The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/

Join us for a live Q&A as I discuss the latest developments in the Sydney market with Mortgage Broker Chris Bates. https://www.wealthful.com.au/

You can ask a question live. https://walktheworld.com.au/

The latest chat with Property Insider Edwin Almeida.

https://www.ribbonproperty.com.au/

Go to the Walk The World Universe at https://walktheworld.com.au/

The latest edition of our finance and property news digest with a distinctively Australian flavour. On a number of issues the worm (see if you can spot her) is turning….

CONTENTS

0:00 Start

1:00 First Home Buyers Fall

3:58 Housing Affordability And Super

8:53 House Price Correction?

12:25 Overt Risk Taking

16:40 Bank Offering Commissions To Real Estate Agents

19:10 Vaccine Bungle And ScoMo

25:48 Australia Post New CEO!

26:40 Conclusions and Close

Go to the Walk The World Universe at https://walktheworld.com.au/

My latest Friday afternoon chat with Journalist Tarric Brooker, who is @AvidCommentator on Twitter.

Go to the Walk The World Universe at https://walktheworld.com.au/

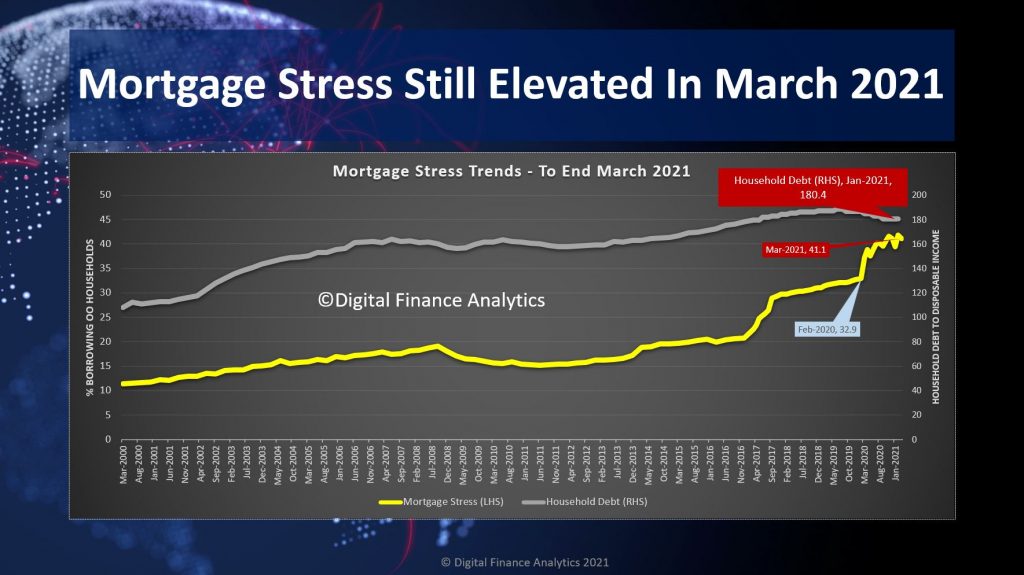

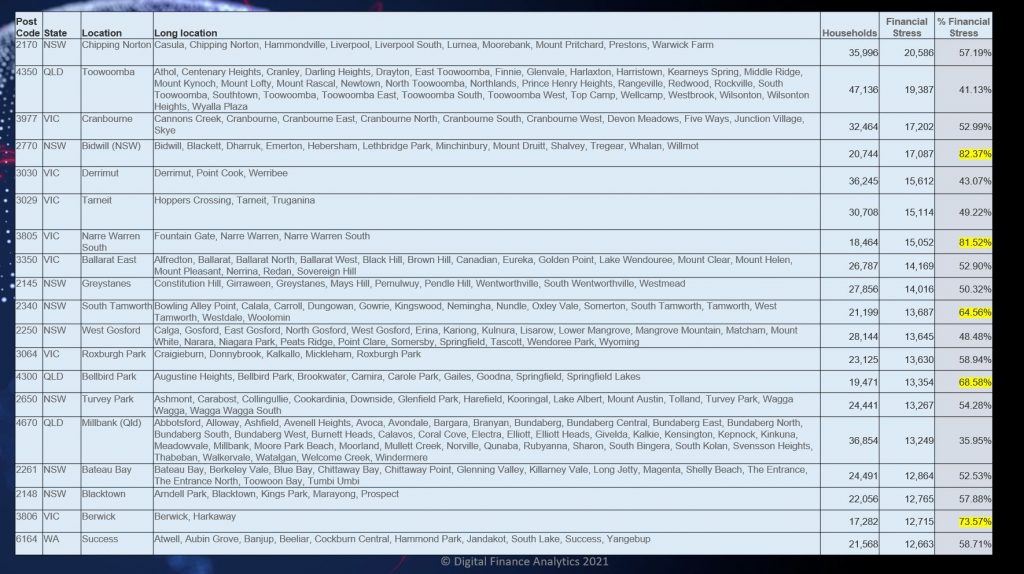

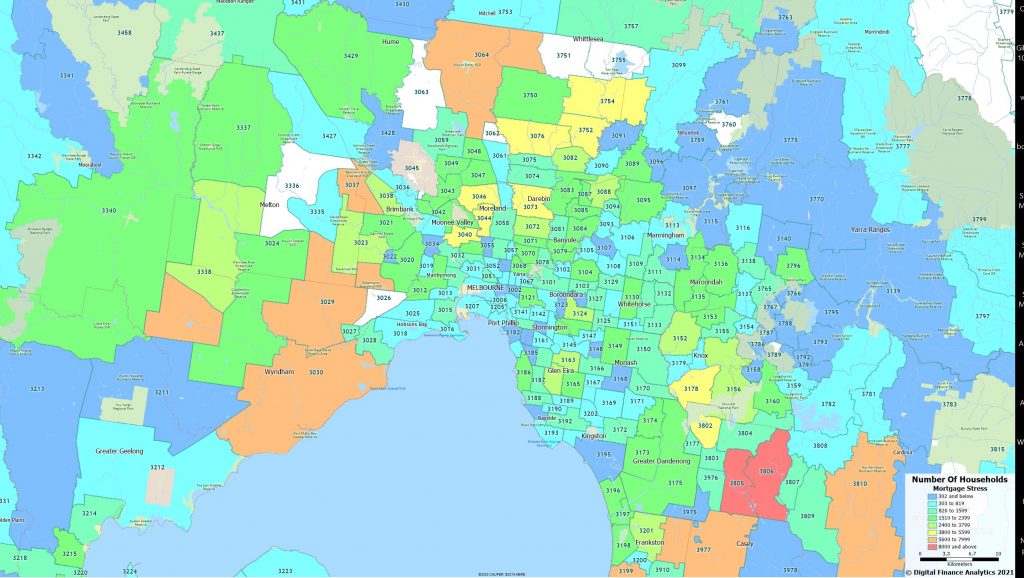

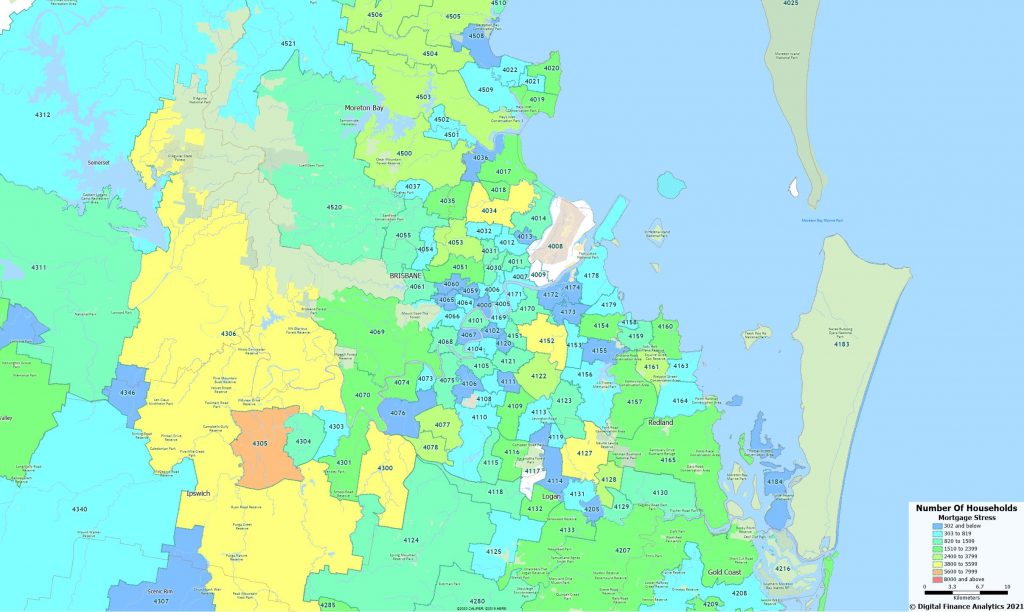

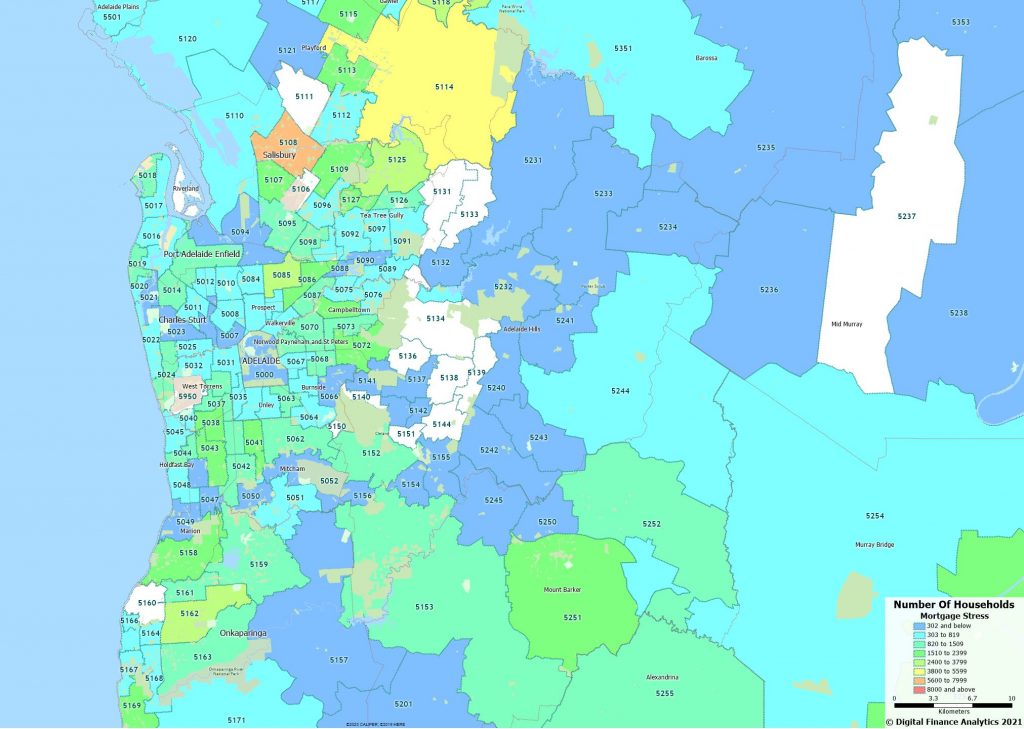

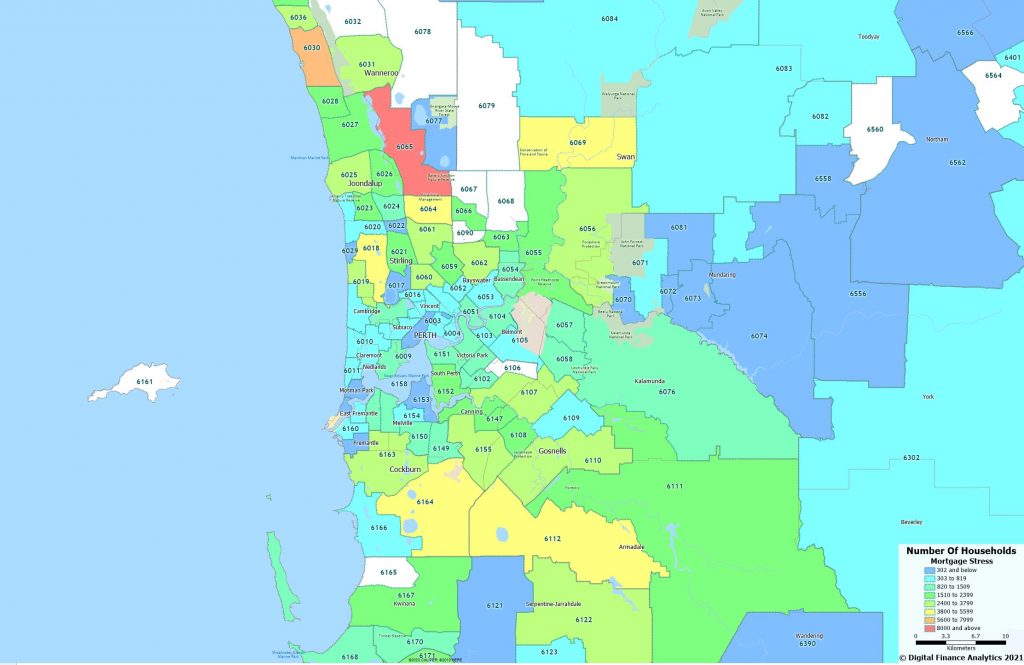

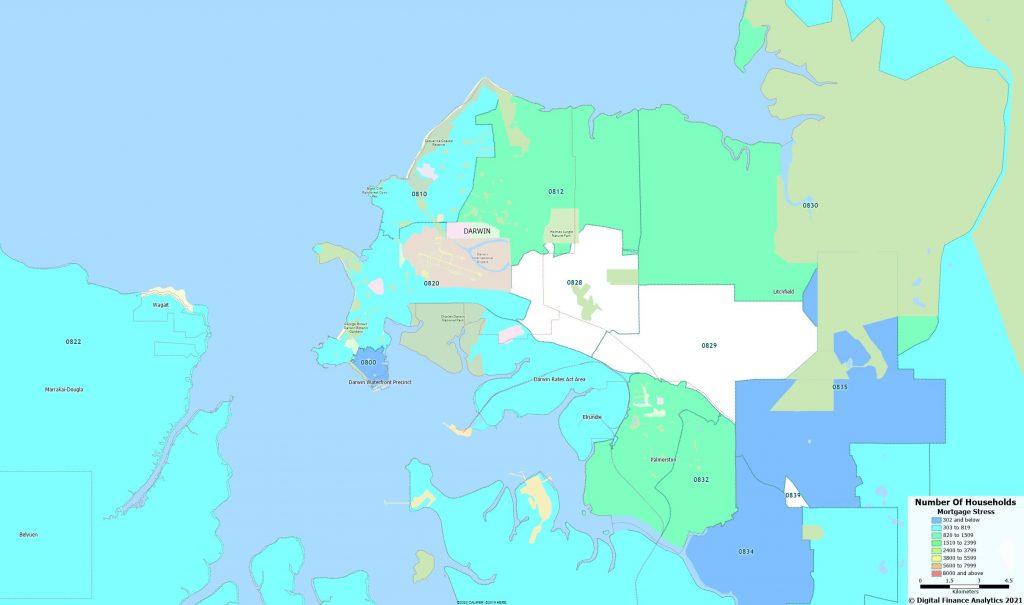

The latest results from our household surveys confirms that there are more households in financial stress than before the pandemic hit. As the various Government support mechanisms