We look at the “property experts” view of the markets, which appears to be on the turn.

Domain published an interesting article before Christmas, looking in particular at the Sydney property market, saying its one for the record books. To which I respond, maybe, but for all the wrong reasons.

Sue Williams wrote: Space: the final frontier – or, for those in the Sydney property market over the past year, the financial frontier. For the biggest trend in pandemic-plagued 2021 has turned out to be the demand for more room in, and around, our homes.

“It’s really been the year when we re-imagined the space in our houses and apartments,” says Domain chief of research and economics Nicola Powell.

“We wanted to have areas in our homes where we could work and, spending so much time indoors during lockdowns, we wanted more living space where we weren’t all on top of each other.

“That’s really driven a lot of the price growth of houses over that of apartments. But another big surprise of the year has been the price growth of three-bedroom units. Generally, the greater number of bedrooms, the more prices have risen.”

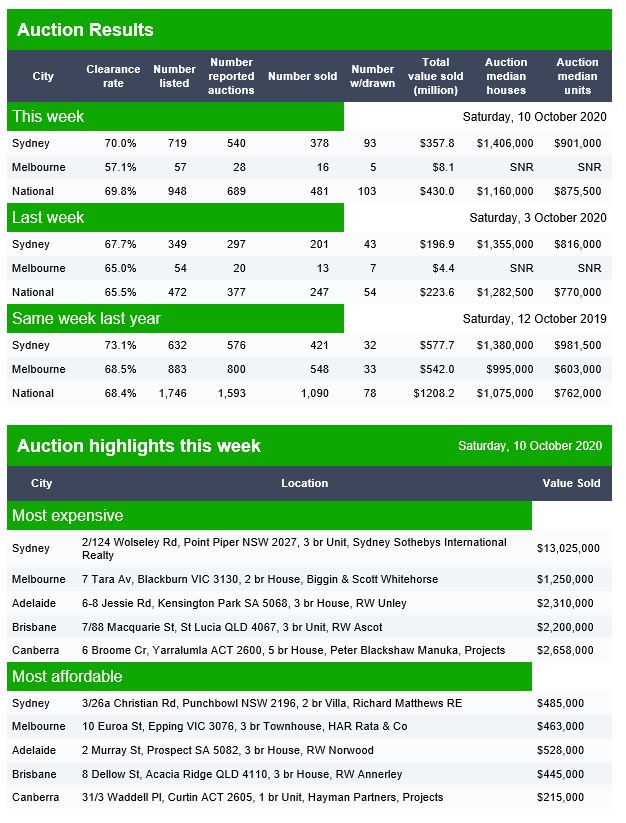

It’s been a strange year in so many ways. With rock-bottom interest rates continuing, no sooner did escalating property prices smash all previous records than they smashed them again three months later – with unprecedented back-to-back quarters of price rises over eight per cent.

As first-home buyers flooded back into the market in 2020, they were suddenly washed back out again by the pricing tsunami, with investors diving in to take their place.

Many were only able to dip their toes in early in 2021 because of the bank of mum and dad.

Go to the Walk The World Universe at https://walktheworld.com.au/