Wayne Byres, APRA chairman appeared before the Senate Economics Legislation Committee today.

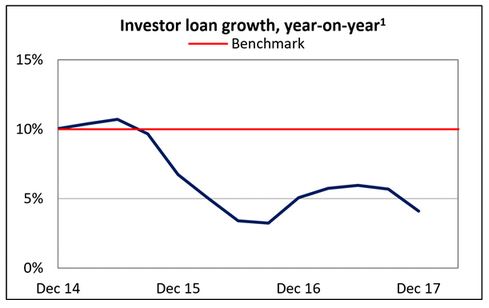

During the session he said that the 10% cap on banks lending to housing investors imposed in December 2014 was “probably reaching the end of its useful life” as lending standards have improved. Essentially it had become redundant.

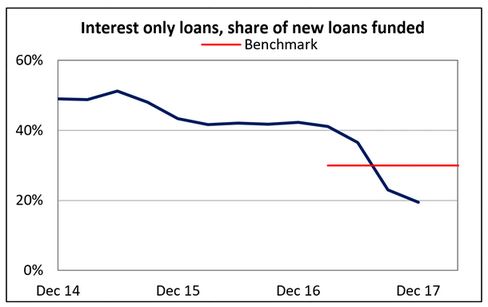

But the other policy which is a limit of more than 30% of lending interest only will stay in place. This more recent additional intervention, dating from March 2017, will stay for now, despite it being a temporary measure. The 30% cap is based on the flow of new lending in a particular quarter, relative to the total flow of new lending in that quarter.

This all points to tighter mortgage lending standards ahead, but still does not address the risks in the back book.

But the tougher lending standards which are now in place will be part of the furniture, plus the new capital risk weightings recently announced. Its all now focussing on loan serviceability, something which should have been on the agenda 5 years ago!

The evidence before the Senate on mortgage fraud is worth watching.

He also included some interesting and relevant charts.

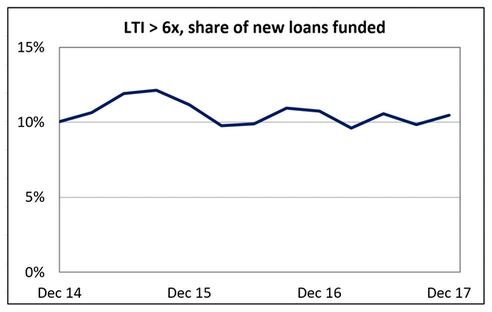

Around 10% of new loans are still Loan to income is still tracking above 6 times loan to income.

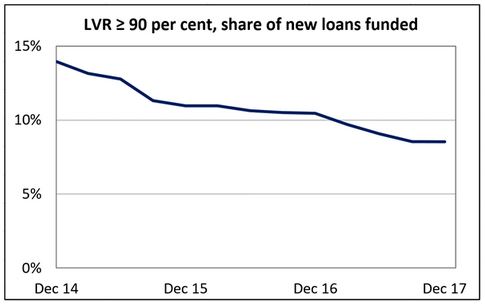

This despite a fall in high LVR new loans.

This despite a fall in high LVR new loans.

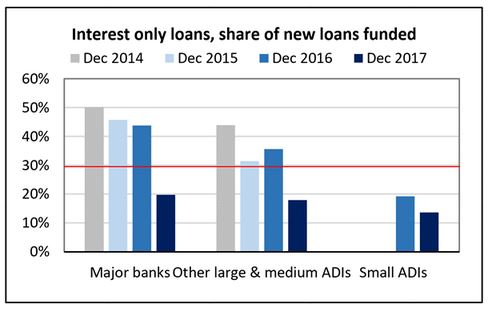

The volume of new interest only loans is down, 20% of loans from the major banks are interest only, higher than other ADI’s

The volume of new interest only loans is down, 20% of loans from the major banks are interest only, higher than other ADI’s

Overall investor loan growth is lower, in fact small ADI’s have slightly higher growth rates than the majors.

Overall investor loan growth is lower, in fact small ADI’s have slightly higher growth rates than the majors.

As a result of the changes the share of new interest only loans has dropped below the target 30%, to about 20%.

As a result of the changes the share of new interest only loans has dropped below the target 30%, to about 20%.

