Westpac has released its December 2018 (1Q18) Pillar 3 update, which highlights a strong capital position, and overall benign risk of loss environment. They also provided some colour on Interest Only Loans.

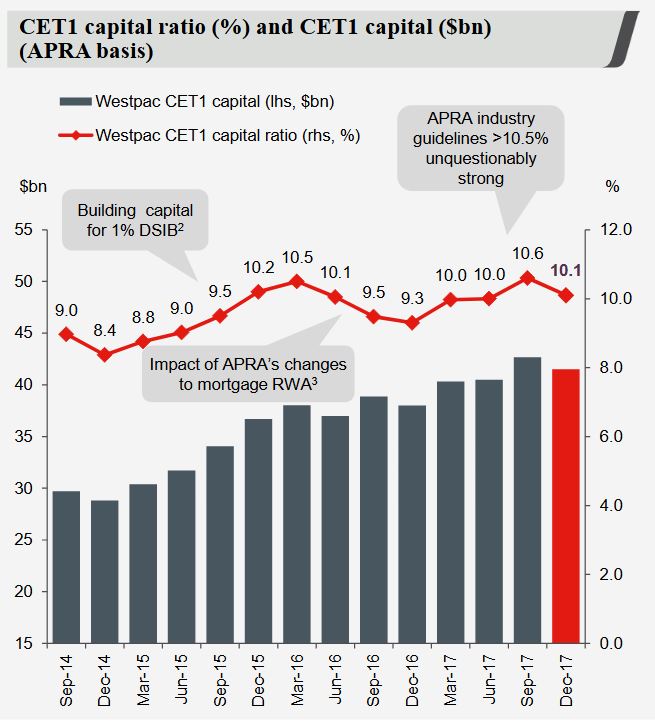

They say that the Common equity Tier 1 (CET1) capital ratio 10.1% at 31 December 2017 down from 10.6% at September 2017. The 2H17 dividend (net of DRP) reduced the CET1 capital ratio by 70bps. Excluding the impact of the dividend, the CET1 ratio increased by around 20bps over the quarter.

Risk weighted assets (RWA) increased $6.1bn (up 1.5% from 30 September 2017) mainly in credit risk from changes to risk models and loan growth, partly offset by improved asset quality across the portfolio. Changes to risk models also contributed to an increase in the regulatory expected loss, which is a deduction to capital. Internationally comparable CET1 capital ratio was 15.7% at 31 December 2017, in the top quartile of banks globally.

Risk weighted assets (RWA) increased $6.1bn (up 1.5% from 30 September 2017) mainly in credit risk from changes to risk models and loan growth, partly offset by improved asset quality across the portfolio. Changes to risk models also contributed to an increase in the regulatory expected loss, which is a deduction to capital. Internationally comparable CET1 capital ratio was 15.7% at 31 December 2017, in the top quartile of banks globally.

Estimated net stable funding ratio (NSFR) was 110% and liquidity coverage ratio (LCR) was 116% which is well above regulatory minimums. They are well progressed on FY18 term funding, $15.4bn issued in the first four months. Westpac will seek to operate with a CET1 ratio of at least 10.5% in March and September under APRA’s existing capital framework and will revise its preferred range once APRA finalises its review of the capital adequacy framework.

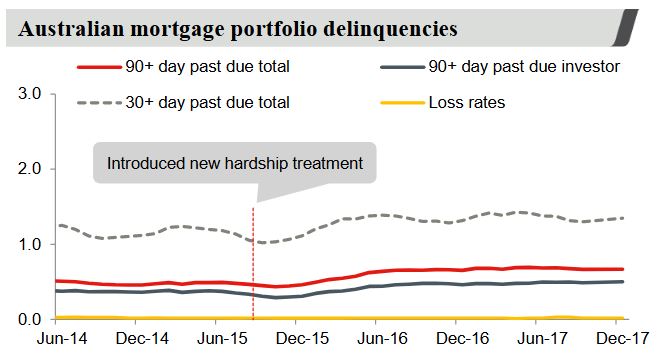

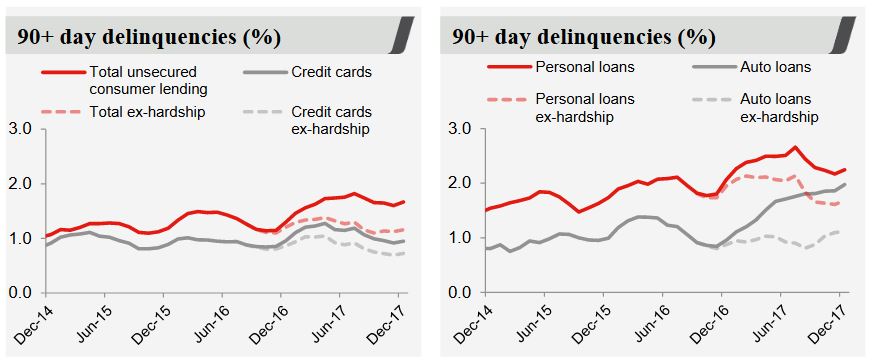

The level of impaired assets were stable with no new large individual impaired loans over $10m in the quarter. Stressed assets to TCE 2bps lower at 1.03%. Australian mortgage delinquencies were flat at 0.67%. Australian unsecured delinquencies were flat at 1.66%.

