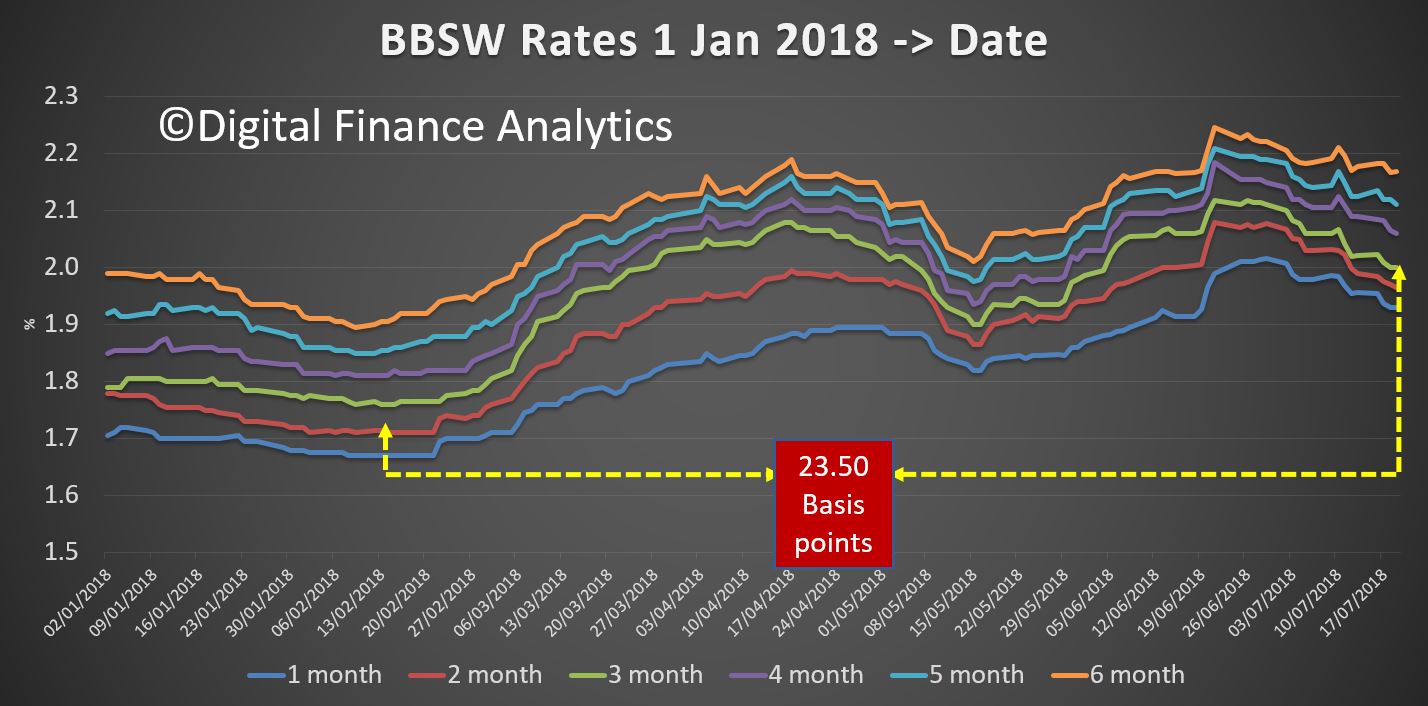

We track the movement in the Bank Bill Swap Rate, as this directly, or indirectly impacts Australian bank funding costs, and of course has led to significant numbers of smaller banks repricing their mortgage books higher in recent weeks.

The latest data shows that last week the 3 month benchmark fell very slightly, leaving funding costs 23.50 basis points higher than the lows in February.

This mirrors recent changes in the US 3-Month rate which is also slightly lower, but we also note that locally some overseas investors are repatriating money back to the US (encouraged by recent tax changes) and perceived elevated risks in the banking system here, relative to the USA.

This mirrors recent changes in the US 3-Month rate which is also slightly lower, but we also note that locally some overseas investors are repatriating money back to the US (encouraged by recent tax changes) and perceived elevated risks in the banking system here, relative to the USA.

The main force at work which may still lift mortgage portfolio rates higher is the aggressive attractor rates now available from several of the major banks as they fight to write the lions share of smaller loan volumes. Our surveys suggest that lower risk owner occupiers and investors can wrangle some really cheap rates at the moment. But this puts more pressure on margins and the back book.

The main force at work which may still lift mortgage portfolio rates higher is the aggressive attractor rates now available from several of the major banks as they fight to write the lions share of smaller loan volumes. Our surveys suggest that lower risk owner occupiers and investors can wrangle some really cheap rates at the moment. But this puts more pressure on margins and the back book.

At some point the funding pressure dam will burst….