Alongside the property exposures data that we discussed recently, see our post, “The Mortgage Industry in Three Sides“, APRA also related their quarterly data relating to banks in Australia to March 2018.

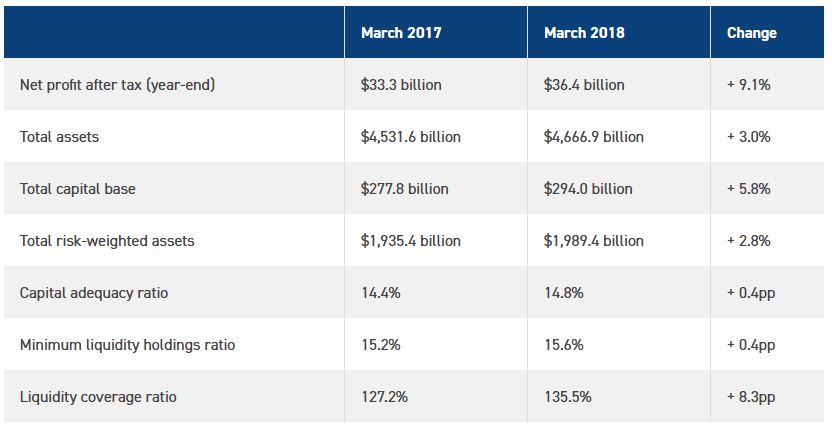

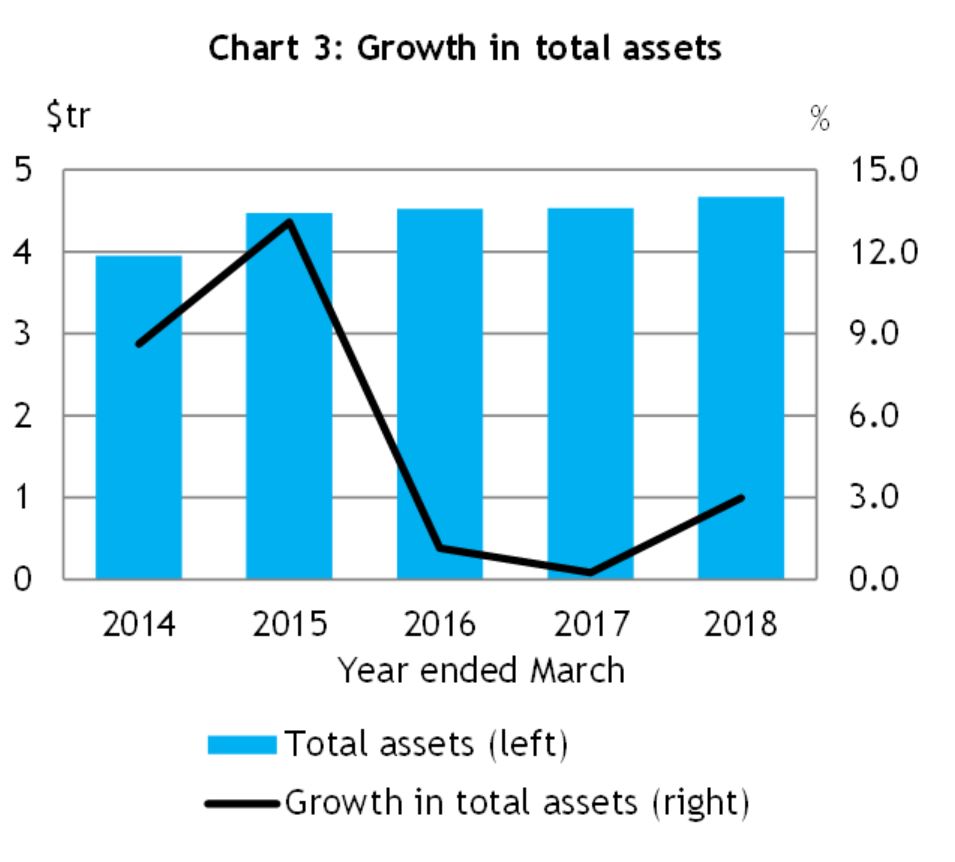

In summary the total profits were up 9.1% compared with a year ago, total assets grew 3% over the same period, the capital base grew 5.8%, the capital adequacy rose 0.4 percentage points and the liquidity coverage ratio rose 8.3 percentage points.

In summary the total profits were up 9.1% compared with a year ago, total assets grew 3% over the same period, the capital base grew 5.8%, the capital adequacy rose 0.4 percentage points and the liquidity coverage ratio rose 8.3 percentage points.

So superficially, all the ratios suggest a tightly run ship. But it is worth looking in more detail at these statistics, because as we will see below the waterline, things look less pristine.

So superficially, all the ratios suggest a tightly run ship. But it is worth looking in more detail at these statistics, because as we will see below the waterline, things look less pristine.

First, there were 148 Authorised Depository Institutions (ADI’s) a.k.a banks at the end of March.

- Endeavour Mutual Bank Ltd changed its name from Select Encompass Credit Union Ltd, with effect from 9 February 2018.

