On 6 June, JPMorgan Chase & Co. announced that it would shut down Finn, its digital consumer banking brand focused on attracting younger customers, via Moody’s.

At first glance, some might consider the decision to shut down the offering as a setback, however it also demonstrates JPM’s superior ability compared to many peers to experiment and invest aggressively in technology while maintaining robust profitability. A customer-centric approach to innovation is essential for incumbent firms to react to the offerings of financial technology (fintech) challengers.

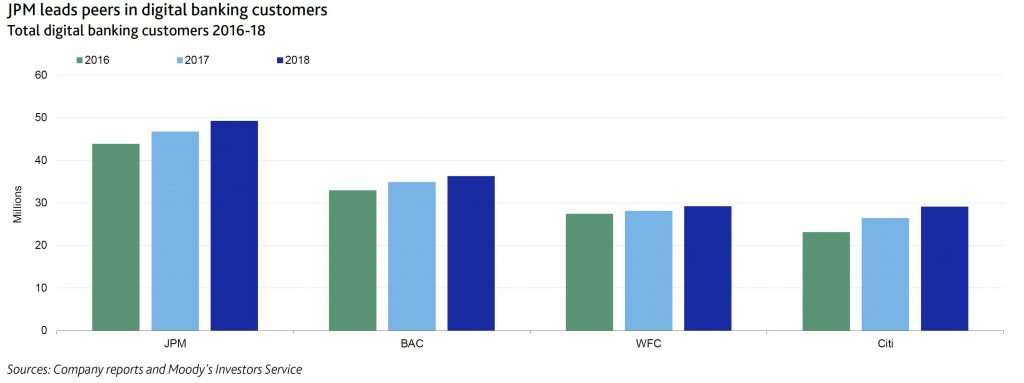

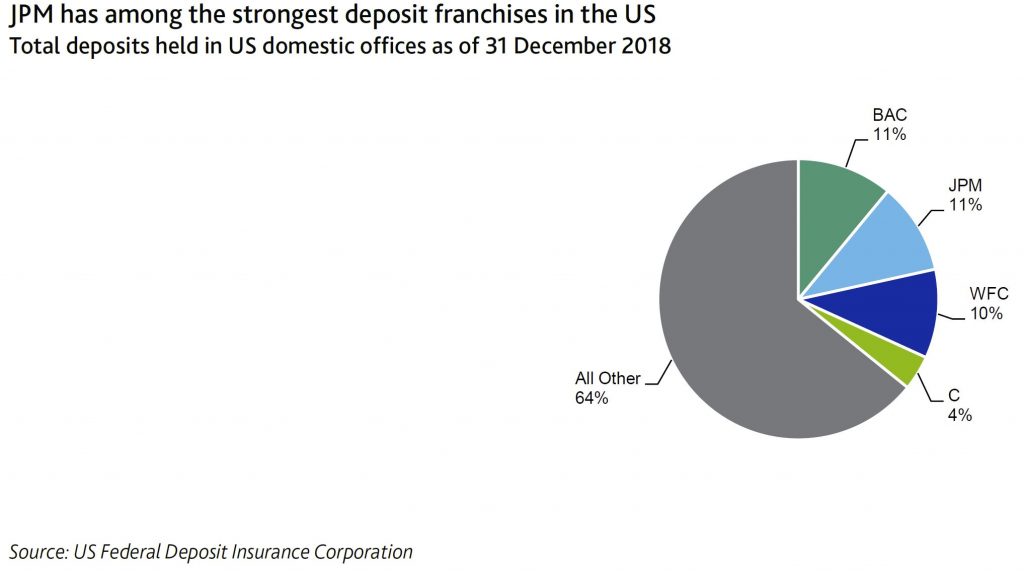

Finn gave users access to an app, branded separately from JPM’s flagship Chase mobile app but running on the same back-end infrastructure, along with various perks, including JPM branch access for more complex banking services and use of the ATMs of partner banks. But more than half of Finn’s users had existing relationships with JPM, which may have influenced the decision to re-focus on the Chase digital banking brand. JPM leads peers in digital banking customers and possesses among the strongest US consumer deposit franchises.

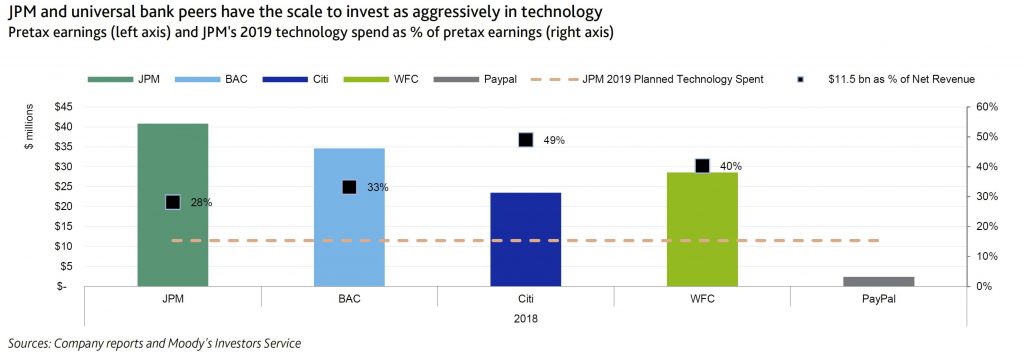

Earlier this year, JPM during its annual investor day announced plans to make $11.5 billion in technology investments in 2019 – a sum equivalent to 28% of its 2018 pre-tax earnings, a credit positive. Only a few of JPM’s large consumer banking peers possess the scale to make such a commitment. These technology investments are important for JPM as it faces a growing number of fintech challengers along various points of the consumer and wholesale banking value chain. JPM noted that these investments would go

toward various initiatives, including developing new products, enhancing client choice, personalization and ease of doing business, and business efficiency.