Australian retail turnover fell 0.5 per cent in December 2017, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures. This follows a 1.3 per cent rise in November 2017.

This is the headline which will get all the coverage, but the trend estimate rose 0.2 per cent in December 2017 following a rise of 0.2 per cent in November 2017. Compared to December 2016 the trend estimate rose 2.0 per cent. This is in line with average income growth.

We will continue to focus on the trend data, as this gives a clearer indication of underlying performance. Retail remains in the doldrums, no surprise given the pressure on households, as we discussed yesterday.

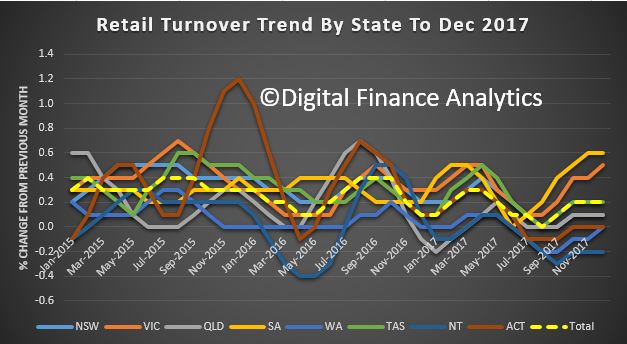

Across the states, trend movements from the previous month was 0.1% in NSW, 0.5% in VIC, 0.1% in QLD, 0.6% in SA, 0.0% in WA, 0.2% in TAS, -0.2% in NT and no change in the ACT.

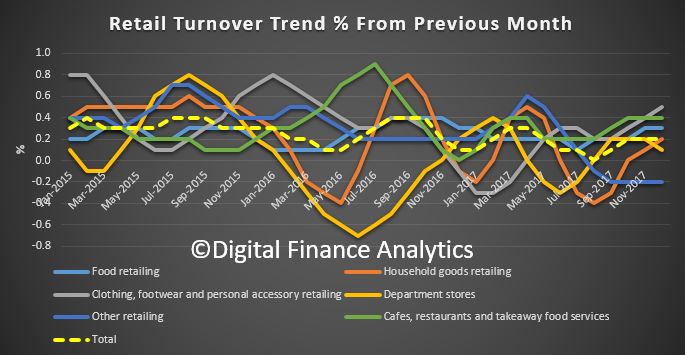

By category, in trend terms, food retailing rose 0.3%, household goods 0.2%, Clothing, footwear and personal accessories 0.5%, department stores 0.1%, other retailing -0.2% and cafes, restaurants and takeaway food 0.4%.

By category, in trend terms, food retailing rose 0.3%, household goods 0.2%, Clothing, footwear and personal accessories 0.5%, department stores 0.1%, other retailing -0.2% and cafes, restaurants and takeaway food 0.4%.

Online retail turnover contributed 4.8 per cent to total retail turnover in original terms in the December month 2017. In December 2016 online retail turnover contributed 3.8 per cent to total retail.

In seasonally adjusted volume terms, turnover rose 0.9 per cent in the December quarter 2017, following a rise of 0.1 per cent in the September quarter 2017. The rise in volumes was led by household goods (3.4 per cent), which benefitted from strong promotions and the release of the iPhone X in the November month.

Martin, firstly congratulations on the increasing recognition of your work – it’s much deserved! I would appreciate it if you delved into how you see Queensland, and specifically Brisbane, travelling. I noted from your mortgage stress reports for December and January that middle-ring Brisbane suburbs – widely considered reasonably affluent – have been in the list of top 10 postcodes for mortgage stress in Queensland. I also note above that trend retail turnover has been relatively weak in Queensland over the last year – this rings true with what I am observing in retail centres with which I am most familiar, and with restaurateurs that I support and speak with (middle-ring Brisbane). The restaurateurs (and their suppliers) certainly are pointing their fingers at over-indebtedness as the cause of their lower takings… Any views on where things are heading in these areas? Thank you

Hi Brett – yes I think these areas are under pressure – I will pull some local data and make a post in coming days.