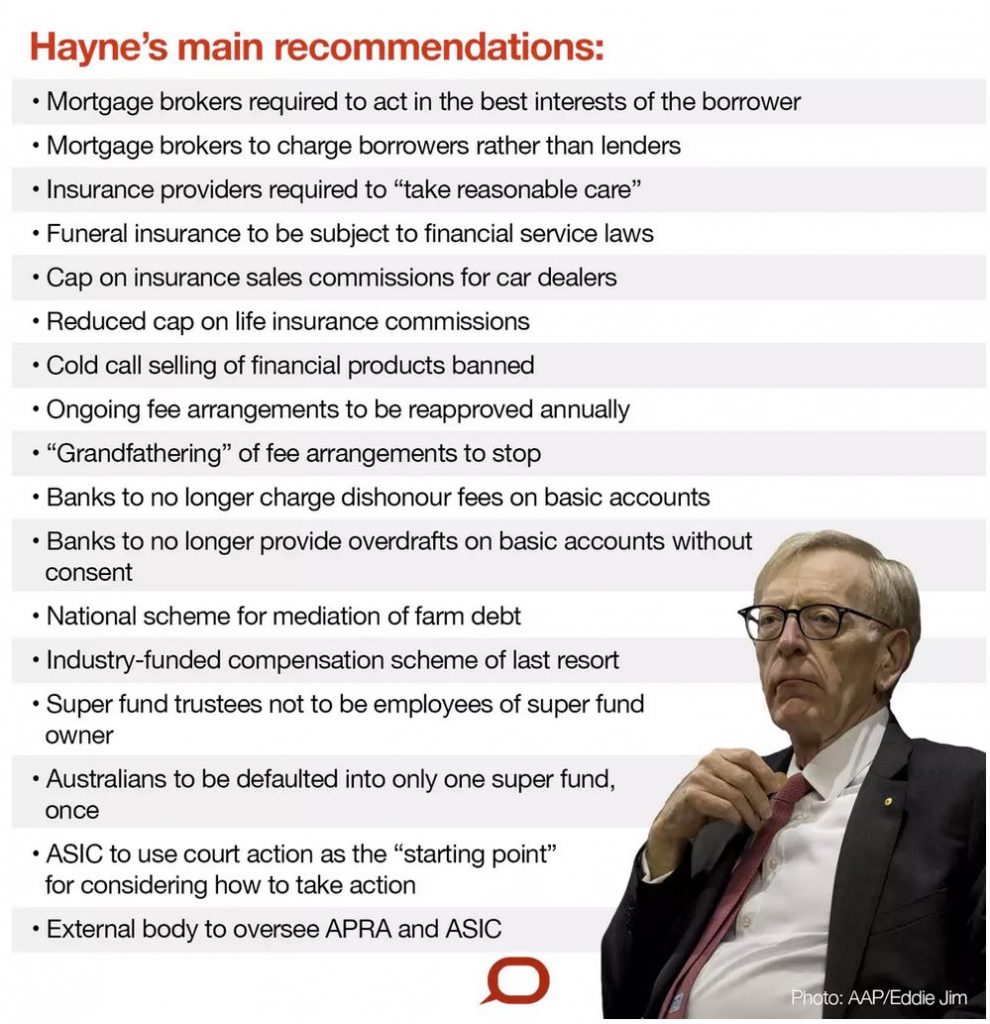

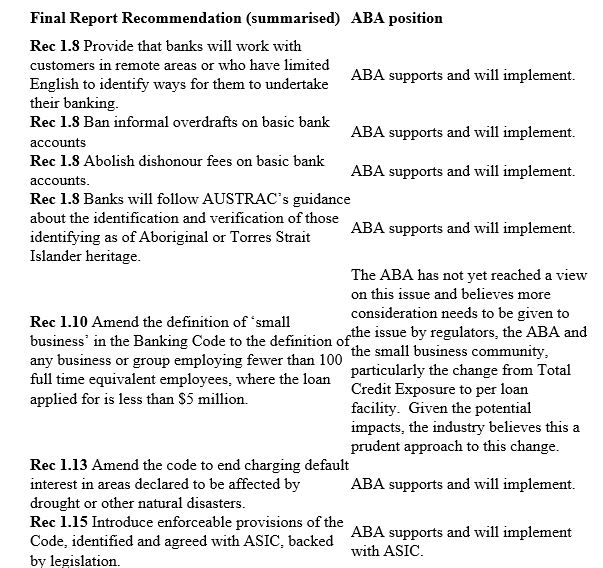

Those with long memories will recall the passage of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry which reported in 2019. The inquiry heard evidence from many individuals as well as from industry representatives, which highlighted egregious behaviour, misaligned incentives and outright deception. The final report made a number of recommendations, many of which have not been implemented, or have been severely diluted. The industry played the long game, and the Government has walked back and watered down most of the reforms. No wonder Justice Hayne refused to shake Treasurer Frydenberg’s hand in that infamous photo, even then the writing was on the wall.

One recommendation in the The final report for the Royal Commission was that “changes in brokers’ remuneration should be made over a period of two or three years, by first prohibiting lenders from paying trail commission to mortgage brokers in respect of new loans, then prohibiting lenders from paying other commissions to mortgage brokers”.

In its official response to the royal commission in 2019, the Labor Party had originally proposed banning trail commissions paid to mortgage brokers and capping upfront commissions at 1.1 per cent. However, both sides of the political spectrum have confirmed that they would not be looking to change broker remuneration, after Labor MP Stephen Jones told The Adviser last month that his party would not seek to change it.

Now, following a meeting with members of industry last week, assistant treasurer Michael Sukkar MP has revealed that the federal government will not proceed with the broker remuneration review this year, after acknowledging that the broker commission structure is not problematic.

While the Morrison government had initially said in its official response to the final report in 2019 that it would ban trail commission payments for new mortgages from 1 July 2020, the Treasurer Josh Frydenberg had suggested to Momentum Media that the role of upfront and trail commissions would instead be reviewed in the “back half” of the year. It is this review that has now been dropped.

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.