CBA released their quarter update to 31 March 2019. Its an unaudited summary. Its weak, and confirms the trends we saw elsewhere. Customer remediation is costing them dear. CBA shares dropped.

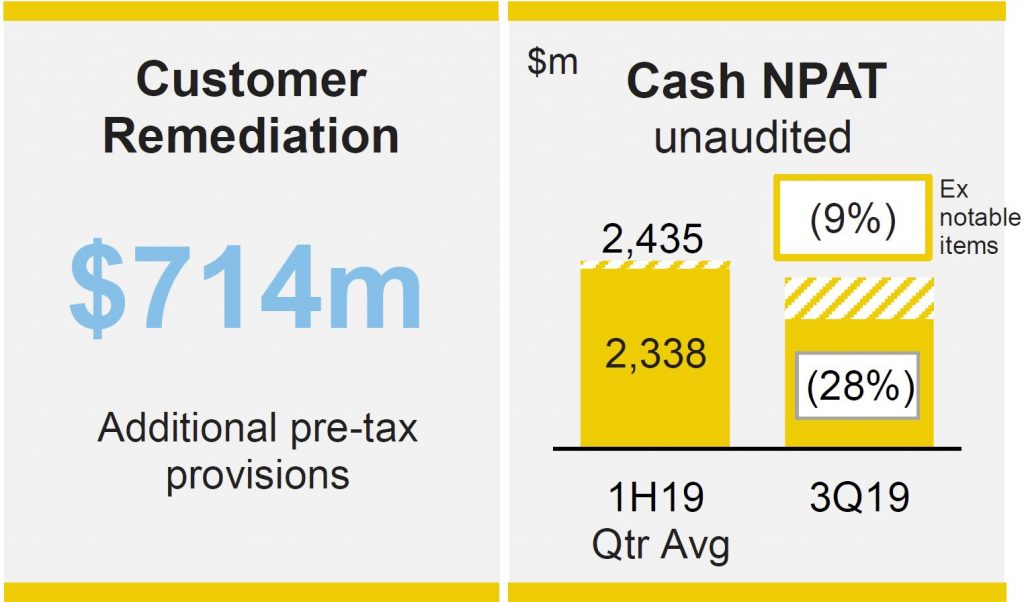

They announced an unaudited statutory net profit of $1.75 billion and a cash net profit of $1.70 billion. Headline profit was impacted by $714 million in pre-tax additional customer remediation which translates to $500 million post-tax.

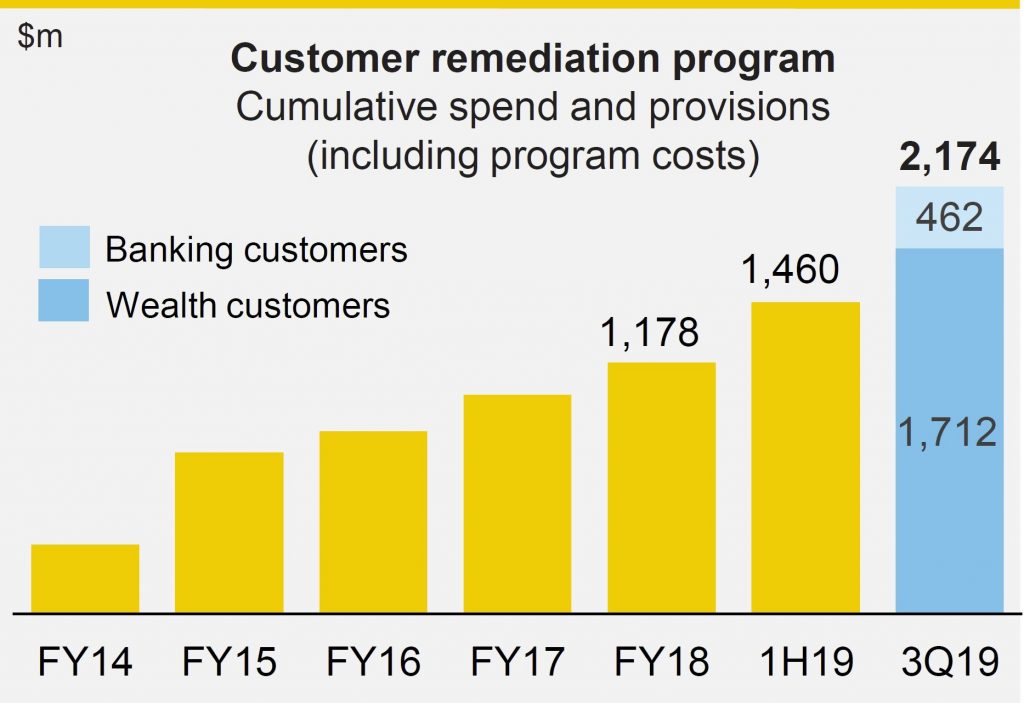

Customer remediation on a cumulative basis now stands at $2.17 billion, an astonishing amount.

