We examine the latest credit data from the RBA and APRA. Who says credit growth is booming?

https://www.rba.gov.au/statistics/frequency/fin-agg/2019/fin-agg-1019.html

https://www.apra.gov.au/monthly-authorised-deposit-taking-institution-statistics

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We examine the latest credit data from the RBA and APRA. Who says credit growth is booming?

https://www.rba.gov.au/statistics/frequency/fin-agg/2019/fin-agg-1019.html

https://www.apra.gov.au/monthly-authorised-deposit-taking-institution-statistics

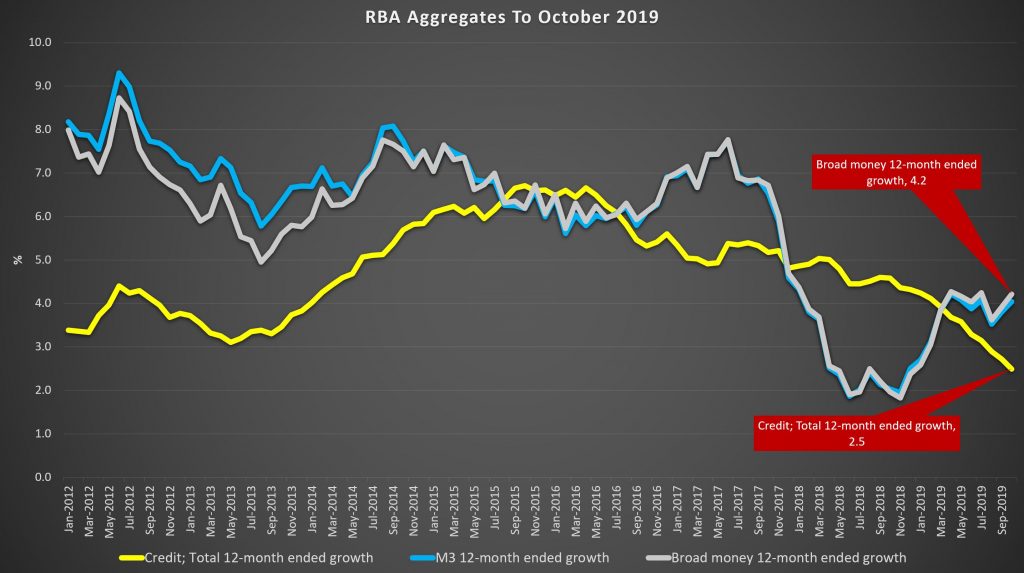

The end of the working month heralds another set of credit stats from both the RBA and APRA. The RBA reports via their Credit Aggregates, which is all credit stock in the system, while APRA reports on the banks (ADI’s) and also provides some individual lender loan stock data. And which ever way you look at it, credit growth is still anaemic, as the “great deleveraging” continues. And given the weak credit impulse, home prices may also be growing more slowly than many are claiming, though that is another story, for another day.

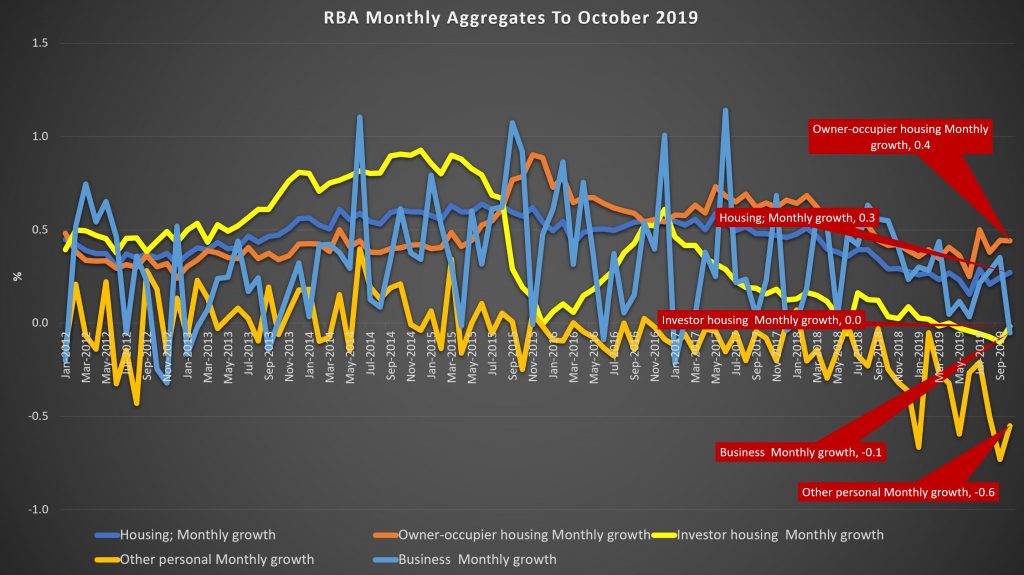

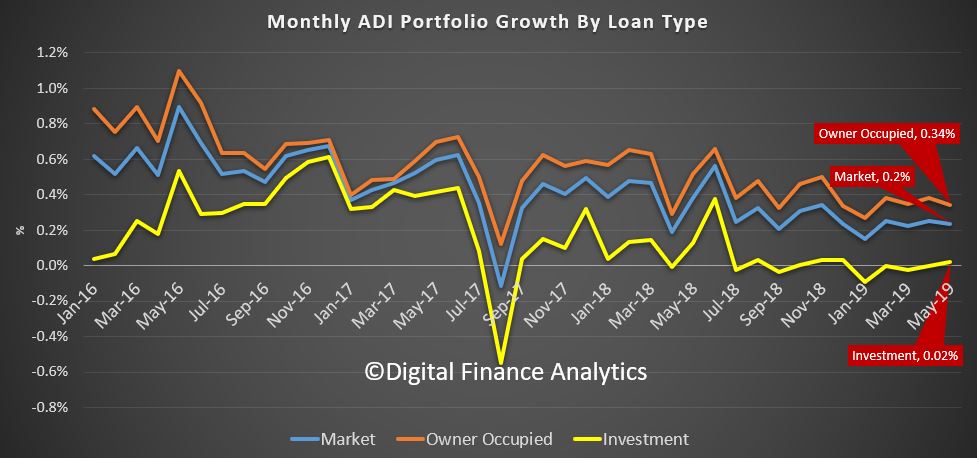

The RBA said that housing credit growth overall was 0.3% higher in October, compared with 0.2% in September. This translates to an annual rate of 3% to October (3.1% last month), compared with 5% just a year back.

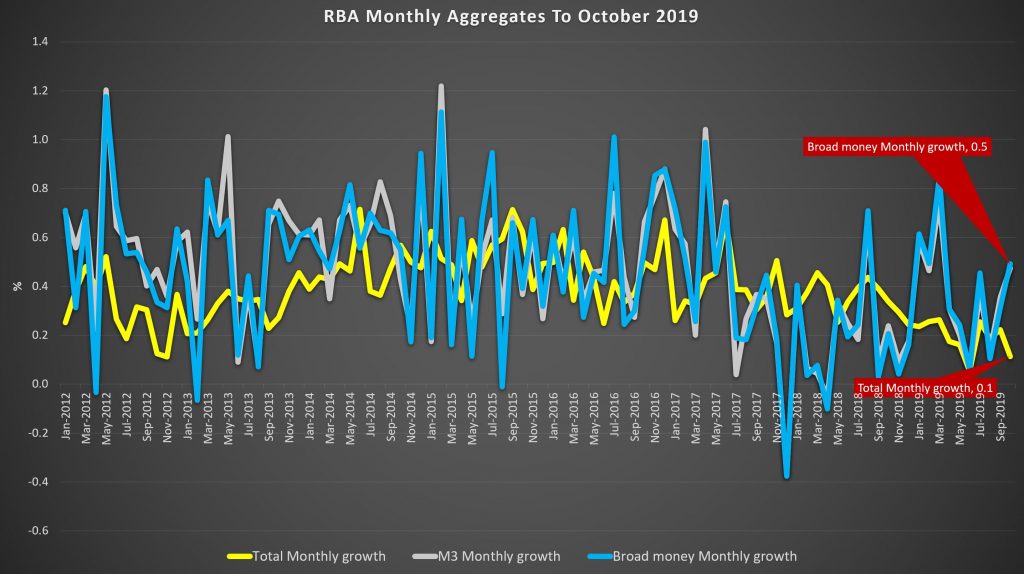

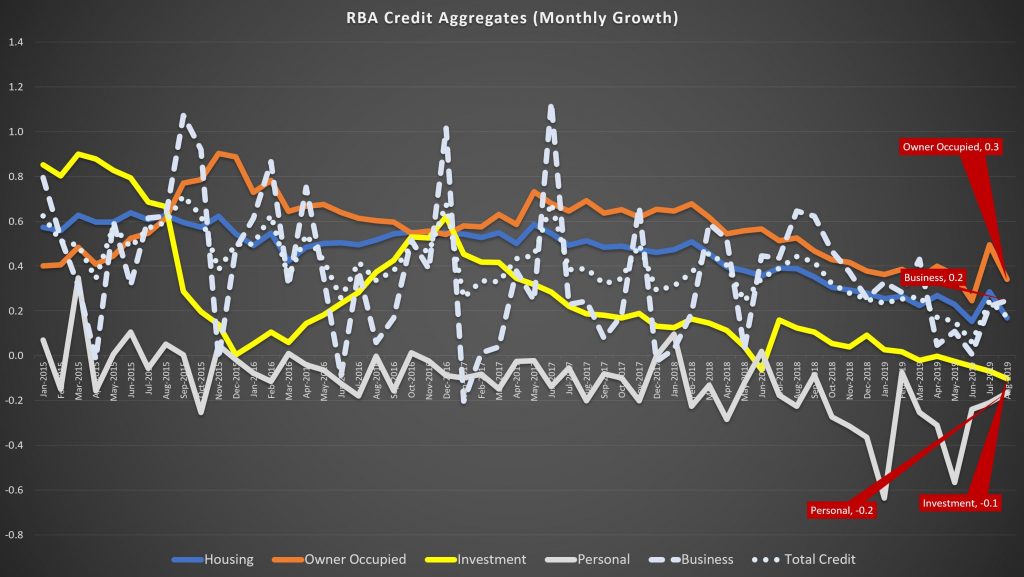

Monthly owner occupied lending rose 0.4% while investor housing lending was flat. Personal credit fell another 0.6% in the month, and business lending was down 0.1%. As a result total credit rose just 0.1%, down from 0.2% last month. Broad money was higher though.

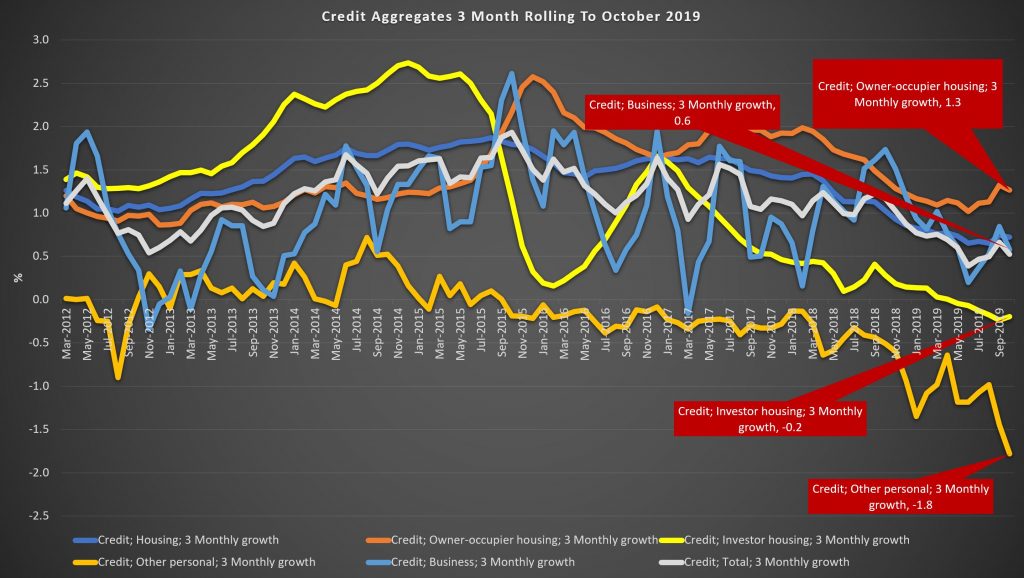

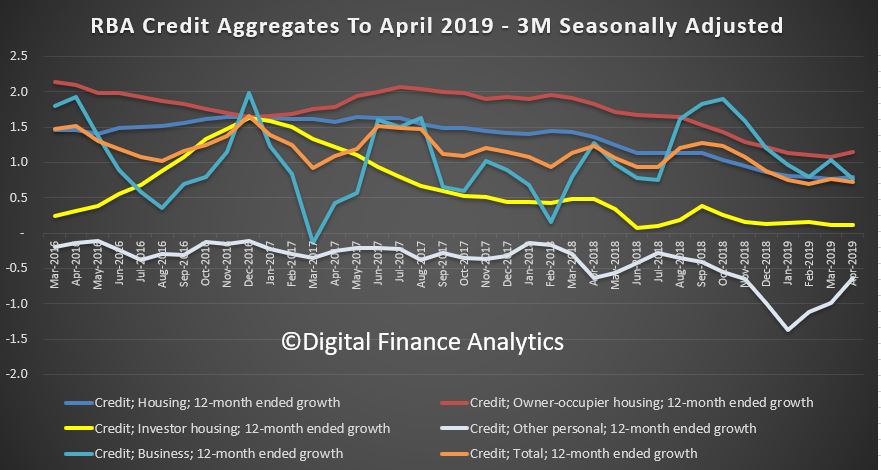

Over a rolling 3 months view, owner occupied credit grew 1.3% while investor credit was down 0.2%, other personal credit was down 1.8% and business credit was up 0.6%.

