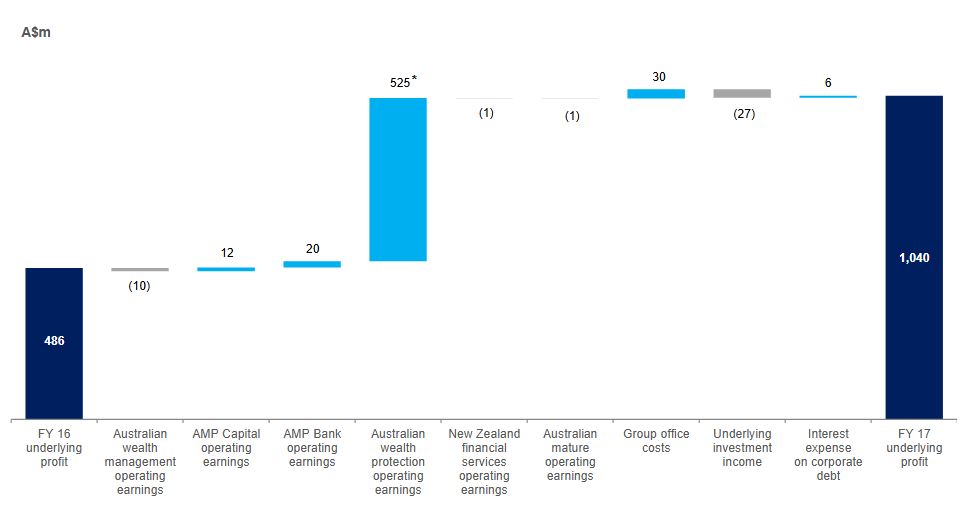

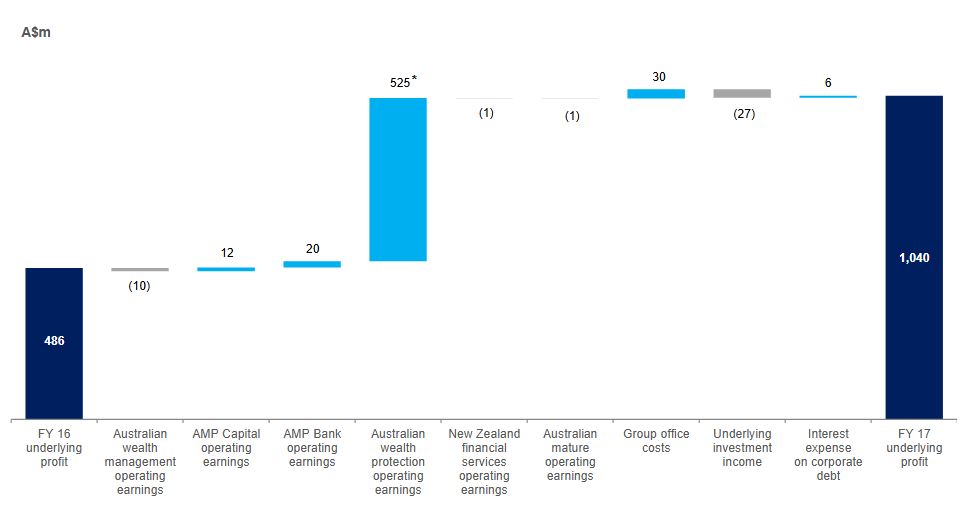

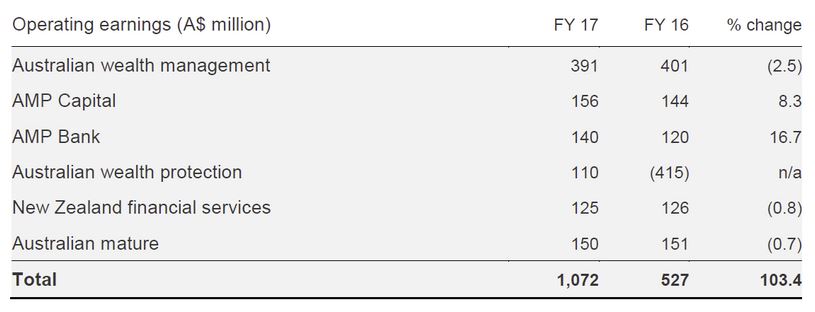

AMP released their FY17 results, and overall the business has improved results compared with last year. Underlying profit was $1,040 million compared with $486 million last year. Margin in the AMP Bank rose 3 basis points to 1.70%. Note that in FY 16 Australian wealth protection reported $415 million loss, following strengthening of best estimate assumptions. So the like for like comparison is difficult.

