The World Bank issued a report on Global Waves of Debt. They warn that the global build-up in debt is unsustainable and the risks are rising. The debt bomb is still ticking….

Tag: World Bank

Drowning In Debt! [Podcast]

The World Bank issued a report on Global Waves of Debt.

They warn that the global build-up in debt is unsustainable and the risks are rising. The debt bomb is still ticking….

Should The World Bank Be Killed Off?

Treasurer Josh Frydenberg has offered support to Donald Trump’s pick for the World Bank Presidency.

David Malpass is currently Under Secretary of the United States Treasury with responsibility for International Affairs, and his previous experience includes being chief economist at Bear Stearns prior to their collapse.

Our Treasurers support is wrong headed.

No matter what the strengths of David Malpass, the next World Bank President should not be American.

After World War Two the victors designed many of our global institutions, including the World Bank, and the International Monetary Fund. Major global institutions were headquartered in Europe or the United States, and there was an agreement that the World Bank President would be a US citizen, while the IMF would be headed by a European.

This cosy arrangement was fine for most of the 20th century, but is at odds with our 21st century world.

Trump’s unspoken ultimatum

It has been suggested that Trump would follow his usual negotiating tactics and withdraw support from the World Bank if the next chief is not American, which is presumably why some countries including Australia are likely to support Malpass.

The search for the US nomination was headed by Steven Mnuchin and Ivanka Trump, with Invanka Trump herself mentioned as a possible nomination.

Malpass may be a better candidate than the President’s daughter, but I doubt it.

Malpass has been a critic of World Bank lending to China and at Bear Stearns he ignored warning signs of crisis in 2007.

But it’s not so much Malpass’ dubious credibility that is the problem, but the idea that the President should always be American.

The American might not be the best candidate

Important global institutions should be led by the best candidate. The views and expertise of emerging market candidates, particularly from larger economies such as China, India, Brazil, Nigeria and Indonesia should be taken more seriously.

In recent years the IMF would have been much better led by a non-European. The decision to bail out French and German banks at the expense of the Greek economy in 2012 was a poor decision made by the French head of the IMF.

The IMF rightly supported restructuring of banks and financial markets after the Asian Financial Crisis in 1997, but did not push for the same for European or US banks after 2008.

So what if Australia and other middle powers did not support Malpass’ nomination?

Better off without the World Bank?

A US withdrawal from the World Bank would probably see its demise. But so what?

The World Bank has become relatively toothless.

Last year China lent more money to emerging market economies than the World Bank.

And this is the point. China needs to be brought into the World Bank and other institutions more fully, not sidelined.

Problems with governance and other issues with China’s Belt and Road initiative would be much better handled by a multilateral agency, whether that is a properly renewed World Bank or a new institution.

