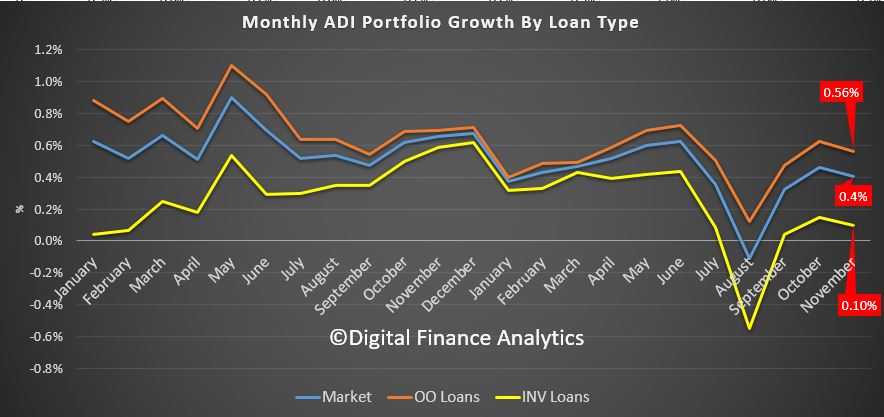

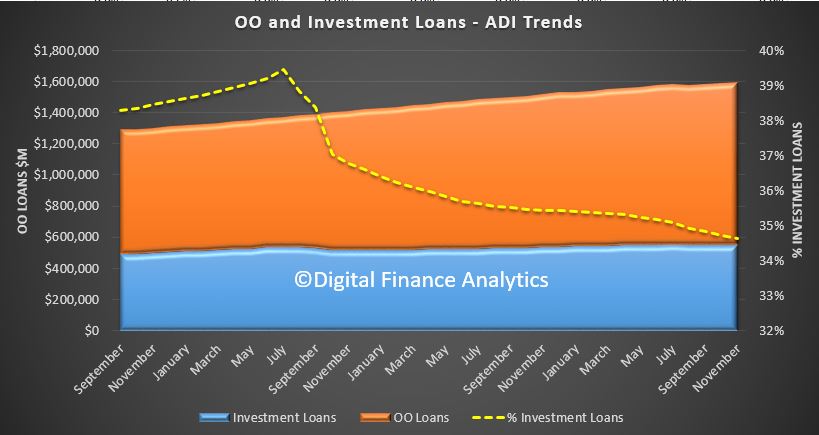

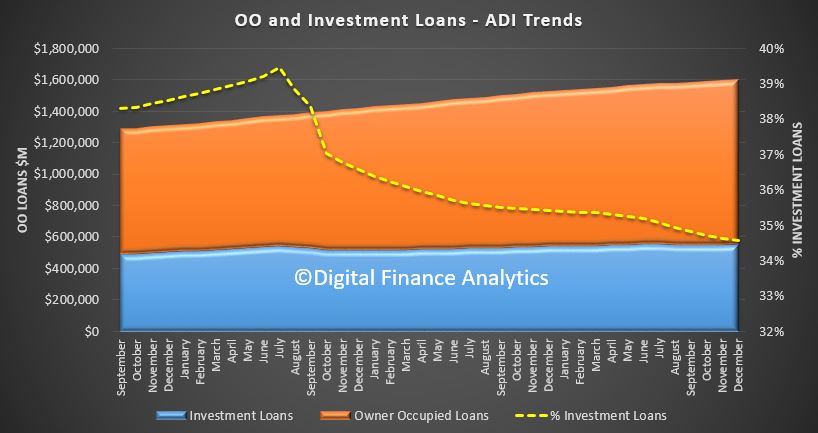

The latest data from APRA, the monthly banking stats for ADI’s shows a growth in total home loan balances to $1.6 trillion, up 0.5%. Within that, lending for owner occupation rose 0.59% from last month to $1.047 trillion while investment loans rose 0.32% to $553 billion. 34.56% of the portfolio are for investment purposes.

The monthly ADI trends show this clearly (the blip in August was CBA adjustments). Growth accelerated across all loans, and within each type.

The monthly ADI trends show this clearly (the blip in August was CBA adjustments). Growth accelerated across all loans, and within each type.