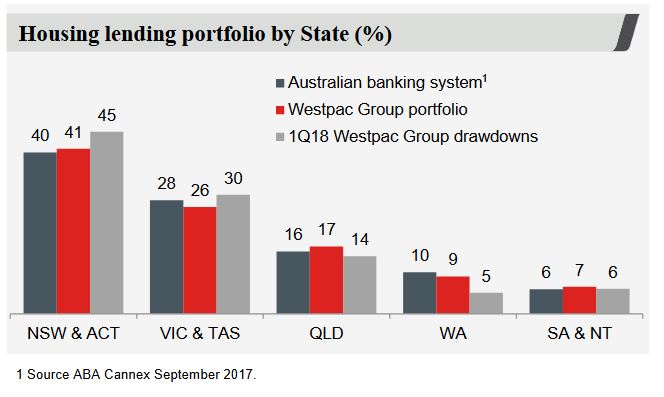

The bulk of mortgage draw downs are in NSW and VIC, with an under representation in WA compared with the market.

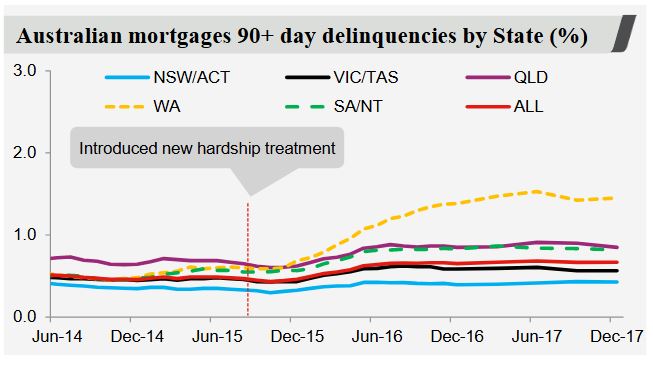

90+ day delinquencies are significantly higher in WA, compared with other states, reflecting the end of the mining boom.

90+ day delinquencies are significantly higher in WA, compared with other states, reflecting the end of the mining boom.

There is a rise in delinquencies for personal loans and auto-loans, compared with credit card debt.

There is a rise in delinquencies for personal loans and auto-loans, compared with credit card debt.

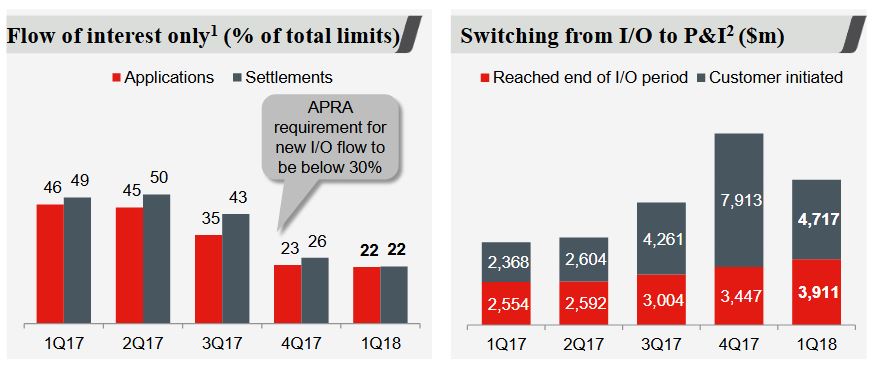

Flow of interest only lending was 22% in 1Q18 (APRA requirement <30%). Investor lending growth using APRA definition was 5.1% and so comfortably below the 10% cap.

Flow of interest only lending was 22% in 1Q18 (APRA requirement <30%). Investor lending growth using APRA definition was 5.1% and so comfortably below the 10% cap.

They provided some further information on the 30% cap.

They provided some further information on the 30% cap.

The 30% interest only cap incorporates all new interest only loans including bridging facilities, construction loans and limit increases on existing loans.

The interest only cap excludes flows from line of credit products, switching between repayment types, such as interest only to P&I or from P&I to interest only and also excludes term extensions of interest only terms within product maximums. Product maximum term for Interest only is 5 years for owner occupied and 10 years for investor loans.

Any request to extend term beyond the product maximum is considered a new loan, and hence is included in the cap.

So does that mean I could get an P&I loan, then subsequently switch it to an IO loan, so avoid the cap?

Also they highlighted key changes in their interest only mortgage settings.

Note that investors are paying more than owner occupiers, and interest only borrowers are paying even more!

Note that investors are paying more than owner occupiers, and interest only borrowers are paying even more!