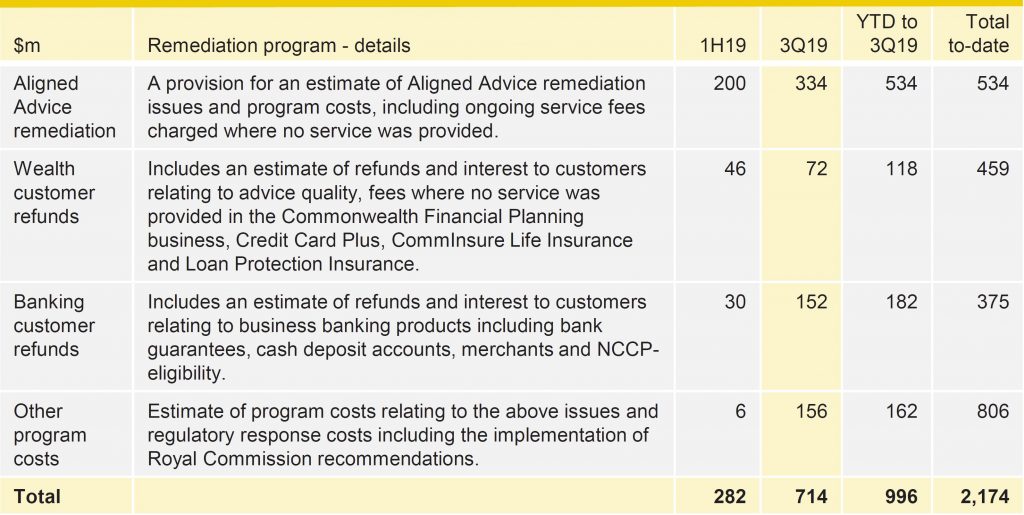

They provided a breakout. Fee for no service and costs of the remediation programmes were the largest items. $374m is included for customer refunds – including $123 million of interest and assumes a refund rate of 24% excluding interest of the ongoing service fee costs from FY09-FY18.

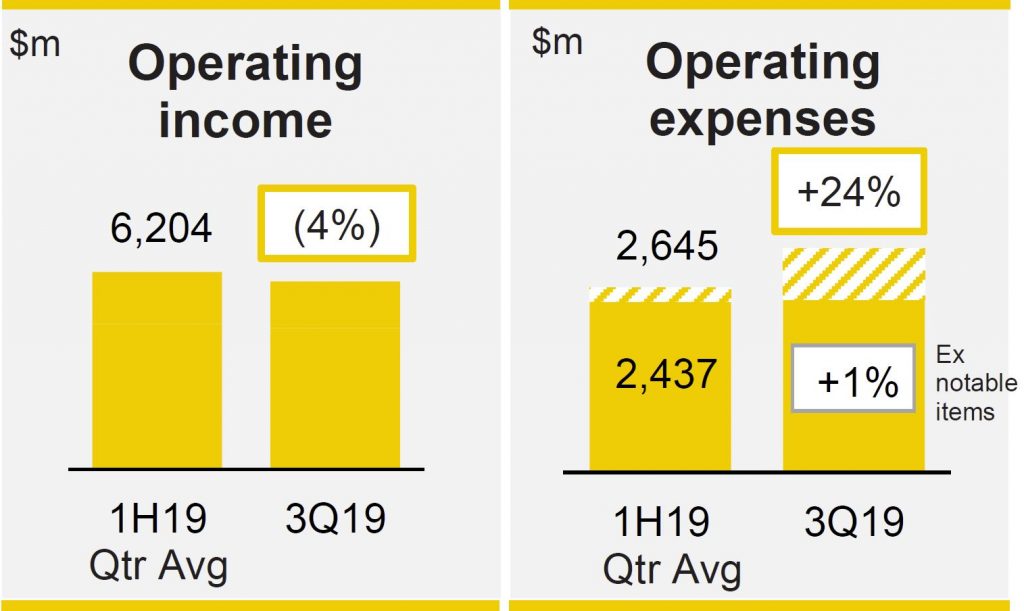

Operating income was 4% lower, thanks to a range of factors, including seasonal factors, “temporary headwinds” including unfavorable derivative valuation adjustments and weather events), and re-based fee income.