- Gateway Bank Ltd changed its name from Gateway Credit Union Ltd, with effect from 1 March 2018.

- My Credit Union Limited had its authority to carry on banking business in Australia revoked, with effect from 1 March 2018.

So the net number rose by 1 from December 2017.

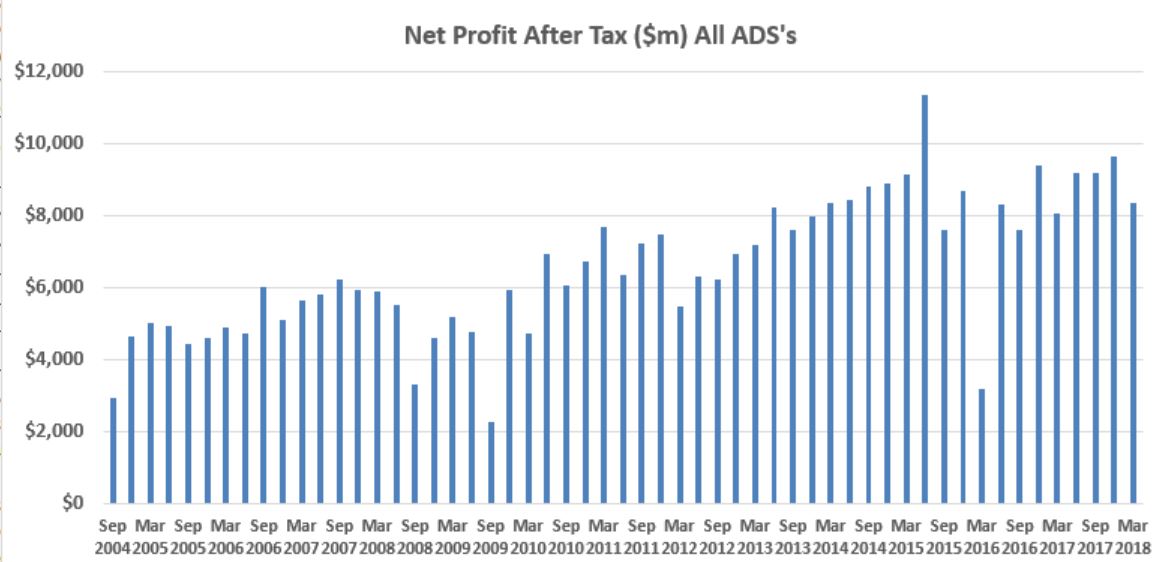

In terms of overall performance, APRA says that the net profit after tax for all ADIs was $36.4 billion for the year ending 31 March 2018. This is an increase of $3.0 billion or 9.1 per cent on the year ending 31 March 2017.

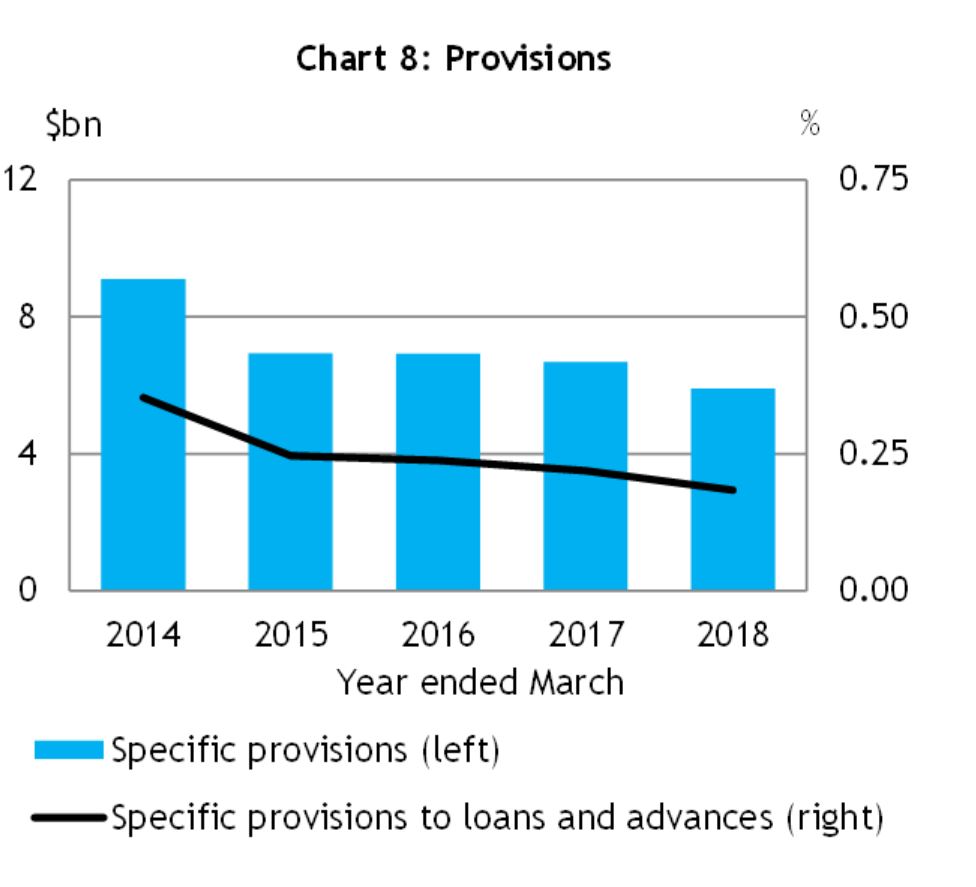

This was because of a nice hike in mortgage margins, in reaction to the regulator’s intervention in the investor mortgage sector, and a significant drop in overall provisions. But top line revenue growth slowed and margins have started to tighten. As a result, profits were lower this quarter compared with the prior three quarters.