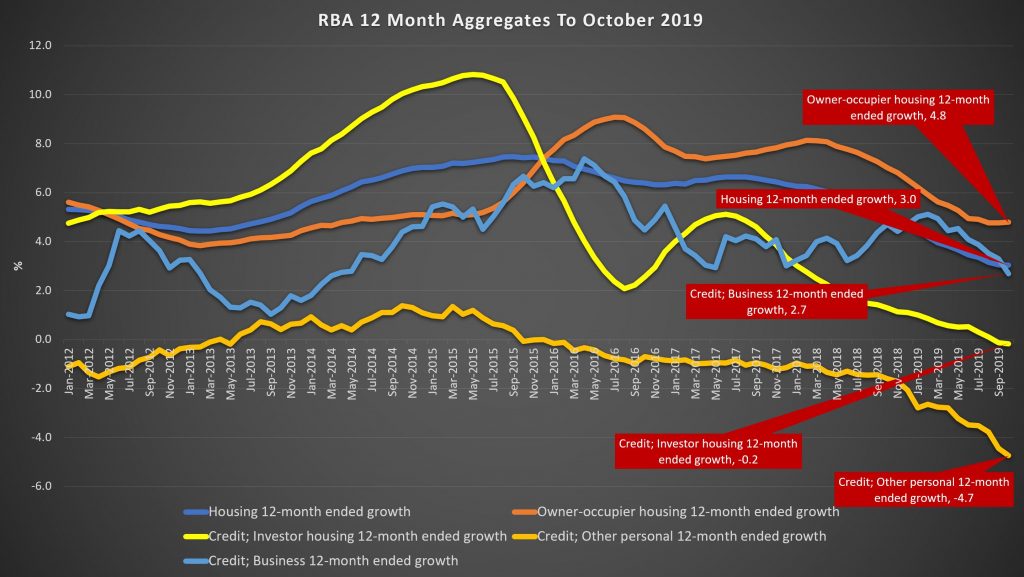

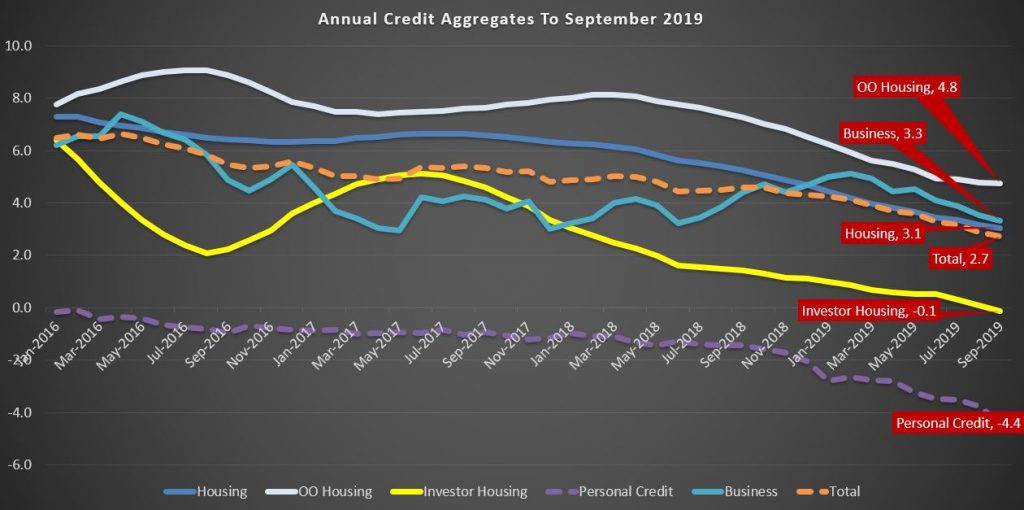

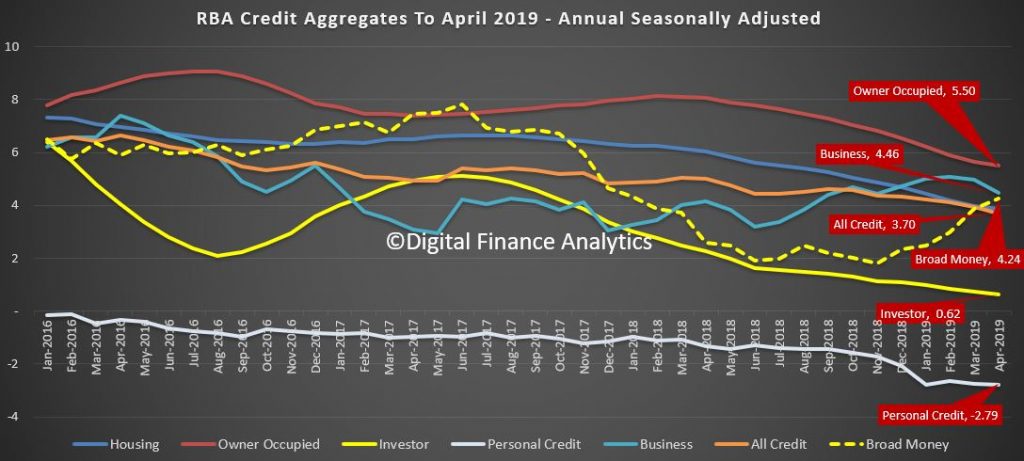

Looking across the rolling 12 month view, housing credit growth dropped from 3.1% to 3%, with owner occupied lending at 4.8% and investor lending down 0.2%. Business credit was 2.7% higher, and personal credit dropped by 4.7%.

As a result, total credit was just 2.5%, as lower as its been for many years, although broad money rose 4.2%.

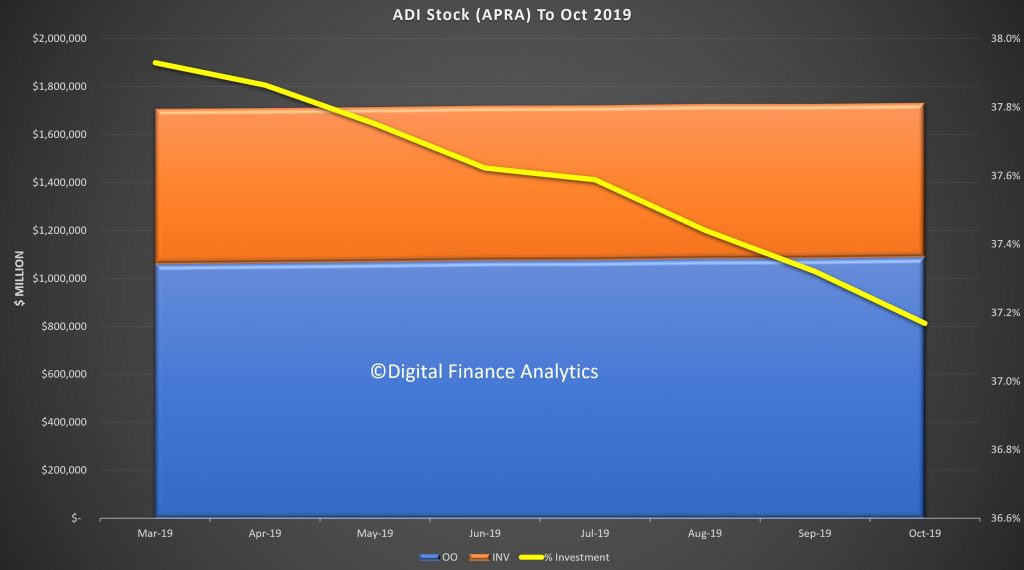

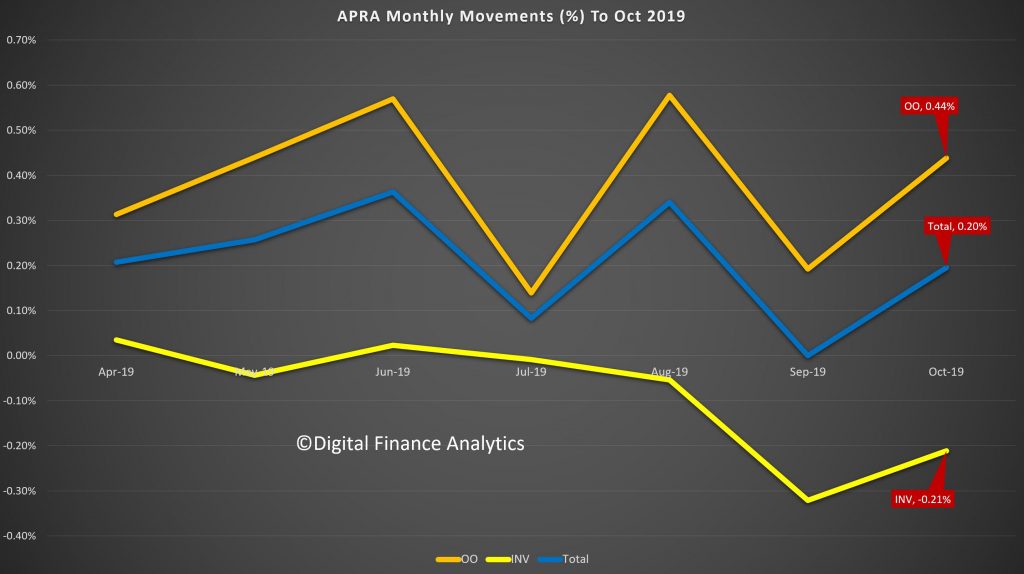

APRA’s new data series continues to contain some surprises. Total lending stock by the banks rose to $1.73 trillion, up 0.2% in the month.

