Today we look at the February numbers from Core Logic and the ABS new lending data, which refinancing apart remain weak. In fact we are not convinced conditions are likely to lead to sustainable price rises.

Tag: CoreLogic

Here Comes Yet More Home Price Falls!

The latest data from Core Logic confirmed more home price falls across both capital cities and the regions. Hobart and Brisbane are hit hardest, and regional areas are hanging on a little better. But even Perth and Adelaide are now going down.

And latest forecasts from CBA are still talking about more falls. Unless we see forms of Government intervention, such as APRA cutting the 3% buffer, the RBA cutting rates, or more fiscal incentives.

http://www.martinnorth.com/

Go to the Walk The World Universe at https://walktheworld.com.au/

Here Come The Property Price Falls!

My thesis and modelling show that availability of credit – driven by interest rates and borrowing capacity is by far the largest driver of home prices. Cut rates and flood the economy with cheap money and property prices are pushed higher, as happened through the COIVD period. Lift rates, tighten borrowing power, and remove stimulus, and prices fall. This thesis has been proved over the pst three years, with Australia’s housing market suffered its biggest annual decline since 2008 last year as sharp interest rate hikes sapped buying power and put off investors.

CoreLogic released their latest national Home Value Index which fell 5.3% in 2022, the first decline since 2018. Annual falls were the biggest in the bellwether market of Sydney, which slid 12.1%, followed by an 8.1% drop in Melbourne. National values declined 1.1% in December, according to the report.

Remember that The Reserve Bank raised interest rates by 3 percentage points since May to 3.1% and is widely expected to hike one or two more times this year. RBA officials have generally publically expressed confidence in Australia’s housing market, highlighting that prices are still higher than at the onset of the pandemic, though recent FOI data underscores their concern falling prices will sap confidence. This despite unemployment at the lowest level in almost 50 years, so they argue most borrowers are well placed to meet their commitments and so loan arrears are likely to be limited.

But overall Australia’s A$9.4 trillion housing market has declined 8% from the recent peak reached in April, after surging 28.6% from a pandemic-induced trough, CoreLogic said.

http://www.martinnorth.com/

Go to the Walk The World Universe at https://walktheworld.com.au/

Homing In On Price Falls, With More To Come…

The latest figures from CoreLogic show prices for homes are easing, and in some places falling. We look at the data, in the light of pressures on households, and rising stress as reported in our latest surveys. And we consider the future trajectory, sheeting the shape of price changes and wealth directly at the door of RBA monetary policy

[CONTENT]

0:00 Start

0:15 Introduction

0:25 June Price Moves

1:50 Major Cities

2:50 Regionals

3:50 Listings and Sales

5:50 Rentals

7:50 Outlook

12:00 Commentary

13:00 Latest Mortgage Stress

13:50 RBA will influence falls or gains

17:45 Conclusion and close

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.

R.I.P. Hedonic Index! – With Edwin Almeida

Property Insider Edwin Almeida and I discuss today’s announcement as the daily CoreLogic index is suspended.

What are the implications?

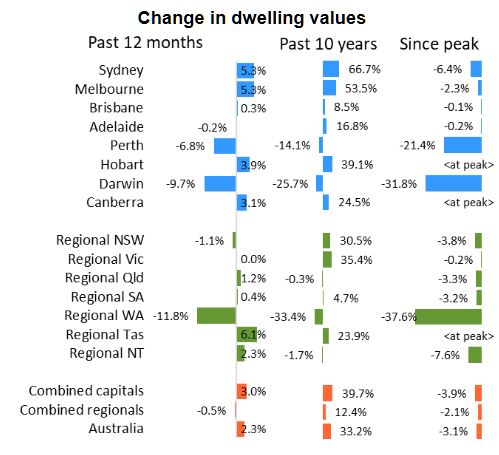

CoreLogic National Index Rose 4.0% Over December Quarter

CoreLogic released their updated data to end December 2019 today.

They confirm a 1.1% rise in national dwelling values over the month, and a 4.0% increase over the quarter to finish out 2019 on a positive note.

This result represents the fastest rate of national dwelling value growth over any three month period since November 2009. Darwin was the only region among the capital cities and ‘rest-of-state’ areas to record a fall in values over the month, with a -0.5% decline.

CoreLogic head of research Tim Lawless said, “Although the monthly capital gains trend remains fast-paced, the 1.1% rise in December was softer relative to the 1.7% gain in November and the 1.2% rise in October. This would suggest that the pace of capital gains may have been dampened by higher advertised stock levels or worsening affordability pressures through early summer.”

Despite a strong rebound over the second half of 2019, property values across most regions of Australia are still below their previous record highs. Nationally, the CoreLogic index recorded a peak in October 2017; dwelling values remained 3.1% below their record high at the end of 2019. If the current quarterly rate of growth persists into 2020, the national housing market will record a nominal recovery in March as dwelling values push higher to new record highs.

Tim Lawless said, “A nominal recovery in housing values implies home owners are becoming wealthier, which may also help to support household spending. However, the flipside is that housing affordability is set to deteriorate even further as dwelling values outpace growth in household incomes, signaling a set-back for those saving for a deposit.”

