According to Computerworld, Heritage Bank has endorsed an application by some of the nation’s biggest banks lodged with the Australian Competition and Consumer Commission that seeks the right to form a cartel to collectively negotiate with, and engage in a boycott of, mobile wallet providers including Apple, Google and Samsung.

The Toowoomba-headquartered mutual bank is the biggest issuer of prepaid cards in Australia.

Last month the Commonwealth Bank of Australia, National Australia Bank, Westpac, and Bendigo and Adelaide Bank submitted the application to Australia’s competition watchdog.

In its submission to the ACCC Heritage argued that the restrictions imposed by Apple on third-party mobile payment apps for the iPhone reduce competition. Apple does not allow services other than its own Apple Pay offering to use the iPhone’s Near Field Communication antenna for contactless transactions.

In the ACCC application the banks indicate that one of the issues they would seek to collectively bargain over is access to the iPhone’s NFC capabilities. For its part, Apple has argued opening up access to NFC would undermine the security of mobile payments on the iPhone.

So far, in Australia only American Express and ANZ customers are able to use Apple Pay after the two companies struck agreements with the iPhone maker, Heritage Bank’s submission notes.

“Those with NFC enabled Android phones can choose from a broad range of issuers who support mobile payments,” Heritage argues. “iPhone users are consequently disadvantaged by the lack of access provided by Apple to issuers who offer their customers the option of a mobile payment wallet other than Apple Pay.”

Heritage adds that currently the industry “is not able to develop and enact agreed Australian standards relating to the safety, security and stability of mobile payments systems for which issuers, not Third Party Wallet Providers, primarily hold the risk.”

Finally, the submission adds, “Fees and other charges levied by Third Party Wallet Providers on issuers may not be able to be passed through to users of the service. This reduces competition since the decision to pass fees to customers of issuers (or not) and the level of those fees may not be negotiable when contracting with Third Party Wallet Providers who control mobile devices.”

EFTPOS provider Tyro has also indicated it backs the banks’ application.

“It is in the Australian public interest to maintain choice for consumers, merchants and banks as to mobile wallet solutions and the applications that they enable,” a submission from the company argues.

“While Apple allows third parties to connect free of charge via Wi-Fi, 3G, Bluetooth and other network protocols to its phone product range, it does not do so for NFC.

“Eliminating third party access to the Apple NFC function is particularly effective in stifling innovation and competition, because it is the only available and highly secure connectivity option that is ubiquitously available across the entire card payment infrastructure and terminal fleet.”

ANZ and Amex the winners in Australia’s banks’ fight with Apple over payment apps

However, South Australia’s Small Business Commissioner, John Chapman, expressed a different opinion: “In my view, this is simply a case whereby powerful banks are simply not used to having to accede to another, more powerful organisation — Apple — a global company that has the smarts and the resources to be able to simply ignore the banks’ demands.”

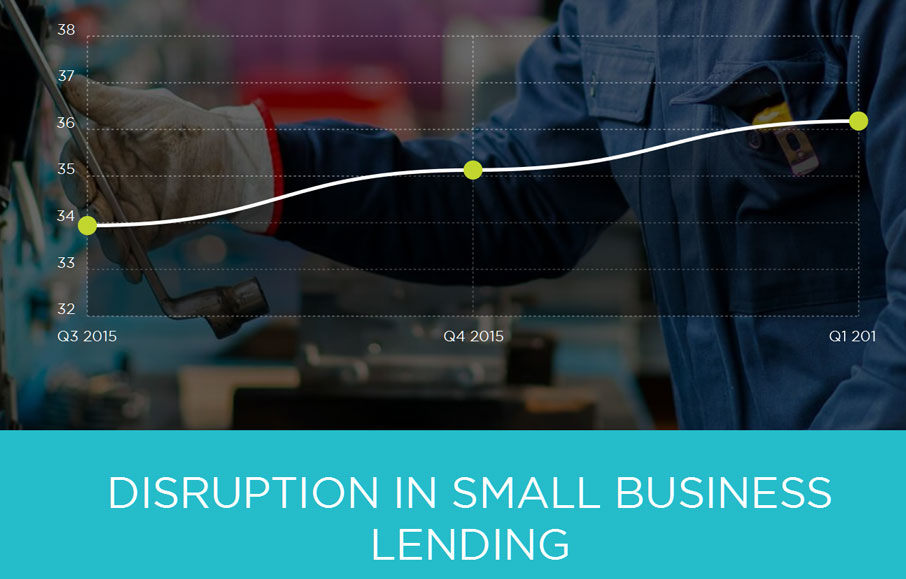

The likelihood of respondents using a mobile payment app soon was low, data from

The likelihood of respondents using a mobile payment app soon was low, data from