We have completed our October 2018 mortgage stress analysis and today we discuss the results.

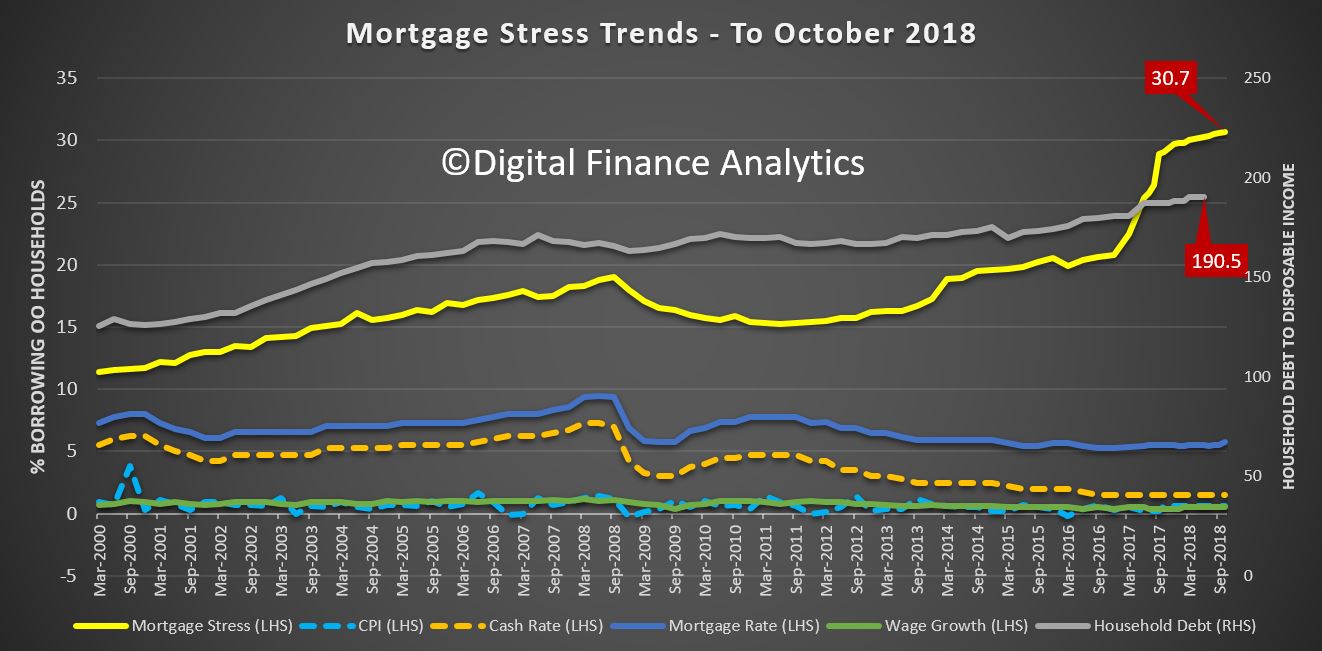

The latest RBA data on household debt to income to June reached a new high of 190.5. This high debt level helps to explain the fact that mortgage stress continues to rise. Having crossed the 1 million Rubicon last month, across Australia, more than 1,008,000 households are estimated to be now in mortgage stress (last month 1,003,000). This equates to 30.7% of owner occupied borrowing households.

In addition, more than 22,000 of these are in severe stress. We estimate that more than 61,000 households risk 30-day default in the next 12 months. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead.

In addition, more than 22,000 of these are in severe stress. We estimate that more than 61,000 households risk 30-day default in the next 12 months. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead.

Our analysis uses the DFA core market model which combines information from our 52,000 household surveys, public data from the RBA, ABS and APRA; and private data from lenders and aggregators. The data is current to the end of October 2018. We analyse household cash flow based on real incomes, outgoings and mortgage repayments, rather than using an arbitrary 30% of income.

Households are defined as “stressed” when net income (or cash flow) does not cover ongoing costs. They may or may not have access to other available assets, and some have paid ahead, but households in mild stress have little leeway in their cash flows, whereas those in severe stress are unable to meet repayments from current income. In both cases, households manage this deficit by cutting back on spending, putting more on credit cards and seeking to refinance, restructure or sell their home. Those in severe stress are more likely to be seeking hardship assistance and are often forced to sell.

This rise in stress, which has continued for the past 6 years, should be of no surprise at all. “Continued rises in living costs – notably child care, school fees and fuel – whilst real incomes continue to fall and underemployment is causing significant pain. Many are dipping into savings to support their finances.”