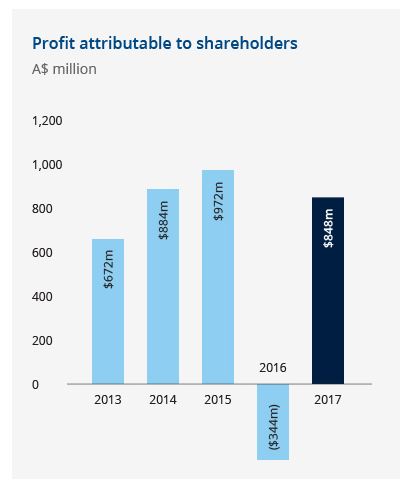

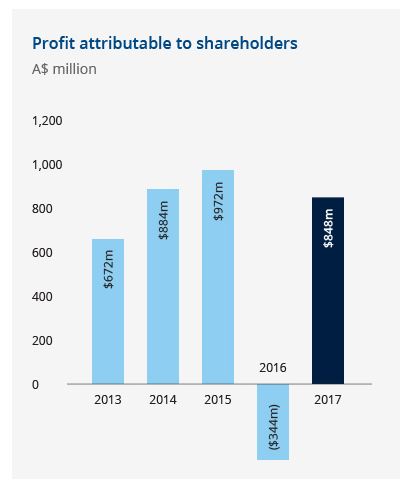

Net profit was $848 million compared with FY 16: -A$344 million.

Net profit was $848 million compared with FY 16: -A$344 million.

