Digital Finance Analytics (DFA) has released the September 2018 mortgage stress and default analysis update. We have just crossed the 1 million, for the first time ever in our history.

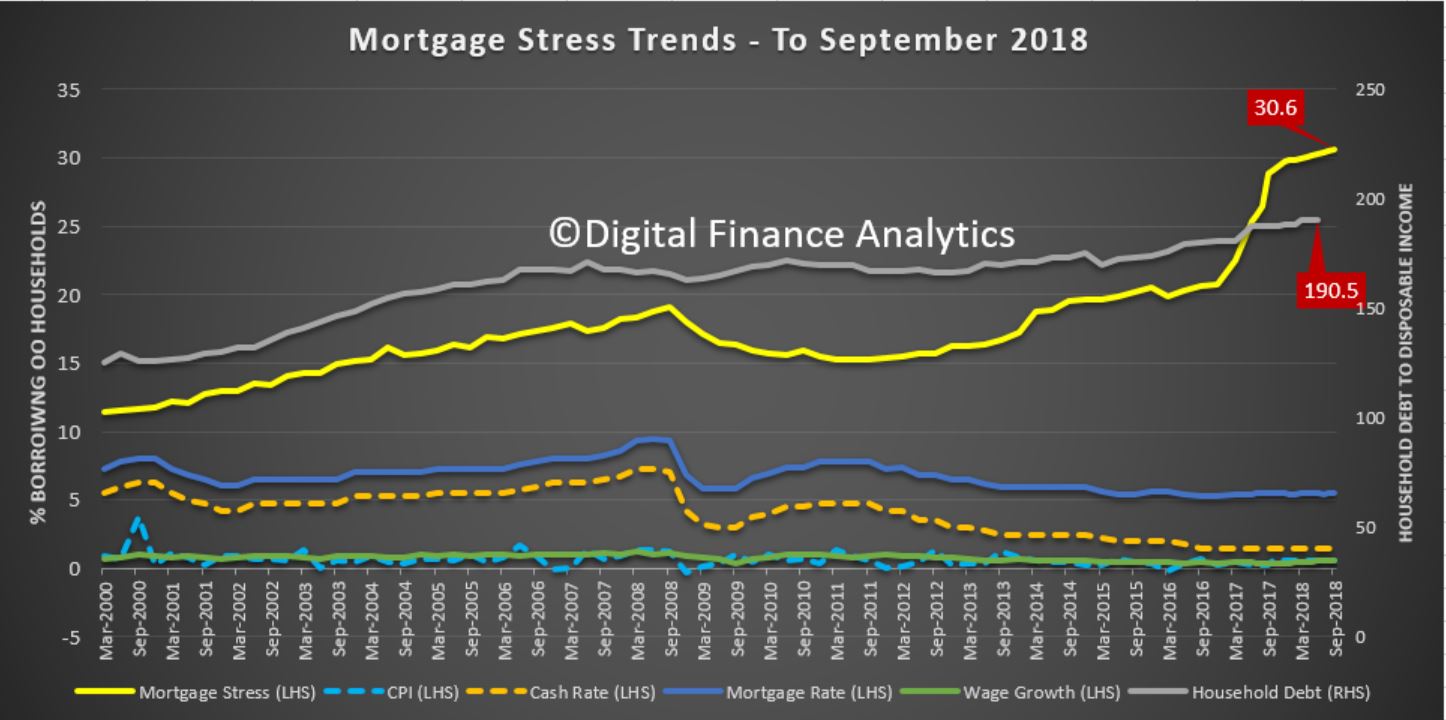

The latest RBA data on household debt to income to June reached a new high of 190.5[1]. This high debt level helps to explain the fact that mortgage stress continues to rise.

Across Australia, more than 1,003,000 households are estimated to be now in mortgage stress (last month 996,000). This equates to 30.6% of owner occupied borrowing households. In addition, more than 22,000 of these are in severe stress. We estimate that more than 61,000 households risk 30-day default in the next 12 months. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead.

