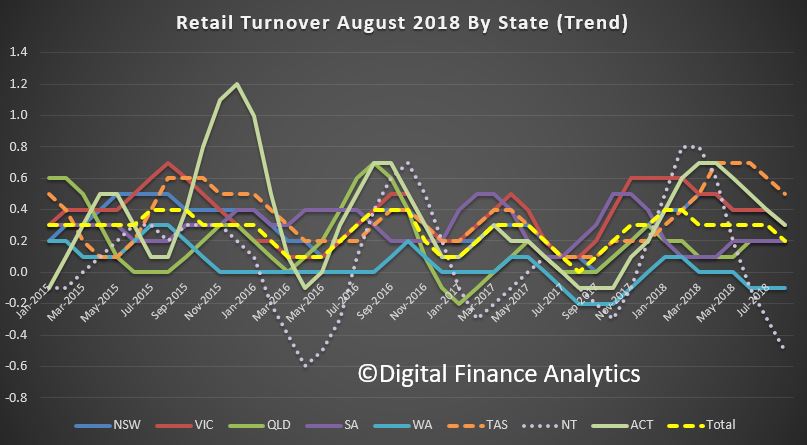

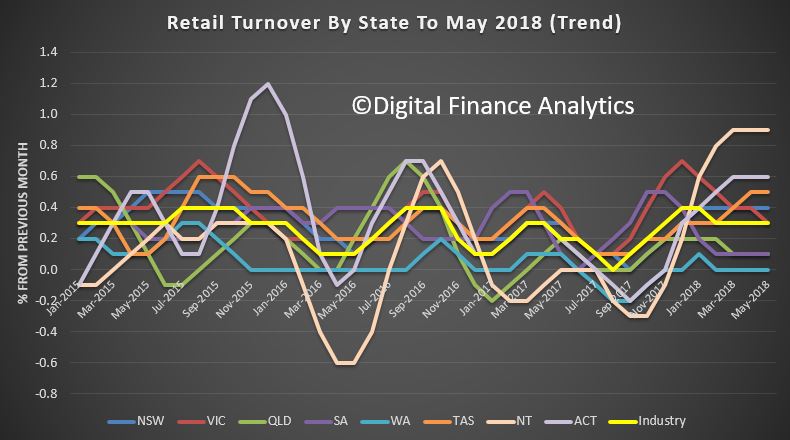

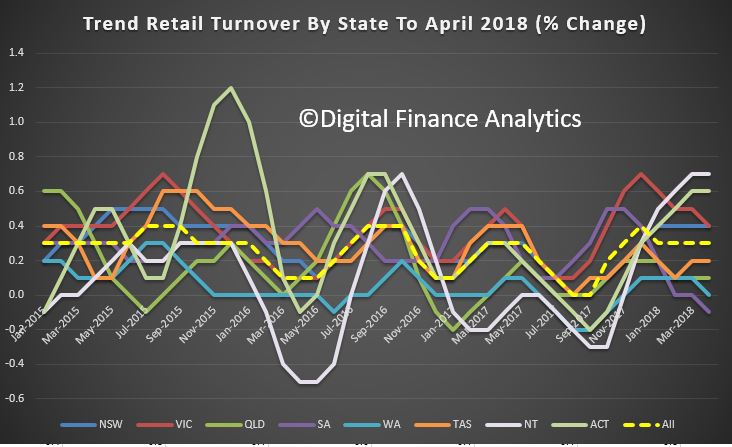

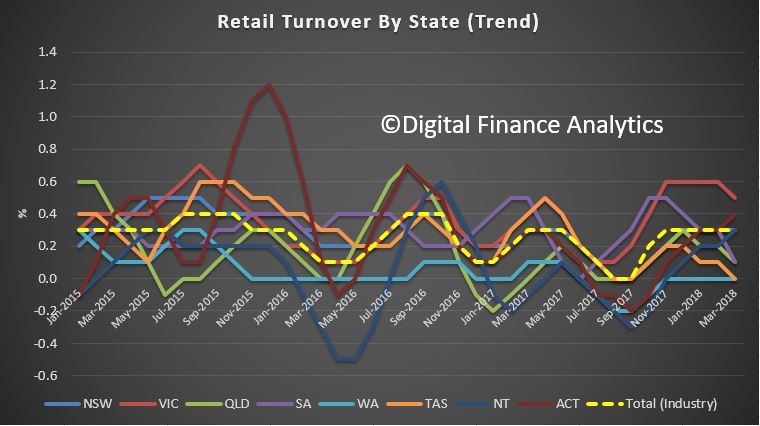

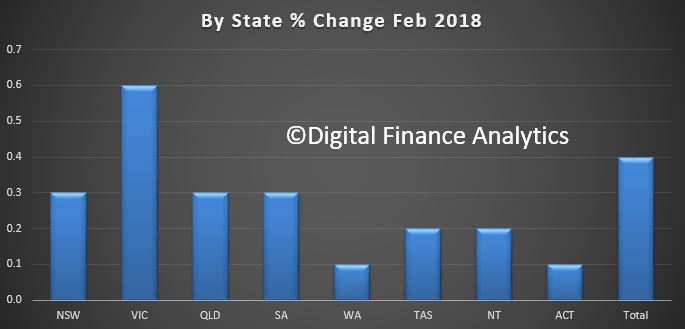

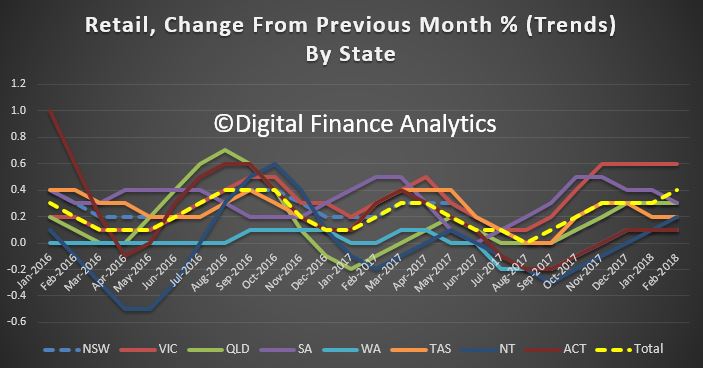

The ABS released their Retail Turnover stats for October 2018. Still looks pretty sluggish. Perhaps Christmas will accelerate the spend. We will see! New South Wales reported a fall, well behind Victoria and Queensland.

They say:

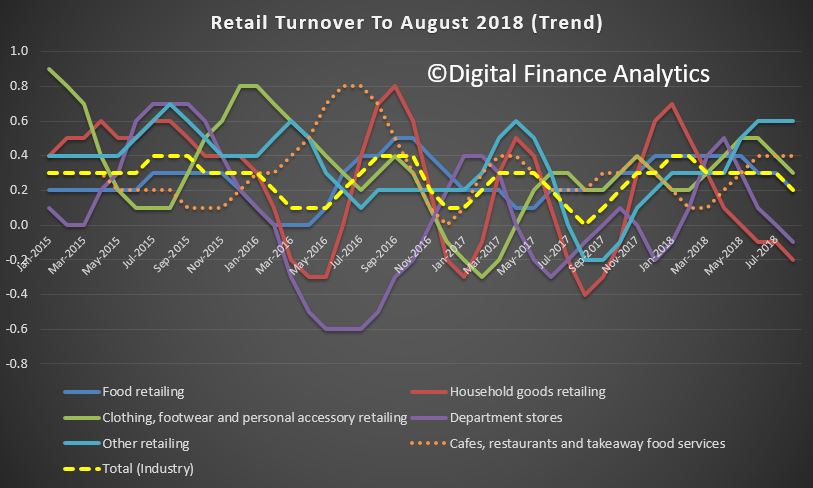

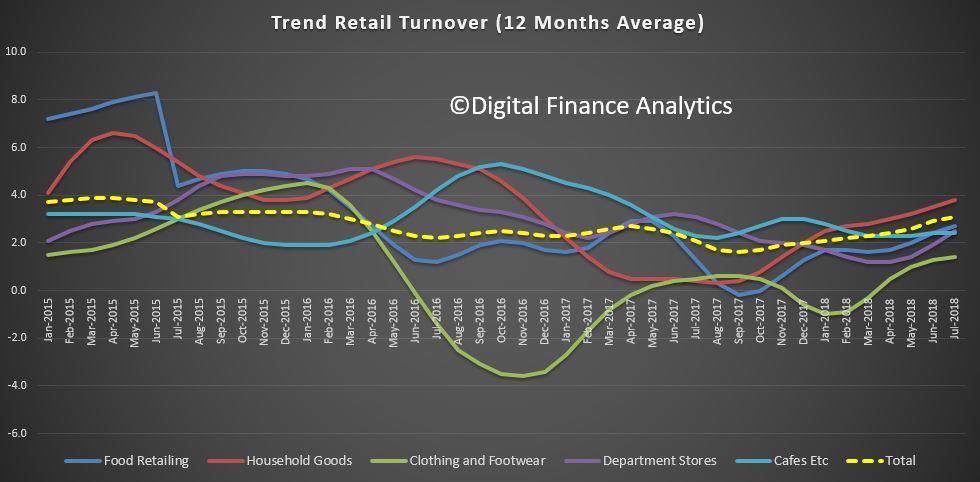

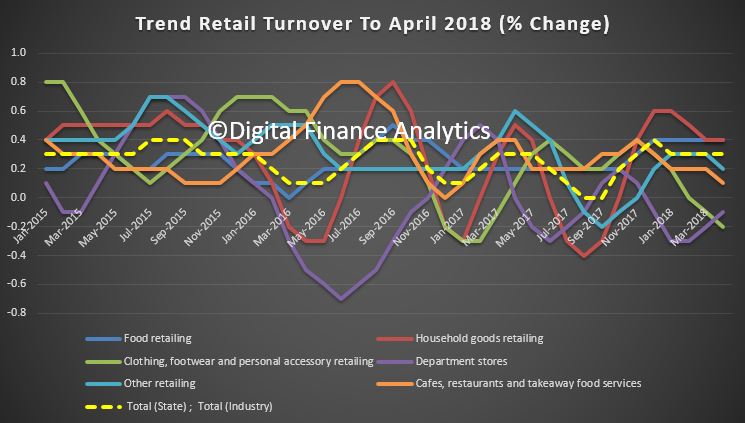

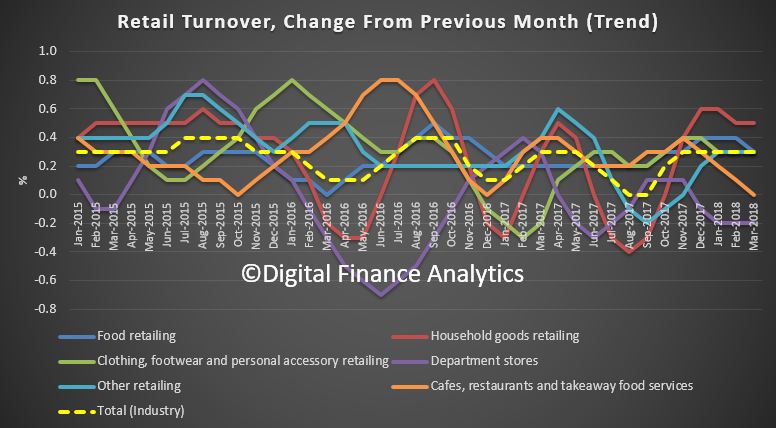