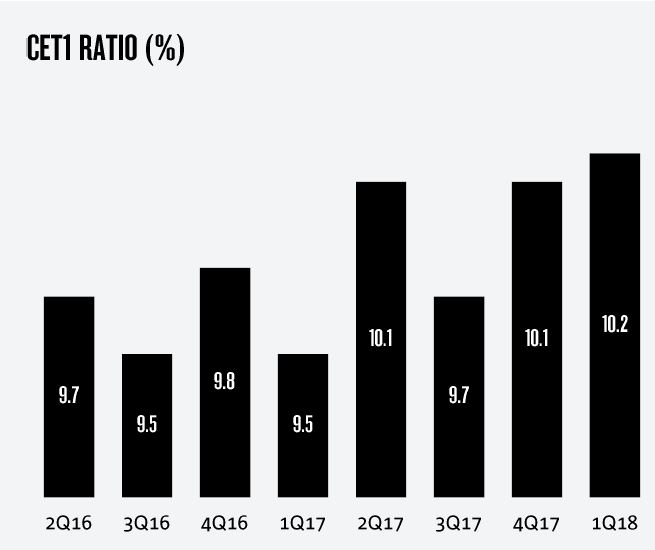

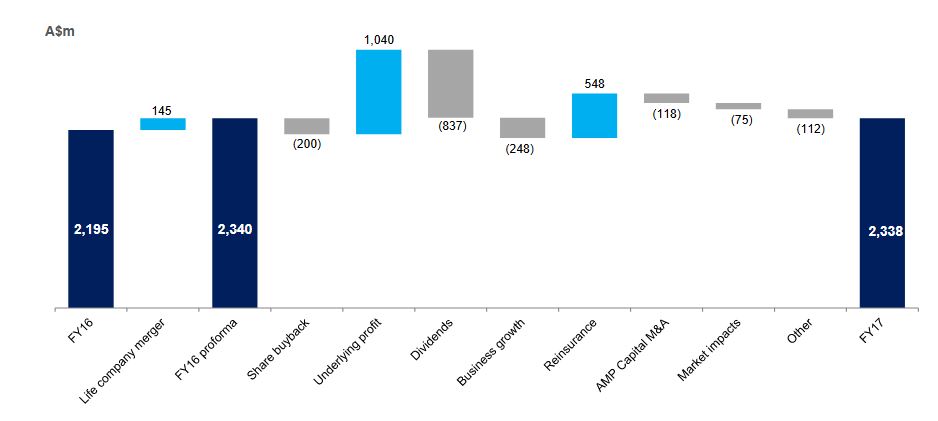

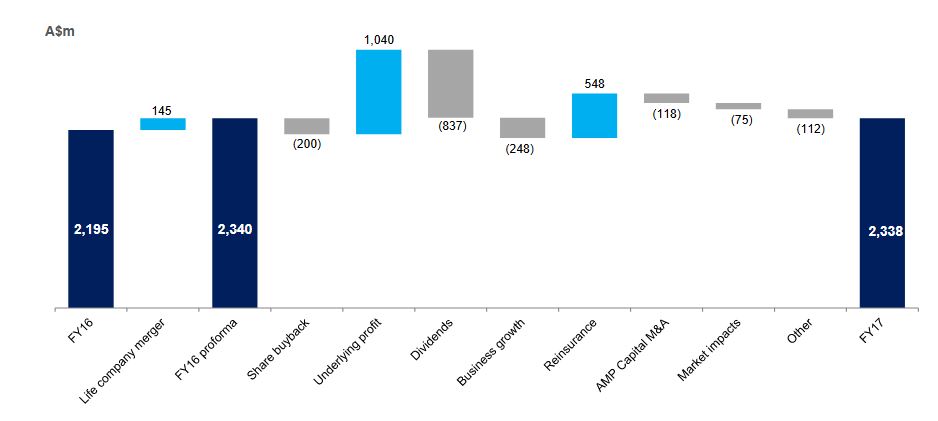

AMP’s capital position remains strong, with level 3 eligible capital resources $2,338 million above minimum regulatory requirements at 31 December 2017, up from $2,195 million at 31 December 2016.

AMP’s capital position remains strong, with level 3 eligible capital resources $2,338 million above minimum regulatory requirements at 31 December 2017, up from $2,195 million at 31 December 2016.

The capital position was strengthened by the second reinsurance program announced at 1H 17. Potential for capital management initiatives will be considered at the conclusion of the portfolio review of AMP’s manage for value businesses. AMP expects to provide a further update at or before its AGM.

The capital position was strengthened by the second reinsurance program announced at 1H 17. Potential for capital management initiatives will be considered at the conclusion of the portfolio review of AMP’s manage for value businesses. AMP expects to provide a further update at or before its AGM.

The final dividend has been maintained at 14.5 cents a share, franked at 90 per cent. The total FY 17 dividend is 29 cents a share and is within AMP’s stated target range of 70 to 90 per cent of underlying profit.

In 2017, AMP announced a strategy to manage its Australian wealth protection, New Zealand and Mature businesses for value and capital efficiency. The completion of a comprehensive reinsurance program of Australian wealth protection, released circa A$1 billion in capital to the group. Disciplined cost management has driven efficiency in New Zealand and Mature. To continue to realise value from these businesses, AMP is well progressed with a portfolio review with all alternatives being considered. As a result, AMP is in discussions with a number of interested parties. While the portfolio review is yet to be concluded, AMP expects to provide a further update at or before its AGM.

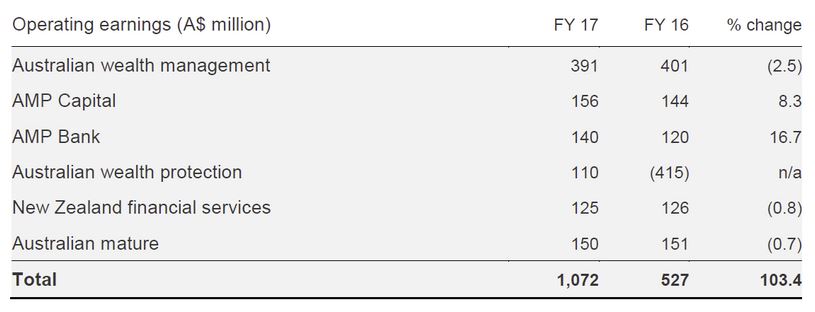

Here are the business unit splits.

Australian wealth management

Australian wealth management

Australian wealth management delivered a resilient performance during a period of high margin compression due to final transitions to MySuper. Operating earnings were 2.5 per cent lower at A$391 million. However, strong growth in net cashflows and 10 per cent growth in other revenue from Advice and SMSF demonstrates the underlying growth trajectory of the business.