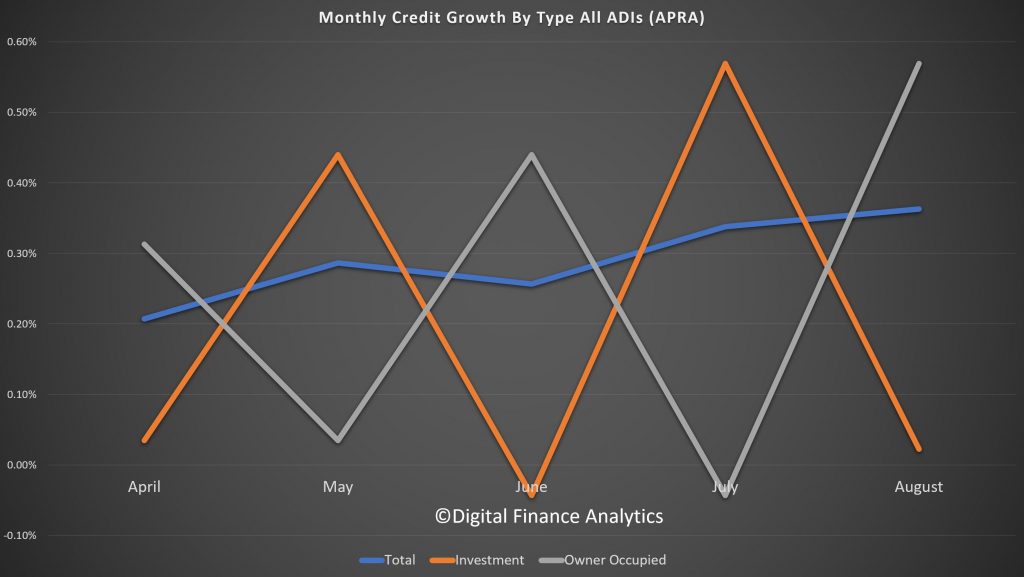

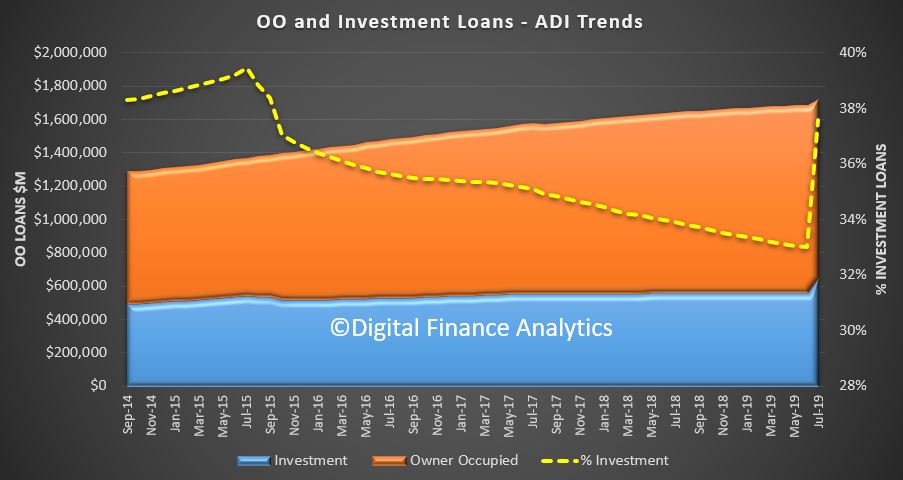

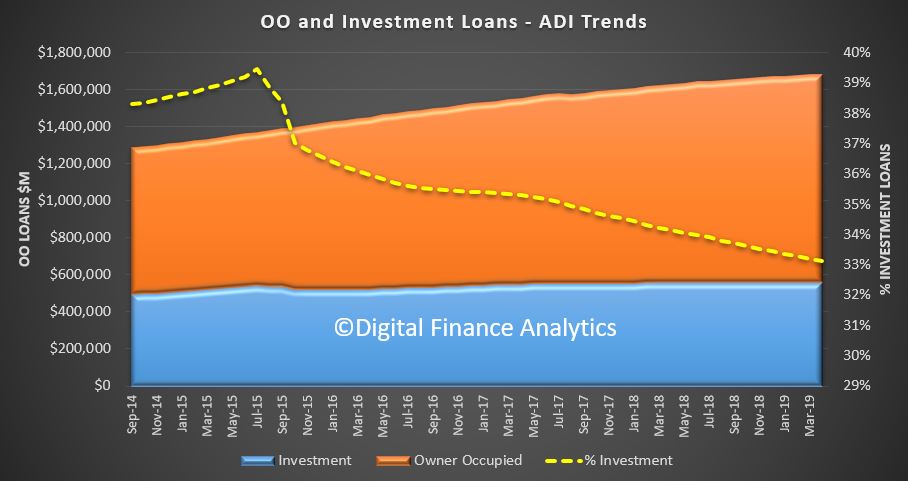

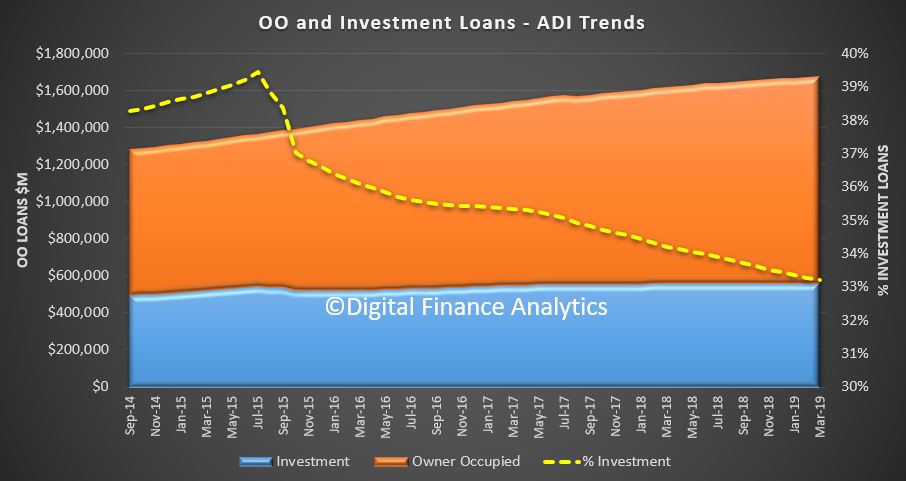

The share of investor loans continues to fall, to around 37.2%, and this is explained by investor loan stock falling by 0.21% in the month, compared with a rise of 0.44% for owner occupied loans. The series still looks a bit weird, so we wonder if there are still reporting issues.

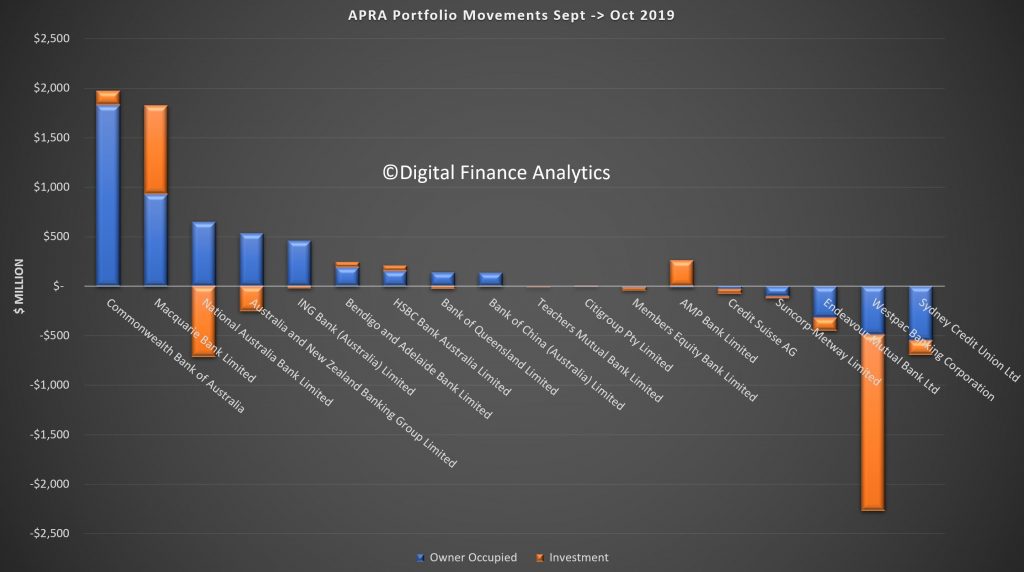

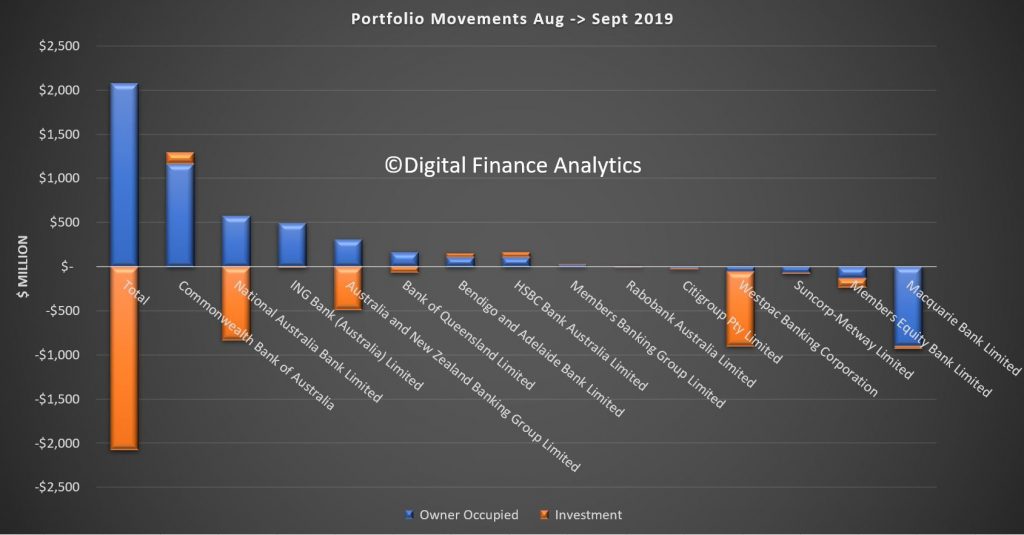

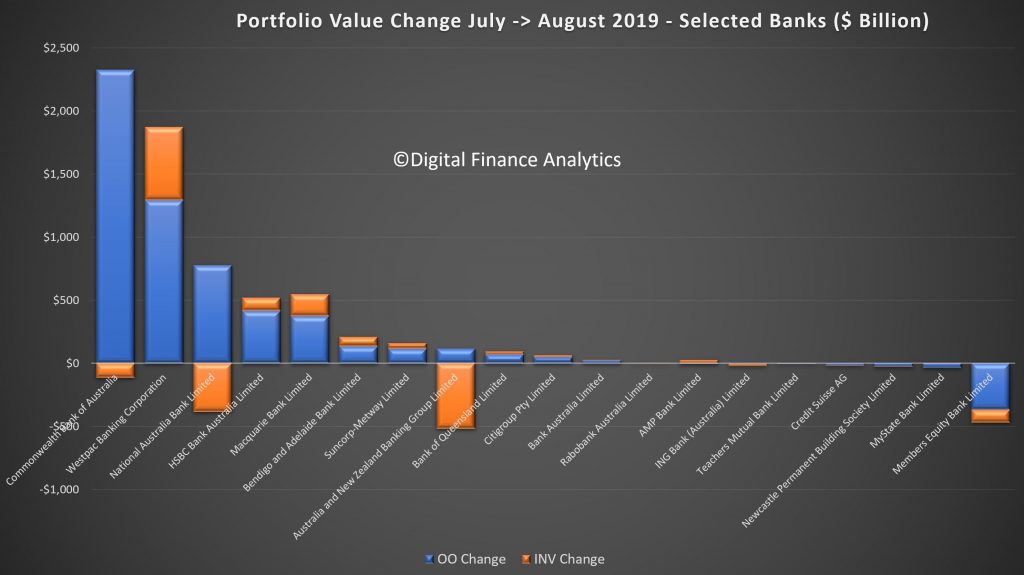

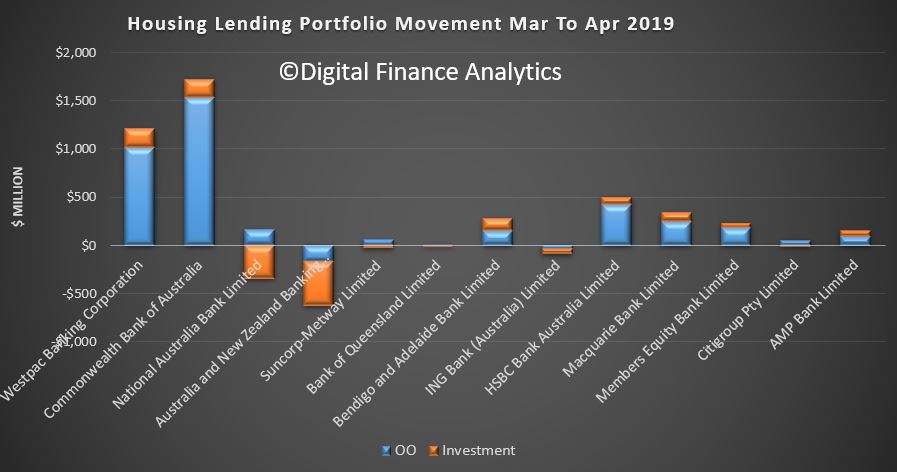

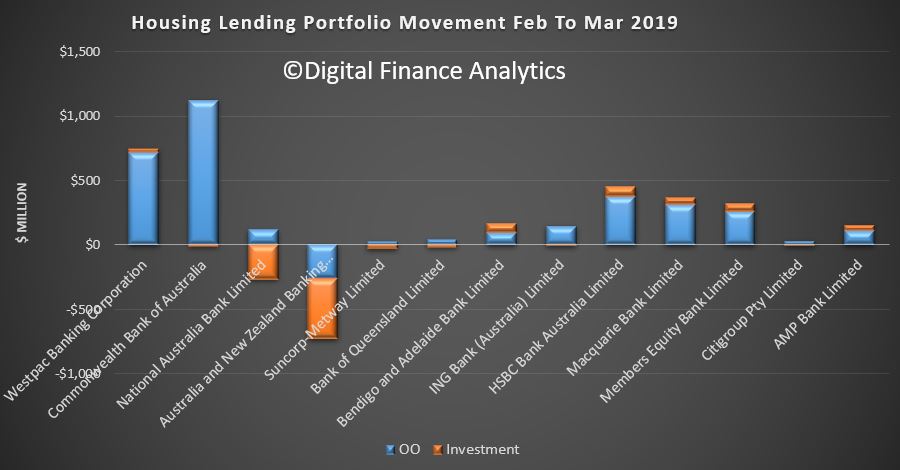

The individual banks stocks of loans varied, with CBA extending their book (consistent with our industry research, as one of the easier lenders at the moment), along with Macquarie – both of which grew both investor and owner occupied pools. NAB and ANZ dropped investor loans, but extended owner occupied loans. But Suncorp and Westpac dropped BOTH investor and owner occupied loan balances (assuming the reporting is correct – lets see if we get a reversal next month).

