More on the digital transformation of the payments system.

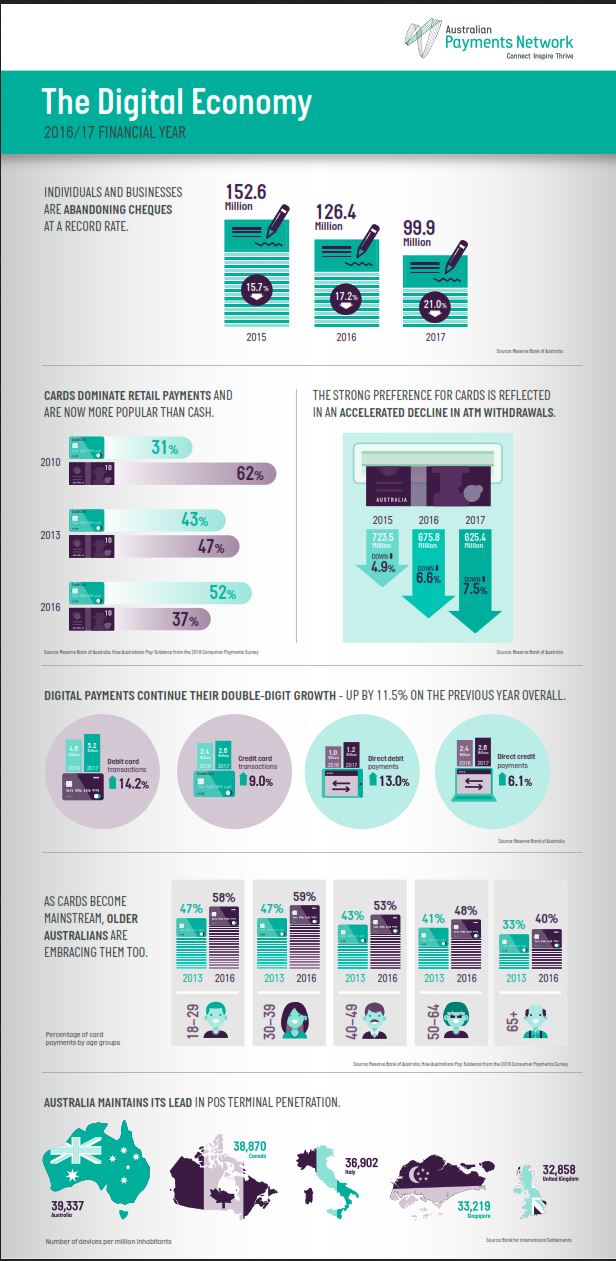

The milestones report entitled Digital Economy released today by Australian Payments Network (AusPayNet), the payments industry self-regulatory body, reinforces that individuals and businesses are abandoning cheques and cash at a record rate as they embrace digital payments.

Today’s report highlights that in the 12 months to 30 June 2017, cheque use plunged 21% to dip under 100 million for the first time – the largest drop ever-recorded. This follows a 17.2% drop for the same period in 2016, and a 15.7% drop in 2015. The value of cheques dropped by 4.22% for the 12-month reporting period. This compares to1.76% the previous year.

Cash has lost its position as the dominant retail payment method, with cards now accounting for 52% of payments. This strong preference for cards is reflected in an accelerated decline in ATM withdrawals. The number of ATM withdrawals dropped by 7.5% to 625.4 million following a 6.6% drop the previous 12 months.

CEO of AusPayNet, Dr Leila Fourie said “The move away from cheques and cash is not surprising. What is surprising, however, is the accelerated rate at which this is happening. In our fast-paced, 24/7 society, consumers and businesses are consistently choosing faster, convenient payment options as new technologies shape a digital first mind-set.”

Digital payments continued their double-digit growth – up by 11.5% on the previous year overall.

In the 12 months to 30 June 2017, Australians made:

• 5.2 billion debit card payments – up 14.2%

• 2.6 billion credit card payments – up 9%

• 1.2 billion direct debit payments – up 13%

• 2.6 billion direct credit payments – up 6.1%

Australia’s card use is enabled by one of the highest penetrations of POS devices (39,337) per million inhabitants, ahead of Canada (38,870), Italy (36,902), Singapore (33,219) and the United Kingdom (32,858). Australia also has a comparatively high smartphone penetration, estimated at 84% in 2016.

“With our high use of smartphones, Australia is well-positioned for the next wave of payments innovation, and the industry’s New Payments Platform for faster payments will provide a stimulus,” said Dr Fourie.

The regulatory environment is continuing to evolve to support the transition to the digital economy. The Report provides an update on the Black Economy Taskforce, open banking, and card surcharging reforms.

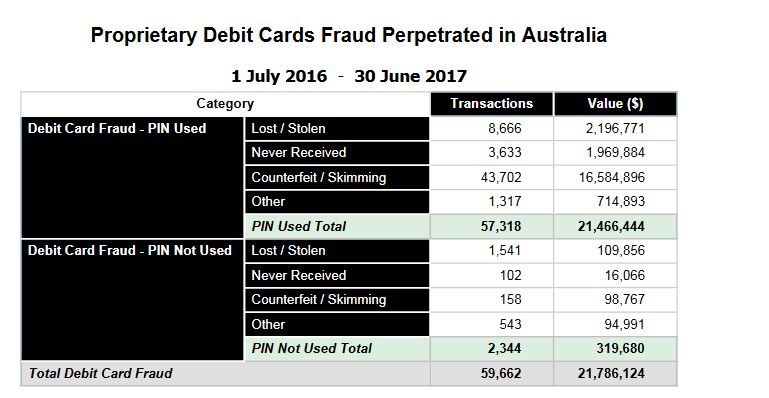

The total fraud on the scheme cards was $516 million.

The total fraud on the scheme cards was $516 million.