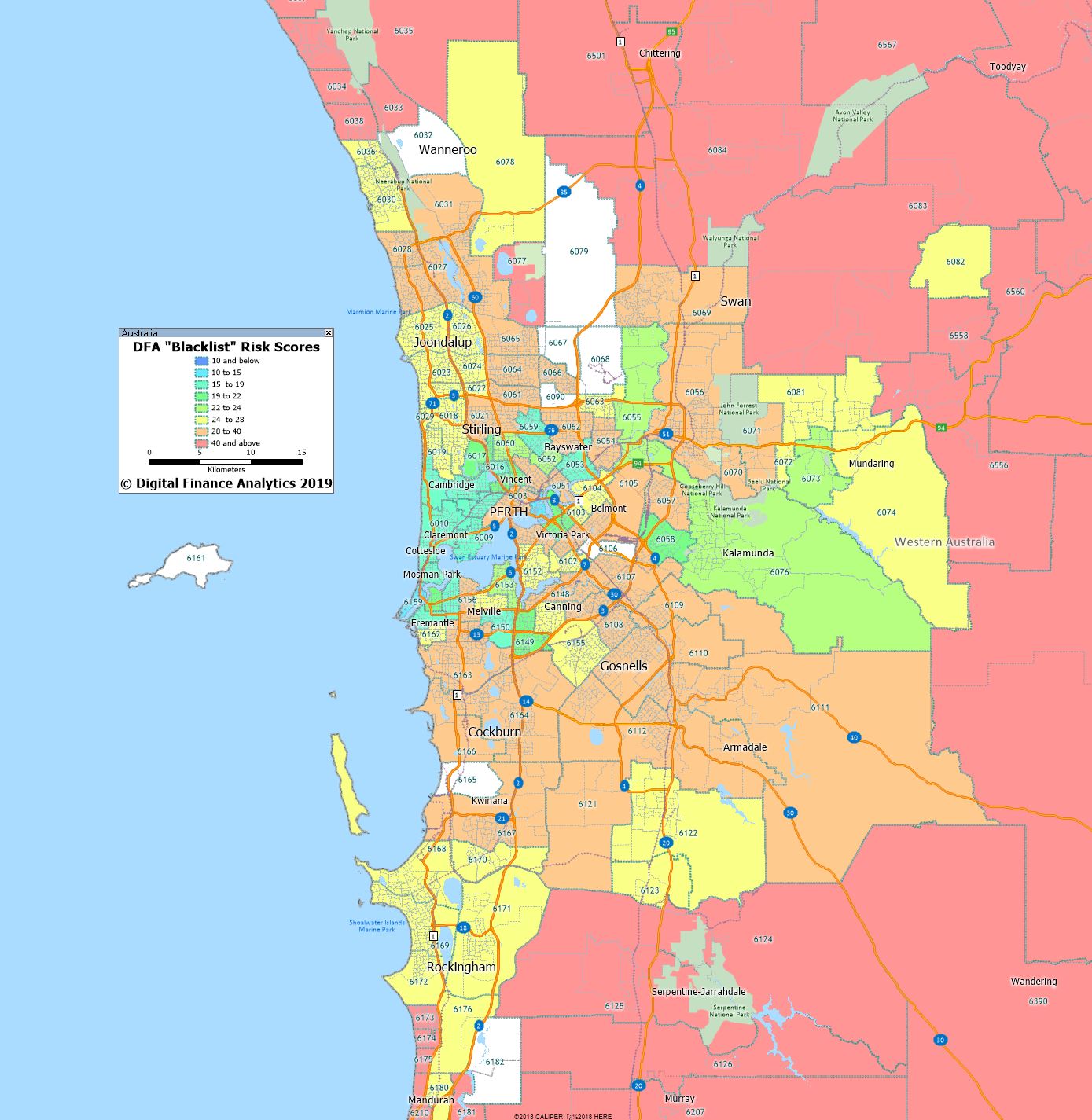

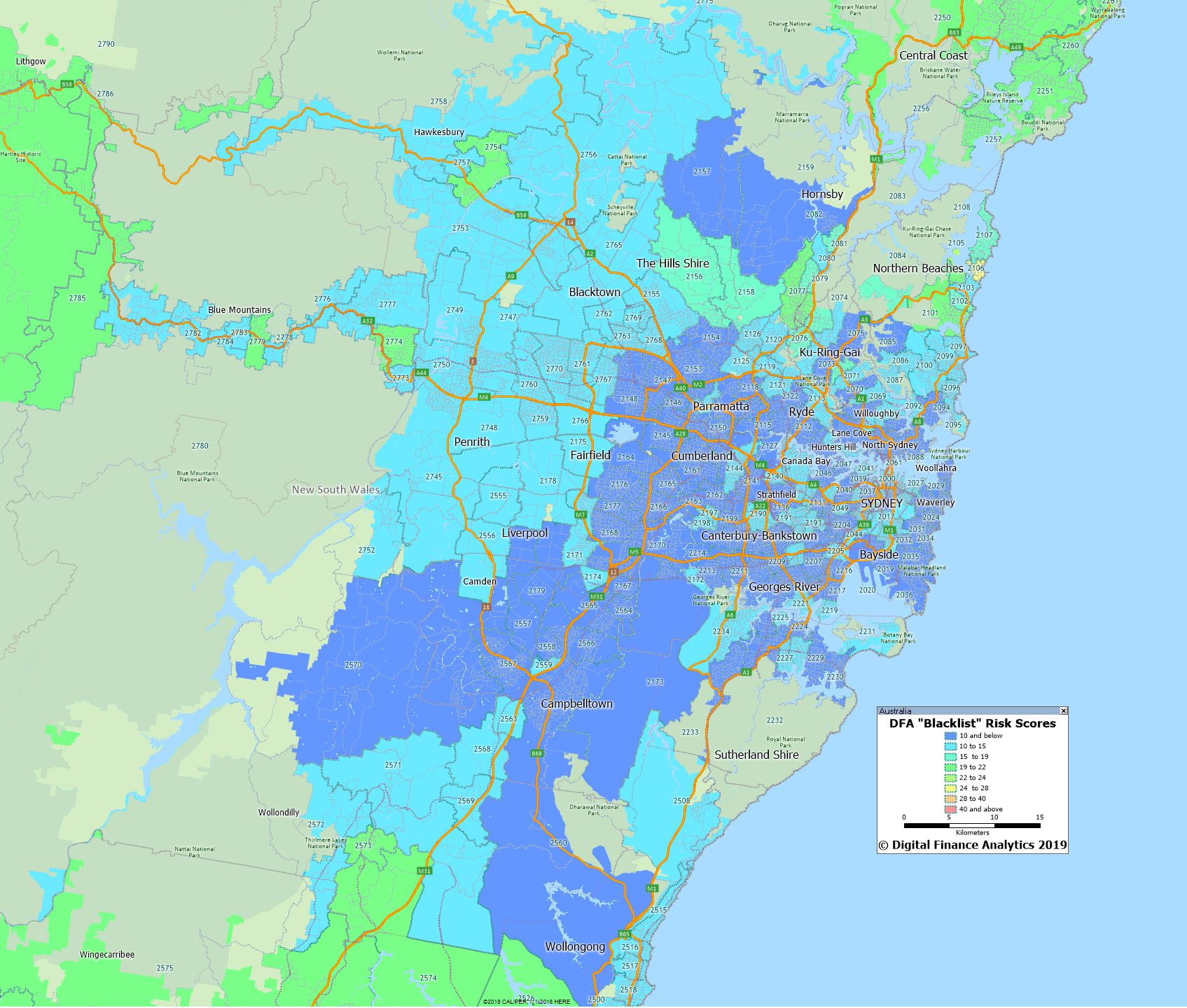

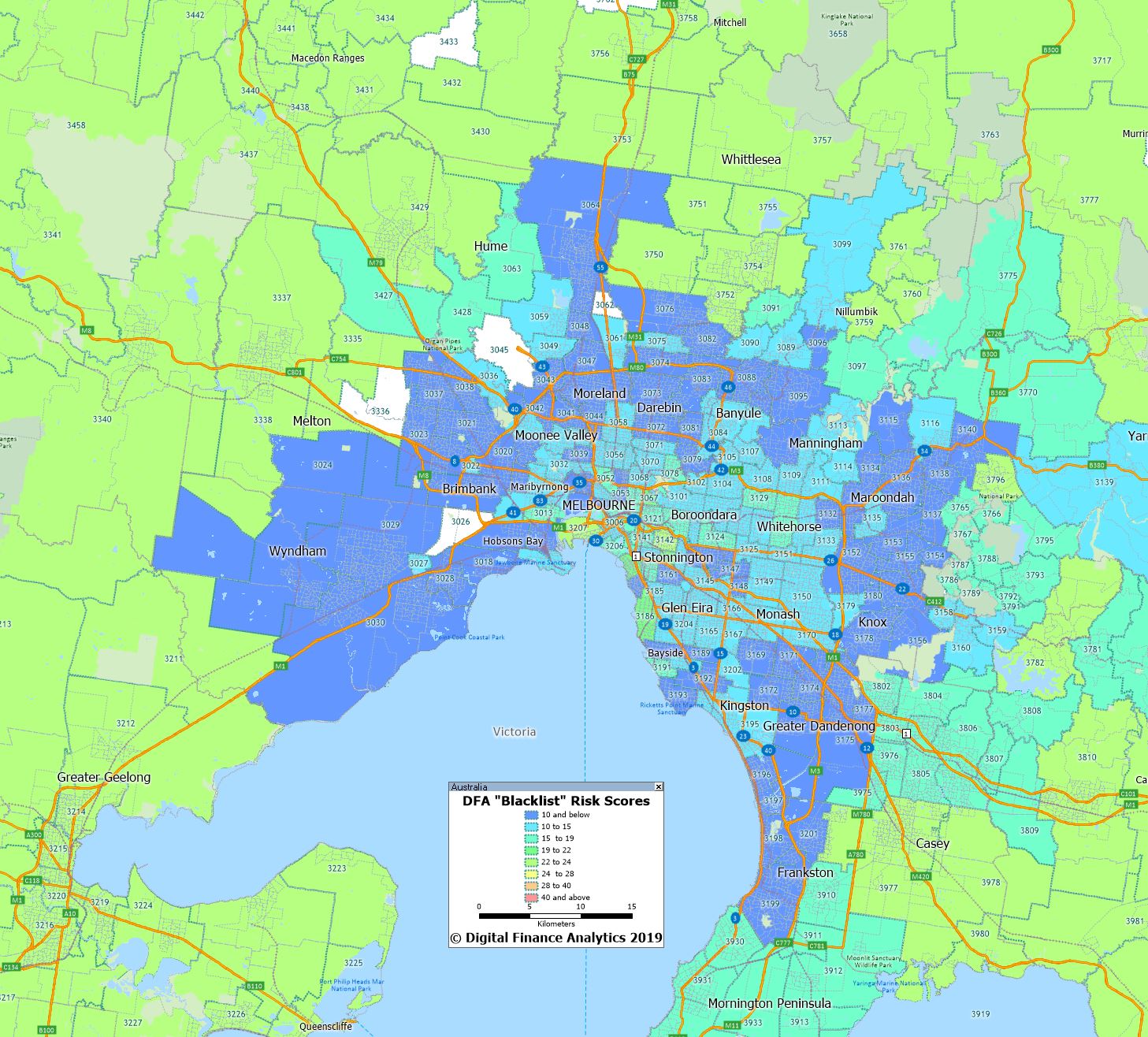

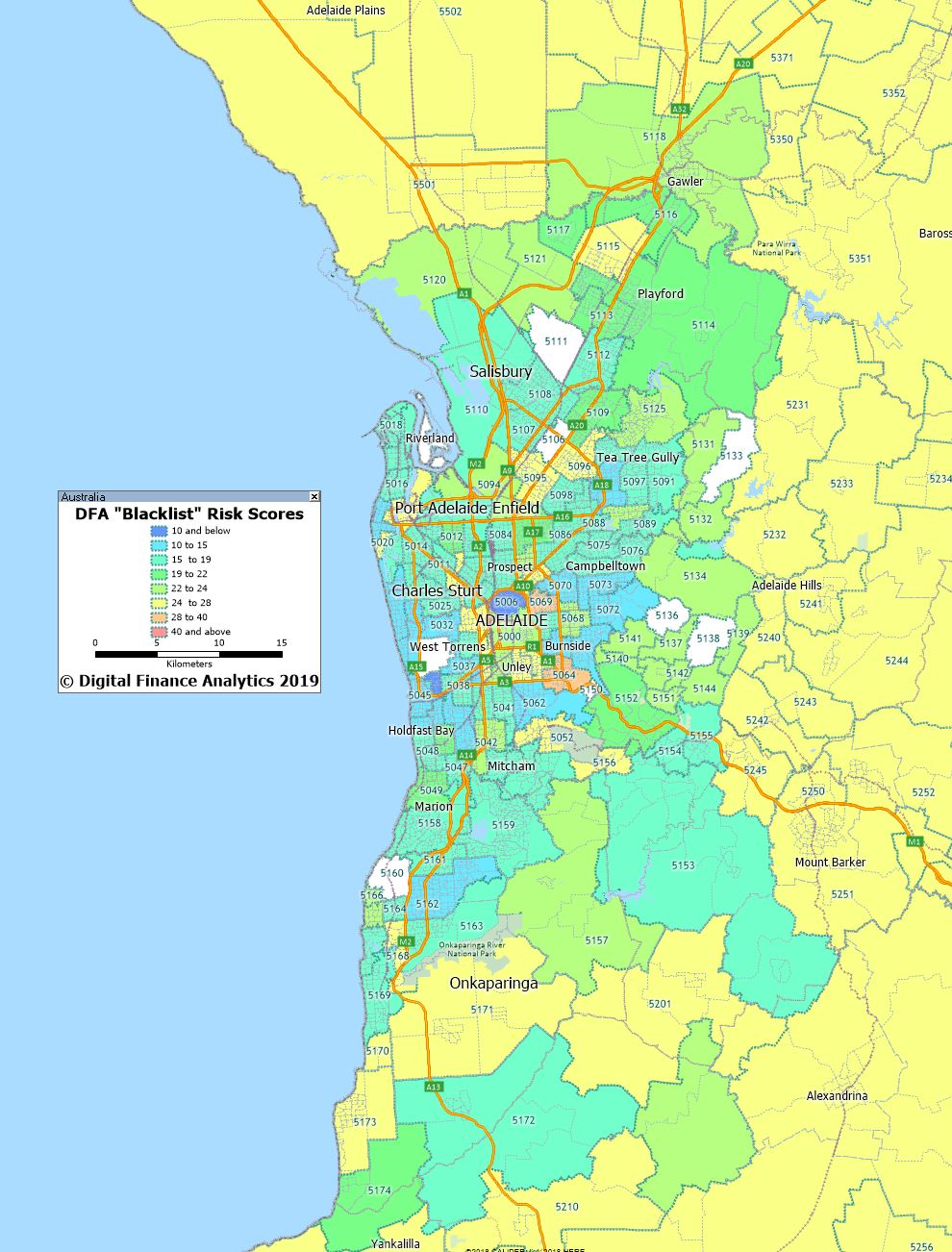

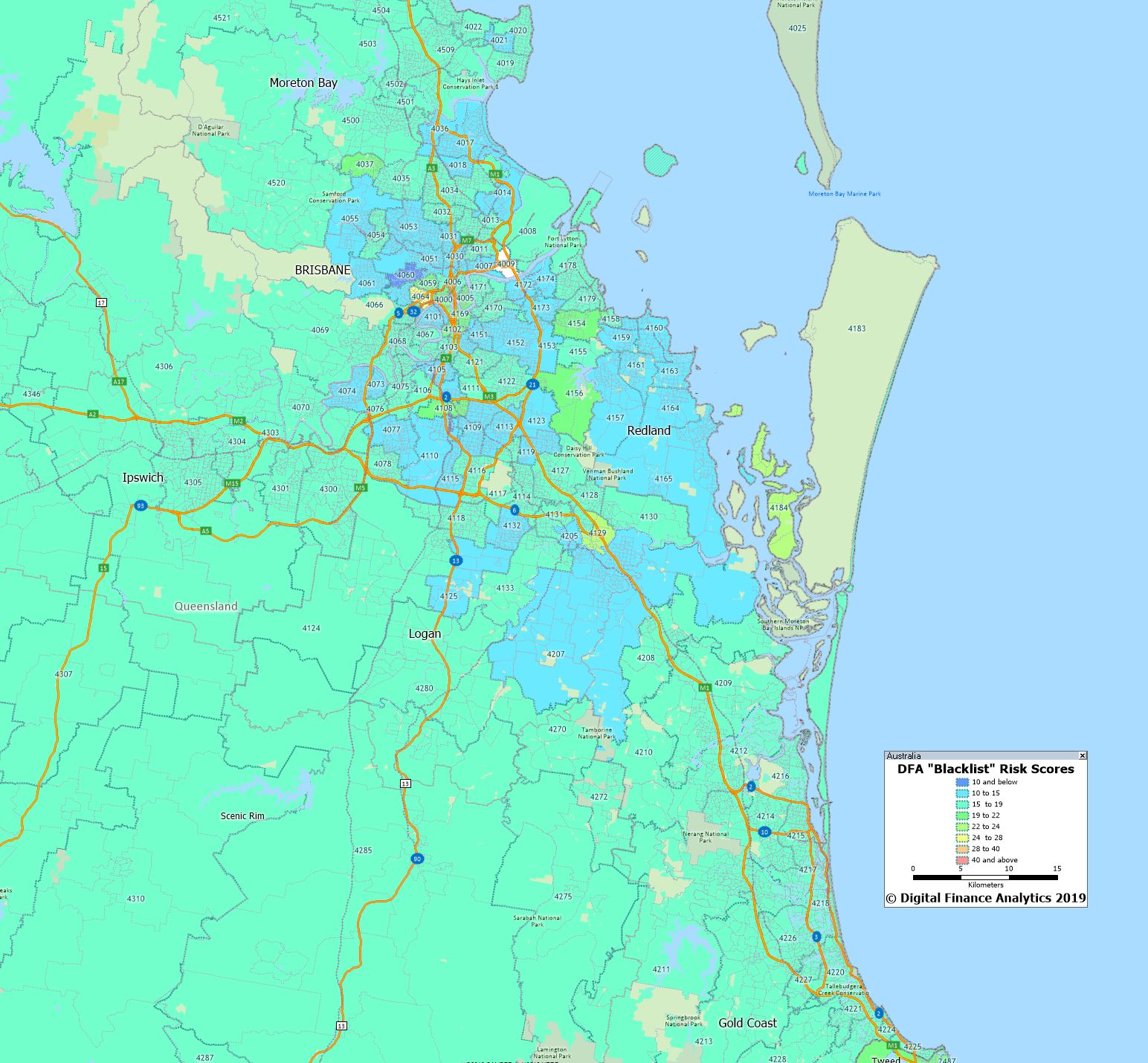

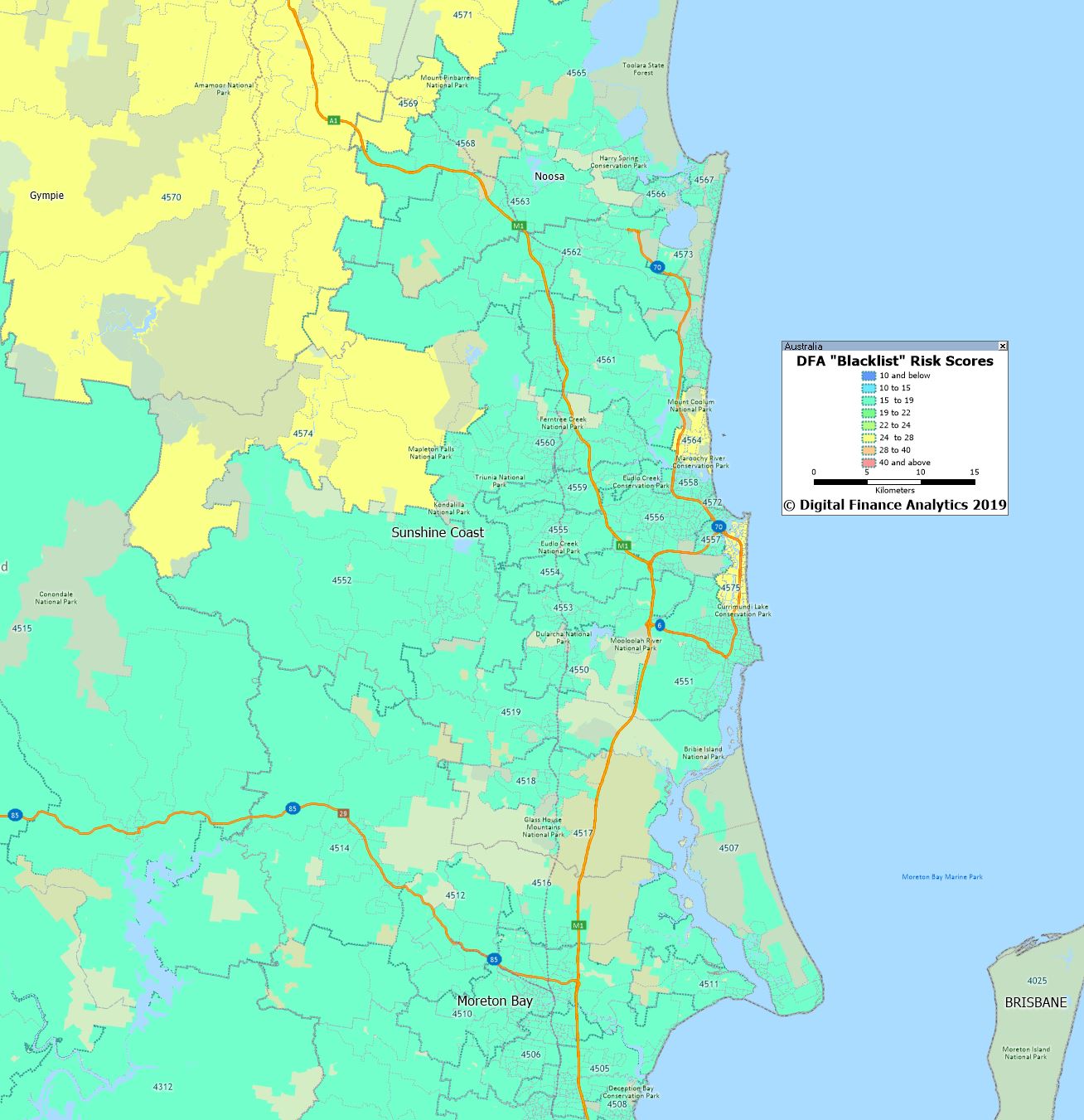

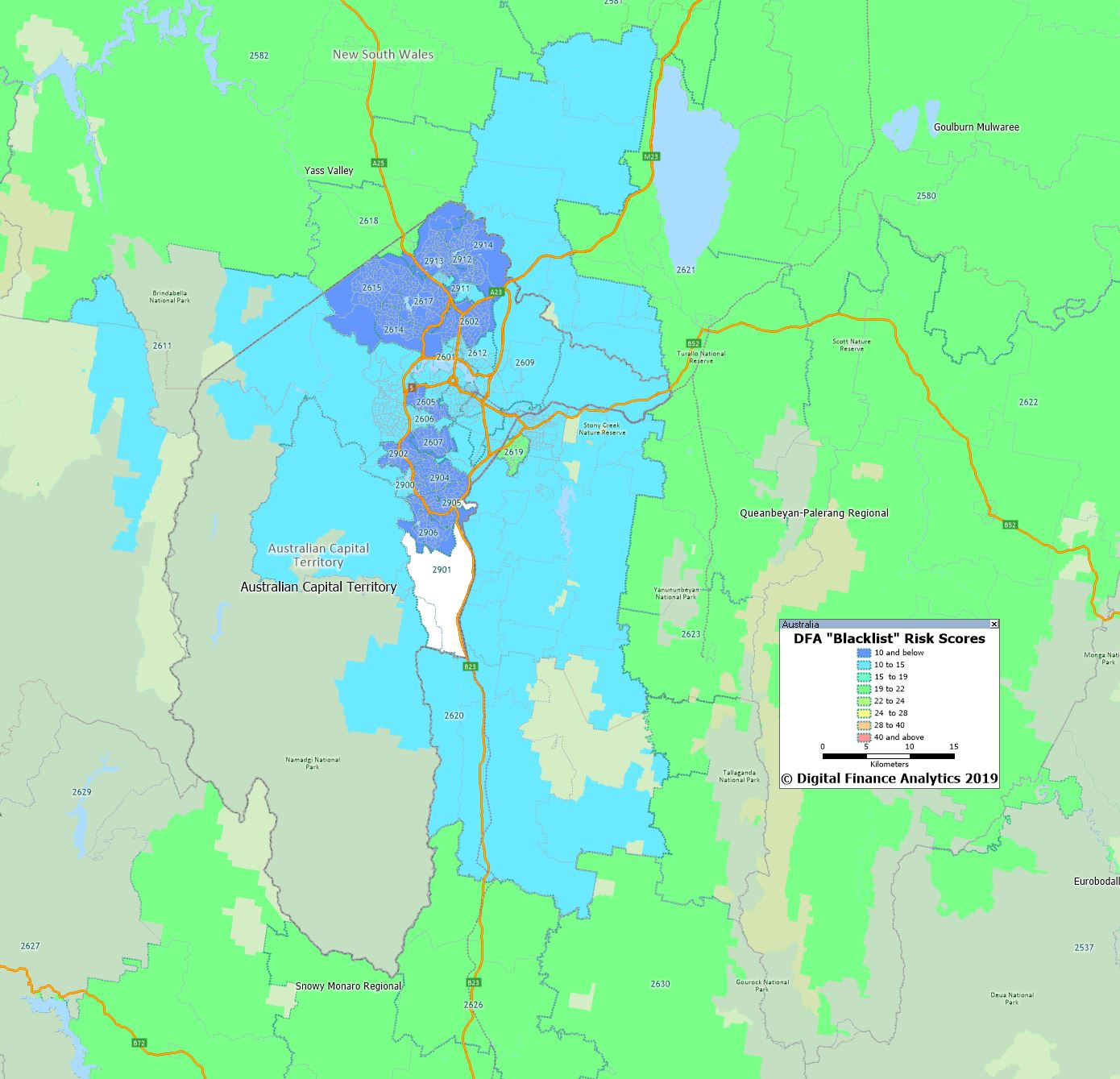

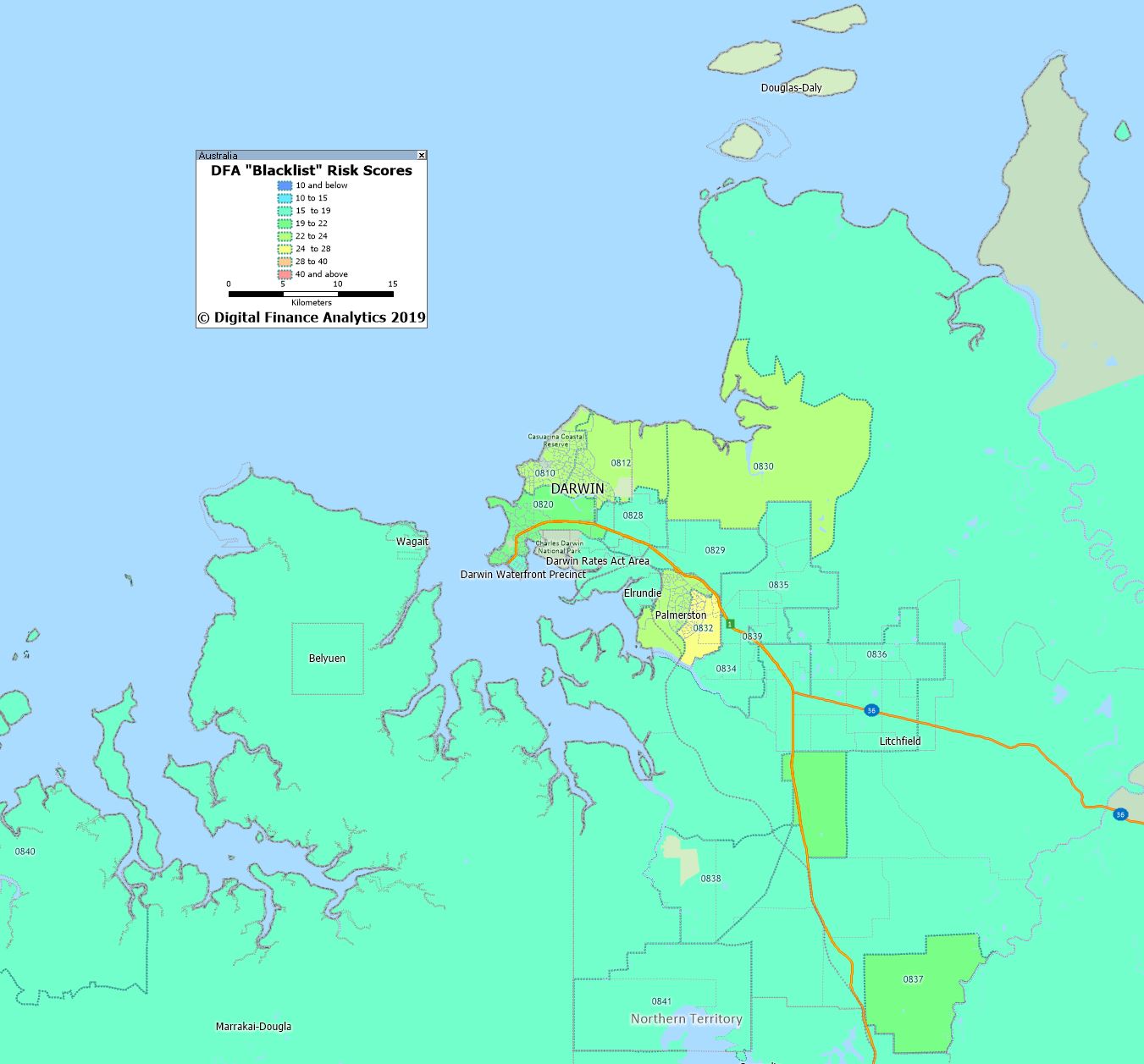

