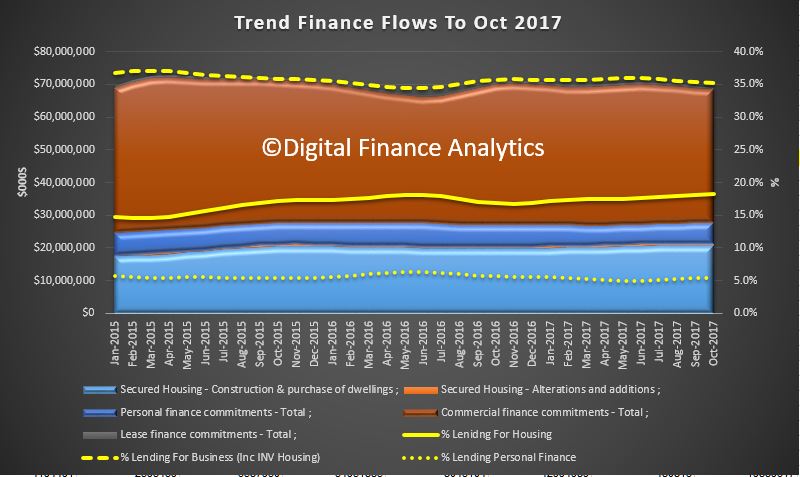

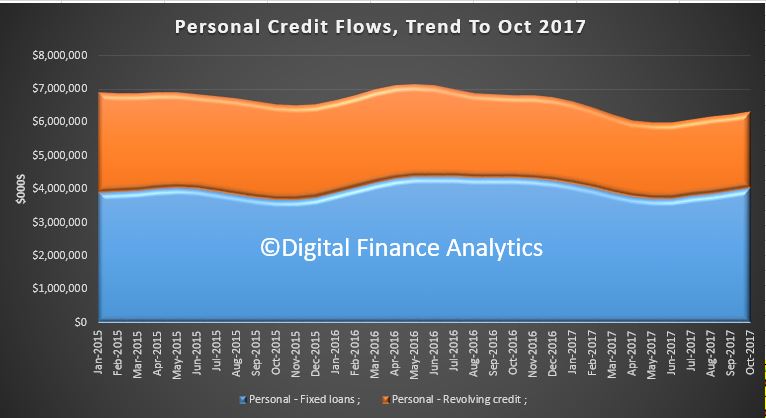

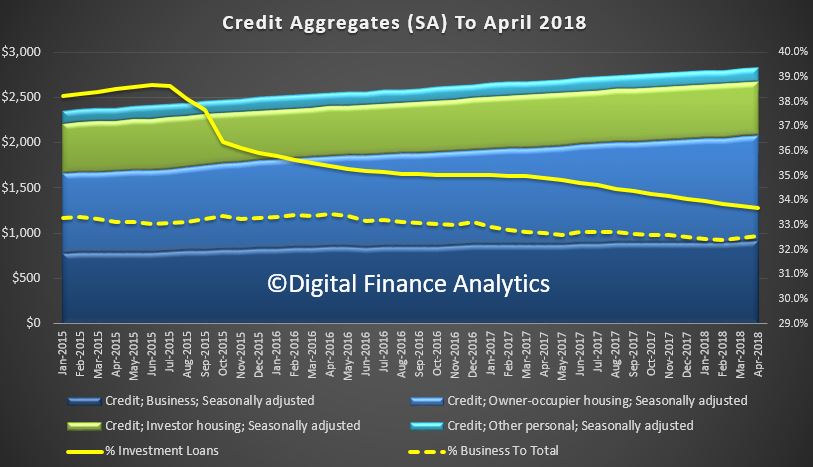

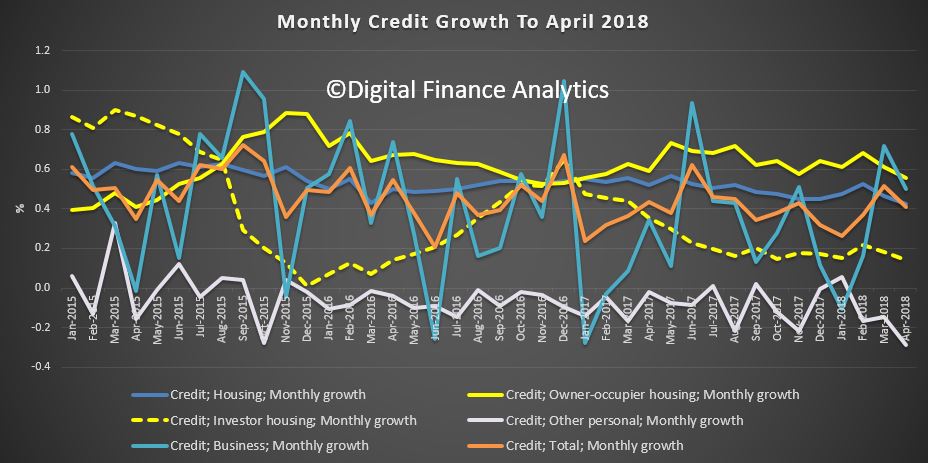

The RBA has released their credit aggregates to April 2018. Total mortgage lending rose $7.2 billion to $1.76 trillion, another record. Within that, owner occupied loans rose $6.4 billion up 0.55%, and investment loans rose 0.14% up $800 million. Personal credit fell 0.3%, down $500 million and business lending rose $6.3 billion, up 0.69%.

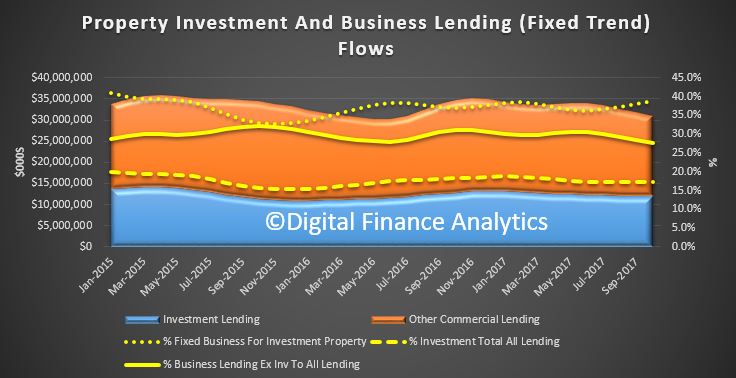

Business lending was 32.5% of all lending, the same as last month, and investment mortgage lending was 33.7%, slightly down on last month, as lending restrictions tighten.

Business lending was 32.5% of all lending, the same as last month, and investment mortgage lending was 33.7%, slightly down on last month, as lending restrictions tighten.