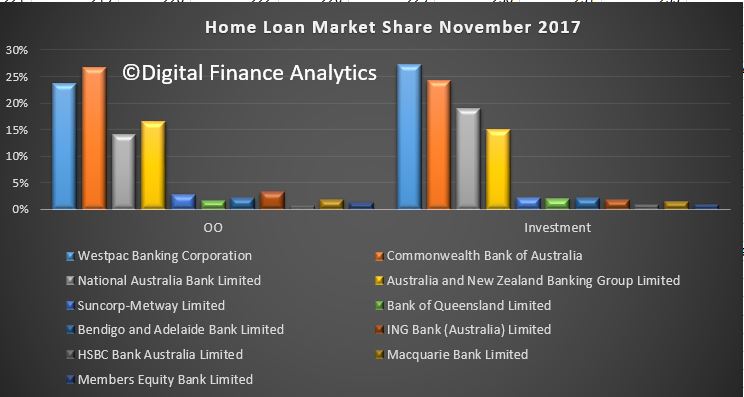

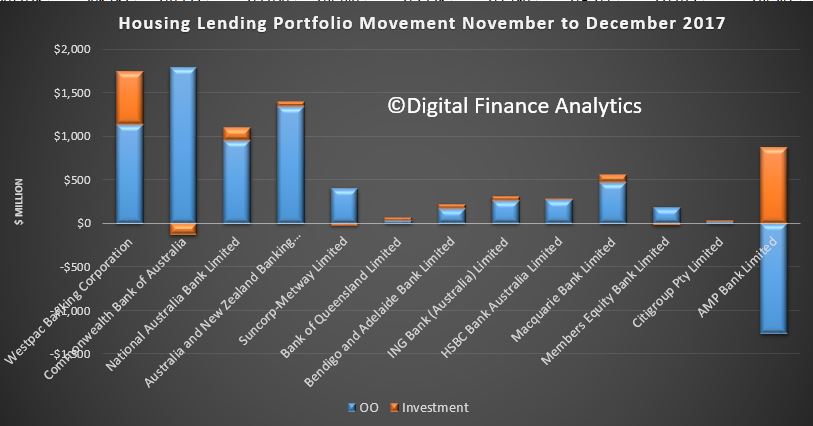

The portfolio movements within institutions show that Westpac is taking the lions share of investment loans (we suggest this involves significant refinancing of existing loans), CBA investment balances fell, while most other players were chasing owner occupied loans. Note the AMP Bank, which looks like a reclassification exercise.

The portfolio movements within institutions show that Westpac is taking the lions share of investment loans (we suggest this involves significant refinancing of existing loans), CBA investment balances fell, while most other players were chasing owner occupied loans. Note the AMP Bank, which looks like a reclassification exercise.

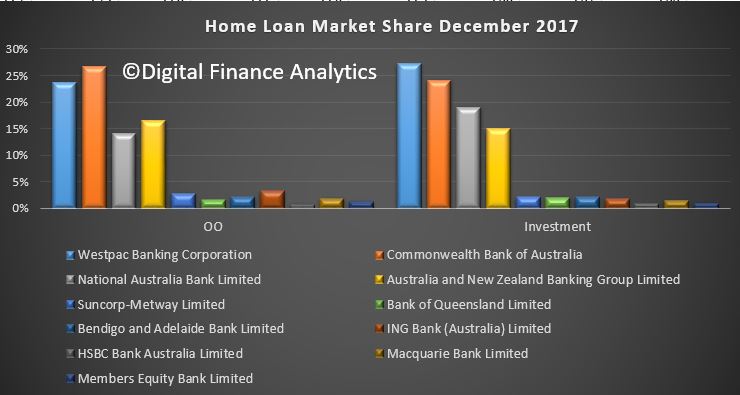

Overall market shares remain stable, with CBA holding the largest share of owner occupied loans and Westpac leading on investment loans.

Overall market shares remain stable, with CBA holding the largest share of owner occupied loans and Westpac leading on investment loans.