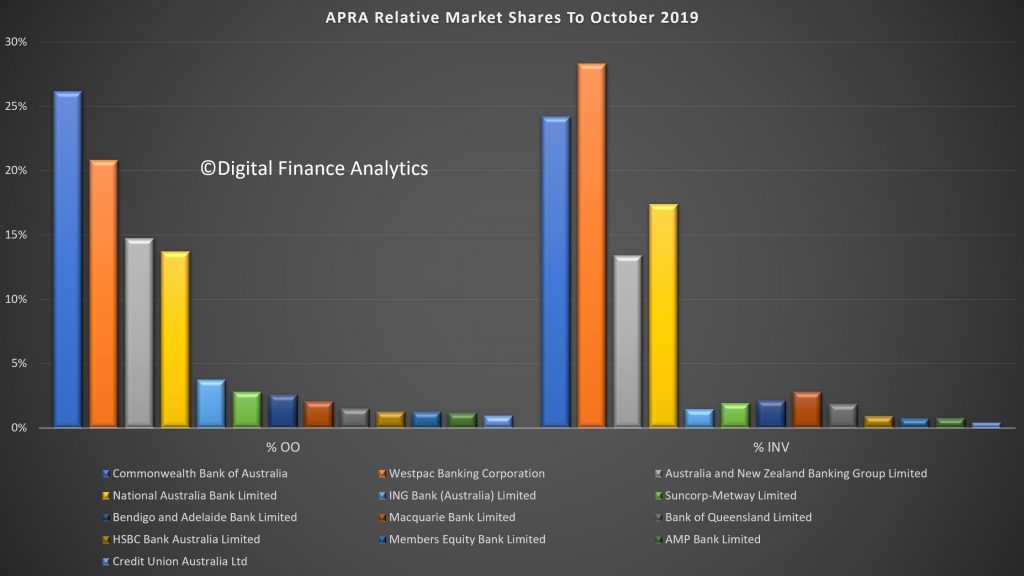

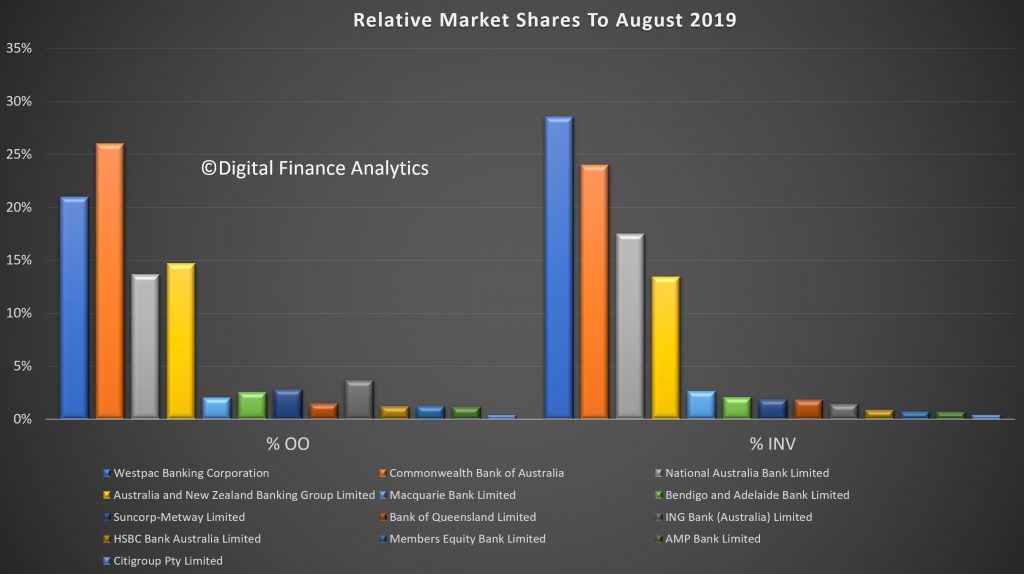

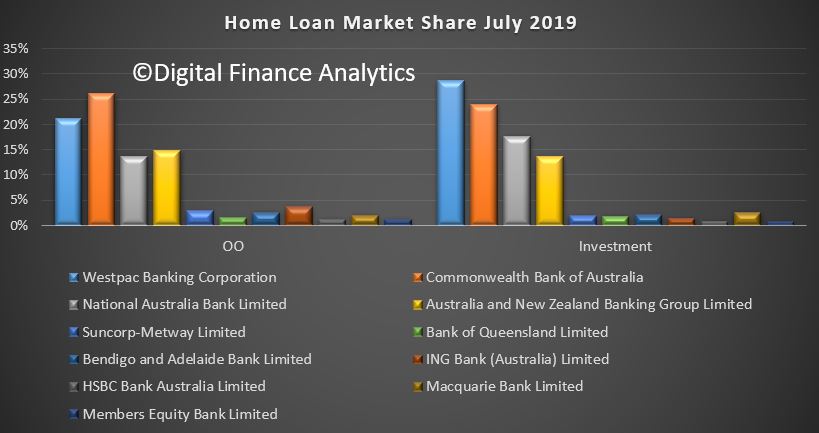

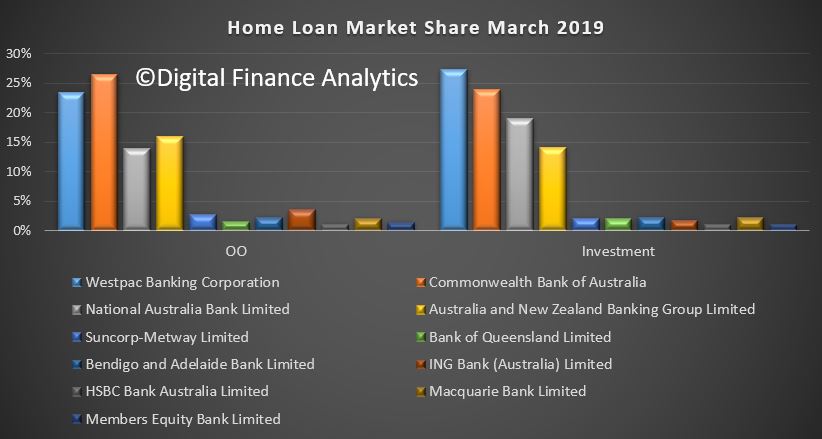

Finally, market shares hardly changed, with CBA the largest owner occupied lender and Westpac the largest investor loan provider.

Given the weak credit growth, this puts into sharp contrast the reported rises in home prices. We know transaction volumes remain low, but our industry contacts indicate a stronger pipeline of applications. Despite this the run-off of existing loans is translating to low net growth.

Even then, loan growth is still strong relative to income growth. But actually the most significant element is the fall in business credit, as more sectors come under pressure.

These results appear to be at odds with the RBA’s glass half full view of the economy, and may indicate more weakness in the GDP out-turn next week.

We are getting to the rub now with the RBA releasing its Credit Aggregate data to end September 2019. This is loan stock data, reflecting the net effect of new loans coming on, old loans repaid, refinancing, and any reclassification which occurred in the month.

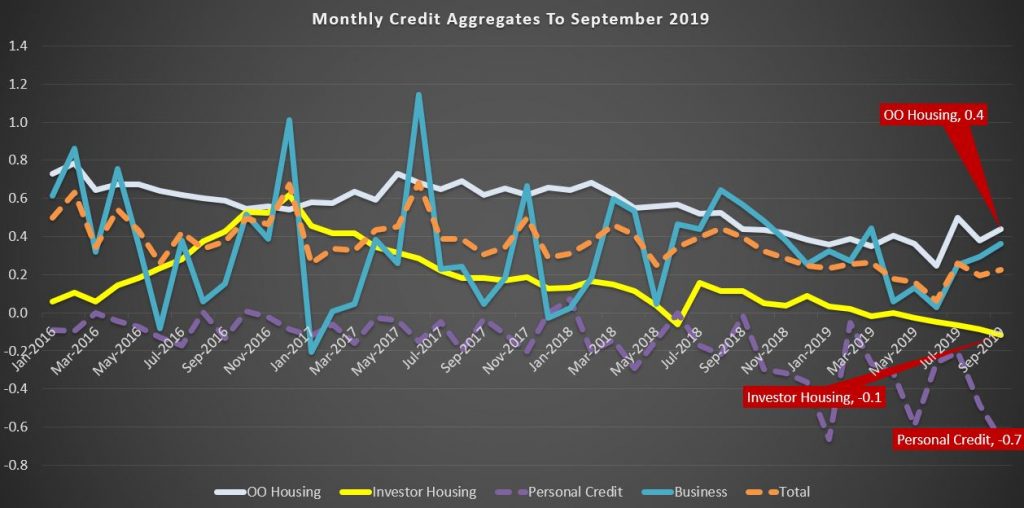

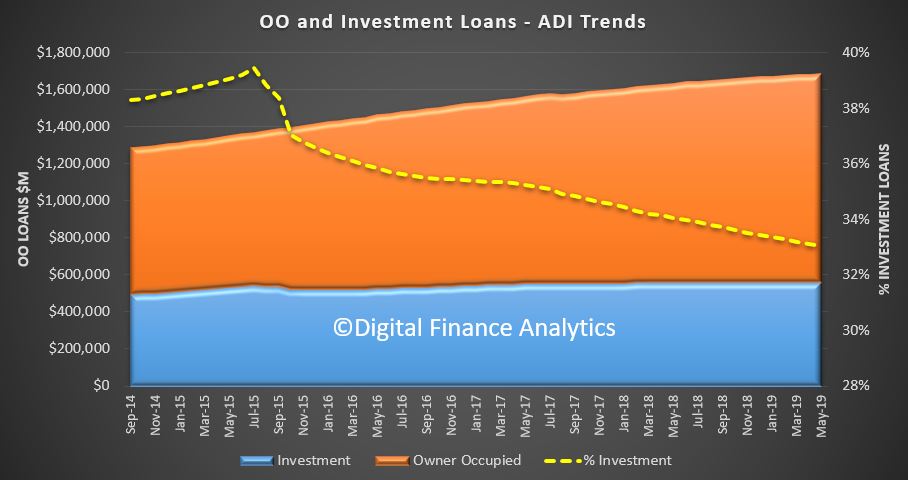

Over the month of September, total credit grew by 0.2%, with housing also at 0.2%, business at 0.4% and personal credit down another 0.7%. Owner occupied lending was a little firmer, but investment lending faded again.

For the year ending, total credit grew by 2.7%, the lowest since June 2011, Housing at 3.1%, the lowest at least since 1977, and business at 3.3%. Personal credit fell 4.4% over the year.

Given the strong link between home prices and housing credit, this suggests home prices will continue weaker ahead. And this, after all the recent adjustments to lending standards and rates.

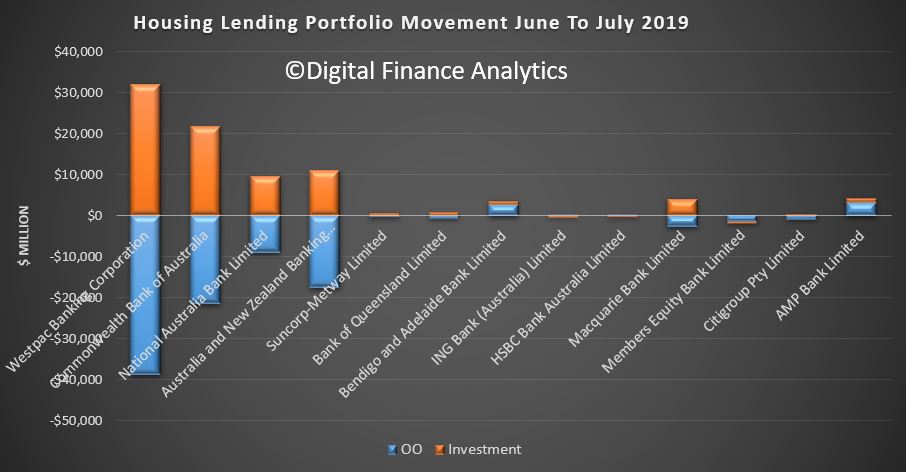

The APRA data also shows some swings between lenders during the month (or reclassification, we cannot tell). NAB, ANZ and Westpac all dropped their investment loan balances, while Macquarie dropped their owner occupied loans.