This was because of a nice hike in mortgage margins, in reaction to the regulator’s intervention in the investor mortgage sector, and a significant drop in overall provisions. But top line revenue growth slowed and margins have started to tighten. As a result, profits were lower this quarter compared with the prior three quarters.

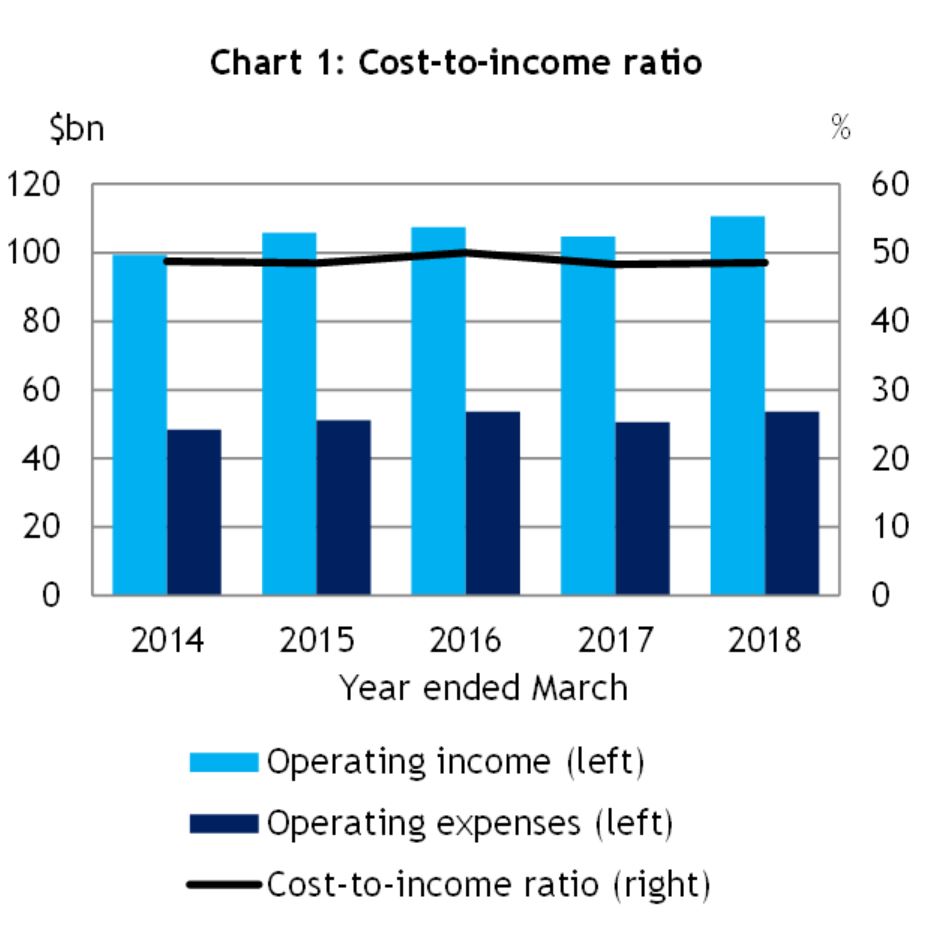

The cost-to-income ratio for all ADIs was 48.5 per cent for the year ending 31 March 2018, compared to 48.2 per cent for the year ending 31 March 2017. In other words, the costs of the business grew faster than income.

