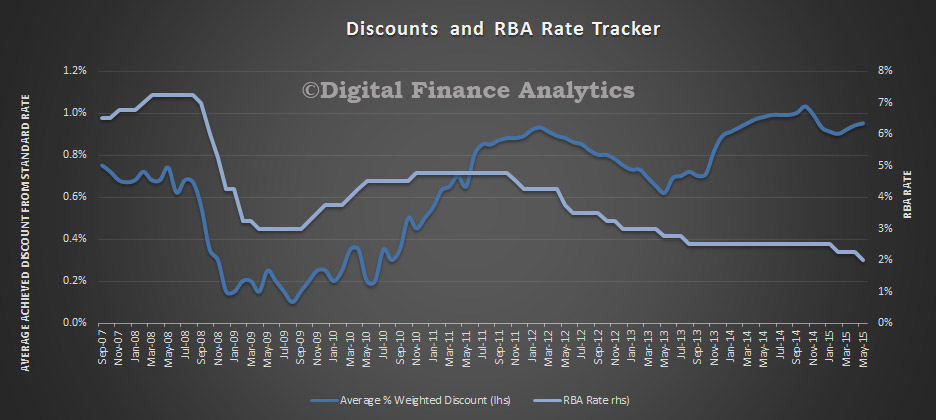

Latest data from the DFA household surveys highlights that many prospective borrowers are still able to grab significant discounts on new or refinanced home loans. The chart below shows the weighted average achieved across loans written, compared with the RBA cash rate. Despite the recent falls, discounting is still rampant.

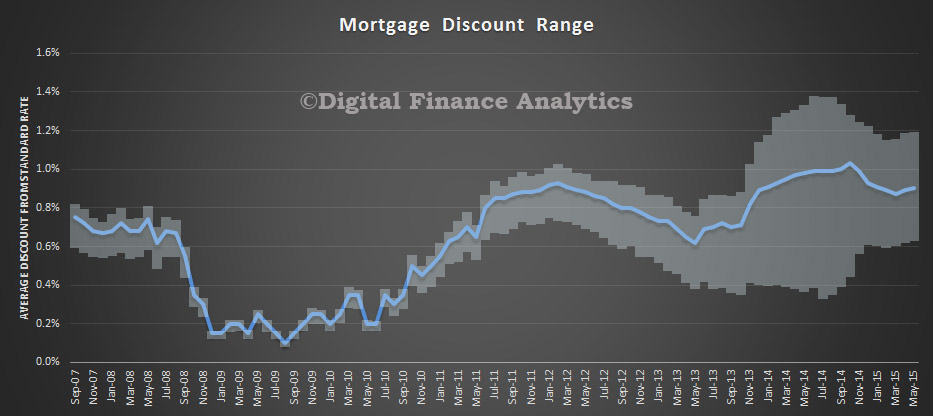

However, we also see significant differences between players and across different customer segments and loan types. Not all households are getting the larger cuts. Discounts also varies by LVR and channel of origination, with those using a broker, on average, doing a little better.

However, we also see significant differences between players and across different customer segments and loan types. Not all households are getting the larger cuts. Discounts also varies by LVR and channel of origination, with those using a broker, on average, doing a little better.

The deep discounting flowed through to some margin compression in the recent results from the banks, and falls in deposit margins, as they continue to attempt to grab a larger share of new business. Households with a mortgage of more than a couple of years duration would do well to check their rate against those currently on offer in the highly competitive market. Even after switching costs, they may do better.

The deep discounting flowed through to some margin compression in the recent results from the banks, and falls in deposit margins, as they continue to attempt to grab a larger share of new business. Households with a mortgage of more than a couple of years duration would do well to check their rate against those currently on offer in the highly competitive market. Even after switching costs, they may do better.

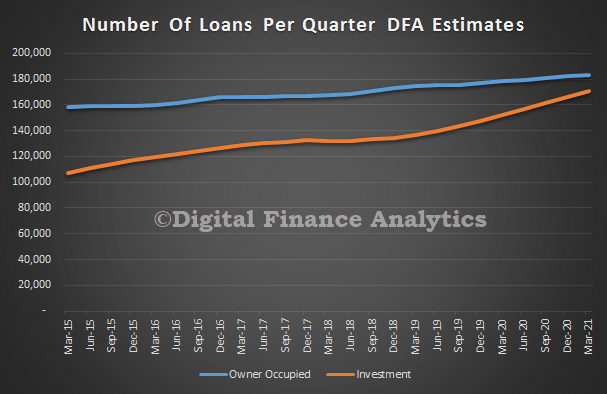

We also updated our strategic demand model, and our trend estimates for mortgage numbers out to 2020. We expect to see investment loan growth containing to run faster than owner occupation loans. Over the medium term we expect the number of owner occupied loans to grow at an average of 2.8%, and investment loans at 7.8% per annum over this period.

Behind the model we have made a number of assumptions about population growth, capital demands, house prices and economic variables, as well as the demand data from our surveys. Significantly, much of the demand is coming from those intending to trade down, buying a smaller place, AND a geared investment property. We will update the segment specific demand data in a later post.

Behind the model we have made a number of assumptions about population growth, capital demands, house prices and economic variables, as well as the demand data from our surveys. Significantly, much of the demand is coming from those intending to trade down, buying a smaller place, AND a geared investment property. We will update the segment specific demand data in a later post.

2 thoughts on “Mortgage Discounts Still Running Hot”