The final set of data from the ABS – Lending Finance to November 2017 highlights again the changes underway in the property sector. They also contain some revisions from last month. As normal we will focus on the trend series, which smooths some of the monthly changes.

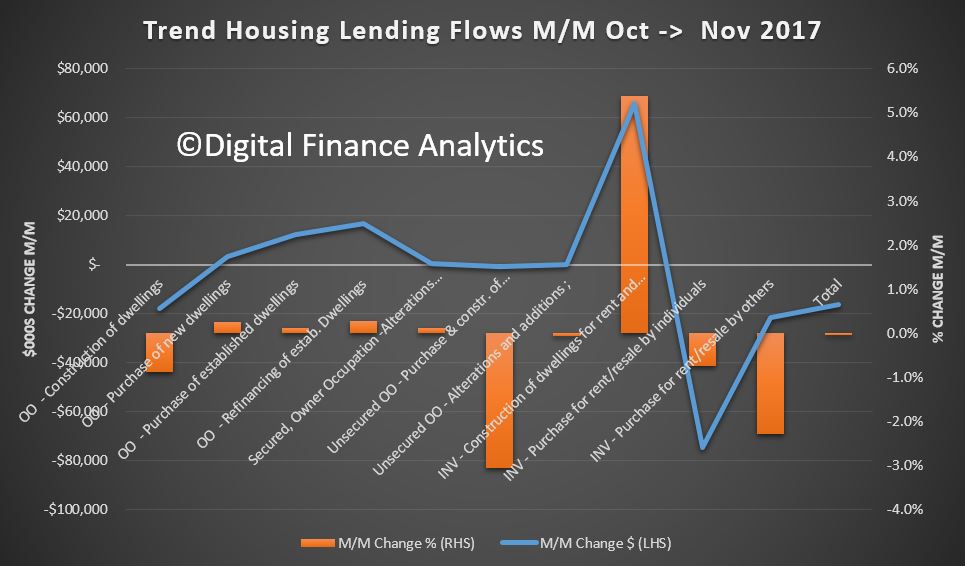

Within the housing series, owner occupied lending for construction fell 0.88% compared with the previous month, down $17m; lending for the purchase of new dwellings rose 0.25%, up $3m; and loans for purchase of existing dwellings rose 0.11%, up $12m.

Refinance of existing owner occupied dwellings rose 0.28%, up $16m.

Looking at investors, borrowing for new investment construction rose 5%, up $65m; while purchase of existing property by investors fell $74m for individuals, down 0.75%; and for other investors, down $21m or 2.28%.

Overall there was a fall of $16m across all categories.

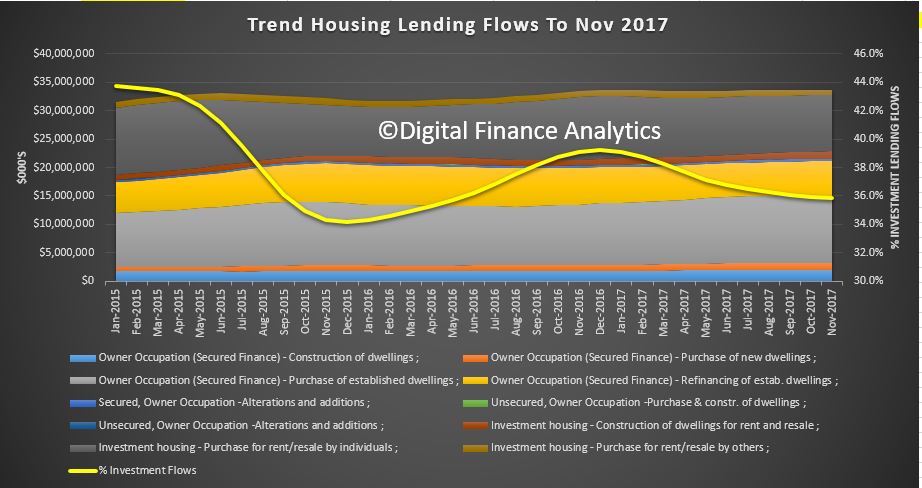

We see a fall in investment lending overall, but it is still 36% of new lending flows, so hardly a startling decline. Those calling for weakening of credit lending rules to support home price growth would do well to reflect that 36% is a big number – double that identified as risky by the Bank of England, who became twitchy at 16%!