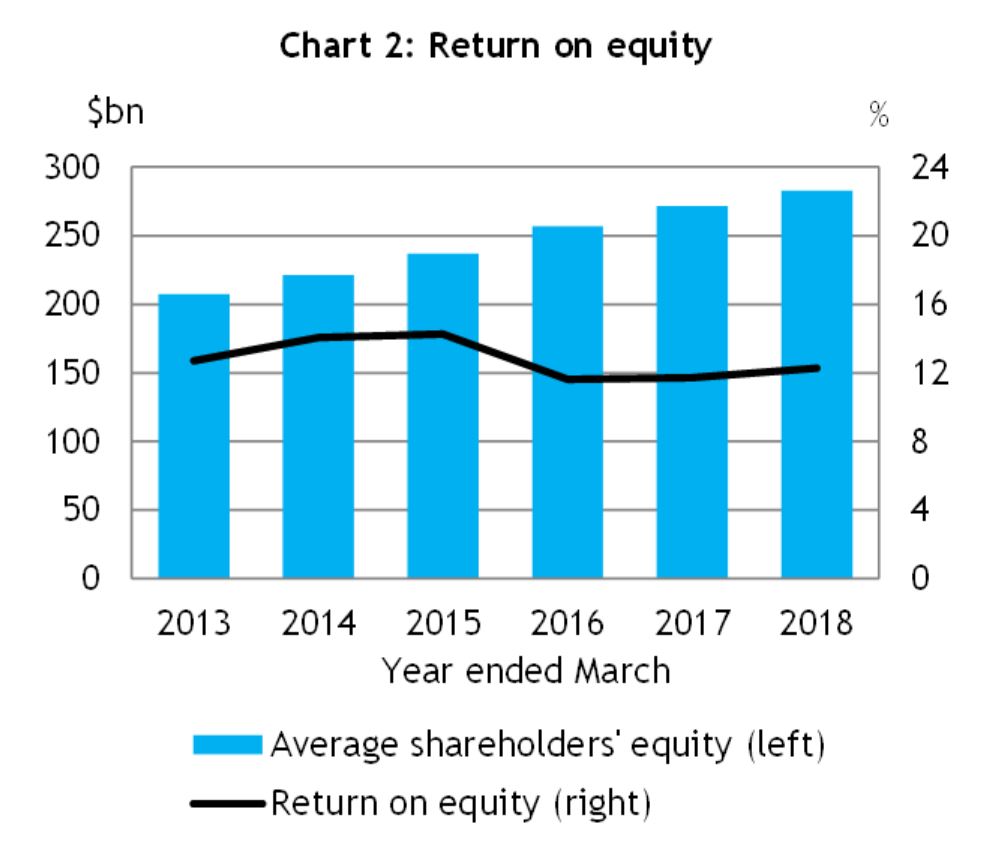

The return on equity for all ADIs increased to 12.3 per cent for the year ending 31 March 2018, compared to 11.7 per cent for the year ending 31 March 2017. We suspect this increase will not be repeated in the coming year.

The return on equity for all ADIs increased to 12.3 per cent for the year ending 31 March 2018, compared to 11.7 per cent for the year ending 31 March 2017. We suspect this increase will not be repeated in the coming year.

That said an ROE of 12.3 per cent would still put the banking sector near the top of both Australian companies and global banks, reflecting a lack of true competition and some poor practices as laid bare by the Royal Commission. The quest for profit growth from some players has proved to be at the cost of customers. If banks do become more customer focussed, it is possible ROE’s will fall, and one-off penalties and fees (for example CBA, ANZ) will also hit returns.

The total assets for all ADIs was $4.67 trillion at 31 March 2018. This is an increase of $135.9 billion (3.0 per cent) on 31 March 2017 and was largely driven by mortgages which grew strongly over the period.

The total assets for all ADIs was $4.67 trillion at 31 March 2018. This is an increase of $135.9 billion (3.0 per cent) on 31 March 2017 and was largely driven by mortgages which grew strongly over the period.