Net cashflows increased 177 per cent on FY 16 to A$931 million, reflecting significant inflows from discretionary super contributions ahead of 1 July 2017 changes to non-concessional caps. The competitive strength of AMP’s corporate super platform also supported inflows, up A$436 million on FY 16 to A$717 million, with several mandate wins.

North, AMP’s flagship wrap platform, continued to perform with net flows of A$5.7 billion, up 14 per cent on FY 16 and up 28 per cent excluding a one-off significant transfer that occurred in FY 16. Assets under management rose 29 per cent to A$34.9 billion over the same period.

In 2017, AMP paid A$2.5 billion in pensions to support customers in their retirement.

AMP Capital

AMP Capital external net cashflows increased significantly to A$5.5 billion (FY 16: A$967 million), the highest since the establishment of AMP Capital in 2003. Cashflows reflect strong international investor interest in AMP Capital’s fixed income, real estate and infrastructure capabilities. External assets under management fees rose by 6 per cent to A$266 million.

Operating earnings increased 8 per cent on FY 16 to A$156 million driven by growth in fee income and particularly in real assets. Controllable costs increased 5 per cent reflecting investment in real asset capabilities, growth initiatives and international expansion. AMP Capital’s cost to income ratio of 61.5 per cent remains within the full-year target of 60 – 65 per cent.

Direct international institutional clients grew 46 per cent to 291 over the year, with AMP Capital managing A$12 billion in assets on their behalf. During the period, AMP Capital established a partnership with, and purchased a minority stake in, US real estate investor, PCCP. The partnership brings together AMP Capital’s Asian distribution capability with PCCP’s US-based investment expertise.

China Life AMP Asset Management[4] (CLAMP) continues to grow rapidly with AUM increasing 59 per cent to RMB 183.3 billion (A$36 billion) in FY 17, supported by the launch of 25 new products including diversified, equity and fixed income funds. Total AUM for China Life Pension Company, the pensions joint venture in which AMP owns a 19.99 per cent stake, grew 41 per cent to RMB 531 billion (A$104.3 billion).

At 31 December 2017, AMP Capital had A$4.2 billion of committed real asset capital available for investment, up A$700m from 30 June 2017. AMP Capital invested A$5.6 billion in new infrastructure and real estate assets in 2017.