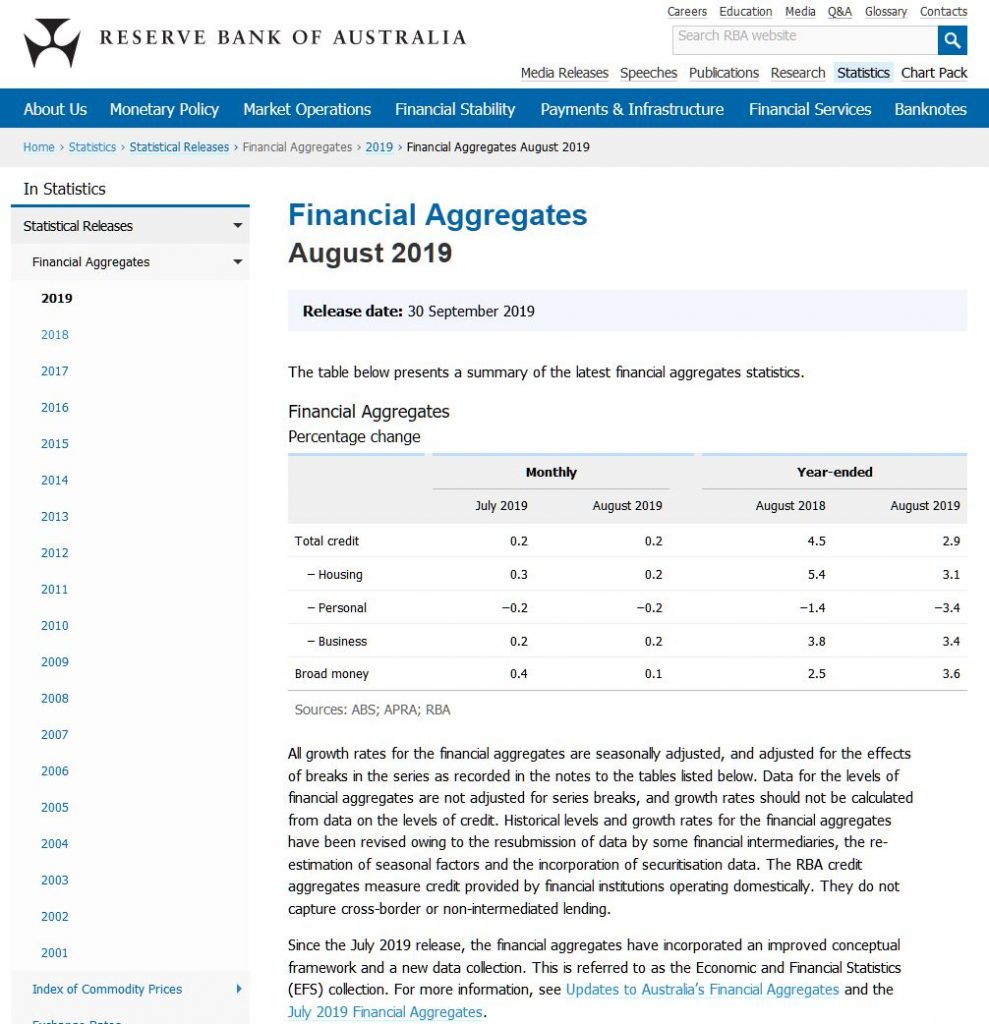

Both the RBA and APRA released their respective credit aggregates to end August today. And its not running to script, despite the rate cuts, some stronger buying signs in some housing markets (but on low, low volumes), and increased competition for loans. Overall credit growth rates continue to decline.

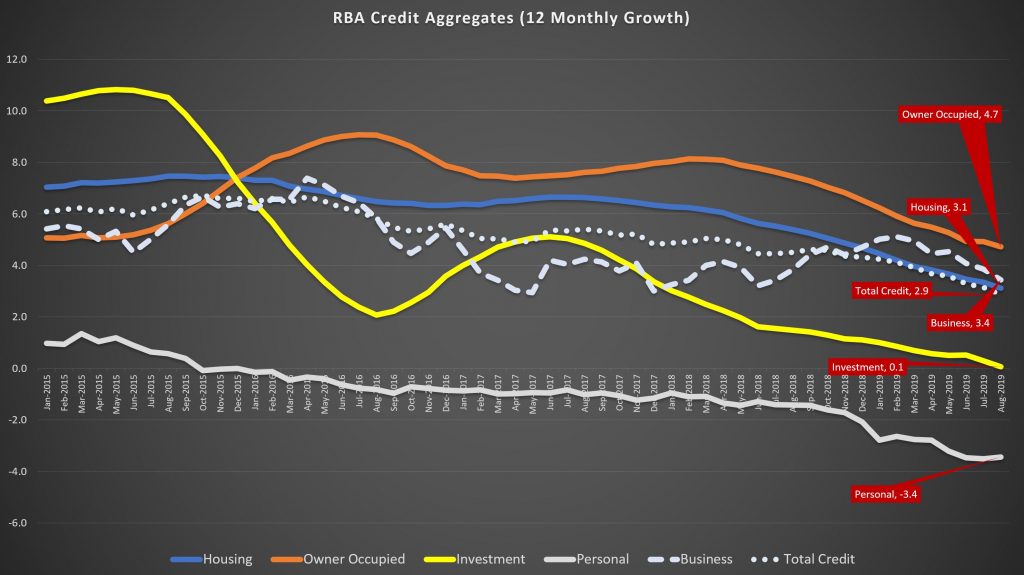

The RBA data over the rolling 12 months showed that credit growth dropped to 2.9%, compared with 4.5% just one year ago. That is the slowest rate of growth since 2011. It peaked in 2015 at 6.6%.

Housing sector growth rose 3.1% over 12 months, compared with 5.4% a year back and from a high of 7.4% back in 2015. Within that owner occupied lending fell to 4.7%, compared with 9.1% back in 2016, and investment lending rose at just 0.1% over 12 months, compared with 10.8% back in May 2015.

Business credit growth eased back to 3.4% annualised, from 3.8% a year ago, and 7.4% back in 2016, reflecting weaker business confidence and concerns about the local and international economic outlook.

Annual personal credit is down 3.4%, compared with down 1.4% a year ago, and up 0.3% in 2015.

The more noisy one month series shows that owner occupied lending rose 0.3%, compared with 0.9% in 2015, investment lending fell 0.1%, compared with a rise of 0.9% in 2015, business credit rose 0.2%, way lower than peaks of more than 1% in 2015 and 2017, and personal credit fell 0.2% again.

Note the RBA makes seasonal adjustments to the data – though they do not disclose the basis of these adjustment, and this year has been far from typical.

They also say:

Historical levels and growth rates for the financial aggregates have been revised owing to the resubmission of data by some financial intermediaries, the re-estimation of seasonal factors and the incorporation of securitisation data. The RBA credit aggregates measure credit provided by financial institutions operating domestically. They do not capture cross-border or non-intermediated lending.

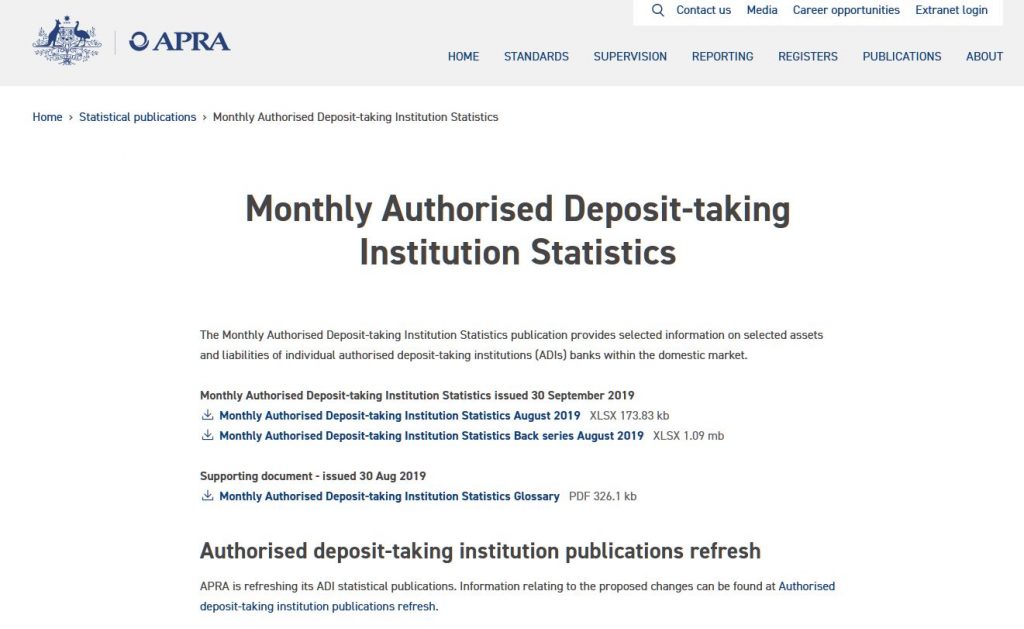

So more data noise. And talking of that the new APRA data is all over the shop. They started running a parallel series in March, and as we discussed last month, the proportion of investment loans in the stock data have risen.

Overall credit stock of housing loans for the ADI’s is running at 0.36% and appears to be rising since April. However, the swings between growth in investor and owner occupied loans are massive, (and in opposite directions). This is not a sign of good data collection in my view.

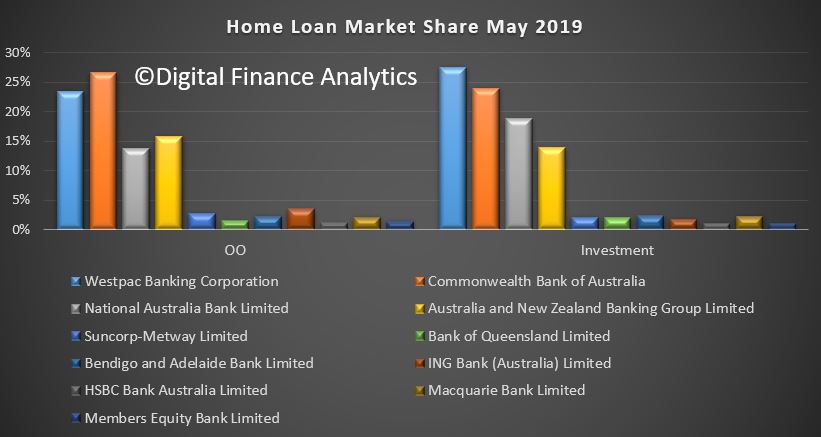

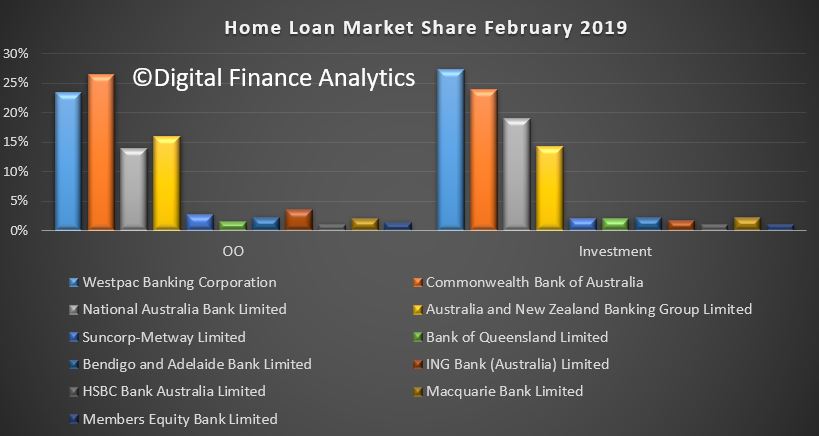

The overall portfolio market shares indicate that CBA remains the largest lender for owner occupied loans, with a 26.1% share, followed by Westpac 21%, and ANZ at 14.7%. In investment lending, Westpac remains a clear leader, with 28.6% of all lending, followed by CBA at 24% and NAB at 17.5%.

The monthly movements tells an interesting story, with CBA driving the largest growth in owner occupied loans (2.3 billion), while dropping investment loans by a small amount. Westpac extended its investment loans by $0.6 billion, and owner occupied loans by $1.3 billion. NAB and ANZ both lost investor share and ME Bank lost owner occupied and investor loans. Other lenders picked some of these up.

Finally, our analysis of the proportion of individual bank portfolios in investment loans (generally more risky in a down-turn), shows that 44.9% of Westpac’s portfolio is investment lending (worth $185 billion), compared with an ADI market average of 37.4%. NAB is at 43.4% and Macquarie at 43.7% and Bank of Queensland at 42.7%. On the other hand CBA is at 35.6% and ANZ at 35.3%.

Data from our surveys suggests weakening demand for credit, and if this eventuates, it is quite possible recent home prices will be confirmed as a bear trap. While some down traders and more affluent households are in the market, many other segments are sitting this one out.

Remember that falling credit growth will translate to falling home prices, the math is that simple. And more rate cuts won’t help much at all!

APRA released their monthly statistics to end July 2019. They are rubbish, in terms of trend tracking because thanks to a revised method of data capturing the value of investment lending rose considerably, offset by a fall in owner occupied loans.

The RBA said that there were reclassifications of loans between owner occupied and investment, plus off shore and onshore borrowers.

The changes from last month are therefore considerable. Westpac made the largest switch with $40 billion dropping from the owner occupied side of the house.

The overall portfolio mix by lender changed less.

But the proportion of investment loans jumped to 37.6%, compared with 33% the previous month. This means that banks ARE EVEN MORE EXPOSED to investment lending than had been previously reported!

Given the size of the changes, it is impossible to tell what is happening within individual lenders (which is convenient?). So we will have to start from this point as a series break.

For the record, the value of owner occupied loans fell 5% from $1.13 trillion to $1.10 trillion, while investment loans rose by 16% from $557.3 billion to $647.4 billion.

Total lending rose from $1.68 trillion to $1.72 trillion, up more than 2%. But this is meaningless.

Frankly this is a joke, and I feel it is designed to hide, not inform. The investment debt bomb just got bigger!

APRA has released their monthly banking statistics to end May 2019. It updates the stock of mortgages by lender.