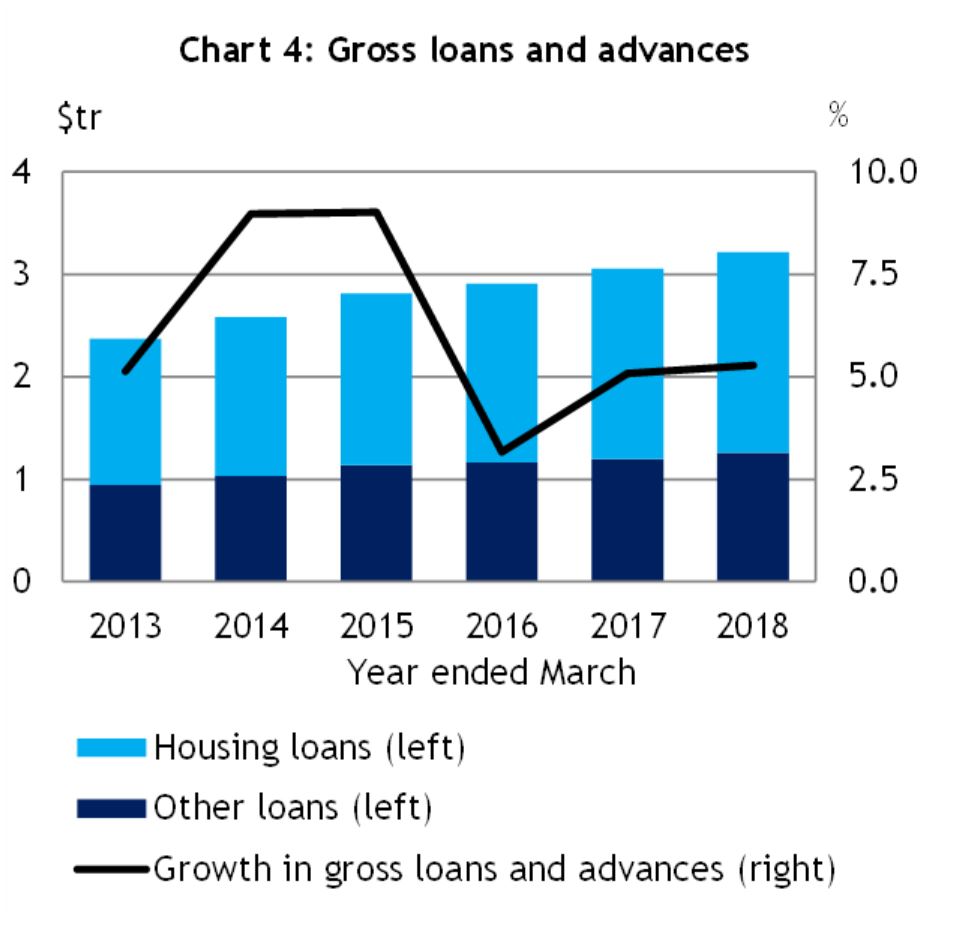

The total gross loans and advances for all ADIs was $3.22 trillion as at 31 March 2018. This is an increase of $161.4 billion (5.3 per cent) on 31 March 2017.

The total gross loans and advances for all ADIs was $3.22 trillion as at 31 March 2018. This is an increase of $161.4 billion (5.3 per cent) on 31 March 2017.

