The end of October data dump from RBA and APRA and the latest from the ABS, we see signs of economic slowing.

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

The end of October data dump from RBA and APRA and the latest from the ABS, we see signs of economic slowing.

Go to the Walk The World Universe at https://walktheworld.com.au/

I am joined by Robbie Barwick from the Australian Citizens Party to discuss a critical policy area, ahead of the new Parliament sitting next week. We want to make sure the politicians are aware of the benefits of a National Postal Bank, and how you can help to raise that awareness.

Flyer: https://citizensparty.org.au/sites/default/files/2022-06/flyer-australia-needs-a-public-post-office-bank-citizens-party-june-22.pdf

MP contact details: https://www.aph.gov.au/Senators_and_Members

Go to the Walk The World Universe at https://walktheworld.com.au/

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon and his Morgan Stanley counterpart, James Gorman, both said Thursday that they aren’t steering their firms toward shelter even as they see a confluence of global events denting the economy in the months ahead.

“The consumer right now is in great shape,” Dimon said on a conference call discussing his company’s second-quarter results. “So even if we go into a recession, they’re entering that recession with less leverage and in far better shape than they did in ’08 and ’09.”

Gorman, on his bank’s earnings call, said a deep or dramatic recession in the US is unlikely, and Morgan Stanley is “long the US” in most of its businesses. “The US is a great region to be in the world.”

Those verdicts come even as second-quarter results at both JPMorgan and Morgan Stanley were hurt by a slowdown from the pandemic-era bonanza that gave them record revenue and profits.

Risks abound, with soaring inflation spurring central banks around the world to dial back the easy-money policies that had pushed markets to all-time highs. Russia’s invasion of Ukraine, along with worries about food and energy security as well as political instability across regions, are also keeping investors on edge.

“If I had to use one word to describe it, it would be ‘complicated,’” Gorman said on the challenges facing the global economy. He said that “Europe is fighting the hardest,” with the dual threat of the war in Ukraine and pressure on gas prices that’s been particularly problematic for countries such as Germany.

Go to the Walk The World Universe at https://walktheworld.com.au/

I caught up with Steve Mickenbecker, Group Executive, Financial Services & Chief Commentator at Canstar to discuss the latest in deposit account rates as they fall though the fall.

Note: DFA has no commercial relationship with Canstar

Bank of Ireland has caved in to public pressure following a public outcry over its plans to heavily restrict cash transactions in its branches, via Irish Independent.

The bank came in for sustained criticism after the Irish Independent revealed yesterday that it plans to restrict over-the-counter cash withdrawals to a minimum of €700 and cash lodgements to a minimum of €3,000 in an effort to push customers towards using ATMs and self-service machines.

However, after criticism from Finance Minister Michael Noonan, as well as groups representing consumers, farmers, older people, rural dwellers and bank workers, the bank conceded that what it called “vulnerable” customers could continue to get cash and make withdrawals of smaller amounts of money at branch counters.

The changes prompted fears of a renewed bout of bank branch closures and staff lay-offs in the wake of the bank’s move to severely restrict counter-based cash transactions.

Mr Noonan described the changes as “surprising and unnecessary”, adding that he expects the bank to “fully honour” its commitment to “vulnerable customers”.

Bank of Ireland said it would continue to allow older customers and those unfamiliar with technology to make cash transactions over the counter.

“Bank of Ireland would like to confirm that vulnerable customers, together with those elderly customers who are not comfortable using self-service channels or other technology solutions, will be assisted by branch staff to use the available in-branch services.”

However, other banks are now expected to follow the lead of Bank of Ireland by moving to set strict limits on over-the-counter cash handling.

It comes after around 200 bank branches were closed, mainly in rural areas, during the financial collapse, with at least 10,000 retail bank staff laid-off.

Banks including Bank of Scotland, Danske, ACC and Irish Nationwide have already closed, limiting banking options for customers.

Now there are concerns that the move by Bank of Ireland to effectively become a cashless bank will prompt more branch shut-downs and redundancies.

Deputy chairman of the Consumers Association Michael Kilcoyne said other banks were set to mirror Bank of Ireland and discourage customers from withdrawing and lodging cash over the counter.

This would make branches in rural areas less viable, he warned.

“The implications of the Bank of Ireland move are very severe. If it gets away with this it will get rid of more staff and close branches.

“This will be a further blow for rural Ireland,” he said.

Mr Kilcoyne predicted that AIB, Ulster Bank and Permanent TSB would make similar moves to curtail cash handling.

And banking union IBOA said it is seeking a meeting with Bank of Ireland boss Richie Boucher over concerns the changes would mean more job losses.

The Irish Farmers’ Association said the changes would cause great difficulty for some farmers who are not familiar with the bank’s online system.