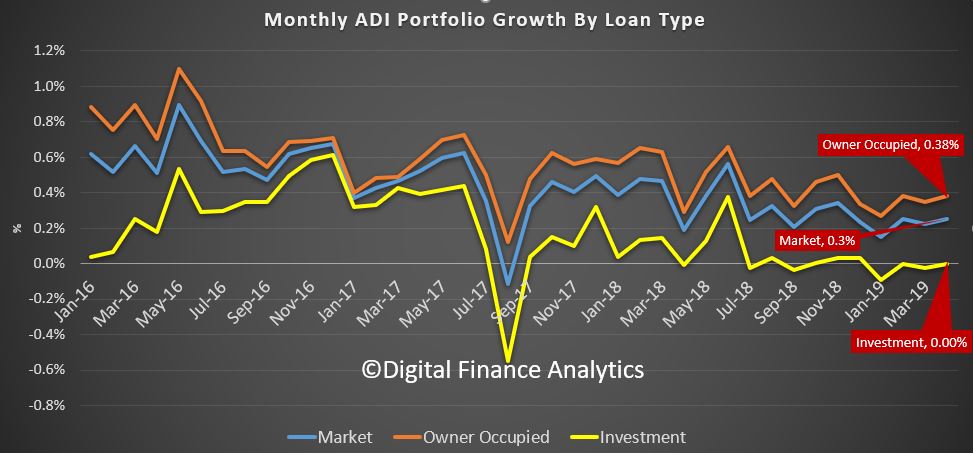

Overall mortgage lending rose o.24% (or 2.8% annualised) to a new record of $1.69 trillion dollars. Within that owner occupied lending rose 0.34% to $1.13 trillion dollars while lending for investment purposes rose 0.023% to $557 billion dollars. Investment loans as a proportion of all loans outstanding fell again to 33.85%.

This of course is the last month before the election, and APRA easing mark 2 and the RBA cash rate cut.

So little here to show the credit impulse is accelerating. Investment lending remains in the doldrums, and owner occupied lending eased back in growth terms.

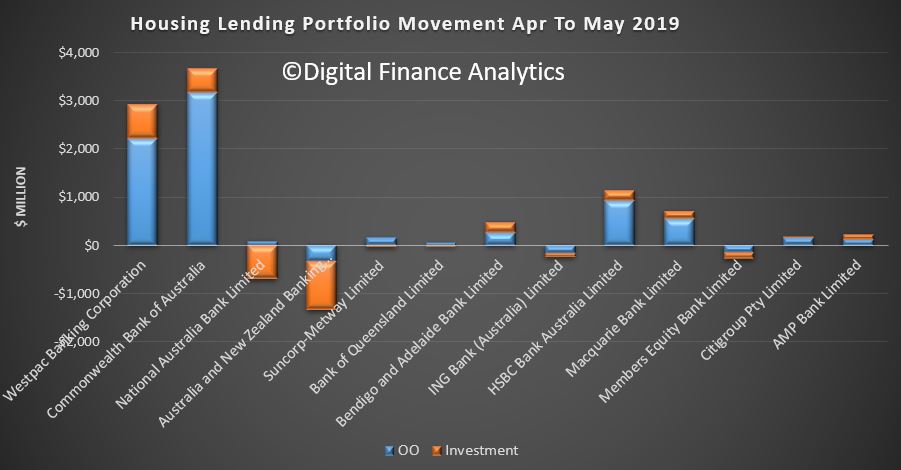

The monthly movements between the banks shows Westpac and CBA in positive territory, on both investment and owner occupied lending, while NAB and ANZ dropped investment loans further. HSBC and Macquarie also advanced, along with Bendigo and Adelaide Banks. Members Equity (ME Bank) dropped also.

That said the portfolio movements were quite limited. CBA holds the largest share of owner occupied loans and Westpac investment loans.

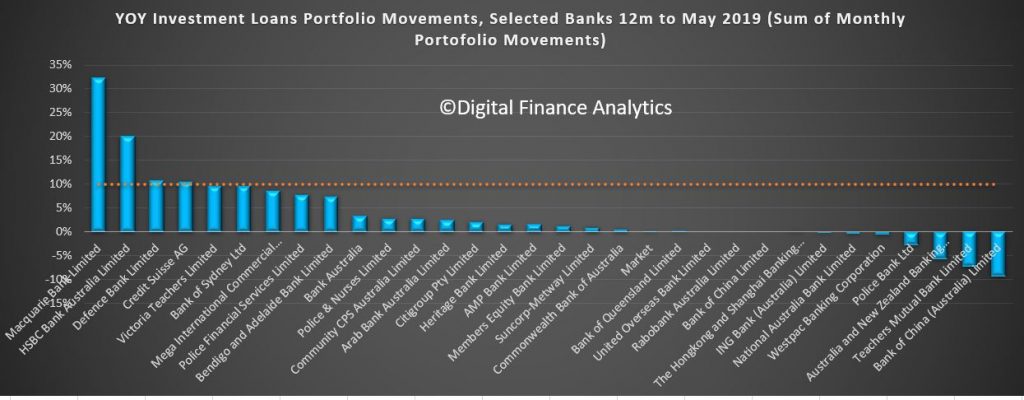

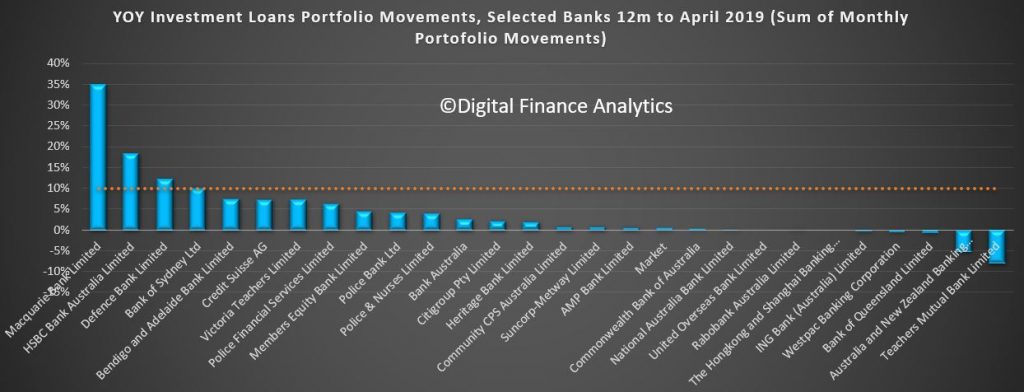

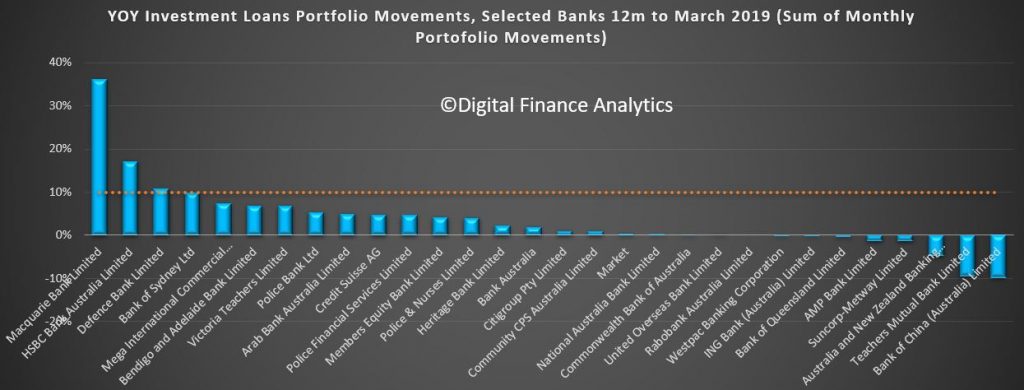

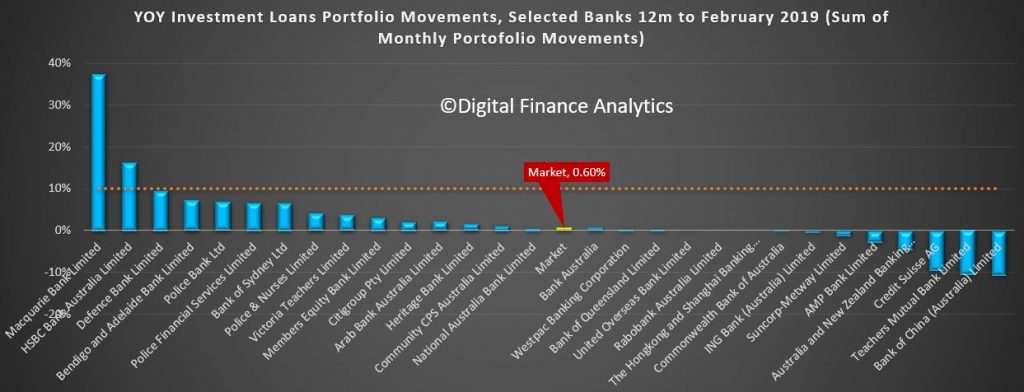

The annualised investment lending trends (sum of monthly movements) puts the majors well behind the likes of Macquarie and HSBC. The abolished investment loan speed limit just accentuates the point that some are driving loan growth very hard.

We would expect lending momentum to pick up in the light of APRA’s changes, lower interest rates and the chatter about home price recovery.

However, to emphasize the obvious point one more time – lending is still growing faster than incomes – so household debt is still growing – adding more weight in the saddlebag of consumer spending. Not that the RBA seems at all worried – though we think they should be!

The RBA data also comes out today and this will give a whole of market view.

We look at the latest stats from RBA and APRA on credit growth. Home lending is STILL growing at 3.9% per annum – yet we are about to stir up the monster some more – “you cannot be serious!”

https://www.rba.gov.au/statistics/frequency/stmt-liabilities-assets.html

https://www.apra.gov.au/publications/monthly-banking-statistics

Once again on the last working day we get the latest credit data from both the RBA and APRA. And fair enough, this is before the election, and the recent spate of “unnatural acts designed to kick start credit growth, but the trends before this are clearly down. Here we are talking about the net stock of loans – rather than new loan flows (so we see the net of old loans closed, refinanced, and new loans written). We will need to wait for the ABS series in a couple of weeks to get the flow stats.

The RBA provides an overview, and a seasonally adjusted series, including the non-bank sector. APRA provides data for the banking sector – ADI’s or authorised depository institutions.

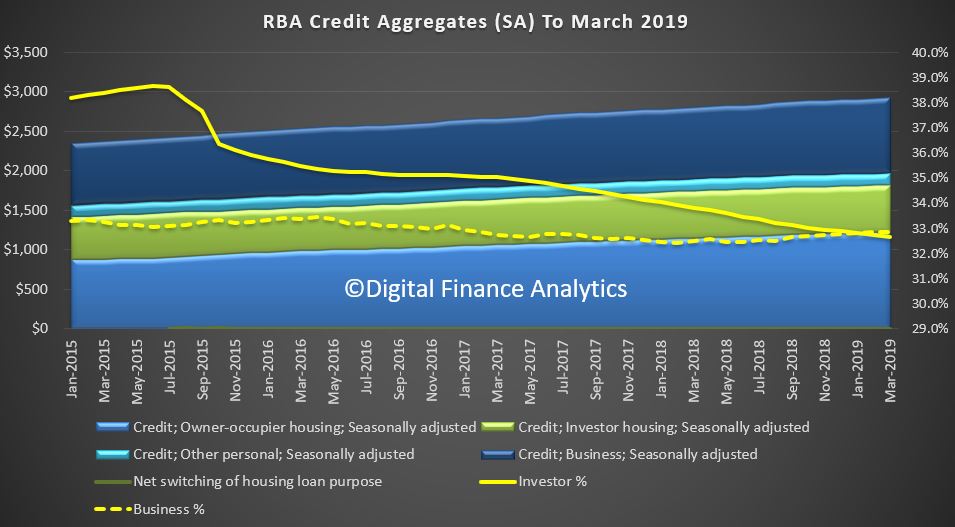

Total credit in the system, is still growing, with housing lending up to $1.83 trillion dollars, with owner occupied lending accounting for $1.23 trillion and investor loans 0.59 trillion. Business lending was 0.96 Trillion dollars and personal credit was $146 million dollars. So, you can see how significant housing credit – and yes, it is STILL growing.

Of that $1.83 trillion dollars for housing, $1.68 trillion comes from the banks, as reported by APRA. Of that $1.12 trillion dollars is for owner occupied housing, and 0.55 trillion dollars for investors. The rest is non-banks, institutions who can lend, but do not fund these loans from holding bank deposits. APRA now have responsibility for these too but is not that actively engaged. So, to the rate of change of credit growth.

We know that housing credit growth has been slowing as demand has slowed, and lending standards tightened, in response to APRA’s interventions and the Royal Commission. But the stark reality is that business lending is also flat according to the RBA.

In fact, last month, total credit grew by only 0.16% and this is the weakest since early 2013.

Overall housing credit was up by 0.28% in the month, and personal credit declined by 0.3%

Annual credit growth slowed to 3.7%, the weakest since November 2013 and the trends are clear.

Slowing Housing credit growth is a large element in the numbers, as we have been tracking. The latest annual figure is just 3.9%, and this is the lowest ever in the series which started back in the late 1970s.