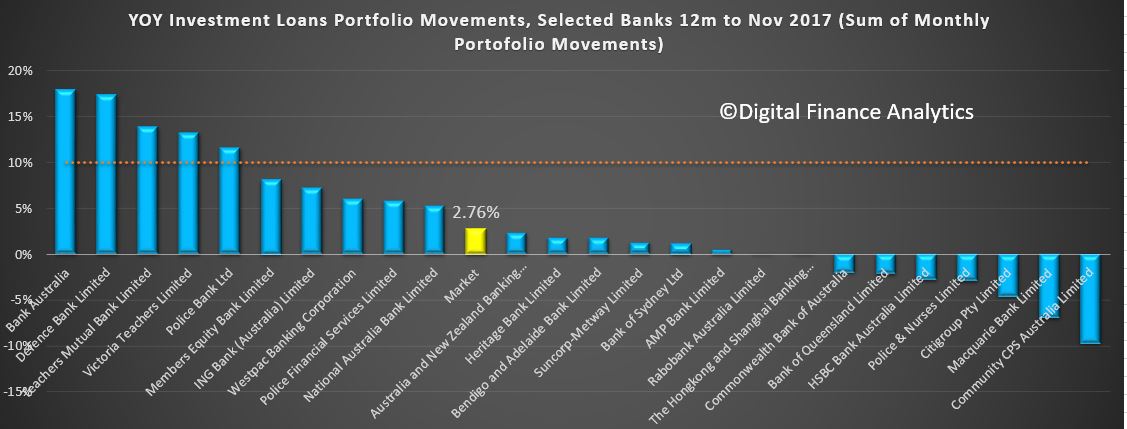

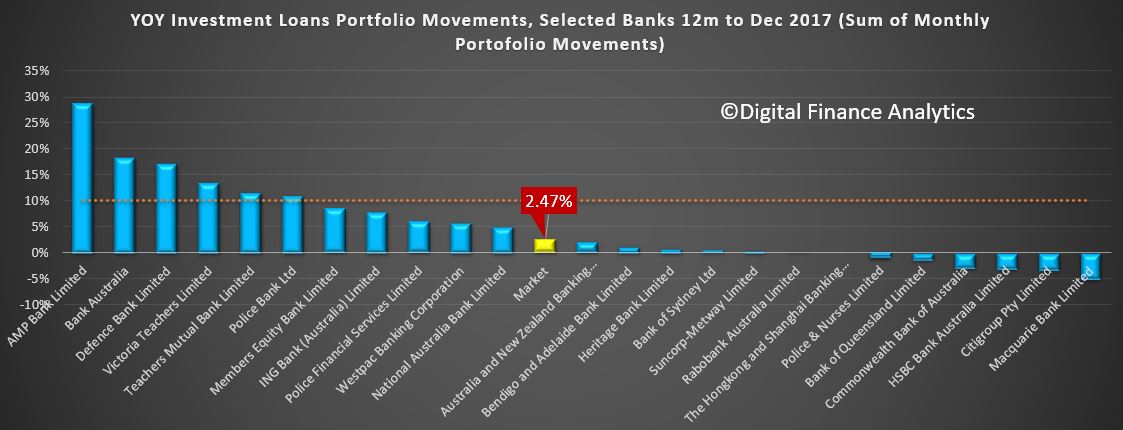

The 10% speed limit for investment loans is less interesting, given the 12 month average grow of 2.4%, but most of the majors are well below the 10%. Westpac is the major growing its investment book fastest, while CBA is in reverse. Clearly different strategies are in play.

The 10% speed limit for investment loans is less interesting, given the 12 month average grow of 2.4%, but most of the majors are well below the 10%. Westpac is the major growing its investment book fastest, while CBA is in reverse. Clearly different strategies are in play.

Standing back, the momentum in lending is surprisingly strong, and reinforces the need to continue to tighten lending standards. This does not gel with recent home price falls, so something is going to give. Either we will see home prices start to lift, or mortgage momentum will sag. Either way, we are clearly in uncertain territory. Given the CoreLogic mortgage leading indicator stats were down, we suspect lending momentum will slide, following lower home prices. We publish our Household Finance Confidence Index shortly where we get an updated read on household intentions.

Standing back, the momentum in lending is surprisingly strong, and reinforces the need to continue to tighten lending standards. This does not gel with recent home price falls, so something is going to give. Either we will see home prices start to lift, or mortgage momentum will sag. Either way, we are clearly in uncertain territory. Given the CoreLogic mortgage leading indicator stats were down, we suspect lending momentum will slide, following lower home prices. We publish our Household Finance Confidence Index shortly where we get an updated read on household intentions.

The RBA data comes out shortly, and we will see what adjustments they report, and momentum in the non-bank sector.