Age Action accused the bank of ignoring the needs of older people by setting high limits on over-the-counter transactions.

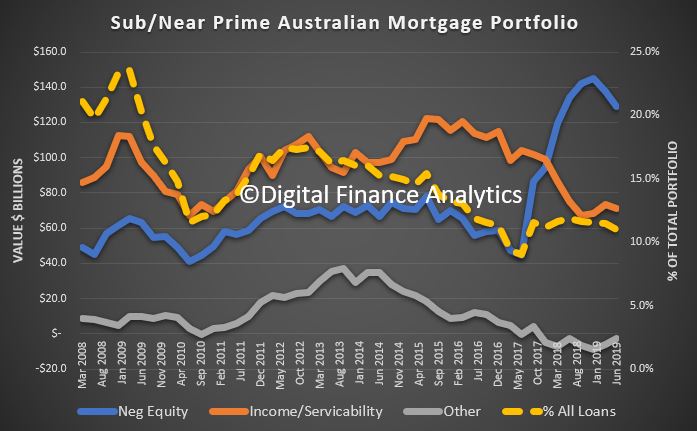

A quick reminder of our live stream event tomorrow, plus we share some new data on Australian sub-prime mortgages and refinancing.

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Contents:

01:40 US Economy and Markets

07:21 UK Brexit

09:30 Euro Zone Stimulus

13:55 Global Interest Rates

14:37 China

18:12 Australia

18:14 Auction Results

19:25 Property Transaction Volumes

20:27 Price Movements

22:24 Finance Commitments

23:38 Weaker Economic Outlook

27:12 New FTB Scheme

29:24 AFR and The Cash Ban

30:24 Market Summary

32:43 Banking In Wonderland

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Property expert Joe Wilkes and I discuss who is saving, and why.

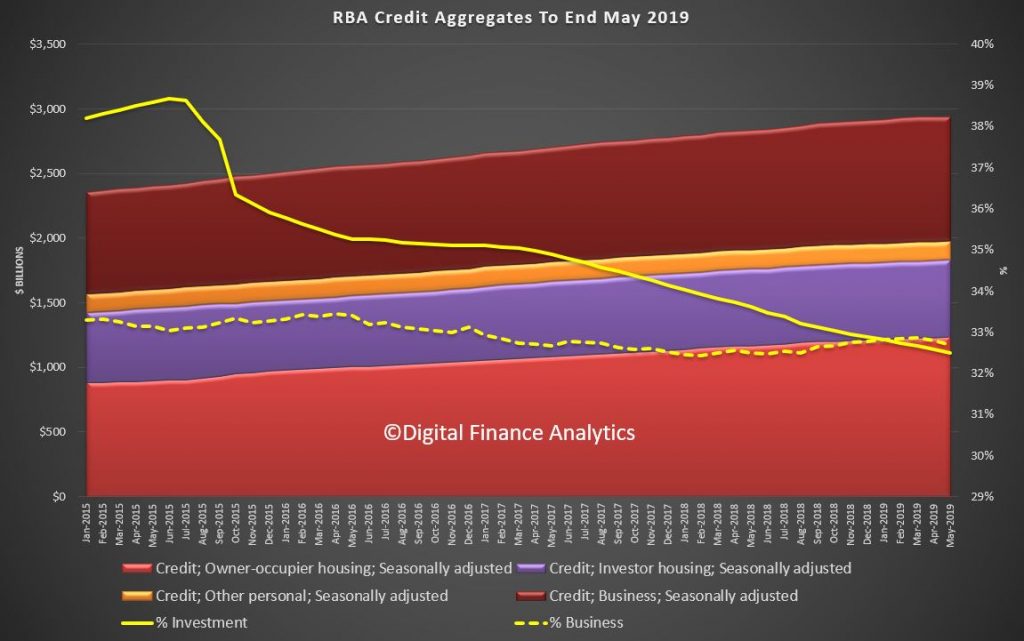

The RBA released their credit aggregates to May 2019 today, we already covered the APRA ADI series in an earlier post.

Seasonally adjusted owner occupied housing rose by 0.34% to $1.24 trillion dollars while investment lending slid 0.04% to $595 billion dollars, and comprises 32.5% of all household finance, in seasonally adjusted terms. Business lending was down 0.35% to $959.6 billion dollars and was 32.7% of credit, the lowest for the past six months. Personal credit fell again, down 0.59% to $145.8 billion dollars.