Author: Mark Crosby, Professor, Monash University

Global Growth Slowing – World Bank

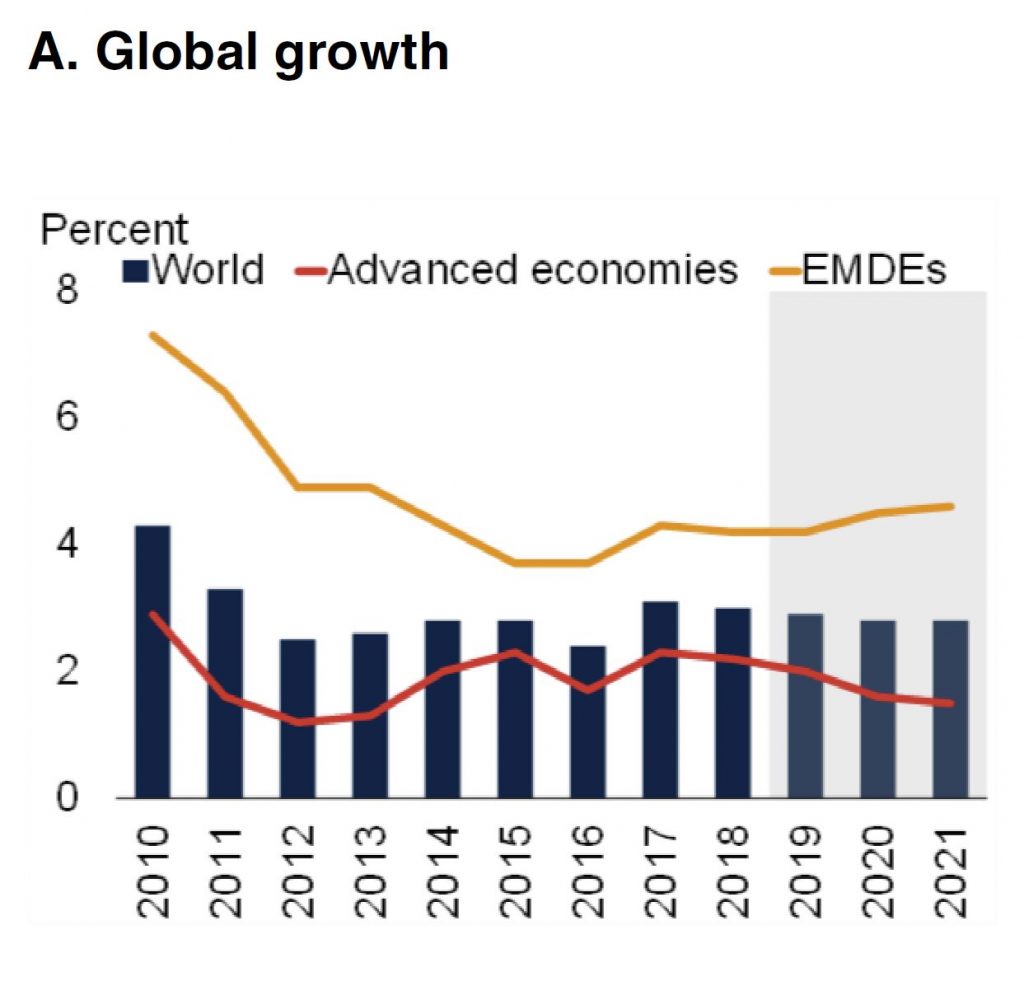

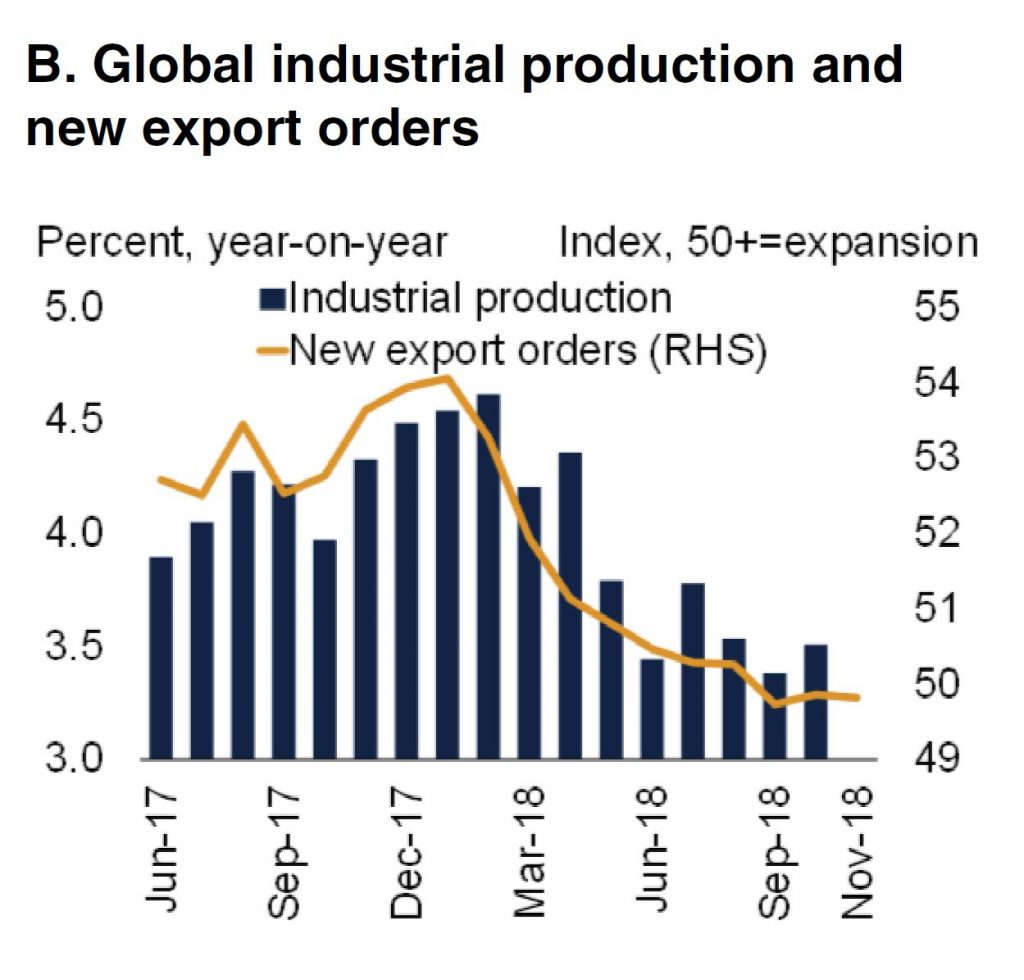

The latest edition of the World Bank Global Economics Prospects Report, January 2019, says global growth is moderating as the recovery in trade and manufacturing activity loses steam. Despite ongoing negotiations, trade tensions among major economies remain elevated.

These tensions, combined with concerns about softening global growth prospects, have weighed on investor sentiment and contributed to declines in global equity prices. Borrowing costs for emerging market and developing economies (EMDEs) have increased, in part as major advanced-economy central banks continue to withdraw policy accommodation in varying degrees. A strengthening U.S. dollar, heightened financial market volatility, and rising risk premiums have intensified capital outflow and currency pressures in some large EMDEs, with some vulnerable countries experiencing substantial financial stress. Energy prices have fluctuated markedly, mainly due to supply factors, with sharp falls toward the end of 2018. Other commodity prices—particularly metals—have also weakened, posing renewed headwinds for commodity exporters.

Economic activity in advanced economies has been diverging of late. Growth in the United States has remained solid, bolstered by fiscal stimulus. In contrast, activity in the Euro Area has been somewhat weaker than previously expected, owing to slowing net exports. While growth in advanced economies is estimated to have slightly decelerated to 2.2 percent last year, it is still above potential and in line with previous forecasts.

EMDE growth edged down to an estimated 4.2 percent in 2018—0.3 percentage point slower than previously projected—as a number of countries with elevated current account deficits experienced substantial financial market pressures and appreciable slowdowns in activity. More generally, as suggested by recent high-frequency indicators, the recovery among commodity exporters has lost momentum significantly, largely owing to country-specific challenges within this group. Activity in commodity importers, while still robust, has slowed somewhat, reflecting capacity constraints and decelerating export growth. In low-income countries (LICs), growth is firming as infrastructure investment continues and easing drought conditions support a rebound in agricultural output. However, LIC metals exporters are struggling partly reflecting softer metals prices. Central banks in many EMDEs have tightened policy to varying degrees to confront currency and inflation pressures.

In all, global growth is projected to moderate from a downwardly revised 3 percent in 2018 to 2.9 percent in 2019 and 2.8 percent in 2020-21, as economic slack dissipates, monetary policy accommodation in advanced economies is removed, and global trade gradually slows. Growth in the United States will continue to be supported by fiscal stimulus in the near term, which will likely lead to larger and more persistent fiscal deficits. Advanced-economy growth will gradually decelerate toward potential, falling to 1.5 percent by the end of the forecast horizon, as monetary policy is normalized and capacity constraints become increasingly binding.