Across Australia, more than 1,003,000 households are estimated to be now in mortgage stress (last month 996,000). This equates to 30.6% of owner occupied borrowing households. In addition, more than 22,000 of these are in severe stress. We estimate that more than 61,000 households risk 30-day default in the next 12 months. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead.

Martin North, Principal of Digital Finance Analytics says this rise in stress is to be expected, and should be of no surprise at all. Indeed, the fact that significant numbers of households have had their potential borrowing power crimped by lending standards belatedly being tightened, and are therefore mortgage prisoners, is significant. More than 40% of those seeking to refinance are now having difficulty. This is strongly aligned to those who are registering as stressed. These are households urgently trying to reduce their monthly outgoings”.

“Continued rises in living costs – notably child care, school fees and fuel – whilst real incomes continue to fall and underemployment is causing significant pain. Many are dipping into savings to support their finances.”

“Continued rises in living costs – notably child care, school fees and fuel – whilst real incomes continue to fall and underemployment is causing significant pain. Many are dipping into savings to support their finances.”

Our analysis uses the DFA core market model which combines information from our 52,000 household surveys, public data from the RBA, ABS and APRA; and private data from lenders and aggregators. The data is current to end September 2018. We analyse household cash flow based on real incomes, outgoings and mortgage repayments, rather than using an arbitrary 30% of income.

Households are defined as “stressed” when net income (or cash flow) does not cover ongoing costs. They may or may not have access to other available assets, and some have paid ahead, but households in mild stress have little leeway in their cash flows, whereas those in severe stress are unable to meet repayments from current income. In both cases, households manage this deficit by cutting back on spending, putting more on credit cards and seeking to refinance, restructure or sell their home. Those in severe stress are more likely to be seeking hardship assistance and are often forced to sell.