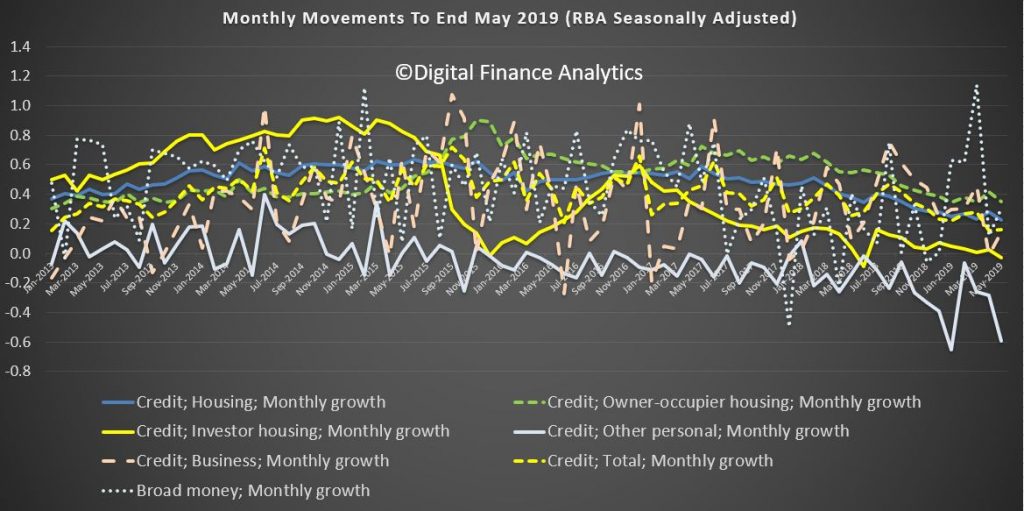

The monthly movements were quite volatile once again.

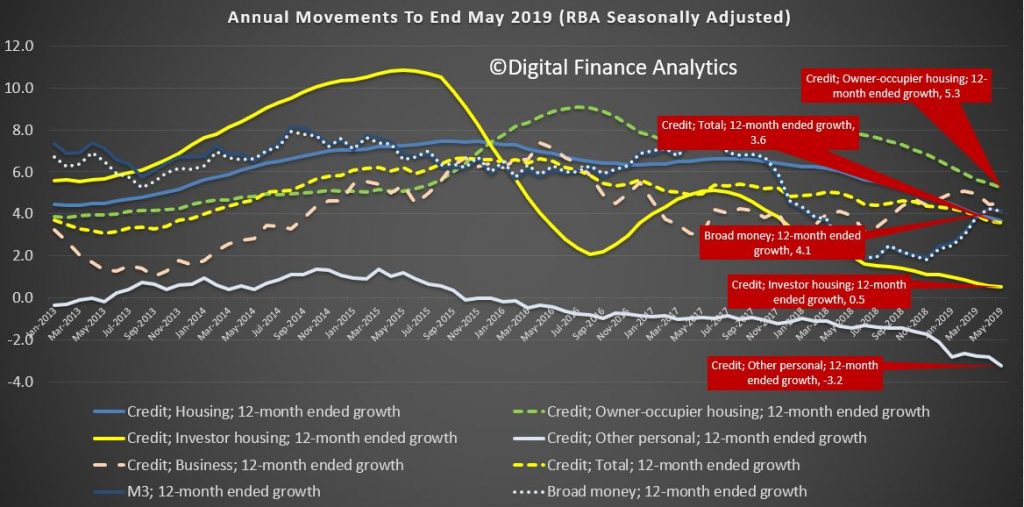

However the annual movements paint a clearer picture. Over the past year owner occupied lending rose 5.3%, investor lending rose just 0.5% while personal credit fell 3.2%. Business lending grew 4.5%. Broad money grew 4.1%, the earlier acceleration in the first past of the year has not been explained.

