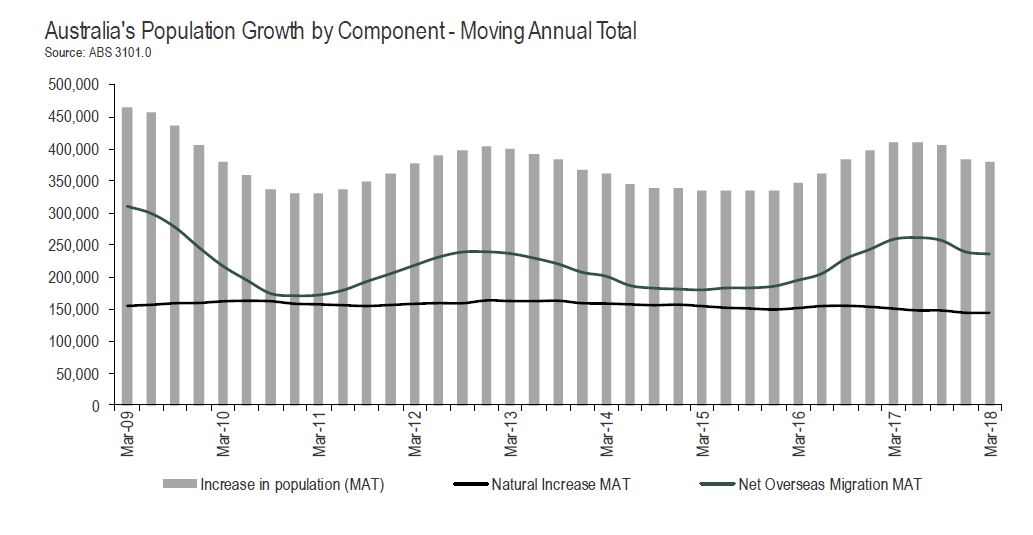

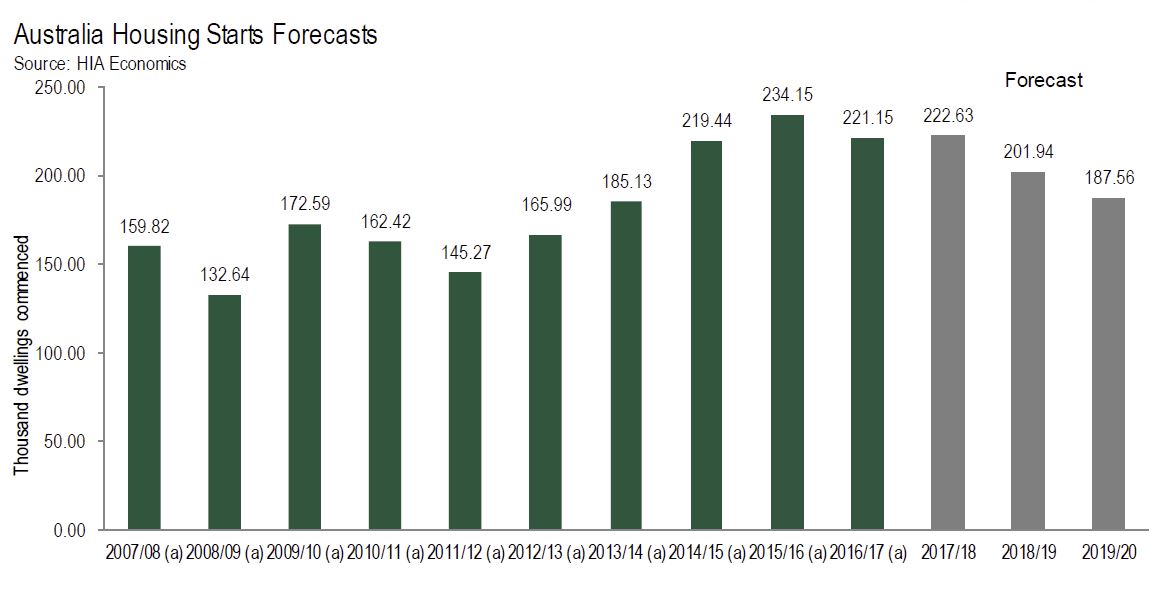

The ABS data on migration shows a 9% fall since visa changes made in April 2017. No surprise then the HIA bemoans the fall, pointing to slowing demand for new property.