And investor loans are growing at less than 5% overall, significantly lower than previously.

And investor loans are growing at less than 5% overall, significantly lower than previously.

So you could say the APRA caps have worked, but more permanent and calibrated measures are the future.

So you could say the APRA caps have worked, but more permanent and calibrated measures are the future.

More broadly, here are his remarks:

I’d like to start this morning by highlighting the importance of the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Bill 2017 which – with the welcome endorsement of this Committee – was recently passed into law by the Parliament.

The Bill delivers a long-awaited and much needed strengthening of APRA’s crisis management powers, better equipping us to deal with a financial crisis and thereby to protect the financial well-being of the Australian community. Put simply, these powers give us enhanced tools to fulfil our key purpose in relation to banking and insurance: to protect bank depositors and insurance policyholders. That purpose is at the heart of all that we do, and the legislation is designed with that protection very much in mind.

With the Bill now passed, the task ahead for APRA is to invest in the necessary preparation and planning to make sure the tools within the new legislation can be effectively used when needed. We hope that is neither an imminent nor common occurrence, but we have much work to do in the period ahead to make sure we, along with the other agencies within the Council of Financial Regulators that will be part of any crisis response, have done the necessary homework to use these new powers effectively when the time comes.

So that is one key piece of work for us in the foreseeable future. But it is far from the only issue on our plate. With the goal of giving industry participants and other stakeholders more visibility and a better understanding of our work program, we released a new publication in January this year outlining our policy priorities for the year ahead across each of the industries we supervise.1 Initial feedback has welcomed this improved transparency of the future pipeline of regulatory initiatives, and the broad timeline for them.

That publication is one example of our ongoing effort to improve our processes of engagement and consultation with the financial sector and other stakeholders. Another prominent example is that we’ve just embarked on our most substantial program of industry engagement to date as we seek input into the design and implementation of our next generation data collection tool.2 Through this process, which we launched on Monday this week, all of our stakeholders will have an opportunity to tell us – at an early stage of its design – what they would like to see the new system deliver, as well as influence how we roll it out.

More generally, and recognising the increased expectations of all public institutions, I thought it would also be timely to briefly recap the ways APRA is accountable for the work we do supervising financial institutions for the benefit of the Australian community. At a time when Parliament has moved to strengthen APRA’s regulatory powers, we fully accept that these accountability measures take on added importance. They play a crucial role in reassuring all of our stakeholders that APRA is acting at all times according to our statutory mandate.

APRA’s accountability measures are many and varied. They start with the obvious measures such as our Annual Report, our Corporate Plan and Annual Performance Statement, and our assessment against the Government’s Regulator Performance Framework. We obviously also make regular appearances before Parliamentary committees such as this to answer questions about our activities, and now meet with the Financial Sector Advisory Council in their role reporting on the performance of regulators. Our annual budget, and the industry levies that fund us, are set by the Government, which also issues us a Statement of Expectations as to how we should approach our role. We comply with the requirements of the Office of Best Practice Regulation in our making of regulation, and our prudential standards for banking and insurance may be disallowed by Parliament, should it so wish.

To give greater visibility to these mechanisms, we have recently set out an overview of our accountability requirements – including some that we impose on ourselves – on our website so that they can be better understood by our stakeholders.3

I’d like to also note that we will be subject to additional scrutiny this year through two other means:

- We expect that aspects of APRA’s activities will be of interest to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. We have already provided, at their request, documents and information to the Commission, and will continue to cooperate fully as it undertakes its important work.

- We will be subject to extensive international scrutiny from the IMF over the year ahead as part of its 2018 Financial Sector Assessment Program (FSAP).4 The FSAP will look at financial sector vulnerabilities and regulatory oversight arrangements in Australia, providing a report card on Australia (and APRA in particular) against internationally-accepted principles of sound prudential regulation. As was the case previously, we expect the IMF to find things we could do better. APRA is ready, along with other members of the regulatory community, to give the IMF our full cooperation and look forward to their feedback.

Finally, time does not permit me to discuss our on-going work in relation to housing lending but, anticipating some questions on this issue, I have circulated some charts which might be helpful for any discussion (see attached).

With those opening remarks, we would now be happy to answer the Committee’s questions.