are ratcheted back, we will see the true impact on the community. Household debt is also turning higher again.

We have 41.1% of mortgaged households (1.5 million) in financial flow stress, despite the lower interest rate environment. While many have paid down debt, other have borrowed more. For example, the average new first time buyer loan is 15-18% larger than a year back- so much for the maintenance of lending standards!

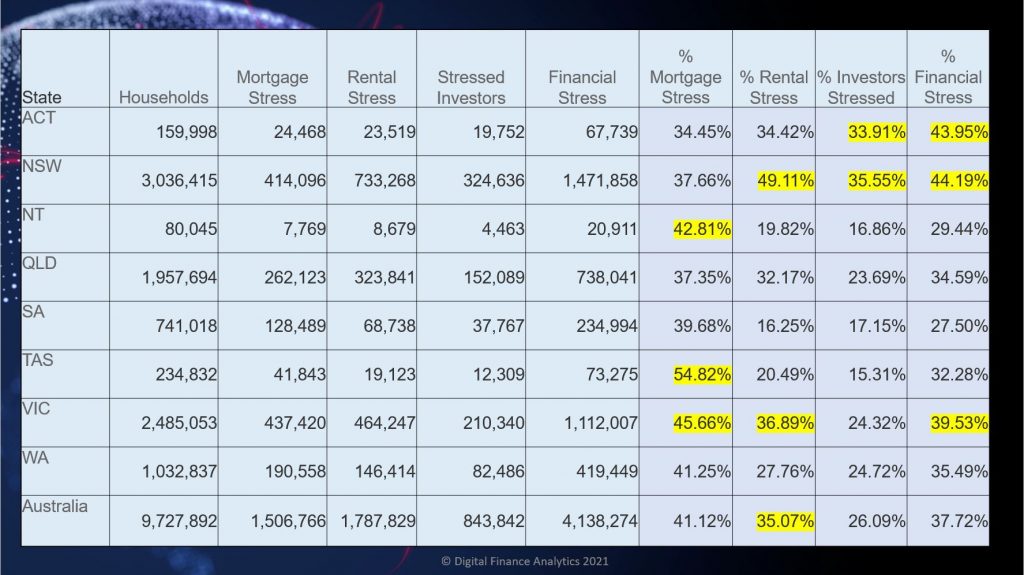

We discussed this in detail in our live show, last night.