Indeed, the fact that significant numbers of households have had their potential borrowing power crimped by lending standards belatedly being tightened, and are therefore mortgage prisoners, is significant. More than 40% of those seeking to refinance are now having difficulty. This is strongly aligned to those who are registering as stressed. These are households urgently trying to reduce their monthly outgoings.

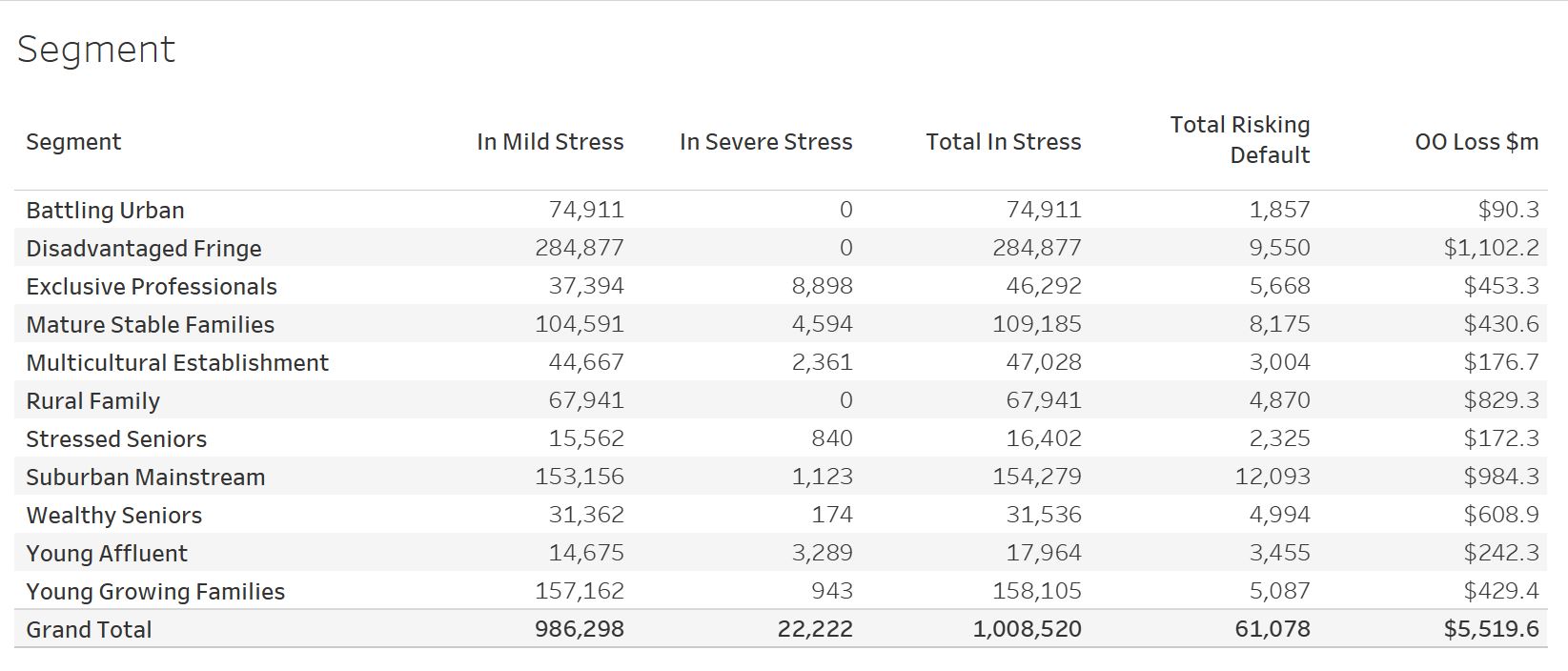

Probability of default extends our mortgage stress analysis by overlaying economic indicators such as employment, future wage growth and cpi changes. Our Core Market Model also examines the potential of portfolio risk of loss in basis point and value terms. Losses are likely to be higher among more affluent households, contrary to the popular belief that affluent households are well protected. This is shown in the segment analysis, with some more wealthy households up against it.

Probability of default extends our mortgage stress analysis by overlaying economic indicators such as employment, future wage growth and cpi changes. Our Core Market Model also examines the potential of portfolio risk of loss in basis point and value terms. Losses are likely to be higher among more affluent households, contrary to the popular belief that affluent households are well protected. This is shown in the segment analysis, with some more wealthy households up against it.