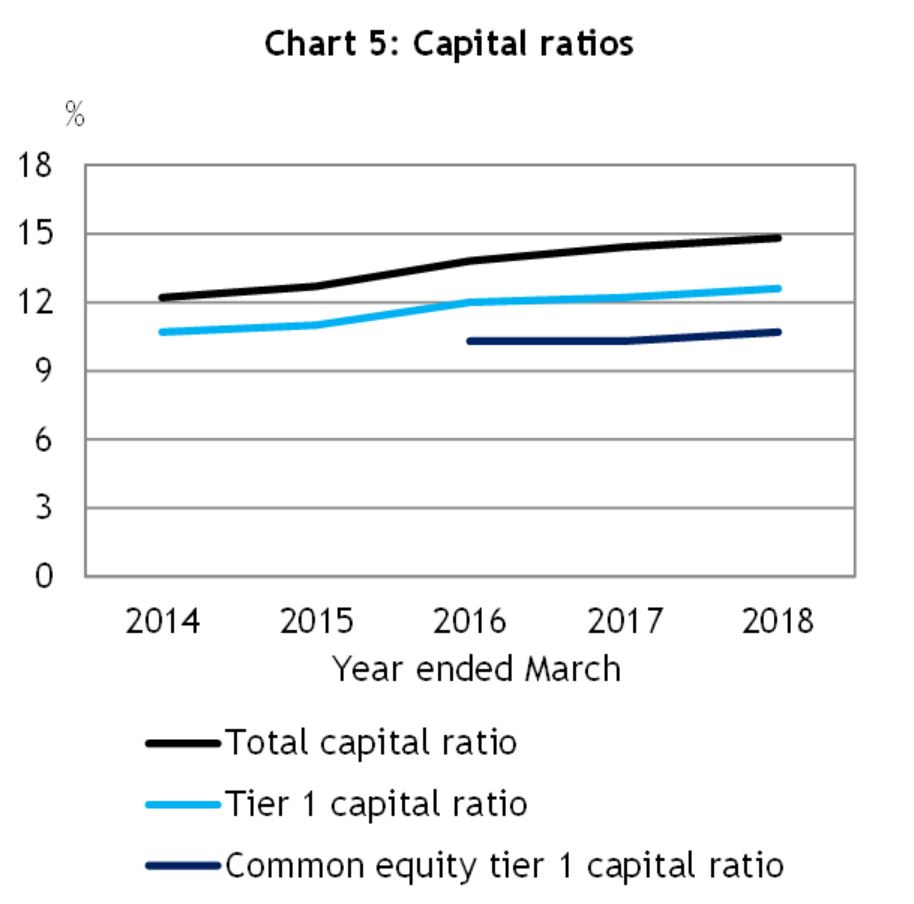

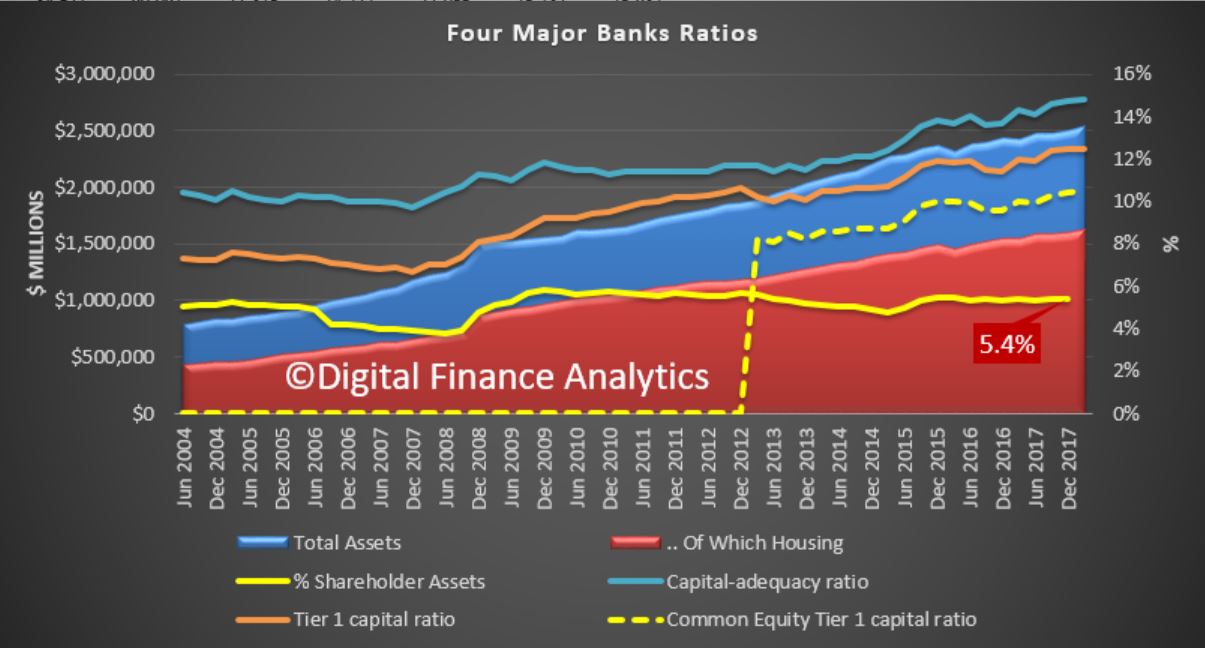

The total capital ratio for all ADIs was 14.8 per cent at 31 March 2018 , an increase from 14.4 per cent on 31 March 2017. This is a reflection of higher APRA targets. The common equity tier 1 ratio for all ADIs was 10.7 per cent at 31 March 2018, an increase from 10.3 per cent on 31 March 2017.

The total capital ratio for all ADIs was 14.8 per cent at 31 March 2018 , an increase from 14.4 per cent on 31 March 2017. This is a reflection of higher APRA targets. The common equity tier 1 ratio for all ADIs was 10.7 per cent at 31 March 2018, an increase from 10.3 per cent on 31 March 2017.

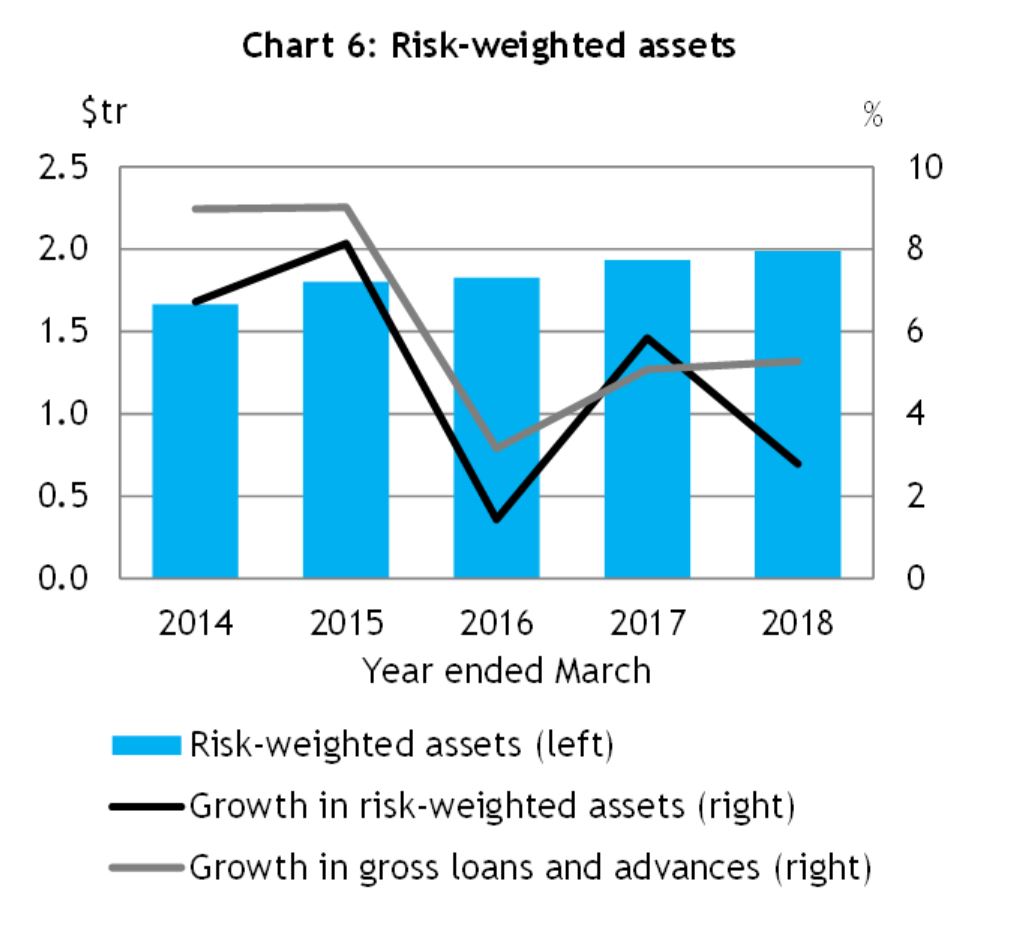

The risk-weighted assets (RWA) for all ADIs was $1.99 trillion at 31 March 2018, an increase of $53.9 billion (2.8 per cent) on 31 March 2017.