Across the states, the patterns are familiar, with Tasmania still reporting the highest proportion of households in mortgage stress thanks to low wages, and rising home prices. Victoria continues to be impacted by the longer lock-downs. Rental stress is being exacerbated by the end of tenant protections, so expect to see more evictions, and rent rises in the weeks ahead. Property investors in NSW are still having rental flow issues (due to high vacancies and lower rents). Overall financial stress – the aggregated measure across all households is highest in NSW, ACT and VIC.

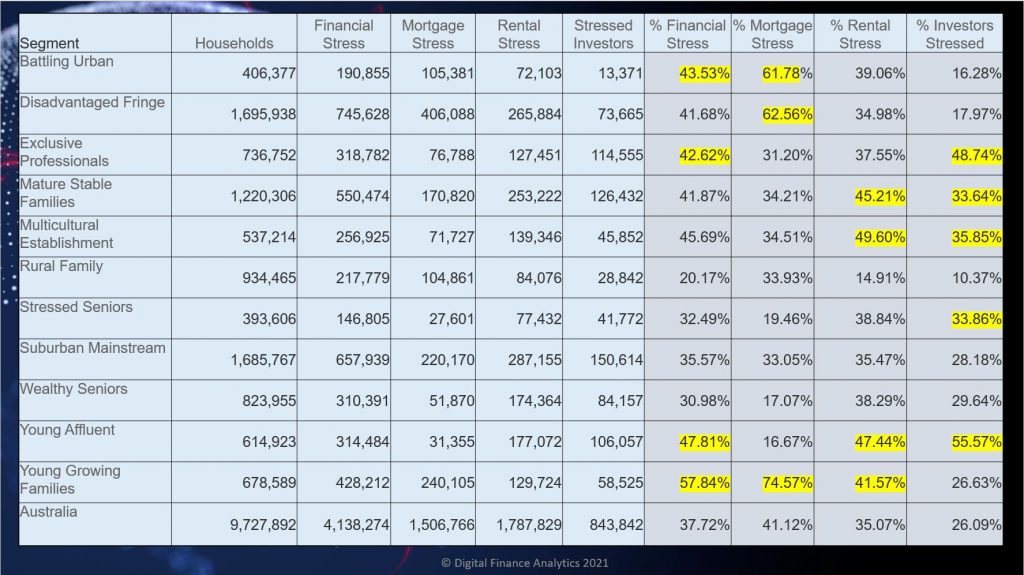

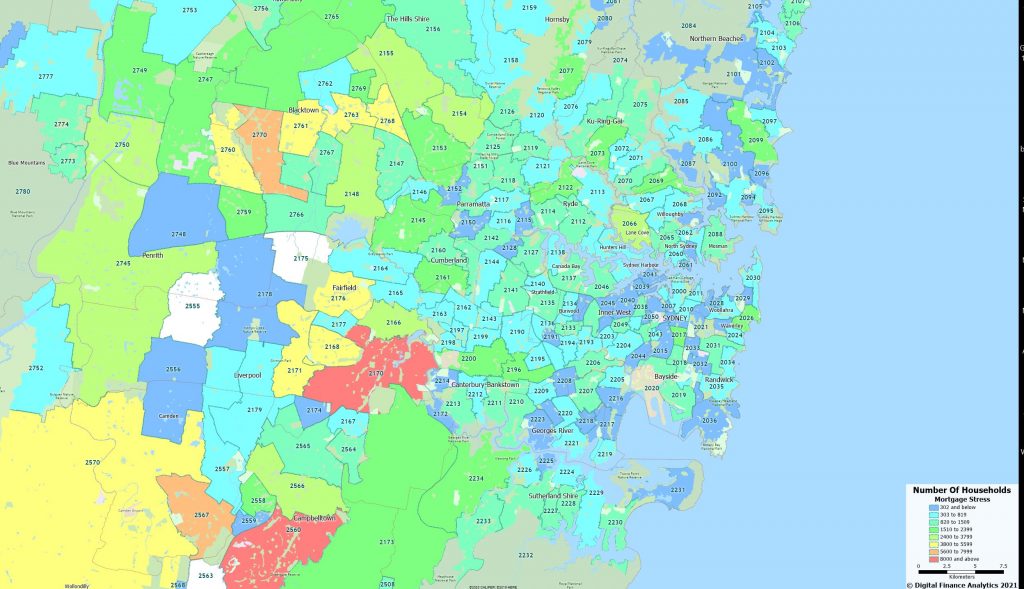

Across our household segments young growing families, and those on the urban fringe in high growth corridors are being impacted, although across our segments and stress categories, it remains a real patchwork.

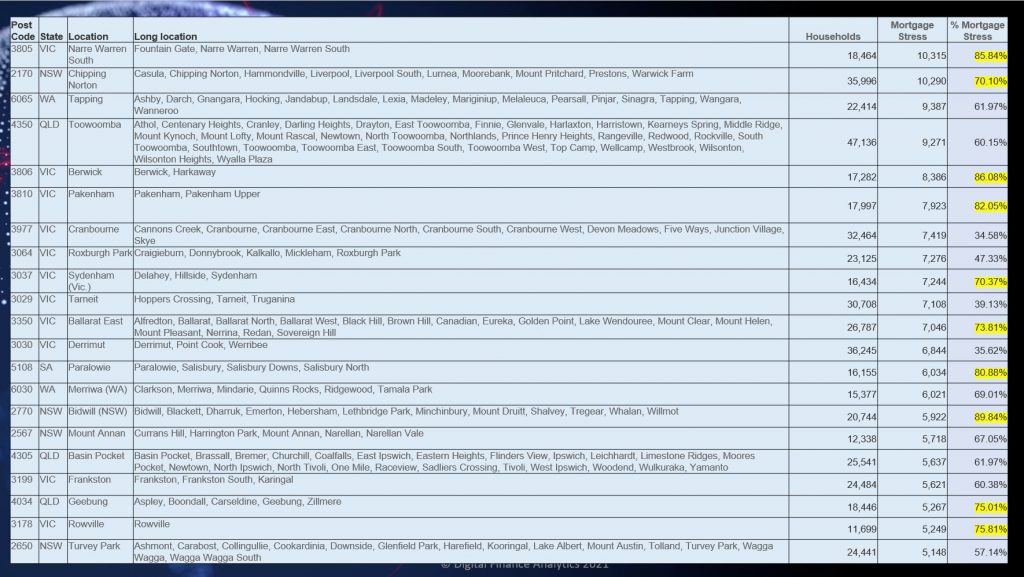

The top post codes for mortgage stress include Narre Warren and Fountain Gate, 3805 in Victoria, and Liverpool 2170 in NSW.

