The Digital Finance Analytical core market model allows us to drill into the dynamics of households, their financial footprint and their property holdings.

We were manipulating the data recently, and found this interesting picture.

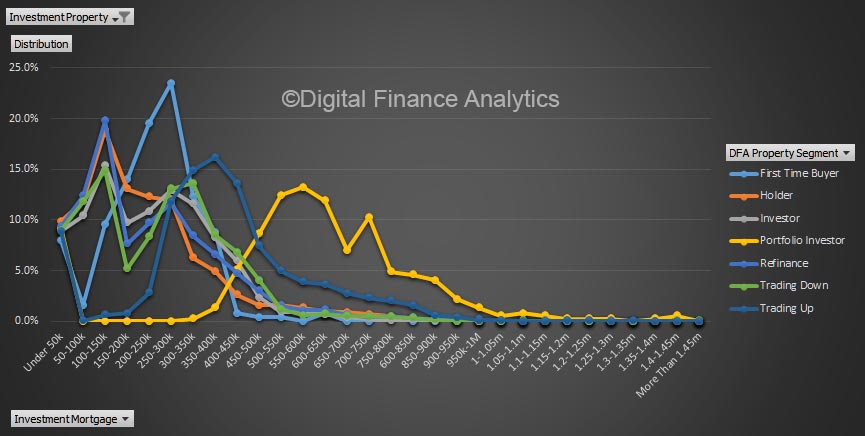

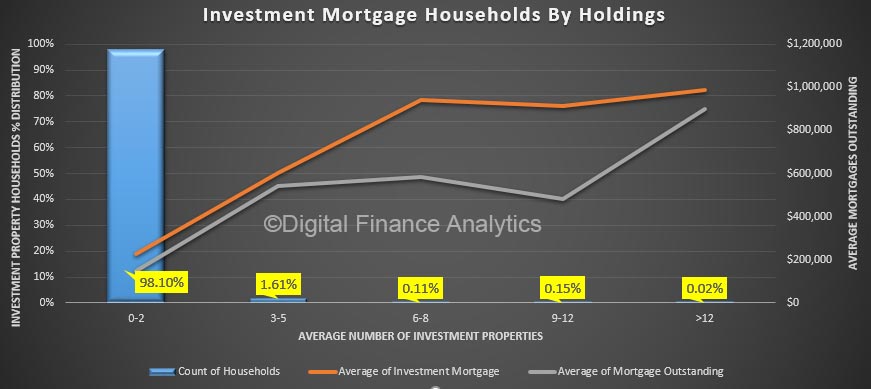

We started by looking at the average number of properties held by households as investment properties. The majority (98%) investors have just one or two properties. However, 1.6% have between 3 and 5, and a smaller number of households have even more. Many of these properties are lower-value units and houses, such as would appeal to first time buyers. This is interesting, because we know those with multiple properties are more active and account for a disproportionate amount of transactions and tax breaks. Indeed many first time buyers would simply be out-bid.

We started by looking at the average number of properties held by households as investment properties. The majority (98%) investors have just one or two properties. However, 1.6% have between 3 and 5, and a smaller number of households have even more. Many of these properties are lower-value units and houses, such as would appeal to first time buyers. This is interesting, because we know those with multiple properties are more active and account for a disproportionate amount of transactions and tax breaks. Indeed many first time buyers would simply be out-bid.

