The big four all announced cuts in their variable mortgage rate (around 75% of borrowers are on variable rates), but the amount of the cuts and the timing does vary between banks.

Both the RBA Governor and The Treasurer on the record said the banks should pass through the full cuts. Borrowers should shop around and demand a better rate – which is always good advice!

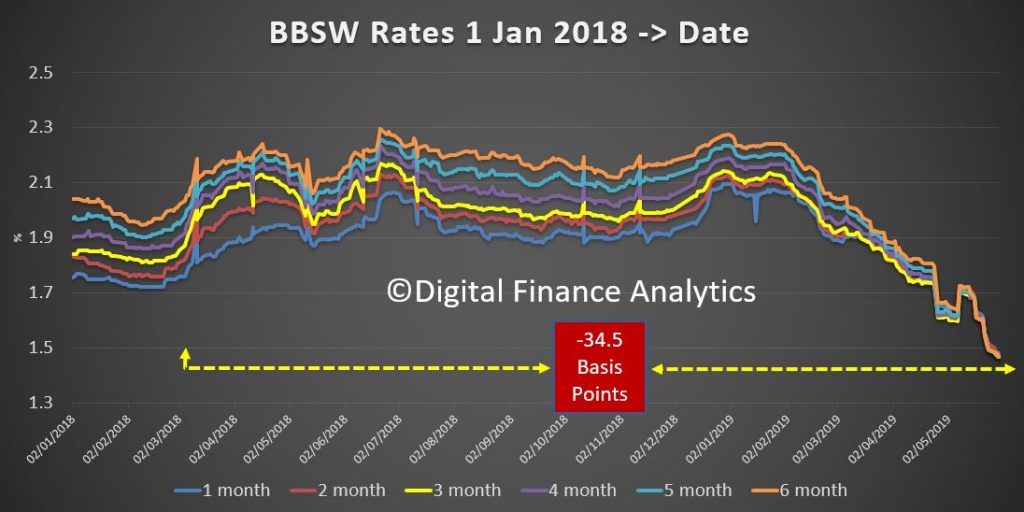

The funding position of the banks, as represented by the BBSW is also supportive of a pass though.

Analysts were expecting about half to pass through, which would be neutral to profits, thus, those who pass through more will see their margins compressed, and it is certain they will cut deposits rates to alleviate this. Funny how deposit rate cuts are hardly reported, and never make the headlines.

As a rule of thumb, a 5 basis point net margin reduction translates into a 1% fall in profit.

One problem is that many call deposits are close to zero now, so expect a bigger trimming of term deposit rates. We also expect some savers to pull funds from deposits to try other investments with a higher return, though with higher risks.

This is how the majors came out:

ANZ

Their Australian variable mortgage rates to decrease by 18 basis points, which is 7 basis points lower than the RBA 25 basis point cash rate cut. This will be effective from the 14th June.

CBA

Their Australian variable rate home loans will decrease by 25 basis points. This will be effective from 25th June. Given their better systems this is a deliberate delay in my view, to protect profits.

NAB

Their Australian variable rate home loans will decrease by 25 basis points. This will be effective from the 14th June.

Westpac

Their Australian variable mortgage rate will decrease by 20 basis point, though its Investor interest-only home loans will reduce by 35 basis points. This will be effective from the 18th June.

Generally investment mortgages now carry a higher mortgage rates than owner occupied lending of course.

Regionals and smaller players already have margin pressures and competitive disadvantage to cope with, yet they will have to keep their rates in line with the market to maintain new and existing business flows.

We are entering a diabolical phase in our interest rate history, and this signals ongoing economic weakness.