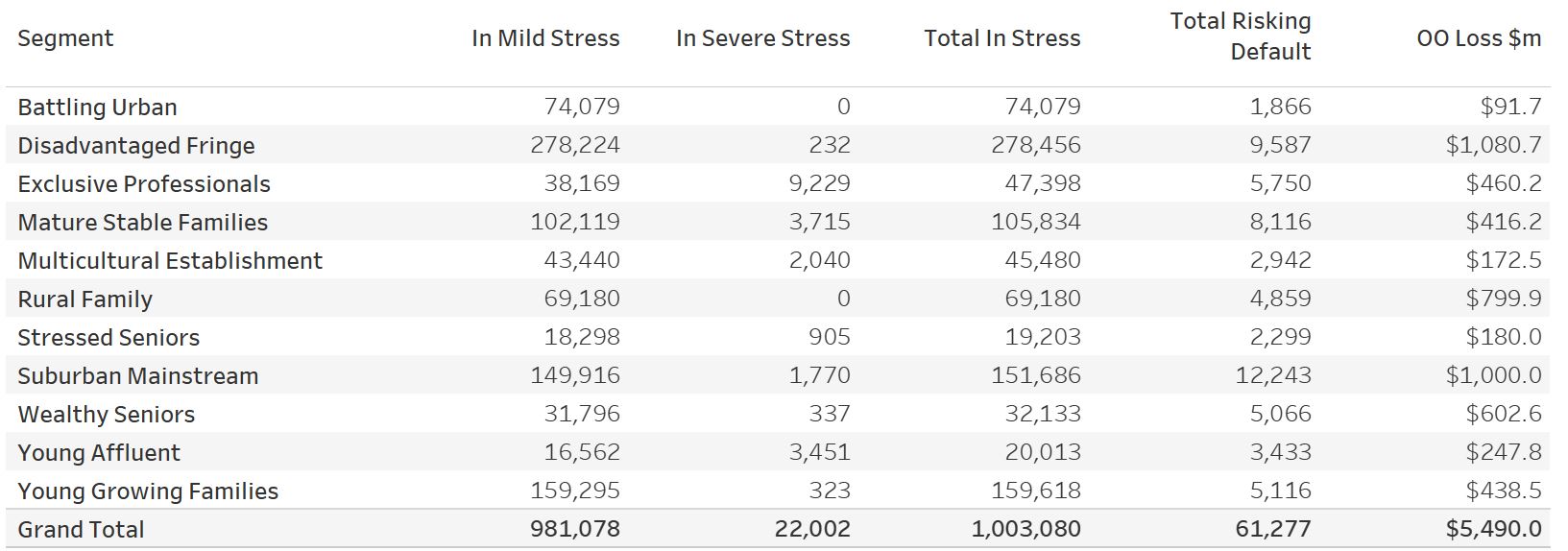

Probability of default extends our mortgage stress analysis by overlaying economic indicators such as employment, future wage growth and cpi changes. Our Core Market Model also examines the potential of portfolio risk of loss in basis point and value terms. Losses are likely to be higher among more affluent households, contrary to the popular belief that affluent households are well protected. This is shown in the segment analysis below:

Stress by the numbers.

Stress by the numbers.