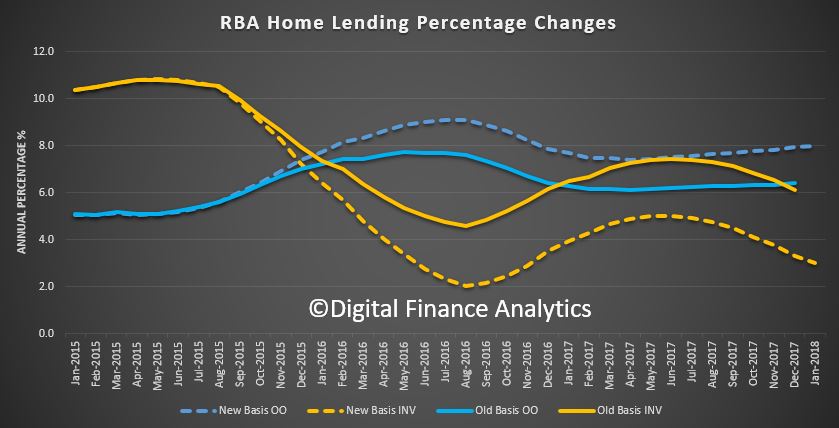

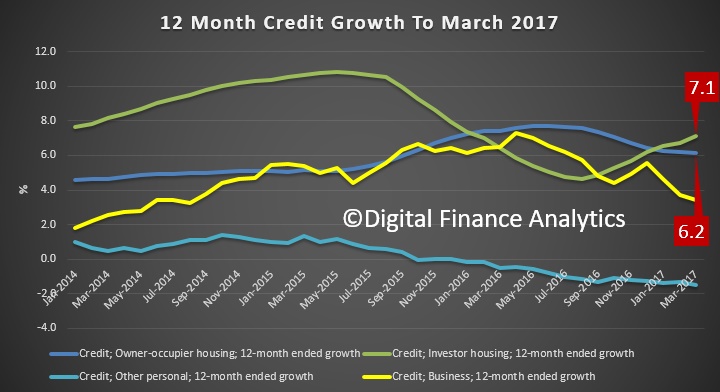

The monthly trends are noisy as normal, although the fall in investor property loans is visible and owner occupied lending is easing.

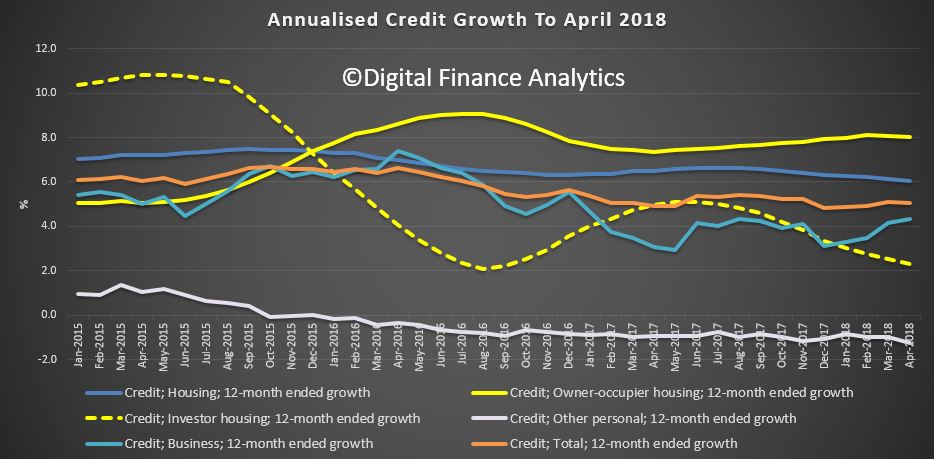

But the annualised stats show owner occupied lending still running at 8%, while business lending is around 4% annualised, investment lending down to 2.3% and personal credit down 0.3%. On this basis, household debt is still rising.

But the annualised stats show owner occupied lending still running at 8%, while business lending is around 4% annualised, investment lending down to 2.3% and personal credit down 0.3%. On this basis, household debt is still rising.

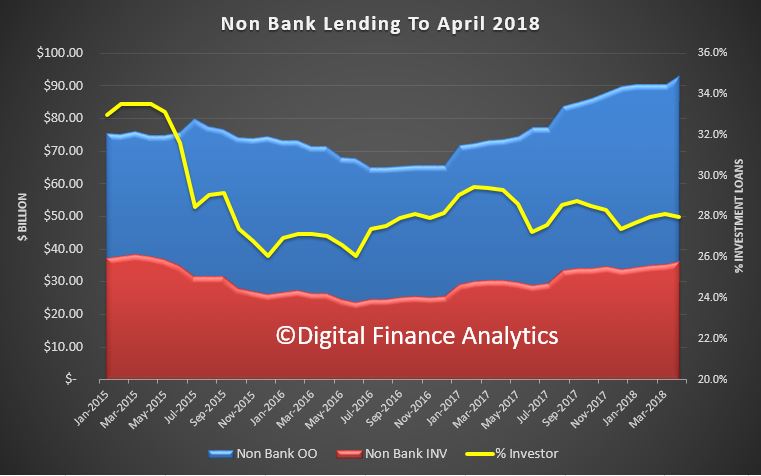

One interesting piece of analysis we completed is the comparison between the RBA data which is of the whole of the market and the APRA data which is bank lending only.

One interesting piece of analysis we completed is the comparison between the RBA data which is of the whole of the market and the APRA data which is bank lending only.