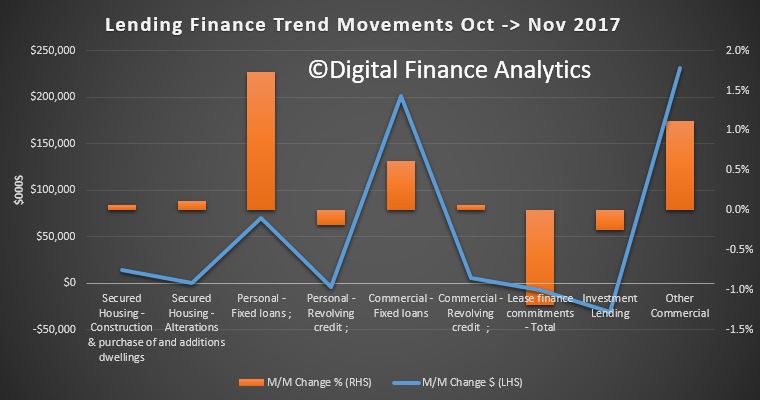

Looking then across all lending categories, personal fixed credit (personal loans rose $70m, up 1.74%; while revolving credit (credit cards) fell $4m down 0.18%. Fixed commercial lending, other than for property investment rose $231m or 1.12%; while lending for investment purposes fell 0.25% or $30m. The share of fixed business lending for housing investment fell to 36.7% of business lending flows, compared with 41% in 2015. Revolving business credit rose $6m up 0.06%.

Looking then across all lending categories, personal fixed credit (personal loans rose $70m, up 1.74%; while revolving credit (credit cards) fell $4m down 0.18%. Fixed commercial lending, other than for property investment rose $231m or 1.12%; while lending for investment purposes fell 0.25% or $30m. The share of fixed business lending for housing investment fell to 36.7% of business lending flows, compared with 41% in 2015. Revolving business credit rose $6m up 0.06%.

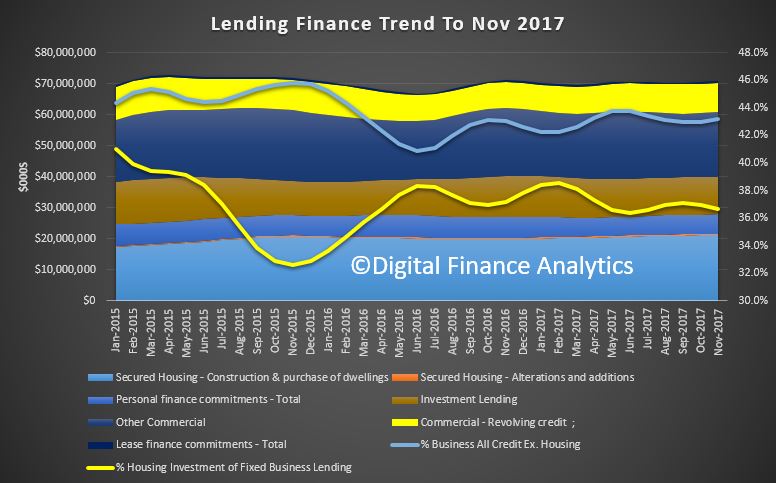

So, what can we conclude? Investment lending momentum is on the turn, though there is still lots of action in the funding of new property construction for investment – mostly in the high rise blocks around our major centres. But in fact momentum appears to be slowing in Brisbane, Sydney and Melbourne. This does not bode well for the construction sector in 2018, as we posit a fall in residential development, only partly offset by a rise in commercial and engineering construction (much of which is state and federal funded).

So, what can we conclude? Investment lending momentum is on the turn, though there is still lots of action in the funding of new property construction for investment – mostly in the high rise blocks around our major centres. But in fact momentum appears to be slowing in Brisbane, Sydney and Melbourne. This does not bode well for the construction sector in 2018, as we posit a fall in residential development, only partly offset by a rise in commercial and engineering construction (much of which is state and federal funded).

The good news is lending to business, other than for housing investment is rising a little, but businesses are still looking to hold costs down, and borrow carefully. This means economic growth will be slow, and potential wages growth will remain contained.

Finally, here is the ABS reporting the data. Note the significant swings between the trend and seasonal adjusted series. You can pick your number, and weave a story to suit, as people are doing.

The total value of owner occupied housing commitments excluding alterations and additions rose 0.1% in trend terms, and the seasonally adjusted series rose 2.7%.

The trend series for the value of total personal finance commitments rose 1.0%. Fixed lending commitments rose 1.7%, while revolving credit commitments fell 0.2%.

The seasonally adjusted series for the value of total personal finance commitments rose 1.1%. Revolving credit commitments rose 2.8% and fixed lending commitments rose 0.1%.

The trend series for the value of total commercial finance commitments rose 0.5%. Fixed lending commitments rose 0.6% and revolving credit commitments rose 0.1%.

The seasonally adjusted series for the value of total commercial finance commitments rose 14.7%. Fixed lending commitments rose 22.0%, while revolving credit commitments fell 8.1%.

The trend series for the value of total lease finance commitments fell 1.2% in November 2017 and the seasonally adjusted series fell 8.0%, after a rise of 4.1% in October 2017.