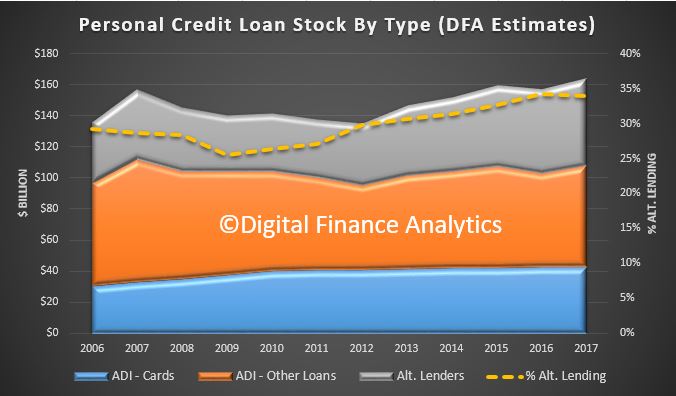

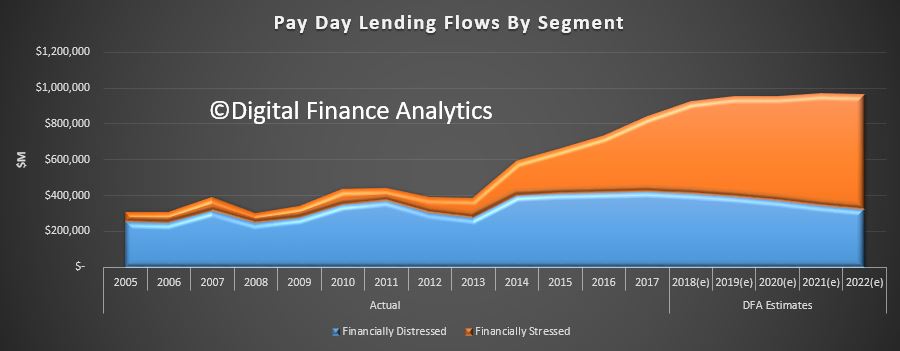

DFA provided data from our household surveys to inform an important report “The Debt Trap” released by more than 20 agencies helping consumers with their financial pressure. Our research, based on our rolling 52,000 households reveals that more households are using short term loans to try and manage their budgets, but many get trapped into debt. This is important given the rise in mortgage stress across the country.

The report also contains case studies which bring home the risks involved.

Worse, the recommendations from an earlier Government review are apparently in a holding pattern, and as a result more are being sucked in due to Government inaction.

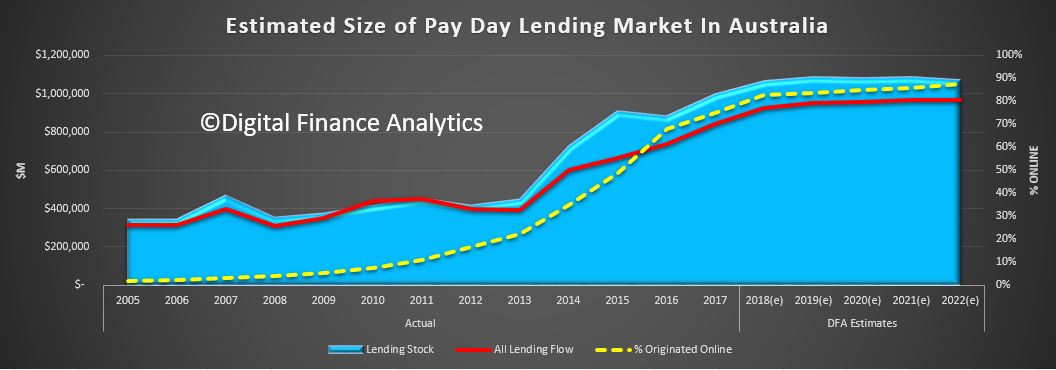

Finally, the rise of apps and online lenders is making is easier for desperate households to get caught up with high cost short term debt.

Here is the official release.

Over 20 consumer advocacy bodies from around the country have released new data revealing that predatory payday lenders are profiting from vulnerable Australians and trapping them in debt, as they call for urgent law reforms.

The Debt Trap: How payday lending is costing Australians projected that the gross amount of payday loans undertaken in Australia will reach a staggering 1.7 billion by the end of 2019. It also found that:

- Over 4.7 million individual payday loans were taken on by around 1.77 million households between April 2016 and July 2019, worth approximately $3.09 billion.

- Victoria is the state leading the country with the highest number of new payday loans

- Digital platforms are adding fuel to the fire, with payday loans that originate online expected to hit 85.8% by the end of 2019.

- The number of women using payday loans has risen from 177,000 in 2016 to 287,000 in 2019, representing a rise to 23.13% of all borrowers. Close of half are single mothers.

The report was released today by over 20 members of the Stop the Debt Trap Alliance – a national coalition of consumer advocacy organisations who see the harm caused by payday loans every day through their advice and casework.

Read the full report here [PDF]

“The harm caused by payday loans is very real, and this newest data shows that more Australian households risk falling into a debt spiral,” says Consumer Action CEO and Alliance spokesperson, Gerard Brody.

“Meanwhile, predatory payday lenders are profiting from vulnerable Australians to the tune of an estimated $550 million in net profit over the past three years alone.”

Brody says that the Federal Government has been sitting on legislative proposals that would make credit safer for over three years, and that the community could not wait any longer.

“Prime Minister Scott Morrison and Treasurer Josh Frydenberg are acting all tough when it comes to big banks and financial institutions, following the Financial Services Royal Commission. Why are they letting payday lenders escape legislative reform, when there is broad consensus across the community that stronger consumer protections are needed?”

The Alliance is calling on the Federal Government to put people before profits and pass the recommendations of the Small Amount Credit Contract (SACC) review into law. This legislation will be critical to making payday loans and consumer leases fair for all Australians. There are only 10 sitting days left to get it done.

“The consultation period for this legislation has concluded. Now it’s time for the Federal Government to do their part to protect Australians from financial harm and introduce these changes to Parliament as a matter of urgency.”