The February 2017 data from the RBA today shows that overall credit grew 0.3% in the month, with housing up 0.6% to an annual 6.4% whilst personal credit and business lending both fell.

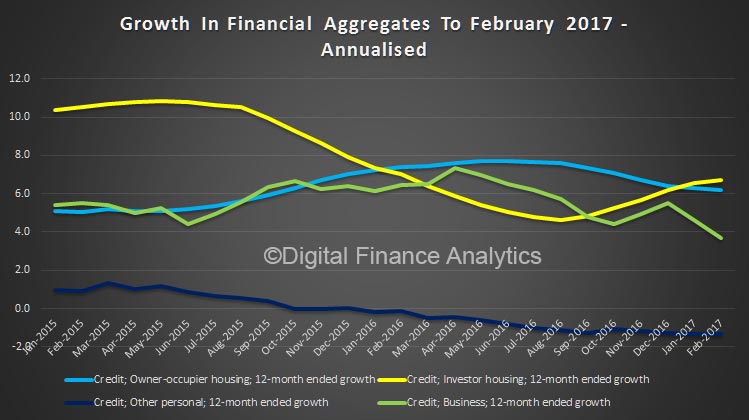

On a 12 month annualised basis, lending for investment housing grew the fastest at 6.7%, whilst owner occupied lending grew by 6.2% and there was a fall in business lending, down to 3.7%.

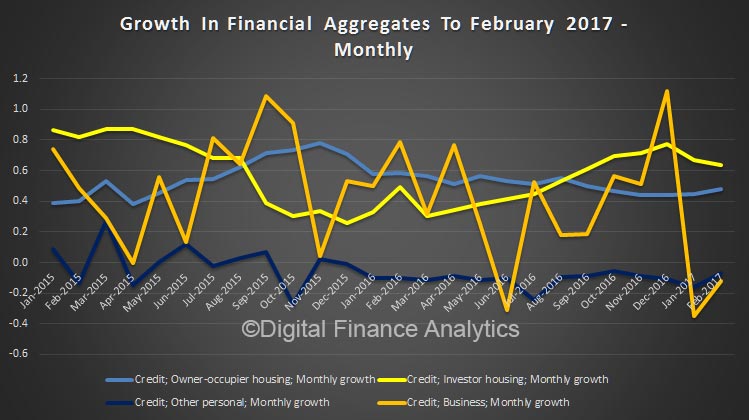

The monthly series showed that investor lending grew faster (0.6%) than lending for owner occupation (0.5%). Business lending took a dive and other personal credit was lower.

The monthly series showed that investor lending grew faster (0.6%) than lending for owner occupation (0.5%). Business lending took a dive and other personal credit was lower.

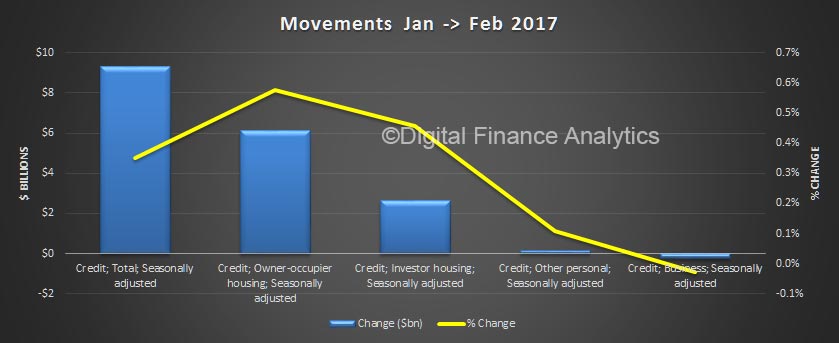

Turning to the month on month movements, (not RBA adjusted), owner occupied housing grew faster than investment lending. In the month, owner occupied loans grew $9.3 billion whilst investment loans grew $2.6 billion, seasonally adjusted.

Turning to the month on month movements, (not RBA adjusted), owner occupied housing grew faster than investment lending. In the month, owner occupied loans grew $9.3 billion whilst investment loans grew $2.6 billion, seasonally adjusted.

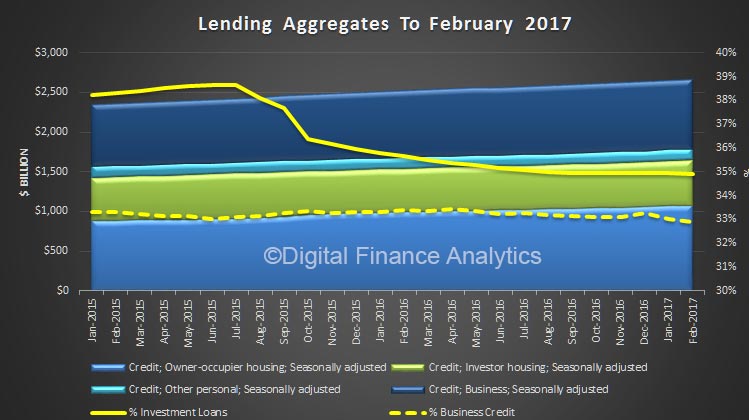

Finally, here is the total value lent by category. Total seasonally adjusted balances for housing was $1.64 trillion, of which investment lending comprised 32.9%, or $575 billion. Lending for owner occupation was $1.071 billion.

Lending for business, as a proportion of all lending fell again.

Lending for business, as a proportion of all lending fell again.

The RBA notes:

Following the introduction of an interest rate differential between housing loans to investors and owner-occupiers in mid-2015, a number of borrowers have changed the purpose of their existing loan; the net value of switching of loan purpose from investor to owner-occupier is estimated to have been $50 billion over the period of July 2015 to February 2017, of which $1 billion occurred in February 2017. These changes are reflected in the level of owner-occupier and investor credit outstanding. However, growth rates for these series have been adjusted to remove the effect of loan purpose changes.

We will discuss the APRA data which is also out today, in a separate post. We doubt the changes by APRA announced today will have much impact on the market, although the continuing out of cycle rate hikes by the banks might.