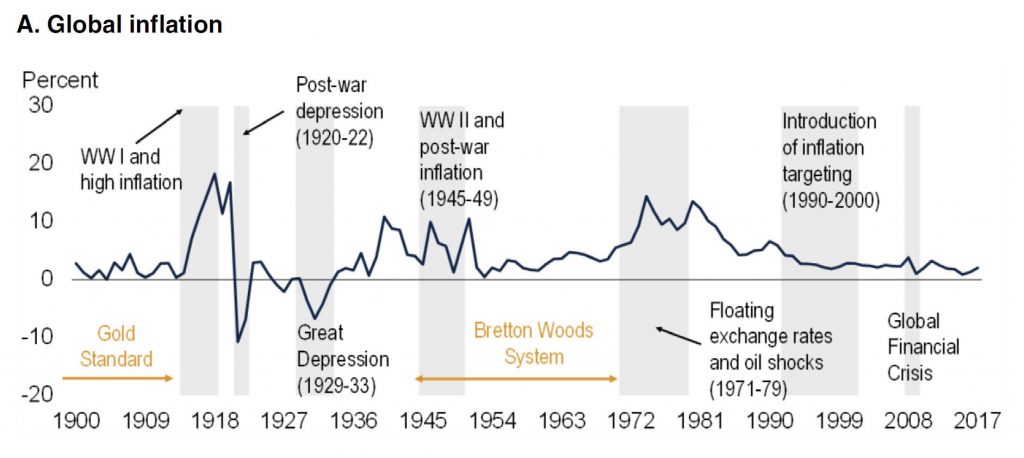

They show that there have been previous periods of low inflation during the Bretton Woods fixed exchange rate system in the post-war period up to the early 1970s, and during the gold standard of the early 1900s.

Softening global trade and tighter financing conditions will result in a more challenging external environment for EMDE economic activity. EMDE growth is expected to stall at 4.2 percent in 2019—0.5 percentage point below previous forecasts, partly reflecting the lingering effects of recent financial stress in some large economies (e.g., Argentina, Turkey), with a sharply weaker-than-expected pickup in commodity exporters accompanied by a deceleration in commodity importers. EMDE

growth is projected to plateau at an average of 4.6 percent in 2020-21, as the recovery in commodity exporters levels off. Per capita growth will remain anemic in several EMDE regions—most notably, in those with a large number of commodity exporters—likely impeding further poverty alleviation.

The projected gradual deceleration of global economic activity over the forecast horizon could be more severe than currently expected given the predominance of substantial downside risks. A sharper-than-expected tightening of global financing conditions, or a renewed rapid appreciation of the U.S. dollar, could exert further downward pressure on activity in EMDEs, including in those with large current account deficits financed by portfolio and bank flows.

Government and/or private sector debt has also risen in a majority of EMDEs over the last few years, including in many LICs, reducing the fiscal room to respond to shocks and heightening the exposure to shifts in market sentiment and rising borrowing costs.

Escalating trade tensions are another major downside risk to the global outlook. If all tariffs currently under consideration were implemented, they would affect about 5 percent of global trade flows and could dampen growth in the economies involved, leading to negative global spillovers.

While some countries could benefit from trade diversion in the short run, rising trade protectionism would stifle investment and severely disrupt global value chains, contributing to higher prices and lower productivity. Other downside risks—such as heightened political uncertainty, escalating geopolitical tensions, and conflict—further cloud the outlook.

Even though the probability of a recession in the United States is still low, and the slowdown in China is projected to be gradual, markedly weaker-than-expected activity in the world’s two largest economies could have a severe impact on global economic prospects. Stimulus measures have bolstered the near-term outlook in these two countries but could contribute to a more abrupt slowdown later on. A simultaneous occurrence of a severe U.S. downturn and a sharper-than expected deceleration in China would significantly increase the probability of an abrupt global slowdown and thus negatively impact the outlook of other EMDEs through trade, financial, and commodity market channels. A global downturn would be particularly detrimental for those EMDEs with reduced policy space to respond to

shocks.

The softening outlook and heightened downside risks exacerbate various challenges faced by policymakers around the world. Advanced economies should use this period of above potential growth to rebuild macroeconomic policy buffers and lay the foundation for stronger growth with reforms that bolster potential output. Care should be taken to avoid shifts in trade and immigration policies that could negatively affect longer-term growth prospects, both domestically and abroad. A renewed commitment to a rulesbased international trading system would also help bolster confidence, investment, and trade.

In a context of limited policy buffers, EMDE policymakers need to bolster the capacity to cope with possible bouts of financial market volatility, including sharp exchange rate movements—while undertaking measures to sustain the ongoing period of historically stable inflation. This immediate priority will require a credible commitment to price stability from central banks, underpinned by strong institutional in dependence, as well as efforts by regulators and prudential authorities to reduce persistent financial fragilities. EMDEs also face substantial fiscal challenges and the risk of worsening debt dynamics as global financing conditions tighten.