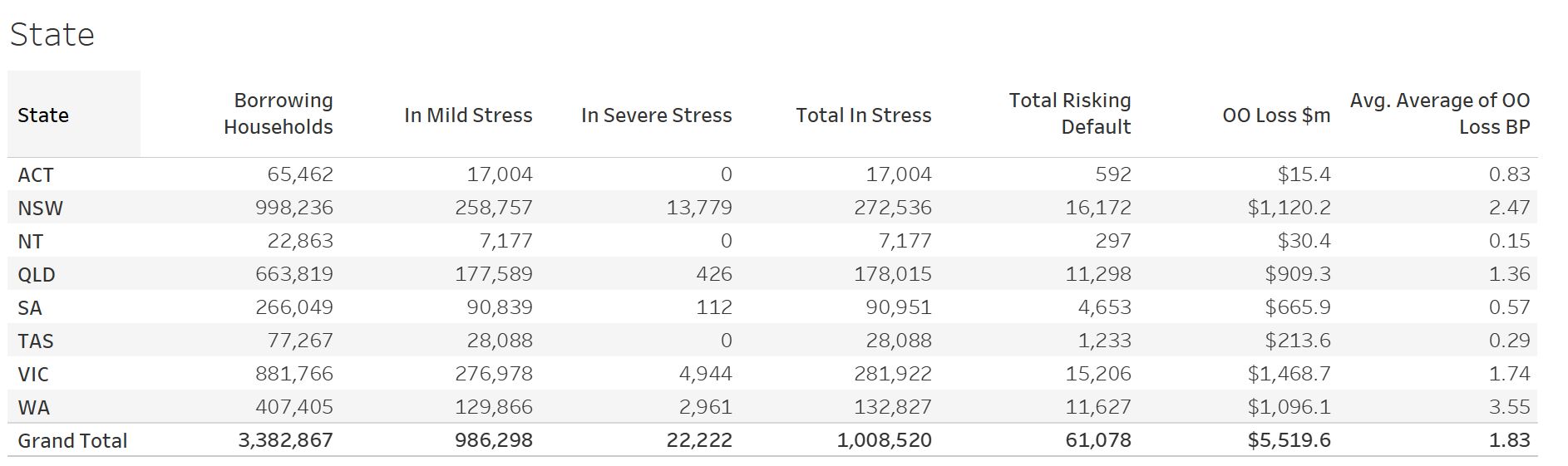

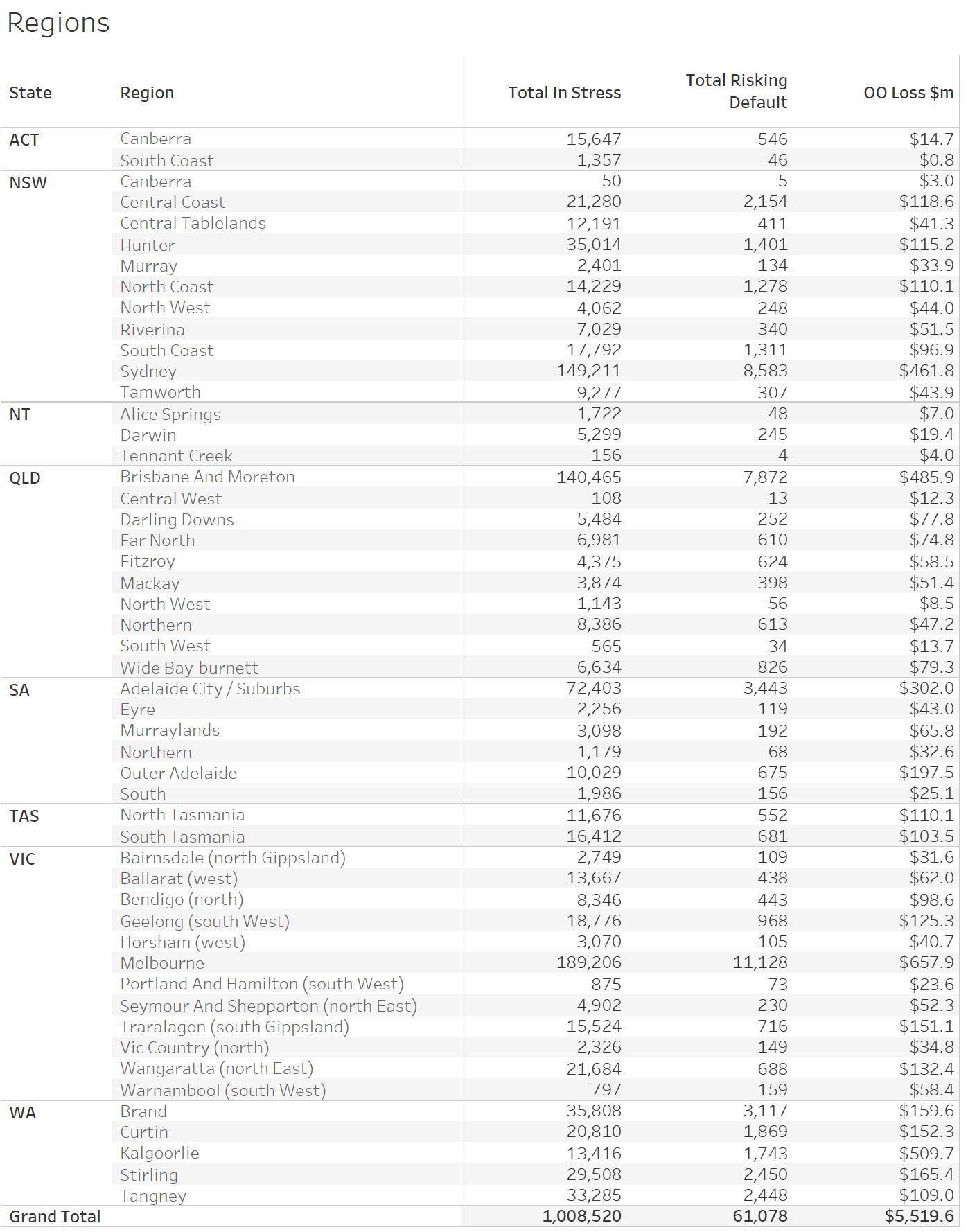

Regional analysis shows that NSW has 272,536 households in stress (276,132 last month), VIC 281,922 (276,926 last month), QLD 178,015 (176,528 last month) and WA has 132,827 (132,700 last month). The probability of default over the next 12 months rose, with around 11,630 in WA, around 11,300 in QLD, 15,200 in VIC and 16,200 in NSW.

Regional analysis shows that NSW has 272,536 households in stress (276,132 last month), VIC 281,922 (276,926 last month), QLD 178,015 (176,528 last month) and WA has 132,827 (132,700 last month). The probability of default over the next 12 months rose, with around 11,630 in WA, around 11,300 in QLD, 15,200 in VIC and 16,200 in NSW.  The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.74 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 3.6 basis points, which equates to $1,096 million from Owner Occupied borrowers.

The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.74 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 3.6 basis points, which equates to $1,096 million from Owner Occupied borrowers.

Turning to the post codes with the largest counts of households in stress, fifth was Melbourne suburb Berwick and Harkaway, 3806, with 5,267 households in stress and 143 risking default.

Turning to the post codes with the largest counts of households in stress, fifth was Melbourne suburb Berwick and Harkaway, 3806, with 5,267 households in stress and 143 risking default.

In fourth place is Toowoomba and the surrounding area, in Queensland, 4350, with 6,437 households in stress and 256 risking default.