The risk-weighted assets (RWA) for all ADIs was $1.99 trillion at 31 March 2018, an increase of $53.9 billion (2.8 per cent) on 31 March 2017.

So if you compare the $3.22 trillion assets with the $1.99 trillion weighted assets for capital purposes, you can see the impact of lower risk weights for some asset types.

So if you compare the $3.22 trillion assets with the $1.99 trillion weighted assets for capital purposes, you can see the impact of lower risk weights for some asset types.

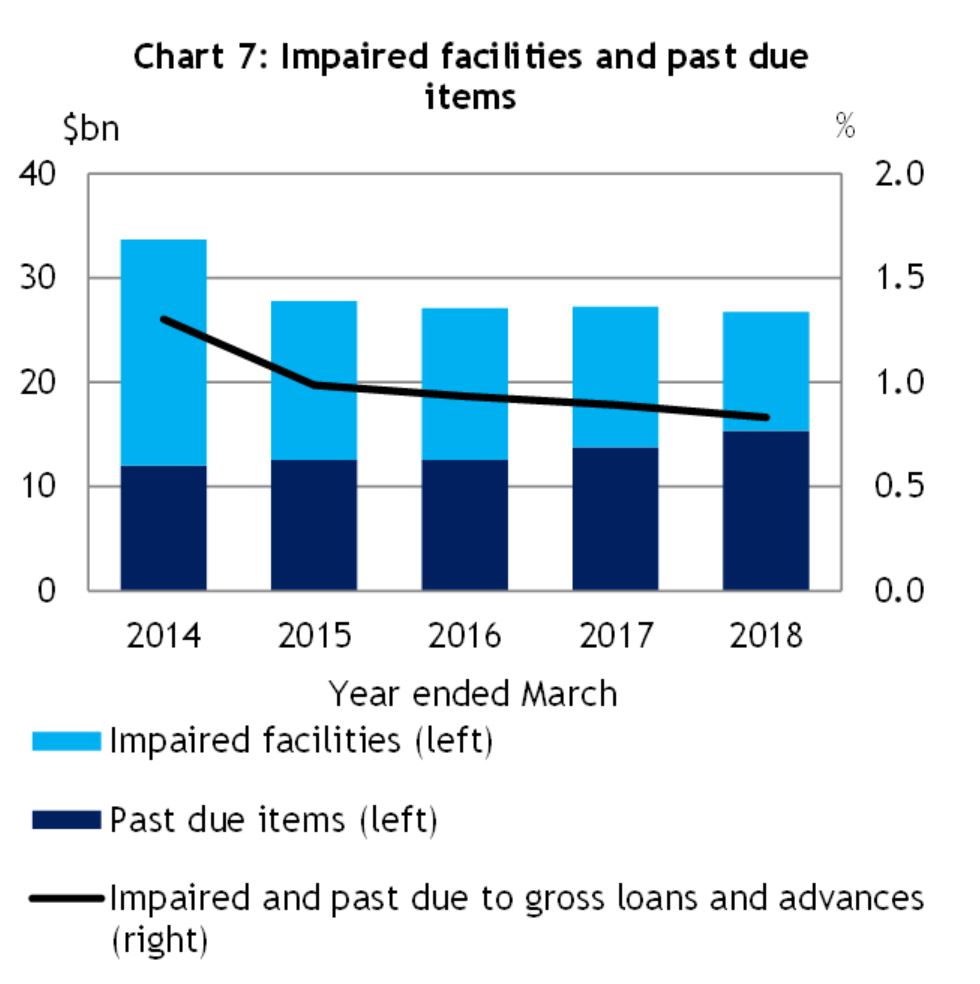

Looking at impairments for all ADIs we see that impaired facilities were $11.4 billion as at 31 March 2018. This is a decrease of $2.1 billion (15.7 per cent) on 31 March 2017.

Past due items were $15.4 billion as at 31 March 2018. This is an increase of $1.6 billion (11.5 per cent) on 31 March 2017. Rising 90 day delinquencies for mortgage loans was the main reason for the uplift, despite commercial loans performing a little better. Expect more delinquencies ahead, as indicated by our mortgage stress analysis. See our post “Mortgage Stress On the Rise”

That said, impaired facilities and past due items as a proportion of gross loans and advances was 0.83 per cent at 31 March 2018, a decrease from 0.89 per cent at 31 March 2017 and specific provisions were $5.9 billion at 31 March 2018. This is a decrease of $0.8 billion (11.7 per cent) on 31 March 2017. In addition, specific provisions as a proportion of gross loans and advances was 0.18 per cent at 31 March 2018, a decrease from 0.22 per cent at 31 March 2017.

That said, impaired facilities and past due items as a proportion of gross loans and advances was 0.83 per cent at 31 March 2018, a decrease from 0.89 per cent at 31 March 2017 and specific provisions were $5.9 billion at 31 March 2018. This is a decrease of $0.8 billion (11.7 per cent) on 31 March 2017. In addition, specific provisions as a proportion of gross loans and advances was 0.18 per cent at 31 March 2018, a decrease from 0.22 per cent at 31 March 2017.