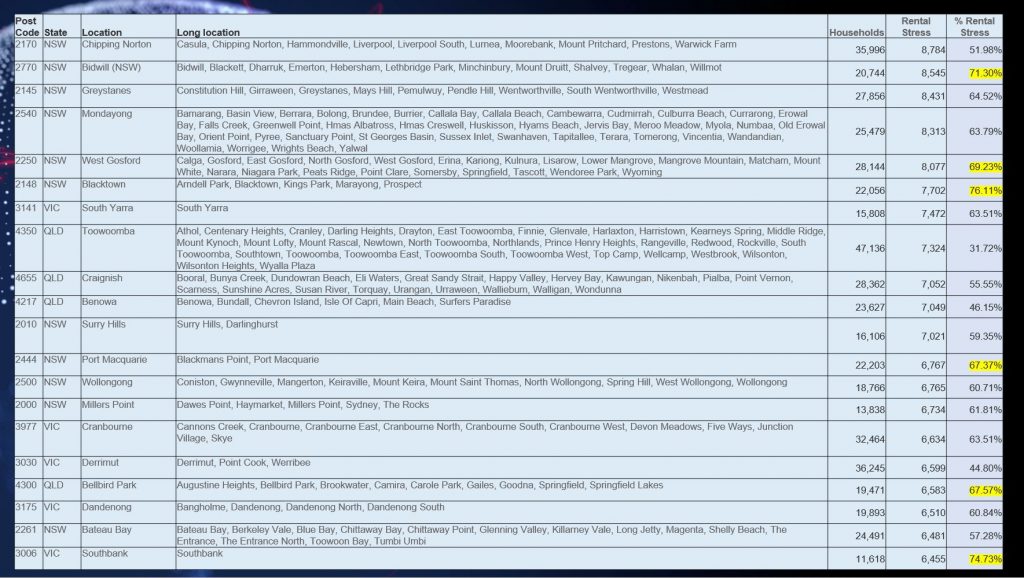

The top rental stress post codes include Liverpool 2170, NSW, Mount Druitt and Lethbridge Park 2770, NSW and Westmead 2145 NSW.

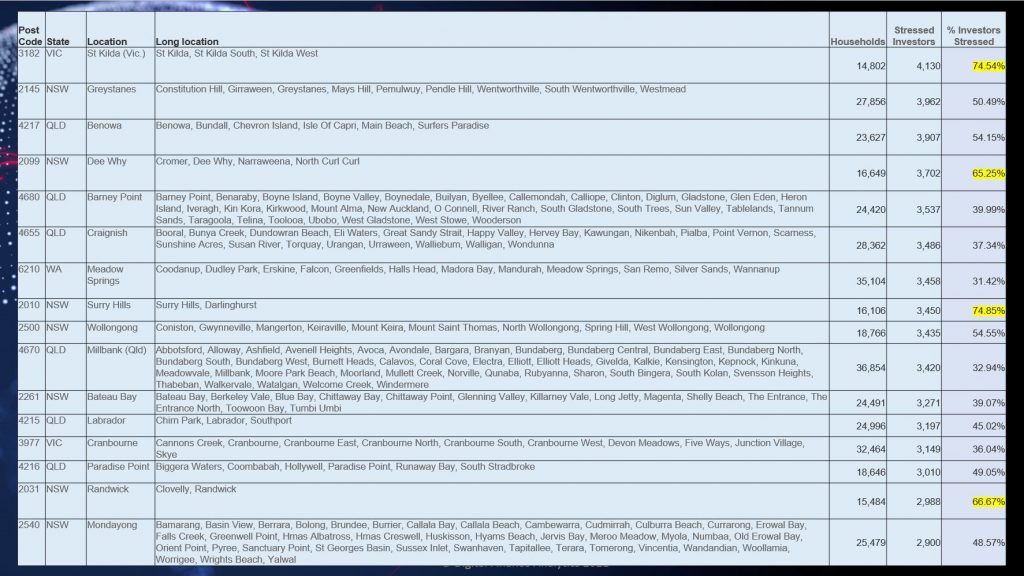

Investor stress is highest is St Kilda 3182, Westmead 2145 and Surfers Paradise 4217 in QLD.

Cumulative financial stress is highest in Liverpool 2170, Mount Druitt 2145, and Westmead 2145.

The mapping of mortgage stress to post codes reveals the potential hot spots, which include many of the high growth corridors, where vast estates continue to be built and sold to people who extend themselves to buy them. Many are first time buyers. Given flat wages, and higher unemployment post JobKeeper, this is one to watch.

Whilst property prices are rising in many areas, the financial pressures on households are building, and we expect to see more casualties ahead. Financial stress can ultimately lead to significant social and behaviourial issues. Mortgage default rates (which are also rising) do not tell the full story.

Join us for our live show, and ask a question via YouTube chat…

The latest in our series of chats with Edwin Almeida, our property insider.

https://www.ribbonproperty.com.au/

Go to the Walk The World Universe at https://walktheworld.com.au/

Frenchs Forest is a suburb of northern Sydney, in the state of New South Wales, Australia. Frenchs Forest is 13 kilometres north of the Sydney central business district in the local government area of Northern Beaches Council.

The suburb went through rezoning post 2018 to include a new hospital, town centre, new relocated high school, 2,200 new homes and $500 million to upgrade the roads.

We look at property in the suburb.

Go to the Walk The World Universe at https://walktheworld.com.au/

The latest edition of our finance and property news digest with a distinctively Australian flavour.

CONTENTS

0:00 Start

0:40 Markets Winning Streak

7:30 US Jobs

10:20 RBA Won’t Stop The Housing Boom

20:00 Home Prices In March

23:45 Risks Rising?

26:55 Fair Trading and Under-quoting

32:45 Conclusions…

Go to the Walk The World Universe at https://walktheworld.com.au/