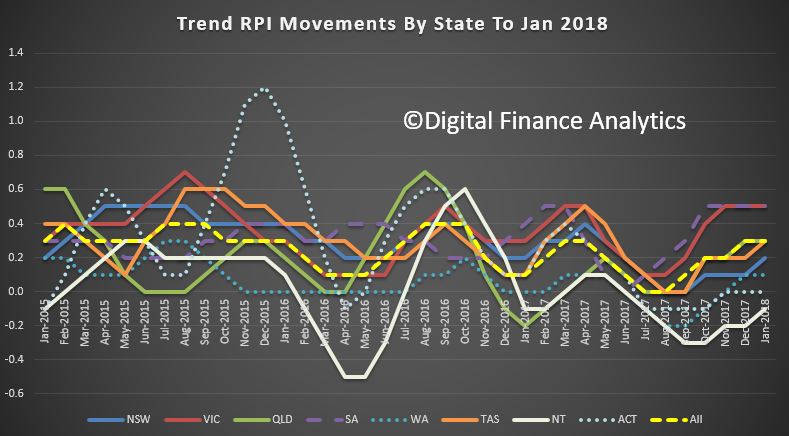

- The trend estimate rose 0.2% in October 2018. This follows a rise of 0.2% in September 2018, and a rise of 0.2% in August 2018.