Looking at the three-month series you might argue that the rate of decline is easing just a little, there is not much here really to get excited about. Of course, most of the commentators are now looking ahead following the Coalitions return to power. The RBA I think cut rates on Tuesday, which is the first cut since August 2016. And of course, APRA is consulting on a proposal to loosen the interest rate buffer test.

I won’t repeat here the significant downside forces which will make a rebound in housing lending difficult, other than to say, the Coalition has promised a home price recovery, so they have to try and engineer it any cost – even if the debt balloon inflates further.

Investor housing momentum is still very weak, and there is little to suggest this will change soon – though some might try to sell into any more optimistic season. So, its down to first time buyers, and those seeking to trade-up.

Turning to business credit, this grew by 4.5% over the past year, up from 3.0% for 2017 but is easing back from gains of 6.4% in 2015 and 5.5% in 2016. In fact, this is an important issue, as business lending and confidence are easing back – not a good sign.

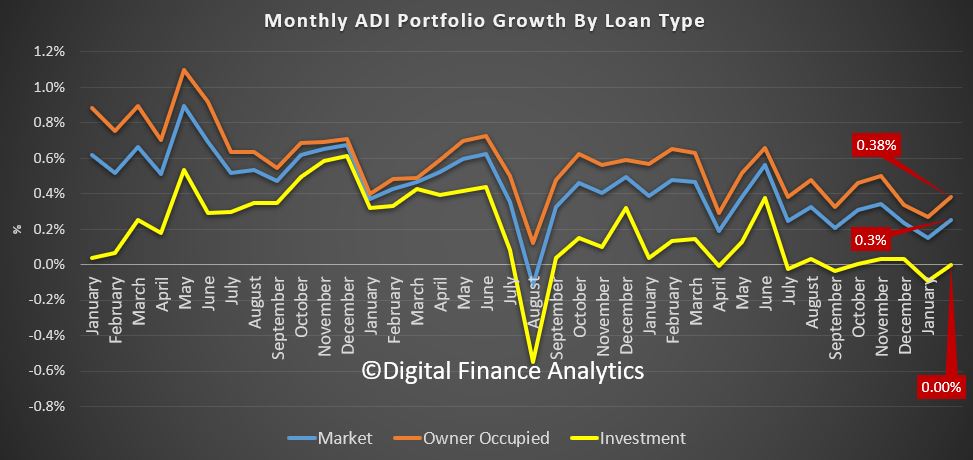

APRA’s data showed that owner occupied lending rose 0.38% in the month, investor lending was flat, and the market growth was 0.3%.

And our analysis of the individual bank data shows that housing market shares did not change that much, although CBA and Westpac were more active in net terms last month, though mainly in owner occupied lending. NAB and ANZ dropped more investor loans.

The 12-month portfolio moves for investor loans reveals the majors below the market. Macquarie and HSBC are leading the charge.

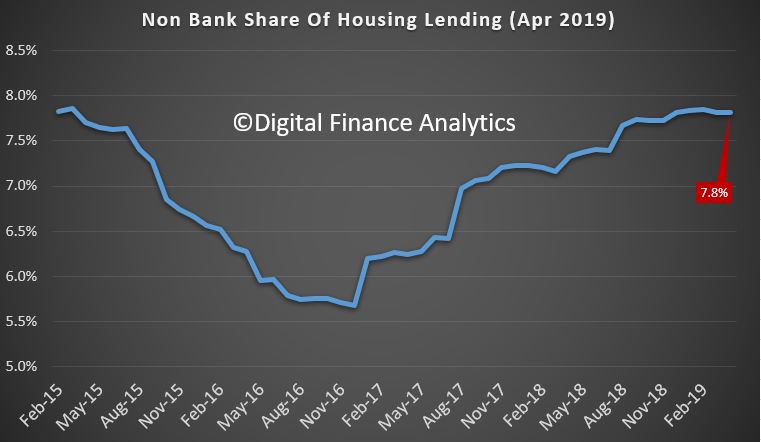

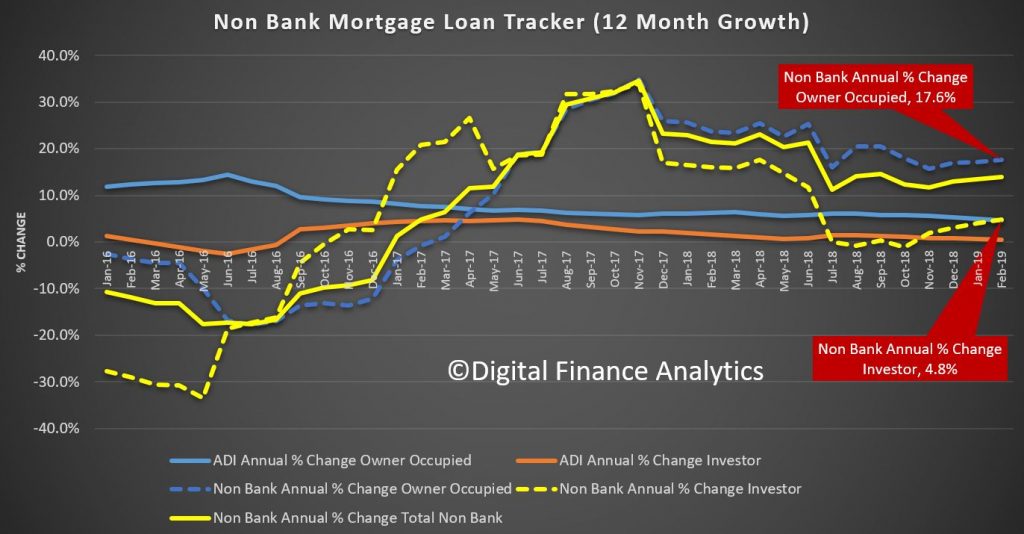

But a comparison of the gap between the Bank lending and RBA data shows the non-banks are still growing their books faster. Overall, they are running at an annualised 7.8%.

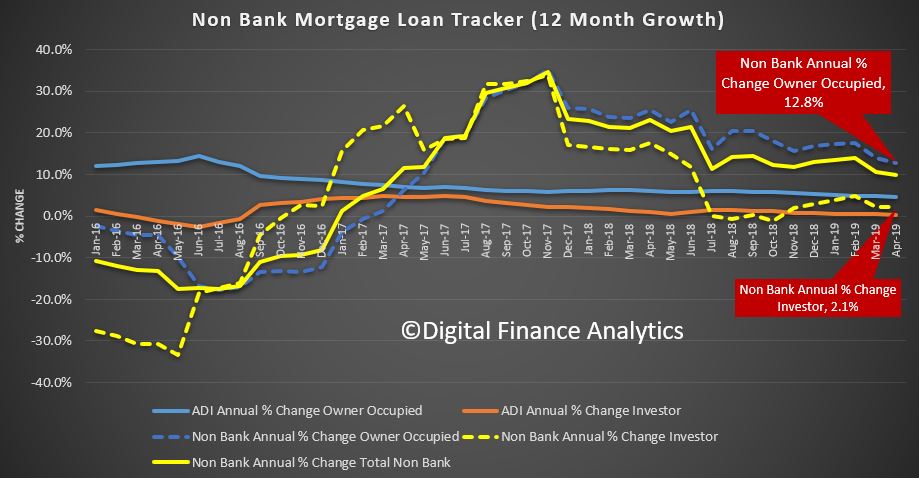

And analysis of owner-occupied lending by the non-banks shows it is still at 12.8%, compared with 2.1% for investor loans, but both above system.

So, standing back, the pre-election trends were weakening, the non-banks were making hay, and investors are still on the sidelines. Now it will be interesting to see if the so-called sentiment swing, and hype shows up in the numbers in the next couple of months. But to state the obvious, a growth rate of 3.9% for credit for households even now is way stronger than wages growth or inflation, so the debt burden is building further, and yet the policy settings are about to be shifted to encourage more of the same. Hardly sensible.

On the last working day of each month the RBA releases their Credit Aggregates and APRA their Monthly Banking Statistics for ADS‘s. Both are now out for March.

The headline news is the overall housing credit is up, to a new record of $1.82 trillion dollars up 0.31% from last month, or 0.31%. Within that owner occupied lending rose 0.32% to $1.22 trillion dollars and investment lending was flat. 32.7% of lending stock is for investment lending purposes, a slight fall from last month, whilst business lending as a proportion of all lending rose from 32.9% from 32.8% to reach $963.7 billion dollars. Personal credit fell 0.27% or $0.4 billion, to $147.1 billion, and continues to fall.

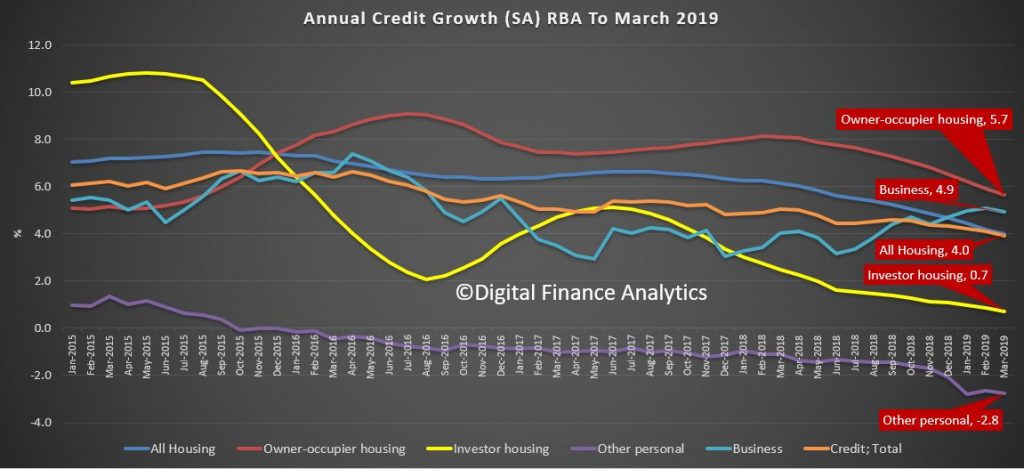

The annualised movements by category shows further weakness, with lending for owner occupied housing now at 5.7%, investment housing lending at 0.7%, giving housing overall growth of just 4% (though still higher than wages growth I would add). Personal credit fell 2.8% over the past year, while business lending rose 4.9% annualised. All these figures are on a seasonally adjusted basis

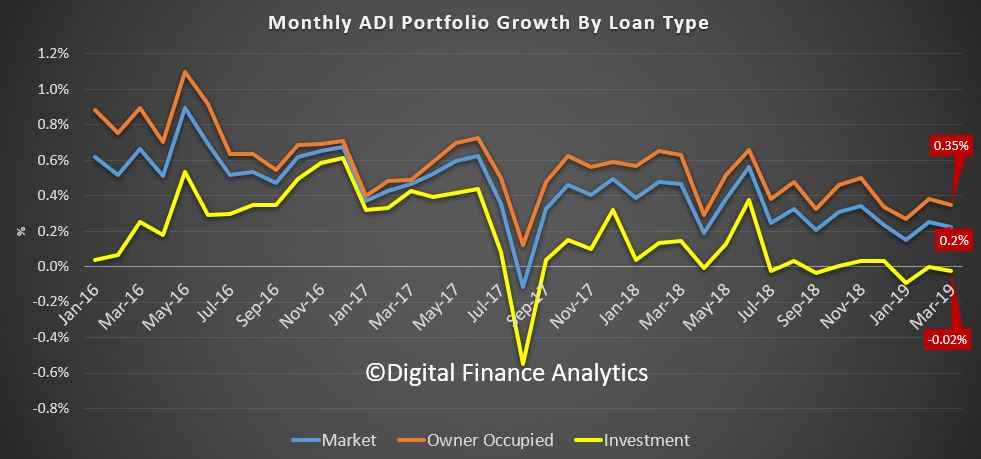

Turning to the APRA data on the banks, owner occupied lending rose 0.35% in March, while investment lending fell by 0.02%, giving total credit growth of just 0.2%. Over the past year owner occupied loans grew by 4.8% (compared with 5.7% at the aggregate level) and investor loans grew 0.4% (compared with 0.7% at the aggregate level). So the banks loan portfolios are growing more slowly than the market.