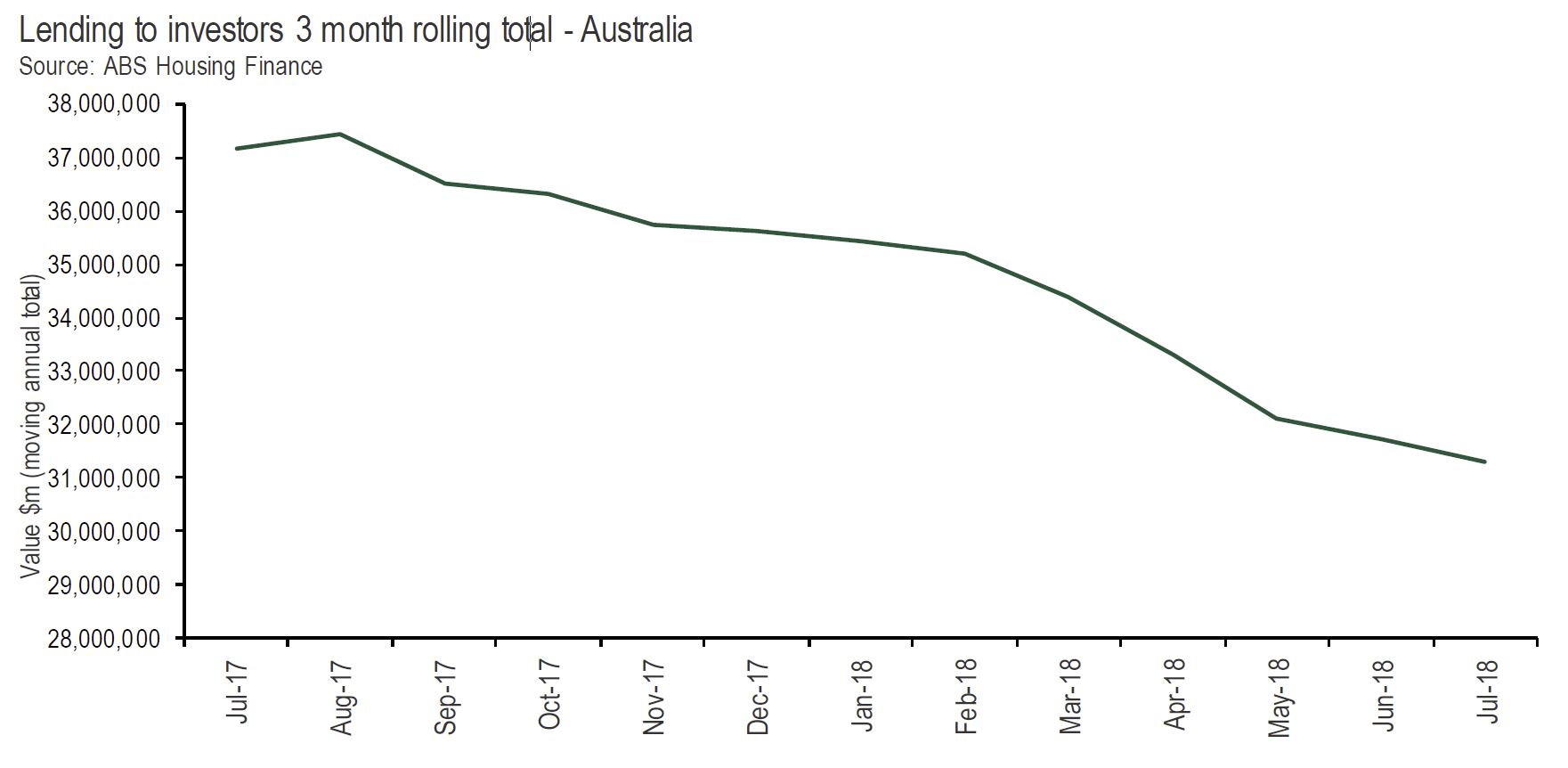

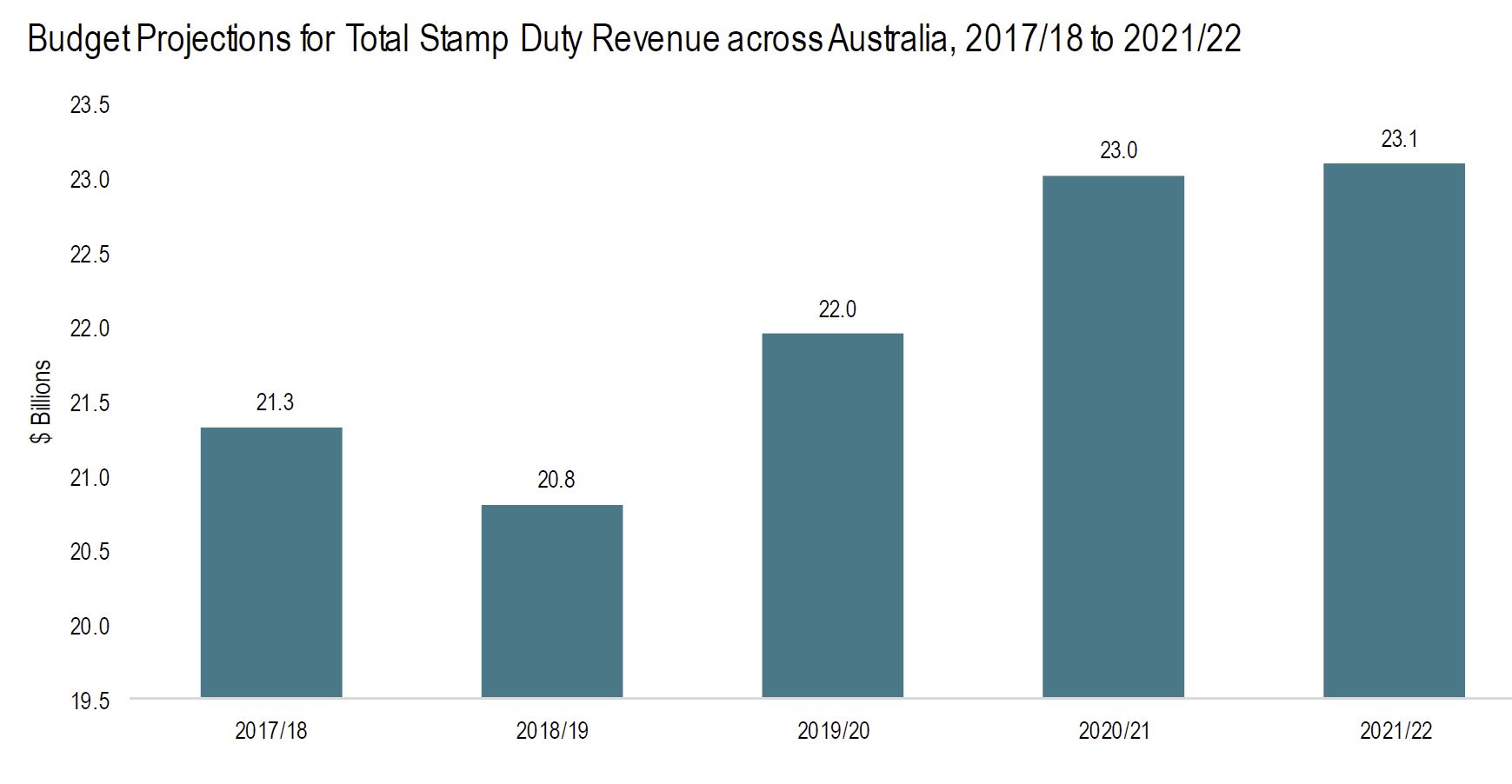

Of course this is another reason why home prices are likely to go lower.

ABS data released today shows that Australia’s annualised population growth rate slowed for the fourth consecutive quarter.

Over the year to March 2018, Victoria saw the strongest growth in population (+2.2 per cent), followed by the ACT (+2.1 per cent) and Queensland (+1.7 per cent). New South Wales was fourth fastest (+1.6 per cent) with Tasmania fifth (+1.0 per cent), Western Australia sixth (+0.8 per cent) and South Australia seventh (+0.7 per cent). The population of the Northern Territory has actually declined over the last two quarters and the annual rate of growth has slowed to 0.1 per cent.

“Australia’s overseas migration fell by 9 per cent since changes to visa requirements came into force in April 2017, slowing the population growth rate to 1.6 per cent,” Mr Murray added.

“In April 2017, Australia introduced a range of visa changes which have been successful in reducing the number of skilled migrants arriving in Australia.

“The current phase of Australia’s 28 years of continuous economic growth is built upon the arrival of skilled migrants. Skilled migration is necessary to offset the impact of our aging population.

“Looking domestically, states such as New South Wales and Victoria that have benefitted the most from overseas migration over recent years are now seeing population growth rates slowing.

“The slowing rate of population growth, while it remains high for a developed economy, will contribute to slower growth of household consumption.

“This means slower growth in sectors such as retail and residential building. Given that these two sectors are amongst the nation’s largest employers the risks presented a decline in population growth should not be underestimated,” concluded Mr Murray.