- The seasonally adjusted estimate rose 0.3% in October 2018. This follows a 0.1% rise in September 2018, and a rise of 0.3% in August 2018.

- In trend terms, Australian turnover rose 3.5% in October 2018 compared with October 2017.

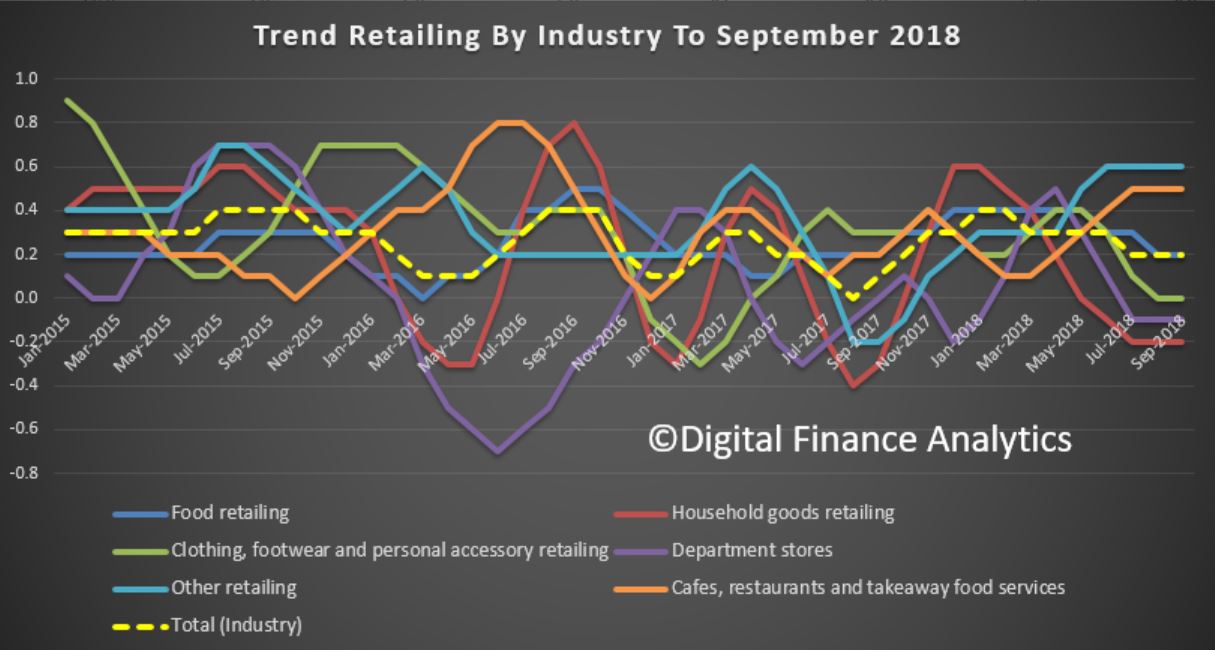

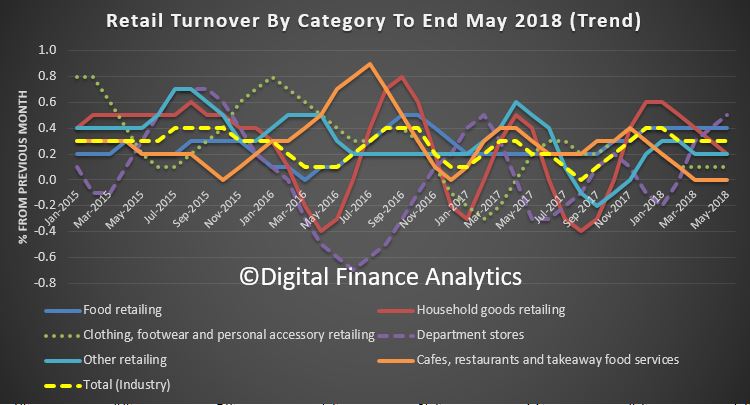

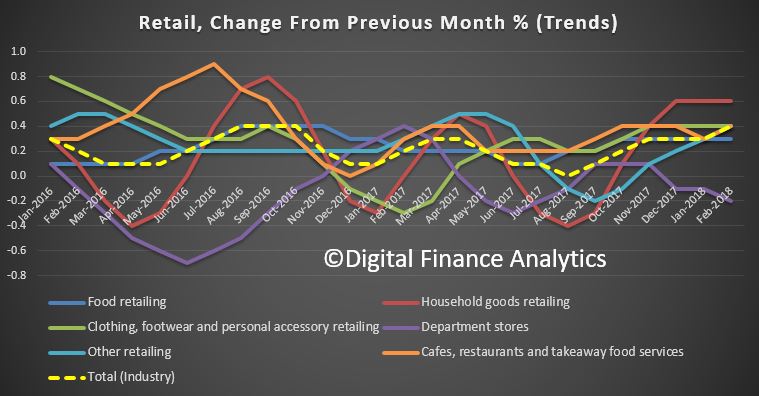

- The following industries rose in trend terms in October 2018: Food retailing (0.2%), Other retailing (0.5%), Cafes, restaurants and takeaway food services (0.2%), and Clothing, footwear and personal accessory retailing (0.2%). Household goods retailing (-0.1%), and Department Stores (-0.1%) fell in trend terms in October 2018.