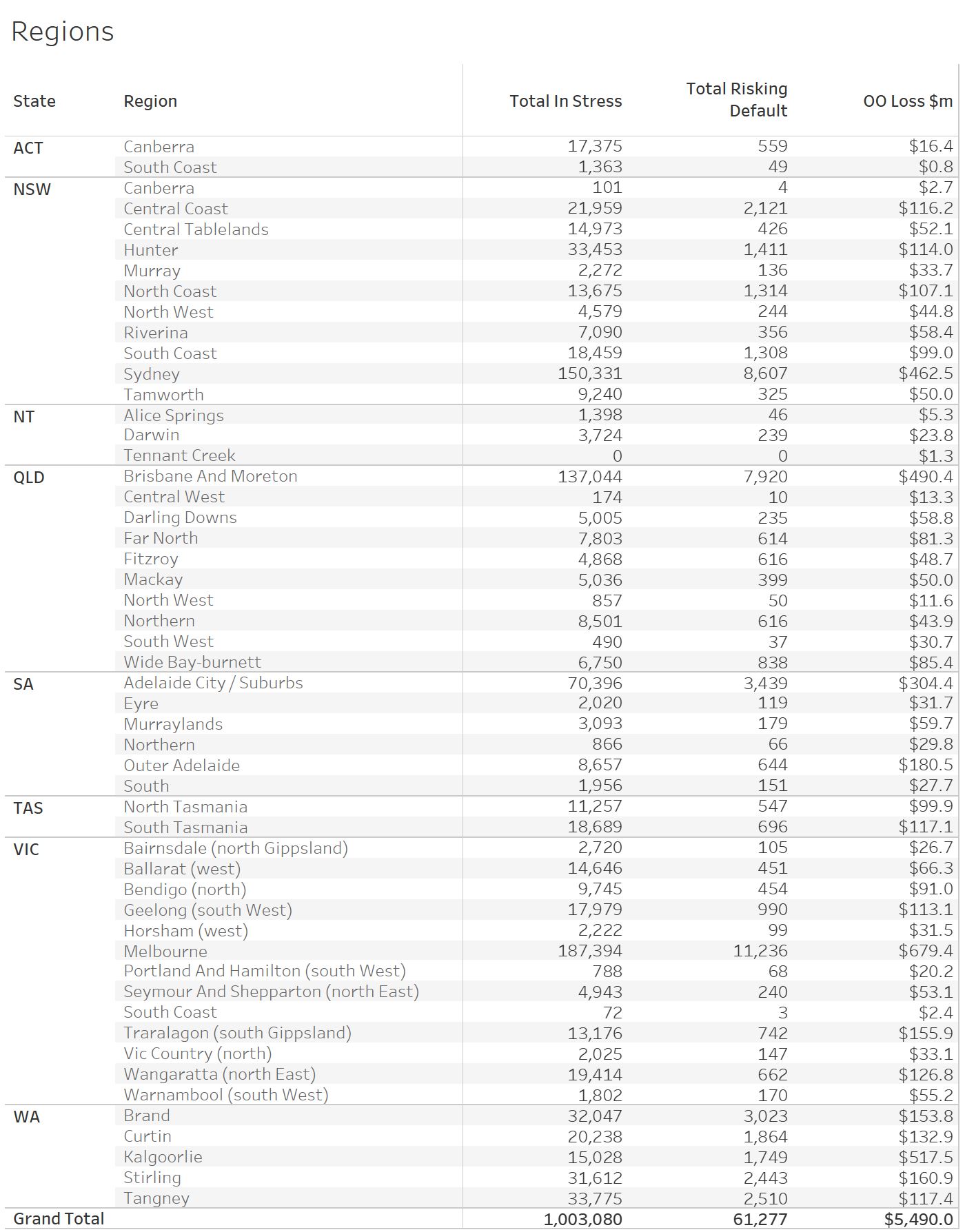

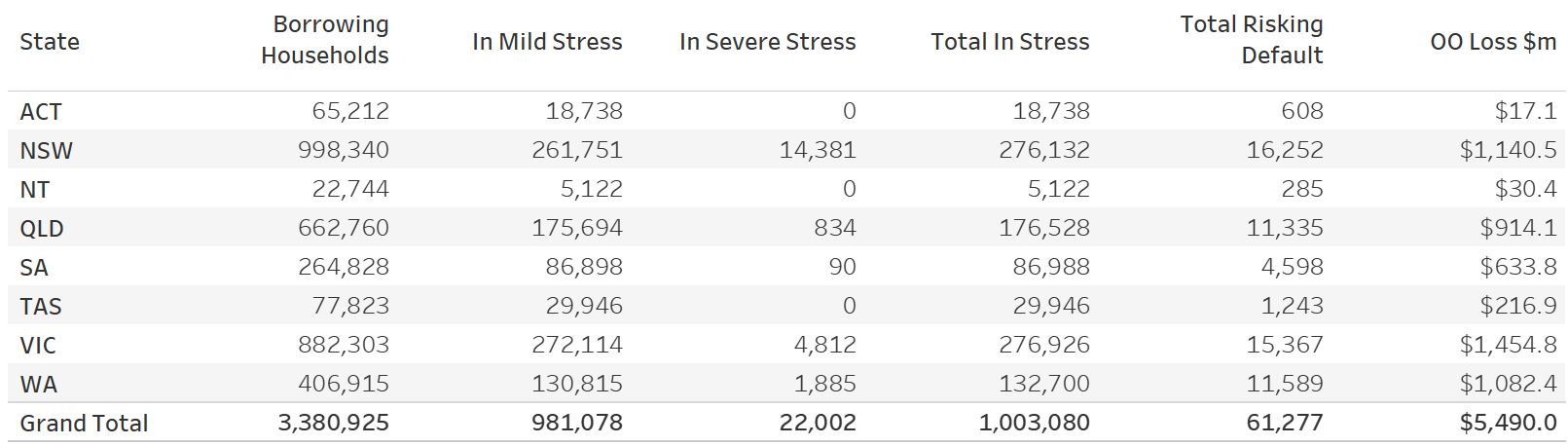

Regional analysis shows that NSW has 276,132 households in stress (270,612 last month), VIC 276,926 (270,551 last month), QLD 176,528 (175,102 last month) and WA has 132,700 (134,333 last month). The probability of default over the next 12 months rose, with around 11,589 in WA, around 11,300 in QLD, 15,300 in VIC and 16,252 in NSW.

The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.45 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 3.4 basis points, which equates to $1,082 million from Owner Occupied borrowers.

The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.45 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 3.4 basis points, which equates to $1,082 million from Owner Occupied borrowers.

Here is a more detailed regional breakdown.

[1] RBA E2 Household Finances – Selected Ratios June 2018

You can request our media release. Note this will NOT automatically send you our research updates, for that register here.

[contact-form to=’mnorth@digitalfinanceanalytics.com’ subject=’Request The September 2018 Stress Release’][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Email Me The September 2018 Media Release’ type=’radio’ required=’1′ options=’Yes Please’/][contact-field label=”Comment If You Like” type=”textarea”/][/contact-form]

Note that the detailed results from our surveys and analysis are made available to our paying clients.