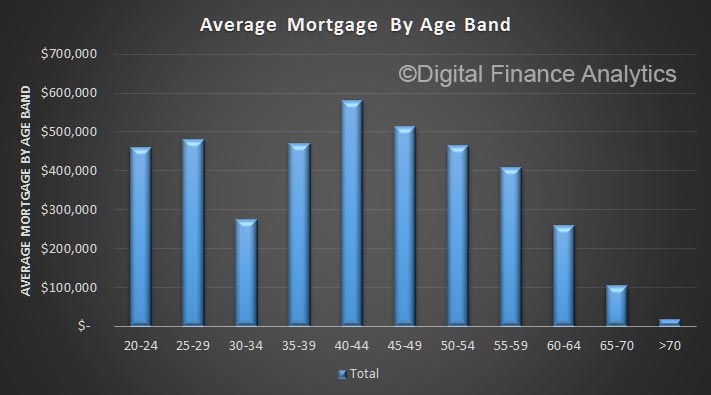

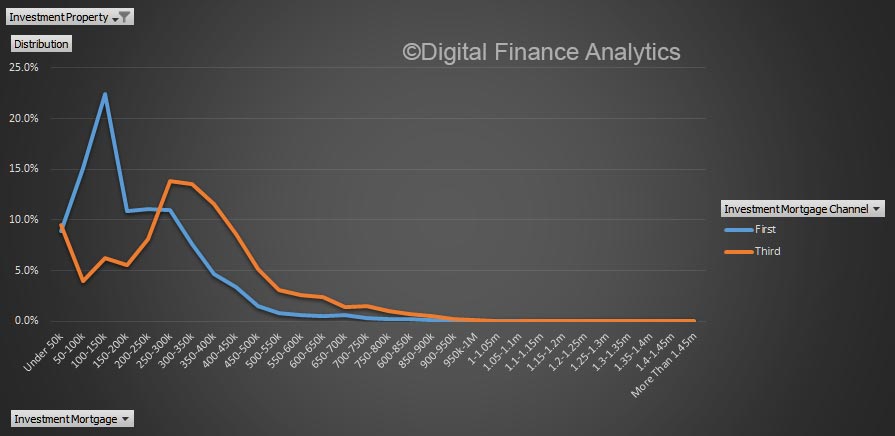

Next, we overlaid the average value of mortgages investor households have, some have total mortgages well above $1m, mostly negative geared.

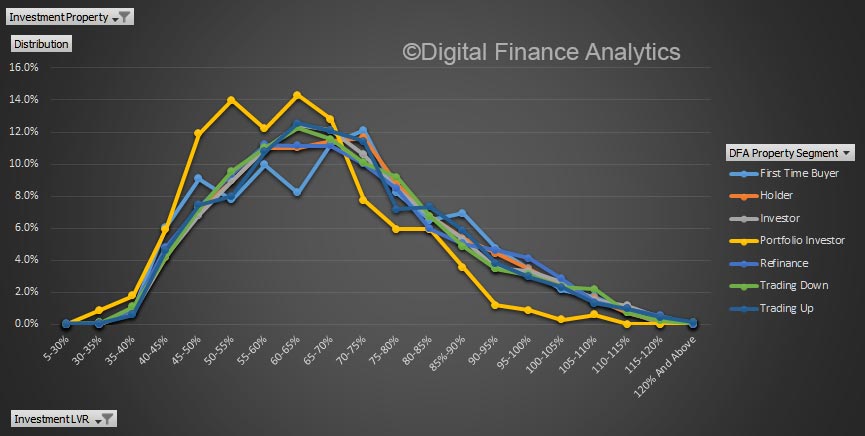

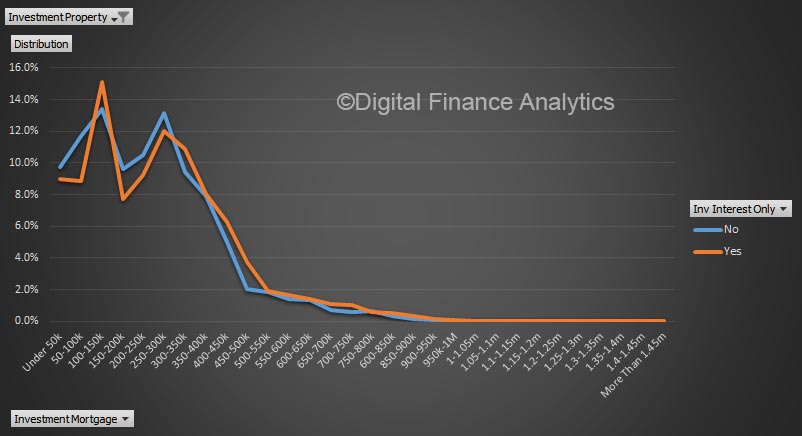

Now some only have investment properties (we identify them as investors, or portfolio investors). But others have BOTH investment and owner occupied property.

