YouTube’s reliance on algorithm-driven traffic expansion continues as it reaches views of 1 Billion hours per day, as reported in ZeroHedge.

In a dramatic confirmation of the relentless growth of online video, at the expense of the agonizing, slow death of conventional TV, YouTube said that its worldwide viewers are now watching more than 1 billion hours of videos a day, on pace to eclipse total US TV viewership over the next few years, a milestone facilitated by the Google aggressive embrace of artificial intelligence to recommend videos. By comparison, Americans watch 1.25 billion hours of live and recorded TV per day according to Nielsen, a figure that has been steadily dropping in recent years. Facebook and Netflix said in January 2016 that users watch 100 million hours and 116 million hours, respectively, of video daily on their platforms.

According to the WSJ, YouTube surpassed the “psychological” figure, which was far higher than previously reported, late last year. Indicatively, in 2012 when Google started building algorithms that tap user data to give each user personalized video lineups designed to keep them watching longer, users spent 100 million hours on its platform, a ten-fold increase in under five years, growing at a pace of roughly 200 million hours per year. Of course, what makes YouTube so unique, is that a vast majority of the content is crowdsourced: feeding the AI recommendations is an unmatched collection of content: 400 hours of video are uploaded to YouTube each minute, or 65 years of video a day.

What is surprising is that despite YouTube’s massive size, it remains unclear if it profitable. Google’s parent Alphabet doesn’t disclose YouTube’s performance, but people familiar with its financials said it took in about $4 billion in revenue in 2014 and roughly broke even. Like most of its social network competitors, YouTube makes most of its money on running ads before videos but it also spends big on technology and rights to content, including deals with TV networks for a planned web-TV service. When asked about profits last year, YouTube Chief Executive Susan Wojcicki said, “Growth is the priority.”

Meanwhile, in a near-monopolistic synergy, YouTube benefits from the enormous reach of Google, which handles about 93% of internet searches, according to market researcher StatCounter. Google embeds YouTube videos in search results and pre-installs the YouTube app on its Android software, which runs 88% of smartphones, according to Strategy Analytics.

That has helped drive new users to its platform, and the statistics are staggering: about 2 billion unique users now watch a YouTube video every 90 days, according to a former manager. In 2013, the last time YouTube disclosed its user base, it said it surpassed 1 billion monthly users. YouTube is now likely larger than the world’s biggest TV network, China Central Television, which has more than 1.2 billion viewers.

A recent adjustment to the YouTube algorihms helped:

YouTube long configured video recommendations to boost total views, but that approach rewarded videos with misleading titles or preview images. To increase user engagement and retention, the company in early 2012 changed its algorithms to boost watch time instead. Immediately, clicks dropped nearly 20% partly because users stuck with videos longer. Some executives and video creators objected.

Months later, YouTube executives unveiled a goal of 1 billion hours of watch time daily by the end of 2016. At the time, optimistic forecasts projected it would reach 400 million hours by then.

YouTube retooled its algorithms using a field of artificial intelligence called machine learning to parse massive databases of user history to improve video recommendations. Previously, the algorithms recommended content largely based on what other users clicked after watching a particular video, the former manager said. Now their “understanding of what is in a video [and] what a person or group of people would like to watch has grown dramatically,” he said.

And while it hardly needs it, YouTube’s reliance on algorithm-driven traffic expansion continues: “last year YouTube partnered with Google Brain, which develops advanced machine-learning software called deep neural networks, which have led to dramatic improvements in other fields, such as language translation. The Google Brain system was able to identify single-use video categories on its own.”

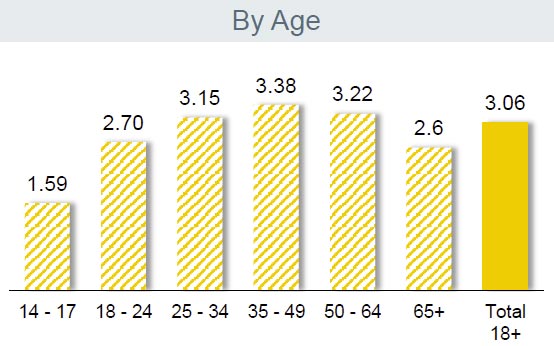

Meanwhile, per just released research from the EIA, according to the latest Residential Energy Consumption Survey (RECS) the number of TVs in active use per US household is declining: an average of 2.3 televisions were used in American homes in 2015, down from an average of 2.6 televisions per household in 2009.

As shown in the chart below, the number of homes with three or more televisions declined from the previous survey conducted in 2009, and a larger share of households reported not using a television at all. Televisions and peripheral equipment such as cable boxes, digital video recorders (DVRs), and video game consoles account for about 6% of all electricity consumption in U.S. homes.

The study also found that entertainment and information devices vary by age: younger households tend to have a lower concentration of televisions per person and a higher concentration of portable devices such as laptops.

The good news: the slow death of corporate-owned, legacy mainstream media continues; the bad news: it is being replaced by the hyper-corporate Google and FaceBook, which in recent months have decided to put on the mantle of supreme arbiters of what is and isn’t considered “fake news.”