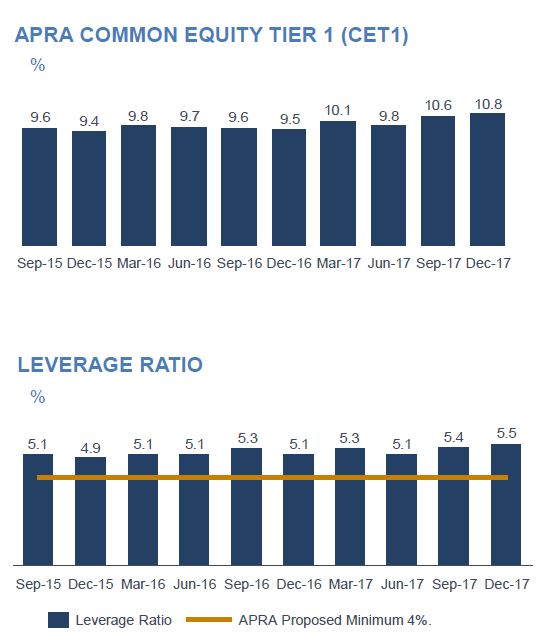

ANZ Banking Group released their 1Q update today. Overall capital ratios are up, with their Common Equity Tier 1 (CET1) ratio at 10.82% at Dec-17, 25bp increase from Sep-17. Dec-17. CET1 ratio includes the proceeds of the sale of Shanghai Rural Commercial Bank stake and a small benefit from the sale of the Asian retail and wealth businesses (Taiwan & Vietnam settlements in the December quarter).

Funding and liquidity position remains strong with LCR 131% (Dec-17

Funding and liquidity position remains strong with LCR 131% (Dec-17

quarter avg) and NSFR 114% (as at 31-Dec-17).

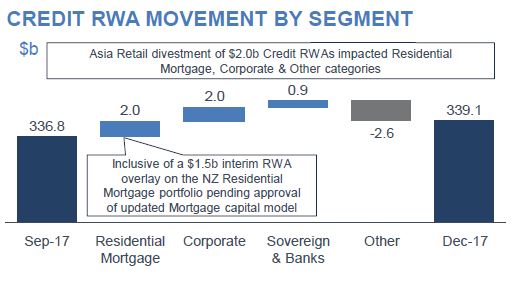

Total Risk Weighted Assets (RWA) increased $2.4b, including a $2.3b increase in Credit RWA, with growth in Residential Mortgages, Corporate and Bank Pillar 3 categories.

Total Risk Weighted Assets (RWA) increased $2.4b, including a $2.3b increase in Credit RWA, with growth in Residential Mortgages, Corporate and Bank Pillar 3 categories.

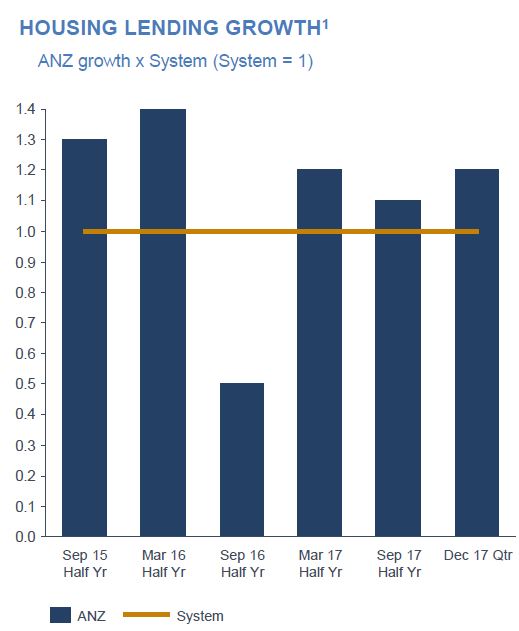

Home lending portfolio grew at 1.2 times system in the December quarter, with Owner Occupied growth of 10% annualised (1.4 times system), Investor growth of 2% annualised.

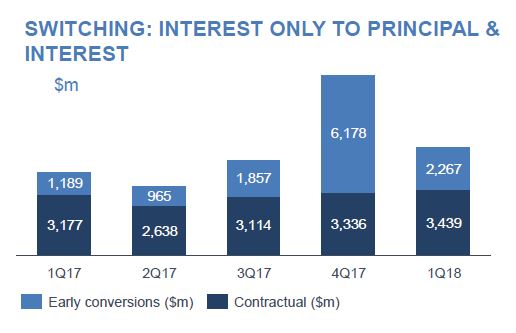

Home lending portfolio grew at 1.2 times system in the December quarter, with Owner Occupied growth of 10% annualised (1.4 times system), Investor growth of 2% annualised. Interest only new business in the December quarter (1Q18) represented 14.3% of total new business flows. $5.7b of interest only loans switched to principal and interest in 1Q18, compared with $9.5b in 4Q17 and $4.3b per quarter on average across 1Q17 to 3Q17.

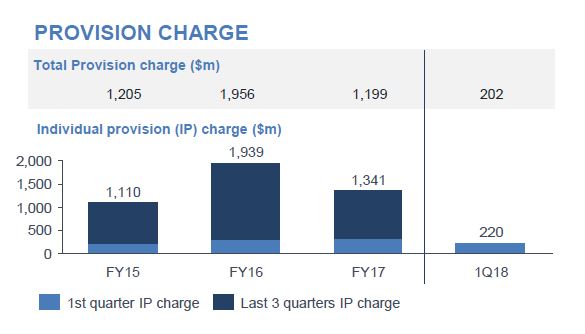

Interest only new business in the December quarter (1Q18) represented 14.3% of total new business flows. $5.7b of interest only loans switched to principal and interest in 1Q18, compared with $9.5b in 4Q17 and $4.3b per quarter on average across 1Q17 to 3Q17. Total provision charge of $202m in 1Q18 with individual provision charge of $220m.

Total provision charge of $202m in 1Q18 with individual provision charge of $220m.

Residential Mortgage 90+ day past due loans (as a % of Residential Mortgage EAD) increased by 1bp.

Residential Mortgage 90+ day past due loans (as a % of Residential Mortgage EAD) increased by 1bp.