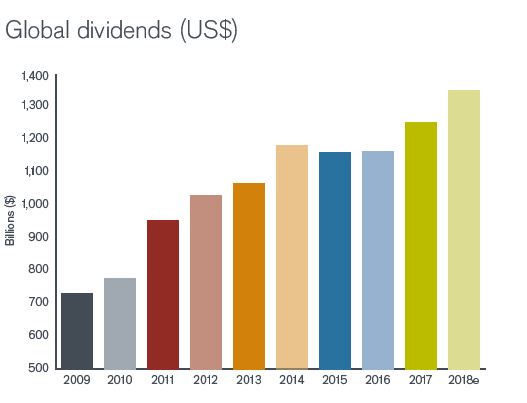

A strengthening world economy and rising corporate confidence pushed global dividends to a new high in 2017, according to the latest Janus Henderson Global Dividend Index. They rose 7.7% on a headline basis, the fastest rate of growth since 2014, and reached a total of $1.252 trillion.

Underlying growth, which adjusts for movements in exchange rates, one-off special dividends and other factors, was an impressive 6.8%, and showed less divergence than in previous years across the different regions of the world, reflecting the broadly based global economic recovery.

Every region of the world and almost every industry saw an increase. Moreover, records were broken in 11 of the index’s 41 countries, among them the United States, Japan, Switzerland, Hong Kong, Taiwan, and the Netherlands.

In Australia, dividends rose to $53.3bn, an increase of 9.7% on an underlying basis. The big story was the return of the mining companies, following rapid improvements in their profits and balance sheet. Between them, BHP and Rio Tinto added $2.9bn, accounting for two-thirds of all Australia’s dividend growth.

Among the banks, which pay more than half of all Australian dividends, and which have very high payout ratios, only Commonwealth Bank increased slightly year-on-year. Even so, no Australian company in our index cut its dividend, though QBE Insurance further reduced the tax credit it was able to provide, meaning that investors received less year-on-year after tax.

In 2017, CBA was the world’s 13th dividend payer (down from 12th the previous year), the only Australian firm in the top 20 according to the JH research.

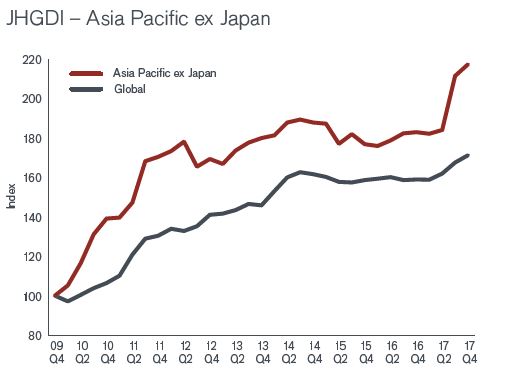

2017 was a record year for Asia Pacific ex Japan. The total paid

jumped 18.8% to $139.9bn, boosted by exceptionally large special dividends in Hong Kong, of which the biggest by far was from China Mobile. Even allowing for these, and other factors elsewhere in the region, underlying growth was impressive at 8.6%. The jump in dividends paid in the region was just enough to push it ahead of North America as the fastest growing region since 2009.

They say that strong earnings growth around the world in 2018 will support continued dividend increases, with 6.1% underlying growth, with every region seeing an increase, plus a weaker dollar means expected headline growth of 7.7%, bringing total global dividends of $1.348 trillion in 2018.

Methodology.

Each year Janus Henderson analyses dividends paid by the 1,200 largest firms by market capitalisation (as at 31/12 before the start of each year). Dividends are included in the model on the date they are paid. Dividends are calculated gross, using the share count prevailing on the pay-date (this is an approximation because companies in practice fix the exchange rate a little before the pay date), and converted to USD using the prevailing exchange rate.