Commsec released their latest state of the state report, calculated from eight key indicators: economic growth; retail spending; business investment; unemployment; construction work done; population growth; housing finance and dwelling commencements. Housing finance and construction therefore drive the index hard.

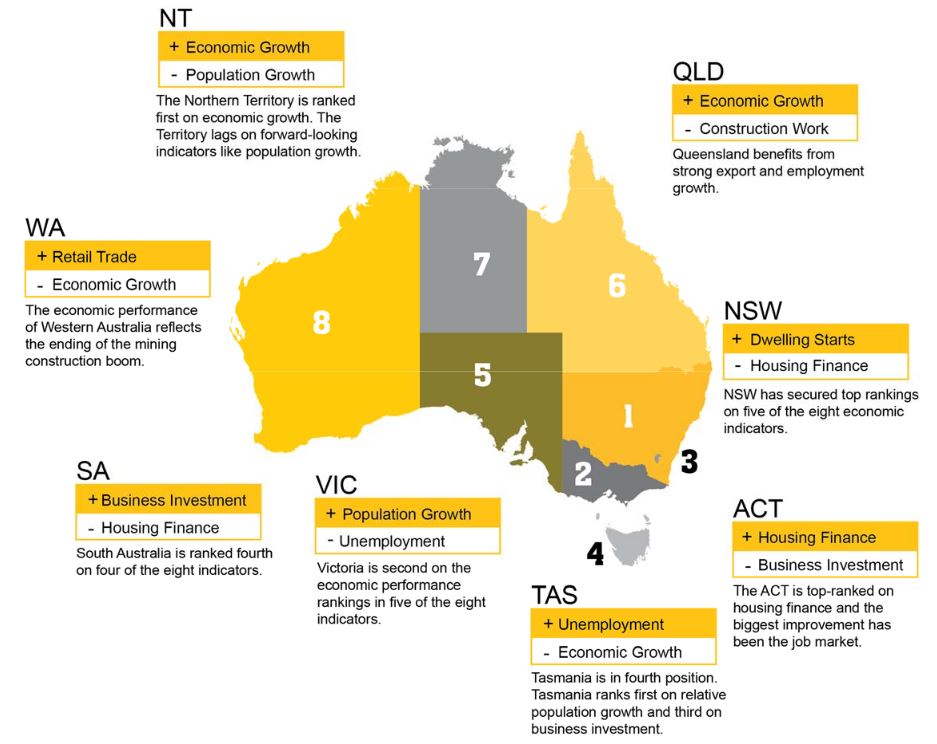

They say that Australia’s economies are in good shape but with some differences in relative performance. NSW remains solidly on top of the economic performance rankings from Victoria while the ACT holds down third spot. Then there is a gap to Tasmania, South Australia and Queensland, and then a gap to the Northern Territory and Western Australia.

They say that Australia’s economies are in good shape but with some differences in relative performance. NSW remains solidly on top of the economic performance rankings from Victoria while the ACT holds down third spot. Then there is a gap to Tasmania, South Australia and Queensland, and then a gap to the Northern Territory and Western Australia.

NSW has secured top rankings on five of the eight economic indicators: retail trade, dwelling starts, equipment investment, construction work and unemployment. NSW is second on economic growth and in third spot on population growth and housing finance.

Victoria is second on the economic performance rankings for five of the eight indicators: retail trade, housing finance, population growth, construction work done and equipment investment. The lowest ranking is fifth on the unemployment rate.

The ACT held on to third spot on the rankings. The biggest improvement has been the job market, with annual employment growth now the strongest in almost a decade. The ACT is top-ranked on housing finance.

There is little to separate three of the next economies with a further gap to Northern Territory and Western Australia. Tasmania has lifted from fifth to fourth position. Tasmania now is top-ranked on relative population growth and is third-placed on equipment investment and unemployment. Population growth is the strongest in 6½ years.

South Australia has eased from fourth to fifth on the performance rankings. South Australia is ranked fourth on four of the eight indicators.

Queensland remains in sixth position. But the outlook is promising with annual employment growth the fastest in the nation and just off the fastest for the state in over a decade.

The Northern Territory retains its seventh position on the economic performance rankings. The Territory is top ranked on economic growth but now lags all other economies on six of the eight indicators. Employment is now lower than a year ago in trend terms. The good news is that exports are growing strongly, up 35 per cent on a year ago.

The economic performance of Western Australia continues to reflect the ending of the mining construction boom. But employment growth was just off the strongest levels seen in five years. And annual population growth has lifted for the past four quarters.