From Mortgage Professional Australia.

Amid regulatory and market concern, banks are scrambling to make mortgage applications tougher, leaving brokers to pick up the pieces, writes MPA editor Sam Richardson

Although ASIC and APRA didn’t exist, applying for a mortgage in 1960s Australia was a highly regulated business. The government controlled not only lending conditions but even your interest rate, and you’d have to head to a branch to apply for a loan. Now you can apply without ever setting foot in a bank or even leaving your computer.

It’s become easier to get a mortgage; for some, too easy. Over four days in late September two major banks added extra checks to an already-extensive application process. ANZ introduced a Customer Interview Guide requiring brokers to ask questions about everything from a customer’s Netflix subscription to whether they were planning to start a family. Three days later CBA introduced a simulator that would show interest-only borrowers how their repayments would change and affect their lifestyle. Customers would be required to fill in an ‘acknowledgement form’ to proceed with an interest-only application.

ANZ and CBA are trapped between a rock and a hard place. On one side is the mantra of customer convenience and choice, but on the other the lenders and regulators are desperate to avoid public embarrassment. Brokers have been caught in the middle.

Two weeks before the majors took action, Swiss investment bank UBS published an alarming and controversial report. Surveying 907 recent borrowers on their experience of getting a mortgage, it argued that the “ease of attaining approval had improved over every prior vintage back to the 1990s”.

Therefore, UBS concluded, “we believe there is little evidence to suggest customers are finding it more difficult to attain credit or that mortgage underwriting standards are being tightened from a customer’s perspective”. That was a problem, UBS argued, because the banks had already written $500m of ‘liar loans’ based on inaccurate information, with ANZ the worst affected.

UBS’s conclusions have been met with intense criticism. ASIC senior executive Michael Saadat told the Senate that, because of the sophistication of the verification process, “we think consumers are probably not the best judge of what banks are doing behind the scenes to make sure borrowers can afford the loans they’re being provided with”.

Yet while it defends lending standards with one hand, ASIC has been strengthening them with the other. The regulator is currently embroiled in a long-running court case against Westpac over the bank’s estimation of customer expenditure, in addition to dictating tougher rules for interest-only lending in April and preparing a ‘shadow shop’ of brokers later this year. Additionally, the Consumer Action Law Centre told MPA that verification was “critically important” and that it supported high standards. For Consumer Action, ASIC and UBS, application standards are still very much a work in progress.

The cost of compliance

Brokers have a very different opinion. Mortgage Choice CEO John Flavell has publicly stated that “lenders are more scrupulous than ever”, explaining that “new legislation requires brokers and lenders to forensically examine a borrower’s assets and liability situation”.

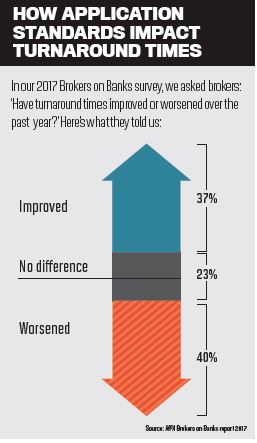

While no friends of the broker channel, UBS noted that brokers “arguably do much of the application heavy lifting” and brokers can attest to the impact of tightening lending standards. Turnaround times have actually got worse over the past year, according to 40% of respondents to MPA’s Brokers on Banks survey. Compliance and bank mismanagement have negated the gains of huge investments in technology, the experience of one broker suggests: “I have been doing this for 20 years. Twenty years ago we were getting unconditional approval in five days. We are still struggling for that 20 years later.”

“If I go back four or five years, I was amazed at just how loose many of the processes were” – Martin North, Digital Finance Analytics

Easier, not shorter

Martin North, principal of consultancy Digital Finance Analytics, has studied mortgage applications for years and has observed an improvement in standards. “If I go back four or five years, I was amazed at just how loose many of the processes were and in fact what would happen is the information would be captured on the form but never used in the underwriting process,” he says.

Progress has been driven not by extra questions for borrowers, North explains, but by an increase in documentation required from applicants. North believes there is room for improvement, however, particularly when it comes to understanding borrower expenditure. Only half of households have formal budgeting, he explains, and “whether it’s a real lie that households have not been truthful with the lenders, or whether they’ve got the best estimate and it might not be accurate, is probably the moot point”.

Applications can be made easier, North argues, but “easier doesn’t necessarily mean shorter”. Improvements in technology could improve underwriting standards for banks while pre-populating interactive application forms for consumers and offering time-saving solutions to brokers.

This is already occurring. Realestate.com.au’s new home loans offering integrates an online calculator into its website, which indicates how a borrower’s lifestyle would be impacted by mortgage repayments on a particular property. When borrowers apply for conditional approval the calculator’s details are fed into the form, allowing a quick online form to lead to instant approval.

For brokers, Advantedge has introduced two mobile apps to make collection of identification documents faster. Looking further ahead, banks have committed to sharing data within two years, which according to Australian Bankers’ Association chief executive Anna Bligh means that “at the click of a button, Australians will be able to directly share their transaction data with other banks or financial services”.

Should technology meet these lofty expectations, today’s paper-heavy application process could eventually be viewed in the same way that we view the branch of the 1960s today. Yet until this technology kicks in, brokers should prepare themselves for more heavy lifting.

%20(324%20x%20484).jpg)