For many EMDEs, it will be imperative to restore fiscal space given cyclical conditions, as well as address the vulnerabilities associated with elevated foreign-currency-denominated debt.

Equally critically, amid a projected deceleration in potential growth, EMDEs face the pressing challenge of ensuring sustained improvements in living standards.

This will require investments in human capital and skills development to raise productivity and take full advantage of technological changes. In the current environment of limited fiscal resources, the urgency of these investments highlights the critical need to prioritize effective public spending and increase public sector efficiency.

Moreover, facilitating the expansion of small- and medium-sized enterprises, including by improving their access to international markets and finance, would also spur productivity and stimulate growth -enhancing investments. For many EMDEs, there is scope to further liberalize trade and improve the extent to which they are integrated into global value chains, which would foster a more efficient allocation of resources, job creation, and export diversification. Policies that help improve outcomes in these areas would also contribute to address the challenges associated with informality, thus reinforcing the basis for future productivity growth.

World Bank Lowers Global Growth Forecast

The World Bank is revising its 2016 global growth forecast down to 2.4 percent from the 2.9 percent pace projected in January. The move is due to sluggish growth in advanced economies, stubbornly low commodity prices, weak global trade, and diminishing capital flows. Commodity-exporting emerging market and developing economies have struggled to adapt to lower prices for oil and other key commodities. Growth in these economies is projected to advance at a meager 0.4 percent pace this year, whereas growth in commodity importers has been more resilient. Projections are subject to substantial downside risks, including additional growth disappointments in advanced economies or key emerging markets and rising policy and geopolitical uncertainties. In an environment of weak growth and eroding policy buffers, structural reforms have become even more urgent. “Depressed commodity prices have slowed growth sharply in commodity-exporting emerging and developing economies, which are home to more than half the global poor,” said World Bank Group President Jim Yong Kim, “Economic growth remains the most important driver of poverty reduction. This underscores the critical priority of pursuing growth-enhancing policies to eliminate extreme poverty and boost shared prosperity.”

In addition to presenting detailed outlooks for the global economy and for each of the world’s emerging market and developing regions, this report analyses two topical policy challenges for policymakers to navigate.

The first charts an important vulnerability that risks sidetracking economic recovery in emerging and developing economies: the rapid increase in private-sector credit since 2010. This buildup has been greatest among commodity exporting countries, where credit levels had been modest. In contrast, credit has been stagnant or shrinking among commodity importing countries, where previously it had been considerably higher than in commodity exporters.

The second has to do with tools for assessing the risks surrounding prospects for the world economy and concludes that forecast uncertainty has increased since January 2016, while the balance of risks for global growth has further tilted to the downside.

The world economy is projected to expand at 2.4 percent in 2016, roughly at the same insipid pace we experienced last year. On the plus side, commodity importers will maintain their relatively high growth, as the low prices become stable. On the other hand, commodity exporters will continue to face challenges, though even in these economies there should be a slow positive upturn, as commodity prices stabilize and they slowly begin to diversify their economy.

Although global growth is projected to accelerate gradually, a wide range of risks threaten to derail the recovery, including a sharper-than-expected slowdown in major emerging markets, sudden escalation of financial market volatility, heightened geopolitical tensions, slowing activity in advanced economies, and diminished confidence in the effectiveness of policies to spur growth. These risks are compounded by the fact that for many countries policy buffers have eroded substantially, particularly in commodity exporting emerging and developing countries.

Against this backdrop of weak growth, pronounced risks, and limited policy space, policymakers in emerging and developing economies should put a premium on enacting reforms, which, even if they seem difficult in the short run, foster stronger growth in the medium and the long run.

Among these measures, efforts to invest in infrastructure and education, health and other human skills and wellbeing, as well as initiatives to promote economic diversification and liberalize trade, will boost growth prospects and improve standards of living. The international community has an important role to play in the pursuit of these goals.