Now this is tricky, as the non-bank data is up to three months behind, and only covers about 70% of the market, but we can get an indication of the relative momentum between the banks and non banks.

We see that non-bank lending has indeed been growing, since late 2016. The proportion of loans for property investors is around 28%, lower than from the banks. Back in 2015, the non-bank investor split was around 34%.

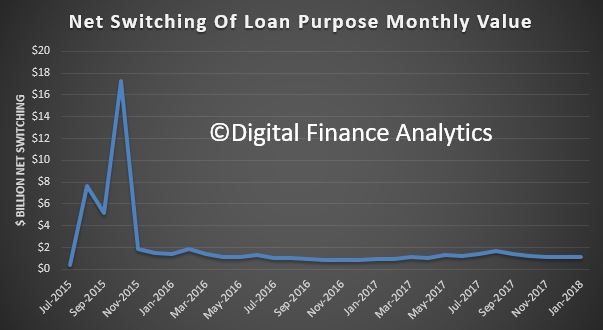

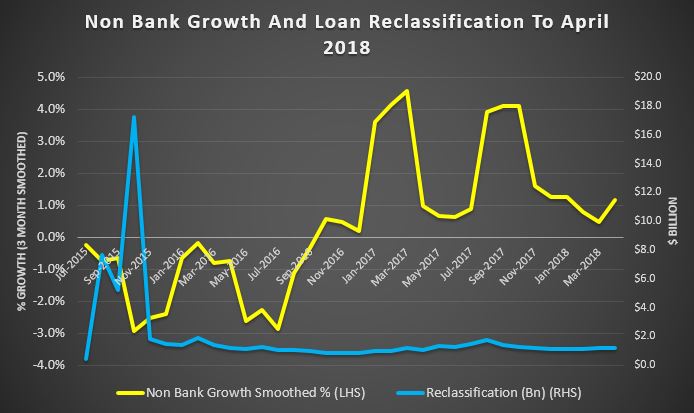

The percentage growth from the non-bank sector appears stronger than the banks. Across all portfolios, loan reclassification is still running at a little over $1 billion each month.

The percentage growth from the non-bank sector appears stronger than the banks. Across all portfolios, loan reclassification is still running at a little over $1 billion each month.

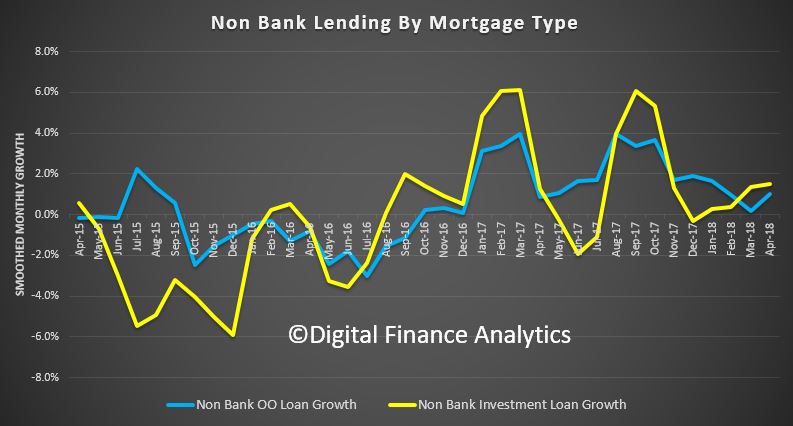

Finally if we look at the relative growth of owner occupied and investment loans in the non-bank sector we see stronger investment lending in the past couple of months. Bank investment property lending actually fell on April according to APRA stats.

Finally if we look at the relative growth of owner occupied and investment loans in the non-bank sector we see stronger investment lending in the past couple of months. Bank investment property lending actually fell on April according to APRA stats.

As expected, as banks throttle back their lending, the non-banks are filling some of the void – but of course the supervision of the non-banks is a work in progress, with APRA superficially responsible but perhaps not actively so.

As expected, as banks throttle back their lending, the non-banks are filling some of the void – but of course the supervision of the non-banks is a work in progress, with APRA superficially responsible but perhaps not actively so.

We would expect better and more current non-bank reporting at the very least APRA, take note!