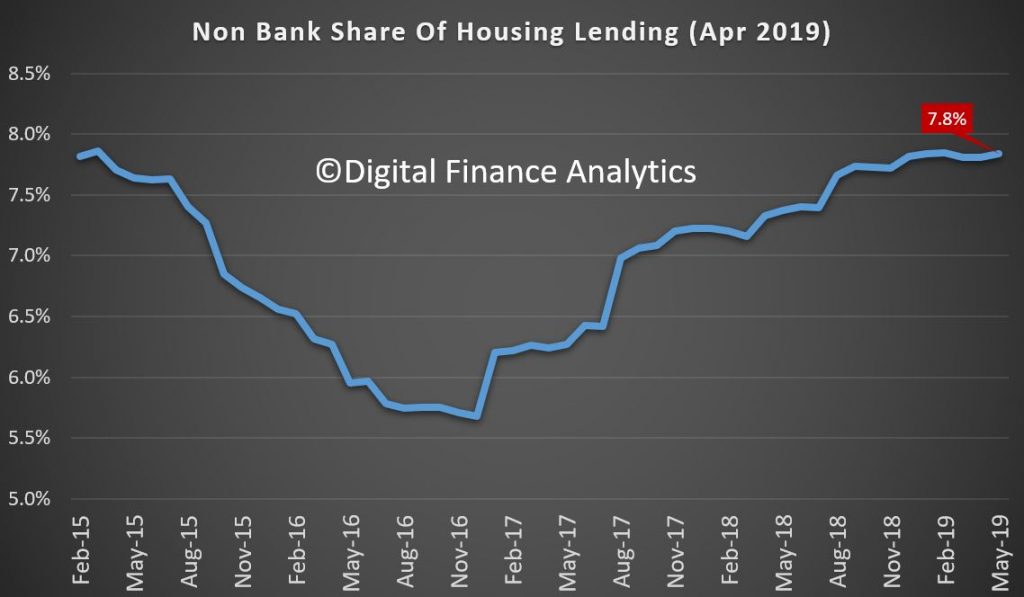

We can proxy the growth in the non bank sector by comparing the APRA and RBA dataset. Whilst only approximate, it does give a fair indication. Non-bank lending recorded an estimated 7.8% rise over the year, significantly higher than the ADI’s.

Overall growth in the non-bank, non-ADI sector for mortgages was an impressive 7.8% annualised.

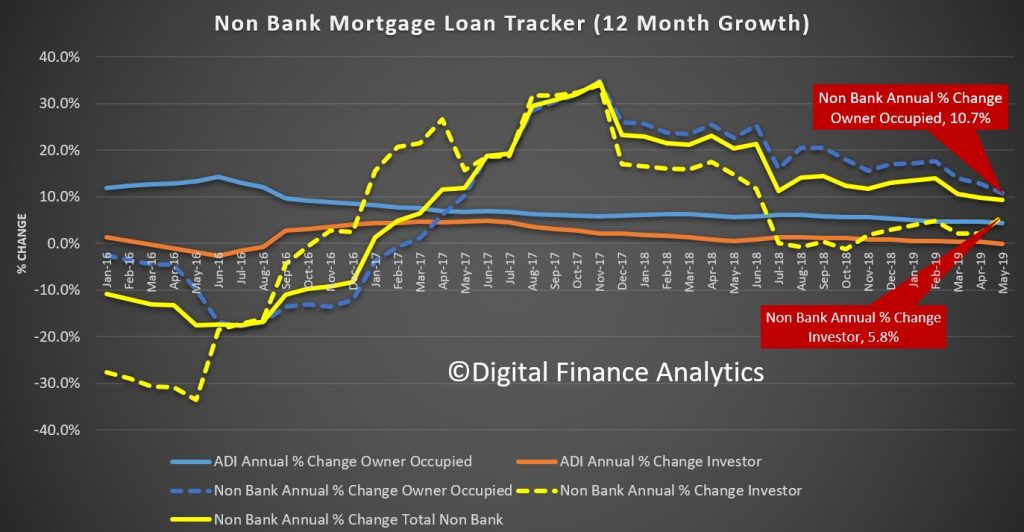

Further analysis by category shows that owner occupied lending by non-banks rose 10.7% over the past year, while investment loans rose 5.8%. Both are higher than the ADI’s, suggesting the non-bank sector is able and willing to lend.

Total household credit growth remain above both inflation and wages, so households are getting mired further into debt, the sustainability of which we question. And again, we think regulators are not looking at the non-bank sector sufficiently hard.

Next month we will see the post-election post-rate cut situation. Many are expecting credit to rebound, and home prices to follow – we will see.

It is also worth noting the RBA will be changing the reporting on the credit aggregates ahead. You can read about their plans. But essentially it will provide more granularity, and make some “significant” revisions to past results. The RBA plans to start publishing the financial aggregates from August 2019 using an improved conceptual framework and a new data collection.

The New Economic and Financial Statistics Collection

Over the past few years, APRA, the ABS and the RBA have worked to modernise the existing set of forms, and banks and other reporting institutions have adapted their infrastructure to be able to report on the new versions of these forms. This has been a large scale and complex project, involving considerable collaboration between the three agencies and the industry. The new set of forms are called the Economic and Financial Statistics (EFS) collection and will better meet the data needs of policymakers.

The EFS collection will be implemented in three phases.

The first phase will focus on data used for the financial aggregates and national accounts finance and wealth estimates.

The second phase will update current forms on housing and business loan approvals. It will also provide much more granular information on banks’ and other reporting institutions’ lending, their liabilities and interest rates.

The third phase will provide information on other aspects of reporting institutions’ activity and performance, including profits, fees charged and activity in specific financial products and markets. The first phase national accounts aggregates will be used in addition to this performance data in the compilation of Australia’s Gross Domestic Product (GDP).

The EFS collection will increase the reliability and accuracy of the inputs used to calculate the aggregates. One of the most important changes in the EFS is more detailed and precise definitions of the data to be reported. These definitions are accompanied by comprehensive guidance to assist institutions in reporting consistent data.