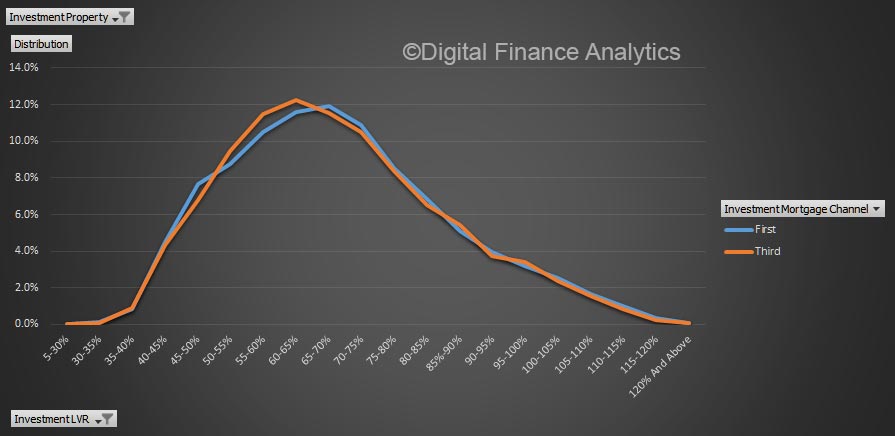

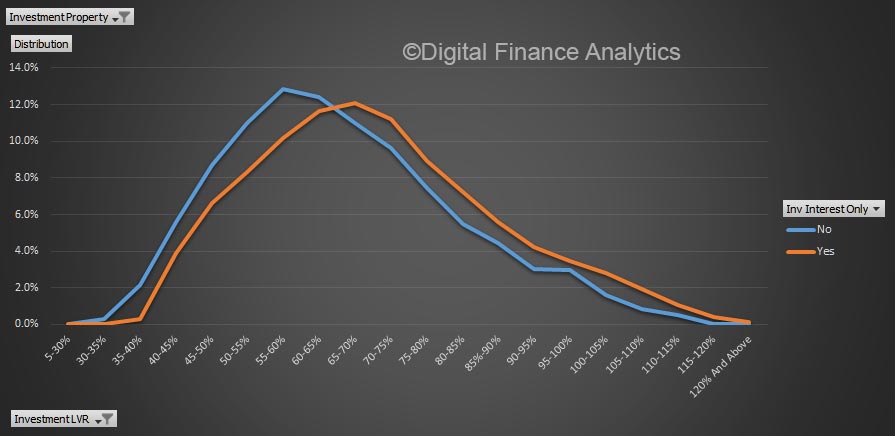

So finally, we added in the average owner occupied mortgage held by these same property investing households. One striking observation is just how leveraged up those with multiple properties are, and that they have a preference for investor loans over owner occupied loans.

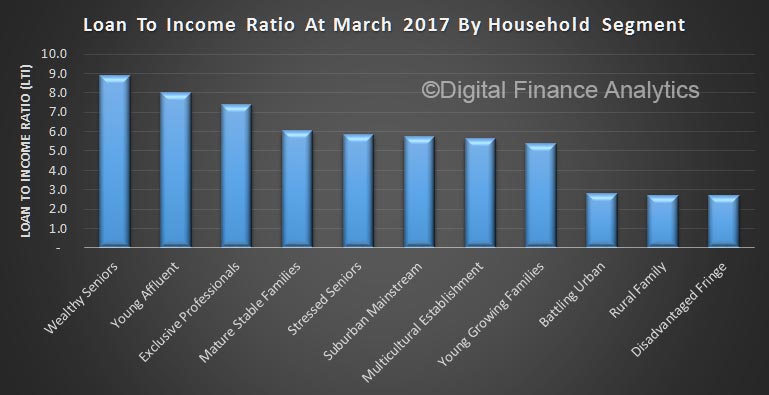

If you wanted to trim back the tax breaks, you could impose a limit on the value of mortgages geared, or the value, or number of investment properties leveraged or with concessionary capital gains. We think a value cap would be better than the number of properties, else, we suspect investors would simply buy a smaller number of higher value properties.