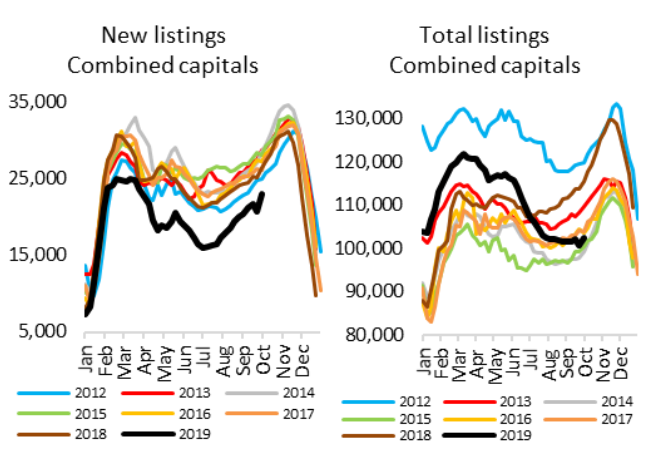

Spring Has Not Sprung This Year!

We look at the latest property listings data released by CoreLogic, and consider the consequences in the light of our household surveys.

Home Prices Stabilised In July

We look at the latest data from CoreLogic.

Home Prices Stabilised In July [Podcast]

We look at the latest data from CoreLogic.

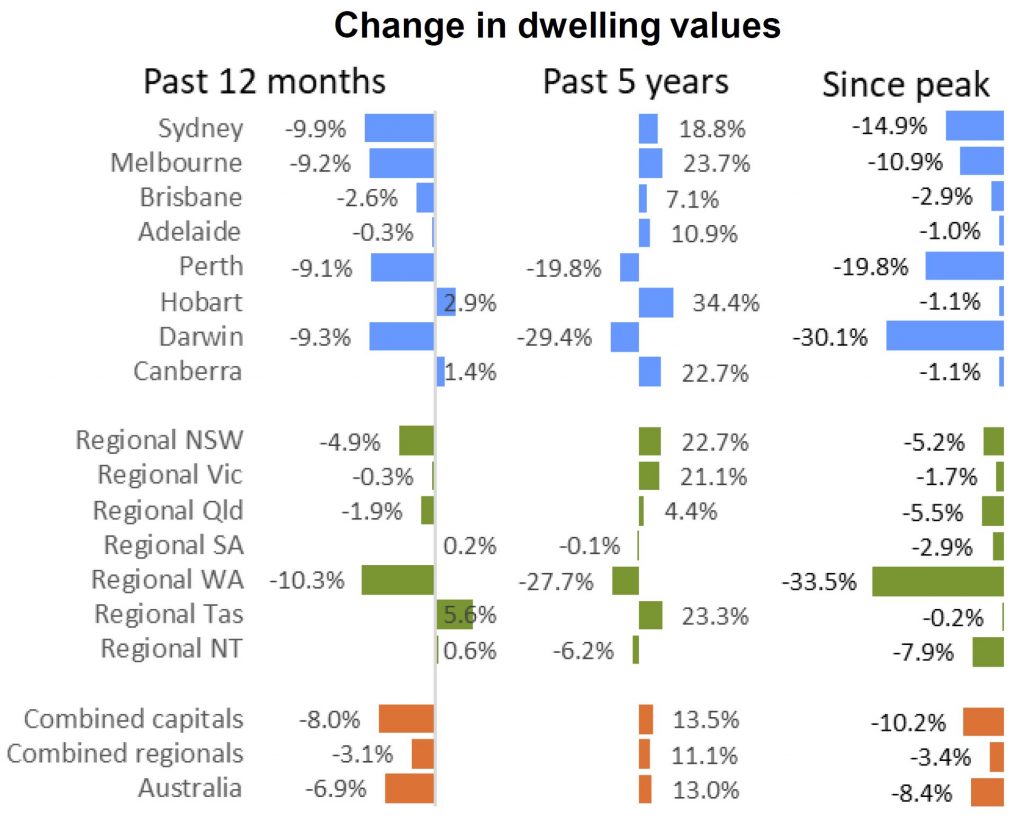

Home Value Falls Continue In June, But A Subtle Change In Places!

CoreLogic reported a 0.2 per cent fall in national dwelling values, the smallest month-on-month decline in the national series since March 2018, according to their June Home Value Index .

On a quarterly basis, every capital city housing market has recorded a drop in value, highlighting the broad geographic scope of this housing market downturn. Annually, the average fall is 6.9%, but regional WA is down one third from peak 5 years back and Darwin down 30.1%, thanks to the wider economic downturn there.

Sydney and Melbourne dwelling values have recorded their first monthly rise since 2017 with Melbourne values increased 0.2 per cent across the past month, while there was 0.1 per cent growth in Sydney.

According to CoreLogic head of research Tim Lawless, the June results presented an early sign that lower mortgage rates and improved sentiment were already having a flow-on effect for housing market conditions in Sydney and Melbourne, while most other regions of Australia continued to show relatively soft housing market outcomes.

“The subtle rate of decline was heavily influenced by trends across Sydney and Melbourne where the pace of falling home values has been consistently reducing over the year to date,” he said.

“Importantly, the improving conditions through to mid- May were largely ‘organic’, pre-dating the positive boost in sentiment following the federal election and interest rate cuts in early June.”

The only other regions to record a rise in housing values over the month were Hobart (+0.2 per cent), as well as the regional areas of South Australia (+0.1per cent) and Northern Territory (+0.2 per cent).

The largest falls over the past three months were recorded in Darwin (-3.6 per cent) and Perth (-2.1 per cent) where the weaker trend has persisted since mid-2014.

Adelaide recorded the smallest decline amongst the capitals over the quarter, with values down 0.4%.

Across the regional markets, values were 0.4% lower over the month to be down 3.1% for the financial year.

Dwelling values recorded a rise over the June quarter in Regional South Australia (+0.6 per cent) and Regional Tasmania (+1.3 per cent).

Mr Lawless said although these areas have recorded modest gains over the quarter, the trend across the regional areas of Australia is generally “one that is losing momentum”.