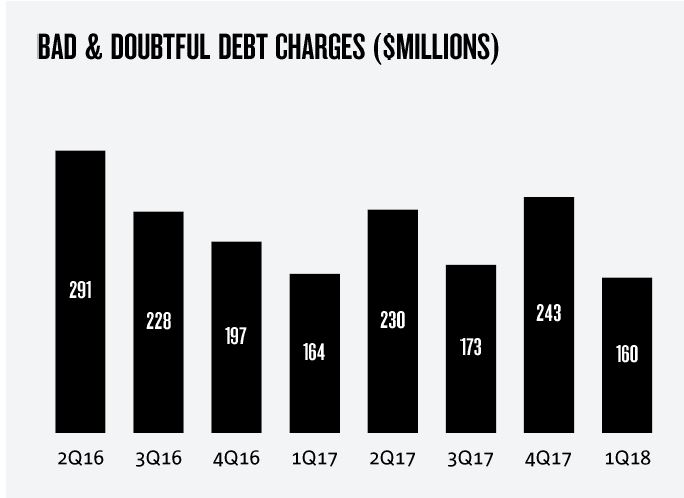

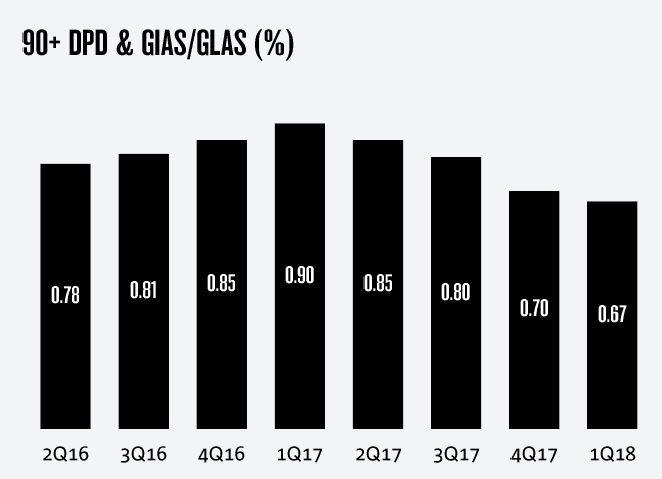

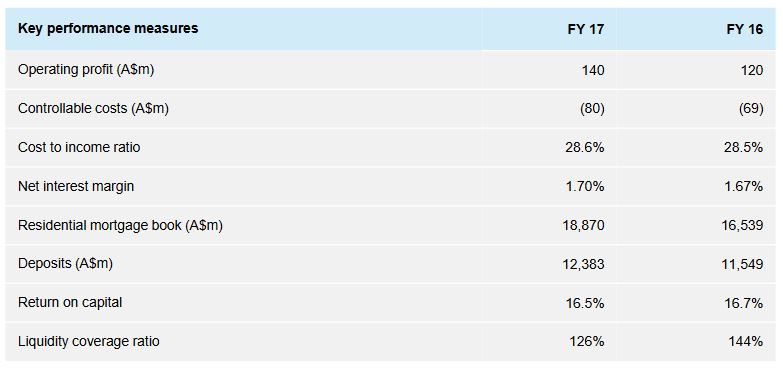

AMP Bank

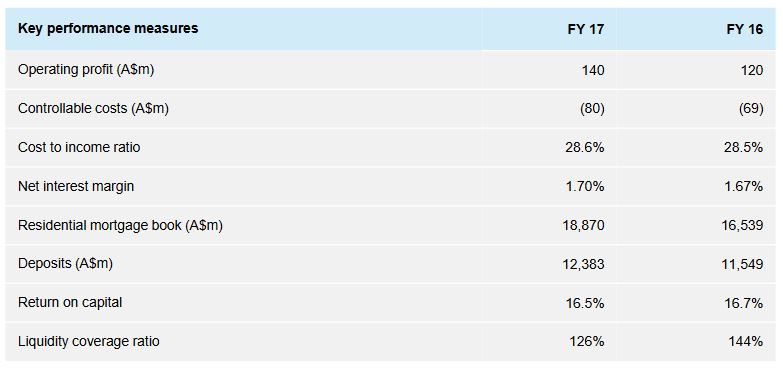

AMP Bank operating earnings rose 17 per cent to A$140 million (FY 16: A$120 million). Performance was driven by a 14 per cent rise in residential lending to A$18.9 billion underpinned by a conservative credit policy. As expected, loan growth moderated in 2H 17 as the market adjusted to new regulatory requirements.

Controllable costs increased in FY 17, reflecting investment in people and technology to support growth, however, the cost to income ratio remained almost flat at 28.6 per cent (FY 16: 28.5 per cent).

Controllable costs increased in FY 17, reflecting investment in people and technology to support growth, however, the cost to income ratio remained almost flat at 28.6 per cent (FY 16: 28.5 per cent).

Australian wealth protection

Performance in wealth protection stabilised following strengthening of best estimate assumptions and completion of a comprehensive reinsurance program, which occurred in FY 17, effectively reinsuring 65 per cent of AMP’s retail life insurance portfolio. Operating earnings improved to A$110 million in FY 17, with experience largely in line with expectations. Profit margins decreased on FY 16 to A$99 million reflecting the assumption changes and reinsurance program. Focus remains on running an efficient and competitive business while maintaining high levels of customer service. In 2017, AMP paid A$1.1 billion in claims to support customers during their time of need.

New Zealand financial services

Operating earnings, down 1 per cent to A$125 million, reflect the depreciation of the New Zealand dollar relative to the Australian dollar. In NZ$ terms, operating earnings increased 1 per cent to NZ$135 million, driven by higher profit margins and disciplined focus on cost control. AMP New Zealand financial services continues to hold market-leading positions in wealth protection and wealth management, in addition to being one of the largest KiwiSaver providers with NZ$5.1 billion in AUM, an increase of 16 per cent on FY 16.

Australian mature

Operating earnings of A$150 million reflect expected portfolio run-off offset by improved investment markets and favourable annuity experience.