Next in third place is Campbelltown in NSW, 2560, with 6,781 households in stress and 110 risking default.

In second place is Tapping and the surrounding areas in WA, 6065 with 7,409 in stress and 298 risking default

And in first place, the post code with the largest number of households in mortgage stress this month is the area around Chipping Norton and Liverpool, 2170, with 7,732 households in stress and 116 risking default.

As always, it’s worth saying that given flat incomes, and rising costs, and some mortgage rate rises, the pressure will continue, and falling home prices will make things worse. Many people do not keep a cash flow, so they do not know their financial position – drawing one up is the first step and ASIC has some excellent advice on their MoneySmart website. And the other point to make is, if you are in financial distress, you should talk to your lender, they do have an obligation to help in cases of hardship. The worst strategy is simply to ignore the issue and hope it will go away. But in my experience, this is unlikely.

We will update the data again next month.

You can request our media release. Note this will NOT automatically send you our research updates, for that register here.

[contact-form to=’mnorth@digitalfinanceanalytics.com’ subject=’Request The October 2018 Stress Release’][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Email Me The October 2018 Media Release’ type=’radio’ required=’1′ options=’Yes Please’/][contact-field label=”Comment If You Like” type=”textarea”/][/contact-form]

Note that the detailed results from our surveys and analysis are made available to our paying clients.