Payments and Financial Inclusion

In recent years, a number of reports have been prepared by organisations on financial inclusion, a topic whose importance is increasingly being recognised. However, few of these reports have addressed what may be called the “payment aspects” of financial inclusion. In cases where the topics of payment systems and payment services have been raised in the context of financial inclusion, discussion has focused only on specific aspects of payments, such as mobile payments, rather than on the payment system in its entirety. Understanding payments in a holistic sense, including how individual elements relate to one other, is crucial to an understanding of financial inclusion and to promoting broader access to and usage of financial services.

The report, published today, provides an analysis of the payment aspects of financial inclusion, on the basis of which it sets out guiding principles designed to assist countries that seek to advance financial inclusion in their markets through payments. The report was first issued in September 2015 as a consultation document. As a result of the comments, we have made changes to the report to strengthen the analysis and sharpen the message. The report has been prepared for the Committee on Payments and Market Infrastructures (CPMI) and the World Bank Group by a task force consisting of representatives from CPMI central banks, non-CPMI central banks active in the area of financial inclusion and international financial institutions.

This report is premised on two key points: (i) efficient, accessible and safe retail payment systems and services are critical for greater financial inclusion; and (ii) a transaction account is an essential financial service in its own right and can also serve as a gateway to other financial services. For the purposes of this report, transaction accounts are defined as accounts (including e-money/prepaid accounts) held with banks or other authorised and/or regulated payment service providers (PSPs), which can be used to make and receive payments and to store value.

The report is structured into five chapters. The first chapter provides an introduction and general overview, including a description of the PAFI Task Force and its mandate, a brief discussion of transaction accounts, and the barriers to the access and usage of such accounts. The second chapter gives an overview of the retail payments landscape from a financial inclusion perspective. The third chapter forms the core analytical portion of the report and outlines a framework for enabling access and usage of payment services by the financially excluded. Each component of this framework is discussed in detail in the report. The fourth chapter of the report describes the key policy objectives when looking at financial inclusion from a payments perspective, and formulates a number of suggestions in the form of guiding principles and key actions for consideration.

In this context, financial inclusion efforts undertaken from a payments angle should be aimed at achieving a number of objectives. Ideally, all individuals and businesses – in particular, micro-sized and small businesses – which are more likely to lack some of the basic financial services or be financially excluded than larger businesses – should be able to have access to and use at least one transaction account operated by a regulated payment service provider:

(i) to perform most, if not all, of their payment needs;

(ii) to safely store some value; and

(iii) to serve as a gateway to other financial services.The guiding principles for achieving these objectives of improved access to and usage of transaction

accounts are the following:

- Commitment from public and private sector organisations to broaden financial inclusion is explicit, strong and sustained over time.

- The legal and regulatory framework underpins financial inclusion by effectively addressing all relevant risks and by protecting consumers, while at the same time fostering innovation and competition.

- Robust, safe, efficient and widely reachable financial and ICT infrastructures are effective for the provision of transaction accounts services, and also support the provision of broader financial services.

- The transaction account and payment product offerings effectively meet a broad range of transaction needs of the target population, at little or no cost.

- The usefulness of transaction accounts is augmented with a broad network of access points that also achieves wide geographical coverage, and by offering a variety of interoperable access channels.

- Individuals gain knowledge, through awareness and financial literacy efforts, of the benefits of adopting transaction accounts, how to use those accounts effectively for payment and store-of-value purposes, and how to access other financial services.

- Large-volume and recurrent payment streams, including remittances, are leveraged to advance financial inclusion objectives, namely by increasing the number of transaction accounts and stimulating the frequent usage of these accounts.

Finally, the fifth chapter of the report addresses a number of issues in connection with measuring the effectiveness of financial inclusion efforts in the context of payments and payment services, with a particular emphasis on transaction account adoption and usage.

New report examines payment aspects of financial inclusion

The Committee on Payments and Market Infrastructures (CPMI) and the World Bank Group today issued a consultative report on Payment aspects of financial inclusion. The report examines demand and supply-side factors affecting financial inclusion in the context of payment systems and services, and suggests measures to address these issues.

Financial inclusion efforts – from a payment perspective – should aim at achieving a number of objectives. Ideally, all individuals and businesses should have access to and be able to use at least one transaction account operated by a regulated payment service provider, to: (i) perform most, if not all, of their payment needs; (ii) safely store some value; and (iii) serve as a gateway to other financial services.