DFA has developed a risk scoring system, which combines information from lenders, and households to provide an indicator of the relative likelihood of an applicant successfully obtaining a mortgage, within a specific post code, and the relative weighting in terms of loan-to-value (LVR) and other factors which will be taken into account.

Additional factors will also include the mix between high-rise and low-rise development (some banks have blacklisted certain development types in some suburbs), and recent home price moves.

On the DFA Blacklist scale, the higher the score, the greater the difficulty in obtaining finance. In practice, this also reflects the relative risks of mortgage stress and default, and is also subject to an economic overlay in terms of relative economic performance and household finances. This was featured in an ABC piece last week. It is not predicative, rather it reflects current behaviour and past risk.

While individual household scores will vary, an average post code score above 15 represent higher than normal risk, meaning many lenders will require a larger deposit, or may prefer not to lend at all. The higher the score, the greater the difficulty in getting finance.

Since I have received many requests for more information, today we are releasing more complete mapping, which is up to the end of April 2019.

The maps are presented in native high resolution. The blue shades are low scoring post codes. Red shows highest scores.

Western Australia, as represented by the area around Perth is by far the most blacklisted region.

In comparison Sydney scores are lower, though with some hot spots.

Melbourne also shows a few hot spots.

Adelaide has some risk areas.

Brisbane and the Gold Coast are fairing quite well (but again, with some hot spots).

The Sunshine Coast is more problematical.

The ACT scored pretty low.

While Darwin was more problematic, reflecting the significant falls in values in recent years, and the economic conditions there.

To emphasise the point, individual lenders and borrowers circumstances will vary, but our analysis does highlight that not all post codes are born equally when it comes to mortgage applications.