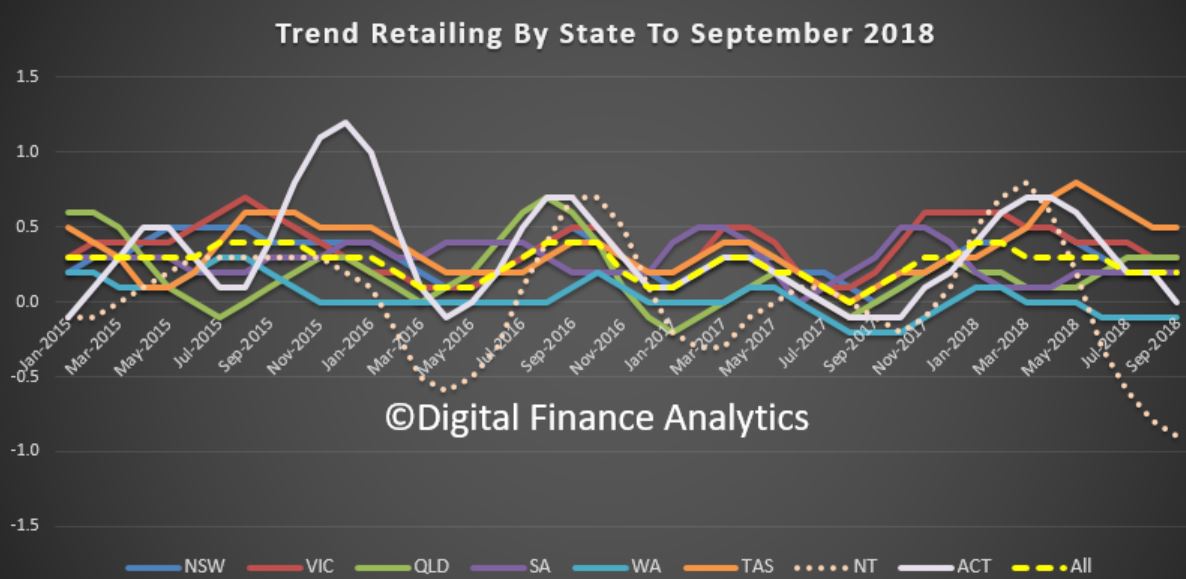

- The following states and territories rose in trend terms in October 2018: Victoria (0.4%), Queensland (0.5%), South Australia (0.3%), Tasmania (0.3%), and the Australian Capital Territory (0.2%). Western Australia was relatively unchanged (0.0%). New South Wales (-0.1%), and the Northern Territory (-0.8%) fell in trend terms in October 2018.

Online retail turnover contributed 5.9 per cent to total retail turnover in original terms in October 2018, a rise from 5.6 per cent in September 2018 and the highest level recorded in the series. In October 2017 online retail turnover contributed 4.7 per cent to total retail.