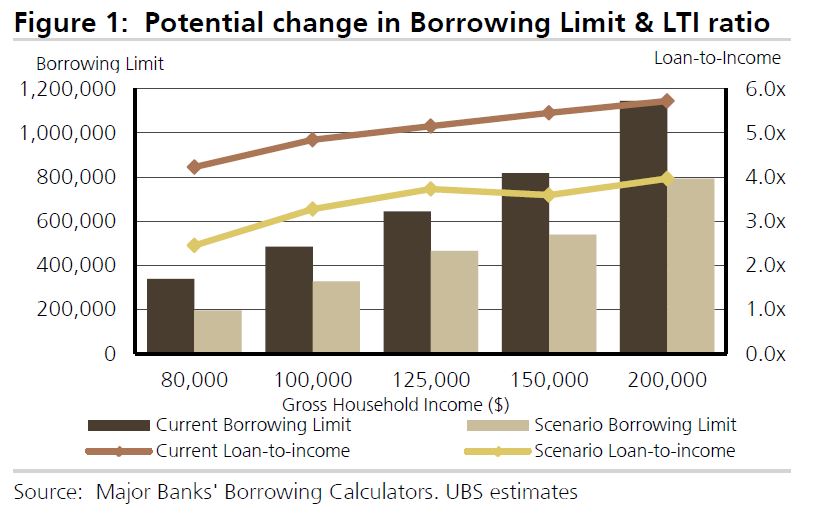

The good people at UBS has published further analysis of the mortgage market, arguing that the Royal Commission outcomes are likely to drive a further material tightening in mortgage underwriting. As a result they think households “borrowing power” could drop by ~35%, mainly thanks to changes to analysis of expenses, as the HEM benchmark, so much critised in the Inquiry, is revised.

Their starting point assumes a family of four has living expenses equal to the HEM ‘Basic’ benchmark of $32,400 p.a. (ie less than the Old Age Pension). This is broadly consistent with the Major banks’ lending practices through 2017.

As a result, the borrowing limits provided by the banks’ home loan calculators fell by ~35% (Loan-to-Income ratio fell from ~5-6x to ~3-4x).

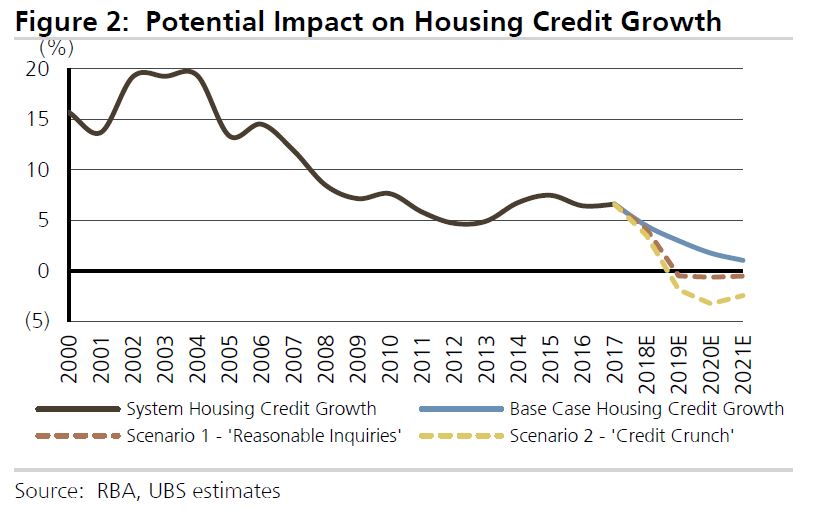

This leads to a reduction in housing credit and a further potential fall in home prices.

This leads to a reduction in housing credit and a further potential fall in home prices.

This plays out similarly to our own scenarios, which we discussed a couple of weeks back, exploring the outcomes from a mild correction, to a crash. A 20% reduction in borrowing power has already hit, by the way, and this before the Royal Commission revelations.

This plays out similarly to our own scenarios, which we discussed a couple of weeks back, exploring the outcomes from a mild correction, to a crash. A 20% reduction in borrowing power has already hit, by the way, and this before the Royal Commission revelations.

This will have a significant impact on the banks, but a broader hit to the economy also.