Benoît Cœuré, member of the Executive Board of the European Central Bank (ECB) and CPMI Chairman, says that, “With this report, the Committee on Payments and Market Infrastructures and the World Bank Group make an important contribution to improving financial inclusion. Financial inclusion efforts are beneficial not only for those that have no access to financial services, but also for the national payments infrastructure and, ultimately, the economy.”

Gloria M. Grandolini, Senior Director, Finance and Markets Global Practice of the World Bank Group, comments that, “This report will help us better understand how payment systems and services promote access to and effective usage of financial services. It provides an essential tool to meeting our ambitious goal of universal financial access for working-age adults by 2020.”

The report outlines seven guiding principles designed to assist countries that want to advance financial inclusion in their markets through payments: (i) commitment from public and private sector organisations; (ii) a robust legal and regulatory framework underpinning financial inclusion; (iii) safe, efficient and widely reachable financial and ICT infrastructures; (iv) transaction accounts and payment product offerings that effectively meet a broad range of transaction needs; (v) availability of a broad network of access points and interoperable access channels; (vi) effective financial literacy efforts; and (vii) the leveraging of large-volume and recurrent payment streams, including remittances, to advance financial inclusion objectives.

In summary, The CPMI-World Bank Group Task Force on the Payment Aspects of Financial Inclusion (PAFI) started its work in April 2014. The task force was mandated to examine demand and supply side factors affecting financial inclusion in the context of payment systems and services, and to suggest measures that could be taken to address these issues. This report is premised on two key points: (i) efficient, accessible, and safe retail payment systems and services are critical for greater financial inclusion; and (ii) a transaction account is an essential financial service in its own right and can also serve as a gateway to other financial services. For the purposes of this report, transaction accounts are defined as accounts (including e-money accounts) held with banks or other authorised and/or regulated payment service providers (PSPs), which can be used to make and receive payments and to store value.

The report is structured into five chapters. The first chapter provides an introduction and general overview, including a description of the PAFI Task Force and its mandate, a brief discussion of transaction accounts, and the barriers to the access and usage of such accounts. The second chapter gives an overview of the retail payments landscape from a financial inclusion perspective. The third chapter forms the core analytical portion of the report and outlines a framework for enabling access and usage of payment services by the financially excluded. Each component of this framework is discussed in detail in the report.

The fourth chapter of the report describes the key policy objectives when looking at financial inclusion from a payments perspective, and formulates a number of suggestions in the form of guiding principles and key actions for consideration. In this context, financial inclusion efforts undertaken from a payments angle should be aimed at achieving a number of objectives. Ideally, all individuals and micro- and some small-sized businesses – which are more likely to lack some of the basic financial services or be financially excluded than larger businesses – should be able to have access to and use at least one transaction account operated by a regulated payment service provider:

(i) to perform most, if not all, of their payment needs;

(ii) to safely store some value; and

(iii) to serve as a gateway to other financial services.

The guiding principles for achieving these objectives of improved access to and usage of transaction accounts are the following:

• Commitment from public and private sector organisations to broaden financial inclusion is explicit, strong and sustained over time.

• The legal and regulatory framework underpins financial inclusion by effectively addressing all relevant risks and by protecting consumers, while at the same time fostering innovation and competition.

• Robust, safe, efficient and widely reachable financial and ICT infrastructures are effective for the provision of transaction accounts services, and also support the provision of broader financial services.

• The transaction account and payment product offerings effectively meet a broad range of the target population’s transaction needs, at little or no cost.

• The usefulness of transaction accounts is augmented by a broad network of access points that also achieves wide geographical coverage, and by offering a variety of interoperable access channels.

• Individuals gain knowledge, through financial literacy efforts, of the benefits of adopting transaction accounts, how to use those accounts effectively for payment and store-of-value purposes, and how to access other financial services.

• Large-volume and recurrent payment streams, including remittances, are leveraged to advance financial inclusion objectives, namely by increasing the number of transaction accounts and stimulating the frequent usage of these accounts.

Finally, the fifth chapter of the report addresses a number of issues in connection with measuring the effectiveness of financial inclusion efforts in the context of payments and payment services, with a particular emphasis on transaction account adoption and usage.