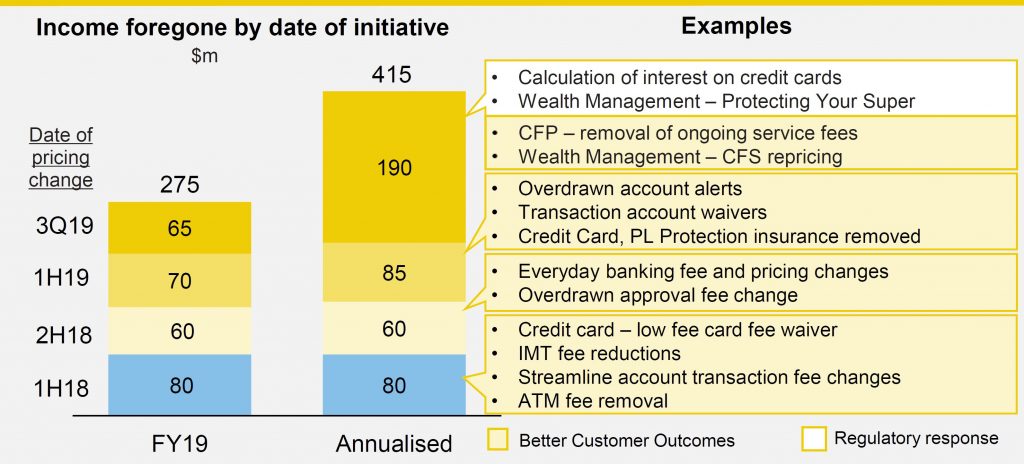

Net interest income was down 3% (due to fewer days in the quarter). The Group’s net interest margin fell “slightly”. Non-interest income was 10% lower, thanks to some “Better Customer Outcomes” initiatives. Income foregone is $415 million, of which $275 million will be recognised in 2019.

Operating expenses rose 1% excluding notable items, of 24% including the additional customer remediation.

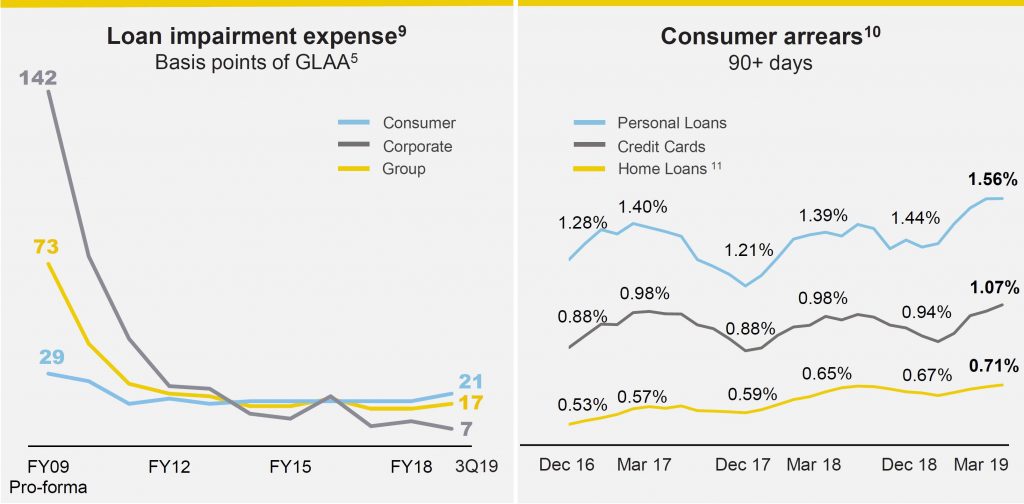

Loan impairment expenses was $314 million in the quarter or 17 basis points of Gross Loans And Acceptances, compared with 15 basis points in 1H19. This includes higher levels of consumer arrears and corporate impaired assets.

Consumer arrears are conveniently attributed to “seasonal factors”, as well as a rising trend, thanks to subdued levels of income growth and cost of living challenges, most evident in the outer metro areas of Perth, Melbourne and Sydney.

Accounts in negative equity are more than 3% of total accounts, based on 31 March 2019 (so higher now). Around three quarters of the negative equity relates to WA and QLD.