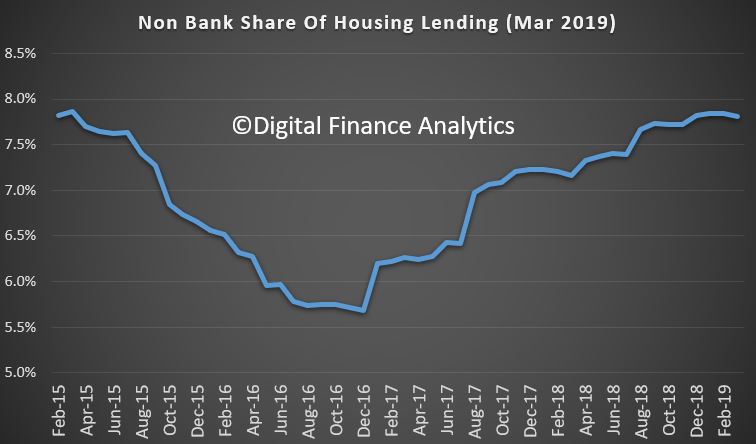

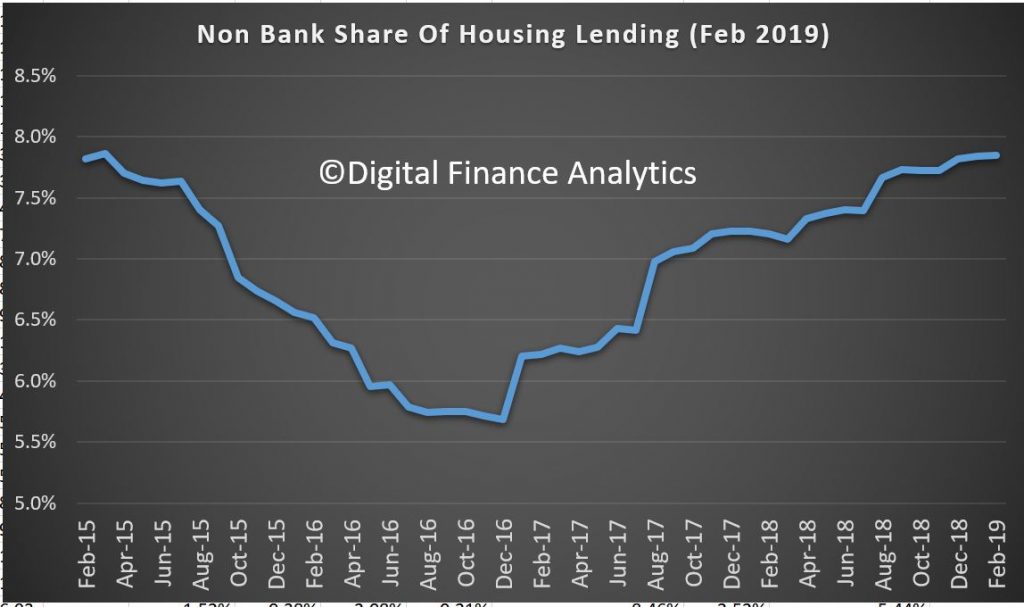

This can be illustrated by comparing the RBA and APRA data (warts and all) to show the non-bank sector is growing faster than the banks. Overall, they have over 7.5% of the market, which is up from the low in December 2016.

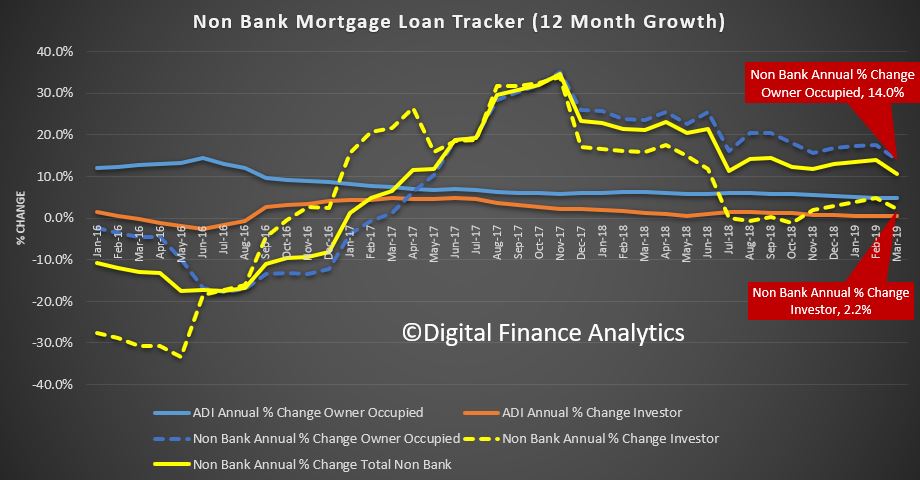

In addition, the rate of growth is significantly higher than the banks. Non-bank owner occupied loans are growing at an annual rate of 14%, while investment loans are 2.2%; both significantly higher than the ADI’s. Non-banks have weaker regulation, and more ability to lend. APRA has yet to truly engage with the sector.

Turning back to the individual lenders, the changes in their portfolios over the month show that Westpac and CBA offered the most new owner occupied loans, while ANZ dropped back, on both owner occupied and investment loans, while NAB dropped investment lending. HSBC, Macquarie and Member Equity Bank (ME) lend more than the regionals.

Overall market shares hardly moved, with CBA still the largest owner occupied lending, and Westpac the biggest investor lender.

Investment lending growth over the past 12 months has been anemic, but some lenders such as Macquarie are making hay. Of course the old 10% speed limit from APRA has gone now, but the relative growth highlights the fact that the four majors are well below market growth levels – and ANZ the weakest (which is why they said they wanted to lend more).

So finally, the total ADI lending book is at $1.68 trillion dollars, with owner occupied loans comprising $1.12 trillion dollars and investment loans $557 billion dollars, and comprising 33.2% of the portfolio – as the ratio continues to fall.

In conclusion, the credit impulse – the rate of change of credit being written is the most significant forward indicator of house price trajectory. The weak state of the market suggests more and significant price falls ahead. Yet despite all this, household debt will continue to rise. There is absolutely no reason to loosen lending requirements, or drop the hurdle rate on these numbers. More households will get into trouble ahead.

The February data from APRA for ADI’s and the credit aggregates from the RBA were released today. The headline news is the rate of housing credit growth continued to slow.

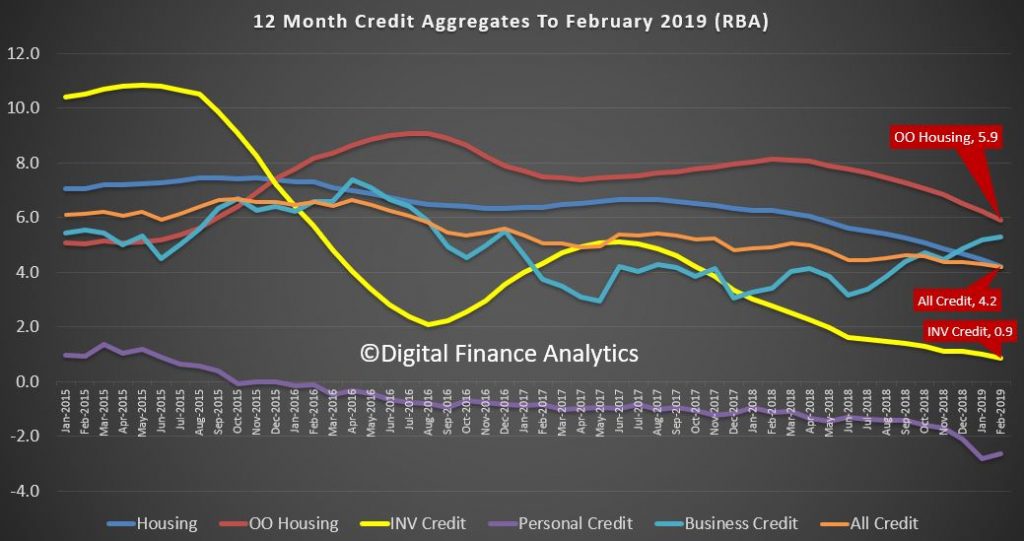

This is quite starkly shown in the RBA’s 12 month series, with total credit annualised growth now standing at 4.2%. Housing credit also fell to the same 4.2% level, from 4.4% a month ago. The fall continues. Within the housing series, lending for owner occupation fell below 6% – down to 5.9% and investment housing lending fell to 0.9% annualised.

The seasonally adjusted RBA data showed that last month total credit for housing grew by 0.31%, up $5.6 billion to $1.81 trillion, another record. Within in that owner occupied lending stock rose 0.42%, seasonally adjusted to $1.22 trillion, up $5.11 billion. Lending for investment property rose 0.09%, or $0.5 billion to $595 billion. Personal credit fell slightly, down 0.07% and business credit rose 0.42% to $960 billion, up $4.06 billion.

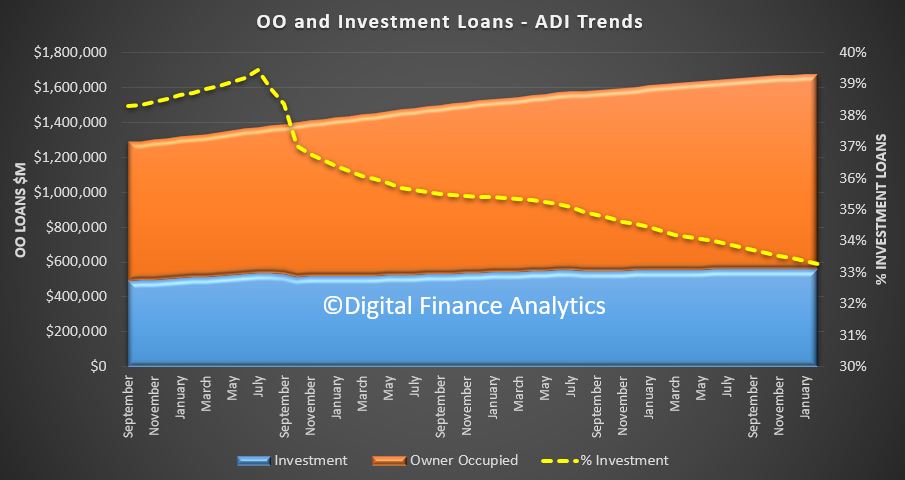

The APRA data revealed that ADI growth was lower than the RBA aggregates. Some of this relates to seasonal adjustments plus, as we will see a rise in non-bank lending. The proportion of investment loans less again to 33.3% of loans outstanding.

Total owner occupied loans were $1.11 trillion, up 0.38%, or $4.2 billion, while investor loans were $557 billion, flat compared with last month. This shows the trends month on month, with a slight uptick in February compared to January, as holidays end and the property market spluttered back to life. The next couple of months will be interesting as we watch for a post-Hayne bounce in lending and more loosening of the credit taps, but into a market where demand, is at best anemic.

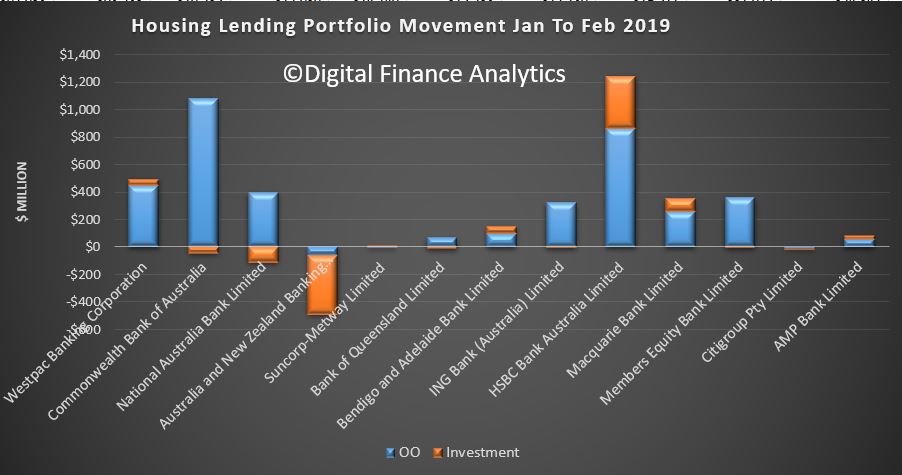

The portfolio movements are interesting (to the extent the data is reported accurately!), with HSBC growing its footprint by more that one billion across both investor and owner occupied lending. Only Westpac, among the big four grew their investor loans, with ANZ reporting a significant slide (no surprise they said they had gone too conservative, and recently introduce a 10-year interest only investor loan). Macquarie and Members Equity grew their books, with the focus on owner occupied loans.

The overall portfolios did not vary that much, with CBA still the largest owner occupied lender, and Westpac the largest investor lender.

The 12 month investor tracker whilst obsolete in one sense as APRA has removed their focus on a 10% speed limit, is significant, in that the market is now at 0.6% annualised.

But the final part of the story is the non-bank lending. This has to be derived, and we know the RBA data is suspect and delayed. But the gap between the RBA and APRA data shows the trends.

Non Bank annualised owner occupied credit is growing at 17.6%, and investor lending at 4.8%. It is clear the non-banks, with their weaker capital requirements, and greater funding flexibility are making hay. Total non bank credit for housing is now around $142 billion or around 7.8% of housing lending. This ratio has been rising since December 2016, and kicked up in line with the tighter APRA rules being applied to the banks.

We have out doubts that APRA is looking hard enough at these lending pools, especially as we are seeing the rise of higher risk “near-prime” offers to borrowers who cannot get loans from the banks.

So to conclude the rate of credit momentum continues to ease – signalling more home prices ahead. The non-banks sector, currently loosely regulated by APRA is growing fast, and just the before the US falls around the GFC, risks are higher here. And finally, and worryingly, household debt is STILL growing… so more stress and financial pressure ahead.

We look at the latest credit stats from the RBA and APRA. The credit impulse is slowing. Its at the slowest rate since 1974. So what does that really mean?