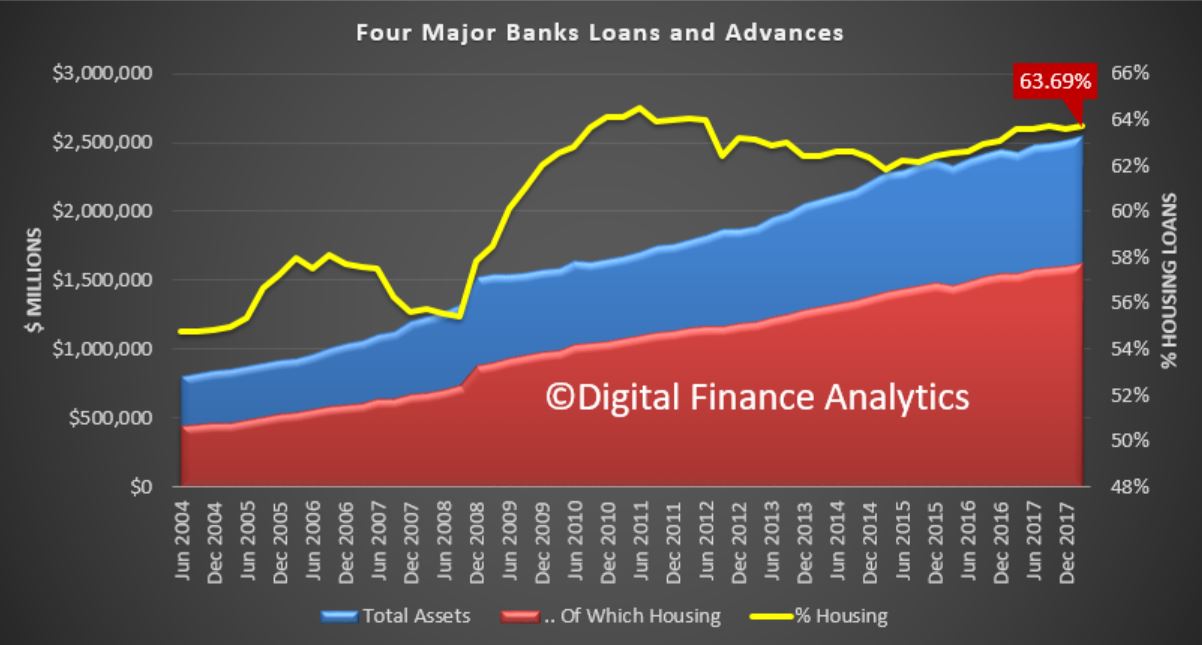

But there were two really important observations in the data, when we look at just the big four. The first is that total loans and advances by the four majors reached $2.55 trillion dollars, a record, and 63.69% of all loans were for housing lending. Not since 2012 has this been such a high proportion, its previous peak was 64.48% in the Jun 2011 quarter. The proportion of investor loans fell slightly, thanks to the recent tightening, but owner occupied lending by the big four remained strong. Think about it, nearly 64% of all loans are property related, so consider what a significant fall in prices would mean for them.

But there were two really important observations in the data, when we look at just the big four. The first is that total loans and advances by the four majors reached $2.55 trillion dollars, a record, and 63.69% of all loans were for housing lending. Not since 2012 has this been such a high proportion, its previous peak was 64.48% in the Jun 2011 quarter. The proportion of investor loans fell slightly, thanks to the recent tightening, but owner occupied lending by the big four remained strong. Think about it, nearly 64% of all loans are property related, so consider what a significant fall in prices would mean for them.

The second observation relates to the critical banking ratios. We all know that APRA has been pushing the capital rations and the newer CET1 (from January 2013) higher, and these are all rising, with the CET1 sitting, on an APRA basis at 10.5%, the highest its been.

The second observation relates to the critical banking ratios. We all know that APRA has been pushing the capital rations and the newer CET1 (from January 2013) higher, and these are all rising, with the CET1 sitting, on an APRA basis at 10.5%, the highest its been.

However, if you look at the ratio of shareholder capital, it is sitting at a miserly 5.4% of all loans. In other words for every $100 invested in the loans made by an investor, they only have $5.40 at risk. This is, in extremis, the heart of the banking business, and this explains why shareholder returns are so high from the banking sector. These are highly leveraged businesses and if their risk and loan underwriting standards are not correctly calibrated it can go wrong very quickly. By the way the smaller banks and mutual have much lower leverage ratios, so they are simply less risky.

However, if you look at the ratio of shareholder capital, it is sitting at a miserly 5.4% of all loans. In other words for every $100 invested in the loans made by an investor, they only have $5.40 at risk. This is, in extremis, the heart of the banking business, and this explains why shareholder returns are so high from the banking sector. These are highly leveraged businesses and if their risk and loan underwriting standards are not correctly calibrated it can go wrong very quickly. By the way the smaller banks and mutual have much lower leverage ratios, so they are simply less risky.

Banking is a risk business, but we see here laid bare, who is really taking the risks while the shareholders are doing very nicely thank-you!