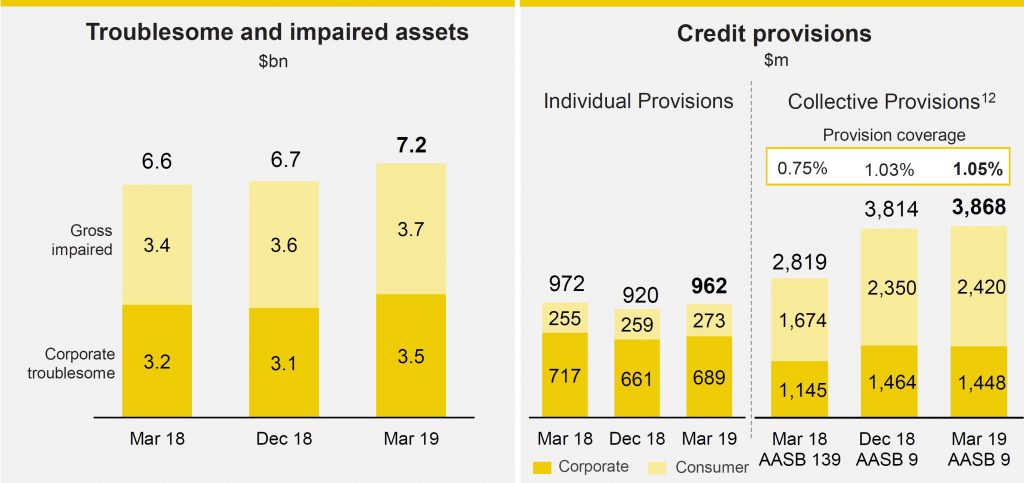

Troublesome and impaired assets rose to $7.2 billion. There are emerging signs of weakness in discretionary retail and drought-affected farmers and communities, including some named corporates, and home loan customers experiencing hardship.

Total provisions were increased by $96 million to around $4.8 billion dollar, and collective provisions were also lifted.

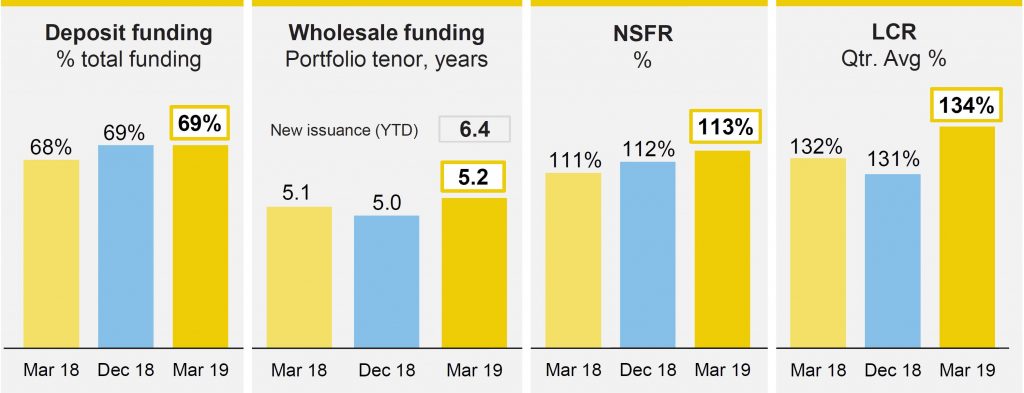

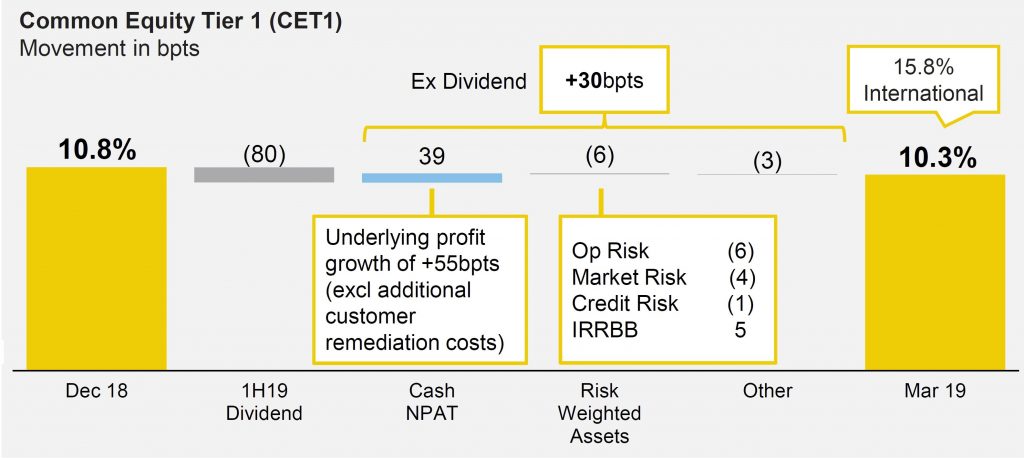

The banks ratios were pretty strong.

But the CET1 ratio fell from 10.8% to 10.3%., after the impact of dividend payments.

We expect to see more pressure on the sector ahead.