The latest data from The Australian Financial Security Authority, for the December 2017 quarter shows a significant rise in personal insolvency – a bellwether for the financial stress within the Australian community.

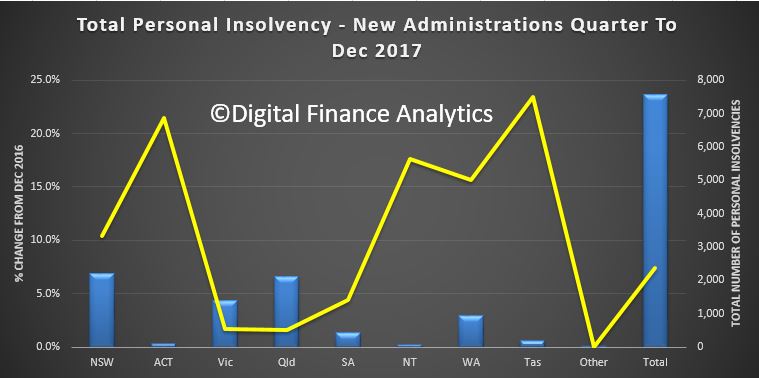

The total number of personal insolvencies in the December quarter 2017 (7,578) increased by 7.4% compared to the December quarter 2016 (7,055). This year-on-year rise follows a rise of 8.0% in the September quarter 2017.

Total personal insolvencies increased in all states and territories in the December quarter 2017, in year-on-year terms.

Quarterly total personal insolvencies remain below the historical peaks reached in 2008–09 and 2009–10 (more than 9,000 personal insolvencies).

The number of bankruptcies increased by 1.3% in year-on-year terms, from 3,976 in the December quarter 2016 to 4,029 in the December quarter 2017. This follows a 0.1% year-on-year rise in the September quarter 2017. Bankruptcies constituted 53.2% of total personal insolvencies, falling from 56.4% in the December quarter 2016.

The number of bankruptcies rose in year-on-year terms in the December quarter 2017 in all states and territories except Victoria, Queensland and South Australia.

In December quarter 2017, the number of debt agreements fell to 3,500 from the record high of 3,885 in the September quarter 2017.

In year-on-year terms, debt agreements rose by 15.3% from the December quarter 2016. This is the tenth consecutive quarter in which debt agreements have increased in year-on-year terms.

Debt agreements constituted 46.2% of total personal insolvencies, rising from 43.0% in the December quarter 2016.

Debt agreements increased in year-on-year terms in all states and territories in the December quarter 2017. Debt agreements in New South Wales reached a record quarterly high of 1,084 debt agreements in the December quarter 2017. There were 51 debt agreements in the Northern Territory (NT) in the December quarter 2017. Debt agreements in the NT also reached this record in the September quarter 2016.

Quarterly personal insolvency agreement levels fluctuate proportionally more than those of bankruptcies and debt agreements as levels are relatively small.

The number of personal insolvency agreements increased by 14.0% in the December quarter 2017 (49) compared to the December quarter 2016 (43).

This is the sixth consecutive quarter in which personal insolvency agreements have increased in year-on-year terms.