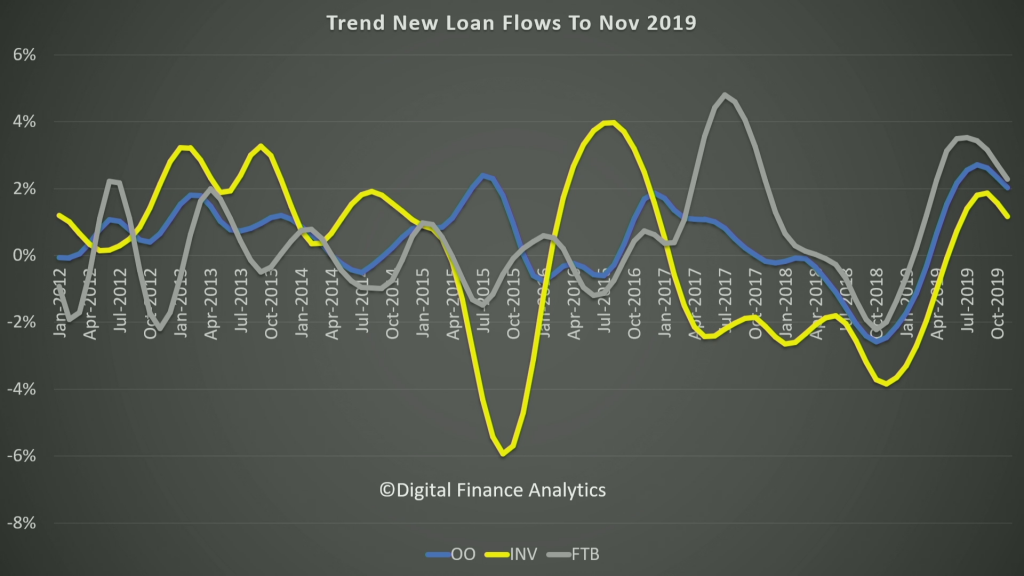

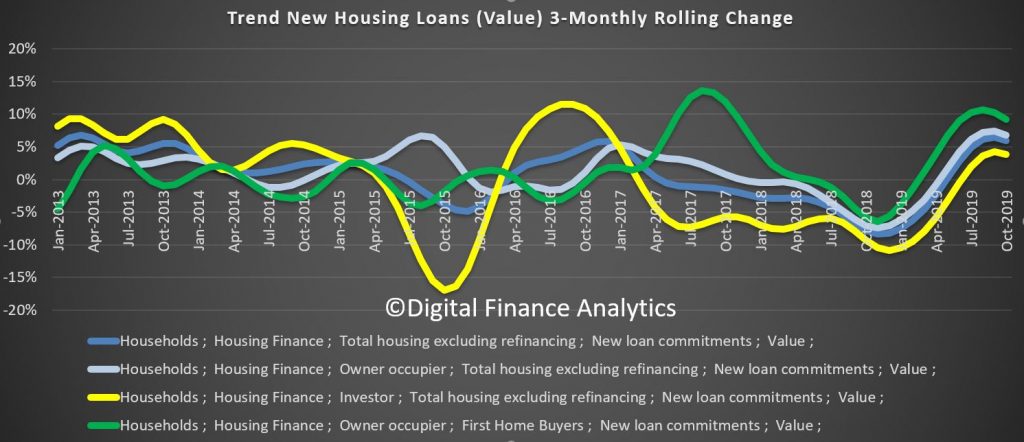

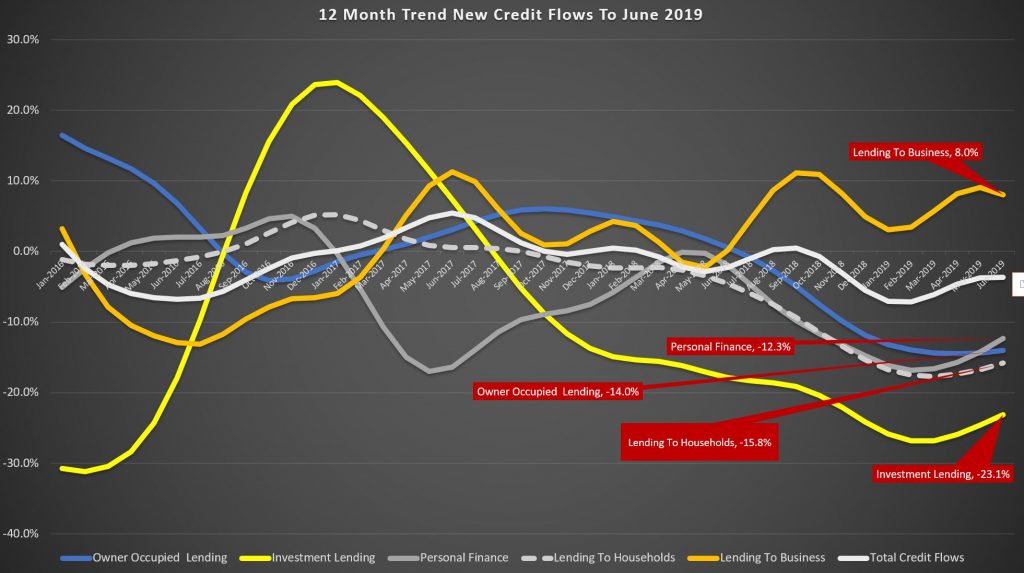

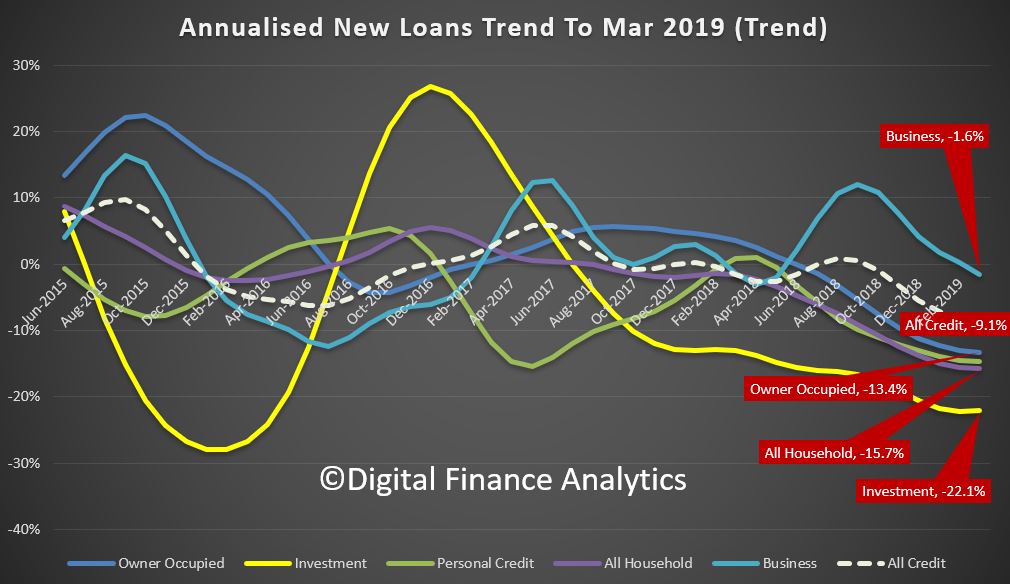

Late last week the ABS released their latest lending indicators to end October 2021. There was much rubbish posted about these numbers, with various claims of booming investor loans, but these stats suggest to me a potential easing of new loan momentum, which is an indicator of easing home prices too – because as you know if you watch the channel, the rate of change of credit is one of the best proxies for price changes.

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.