The Reserve Bank of New Zealand has released an important statement on the new approach they are going to adopt in policy setting. The focus will be on improving wellbeing. In addition they are expanding their dna to avoid group think. This follows their recent moves to lift bank capital.

There is so much here the RBA should embrace.

The Reserve Bank has significantly changed the way it makes monetary policy decisions, keeping itself in step with public expectations.

In a panel discussion last week at the Institute for Monetary and Economic Studies (Bank of Japan) in Tokyo, Reserve Bank Assistant Governor and General Manager of Economics, Financial Markets and Banking Christian Hawkesby talked about the importance of good decision making and governance, and of being credible and trusted, in achieving the long-term goal of improving wellbeing.

“We maintain our legitimacy as an institution by serving the public interest and fulfilling our social obligations. Keeping our ‘social licence’ to operate depends on maintaining the public’s trust that we are improving wellbeing,” Mr Hawkesby said.

“Thirty years ago New Zealand was prepared to accept a single expert – the Governor – making decisions about how to fight inflation. People now expect to see how and why decisions are made, expect that decision makers reflect wider society, and that current issues and concerns are factored into the decision making. By meeting these expectations, we can improve public trust in the legitimacy of the Reserve Bank’s work,” he said.

Mr Hawkesby outlined the new committee process that the Reserve Bank uses for deciding the official cash rate, noting that diversity among decision makers improves the pool of knowledge, insures against extreme views, and reduces groupthink.

“This diversity is needed to confront issues such as climate, technological, and other structural and social changes,” he said.

He also said that collaboration with government can be undertaken in a way that maintains the Reserve Bank’s political independence while working on the broader objective of improving wellbeing.

Here is the supporting speech.

Introduction

Tena koutou katoa

Thank you for the opportunity to talk about the Reserve Bank of New Zealand and the changes we are making to maintain our credibility in times of change.

I would like to focus on two building blocks of credibility:

- renewing a social licence to operate by aligning our objectives with the needs of the public; and

- achieving those objectives through good decision making enabled by a framework of good governance.

A common theme is the importance of transparency.

The imperative for change: Central banks in the 21st century

The first building block of credibility is the renewal of a social licence to operate—by this I mean the legitimacy an institution earns by serving the public interest. It is granted by the public when an institution is seen to fulfil its social obligations.1

New Zealand was the first country to officially adopt inflation targeting in 1989, with a number of central banks around the world following the example.2 Under a single-decision-maker model, we brought inflation down from around twenty percent to two percent in five years. In doing so, we helped build our credibility during the high-inflation environment of the times.3

Fast-forward to 2019, and monetary policy in New Zealand has undergone major change. Firstly, we have adopted a dual mandate, focused on achieving price stability and supporting maximum sustainable employment. Secondly, we have adopted a committee structure for decision making, and are delivering greater transparency in our decision making.

Why the change?

The reform of our framework was not merely a simple choice based on technical performance. As you can see in figure 1, when it comes to inflation and growth, over the past 30 years inflation-targeting central banks (e.g. New Zealand and the United Kingdom) have a pretty similar track record to central banks with a dual mandate (e.g. Australia and the United States). 4

The imperative for change comes from more than examining our history; it comes from our expectations of the future, and the present we find ourselves in. Our policy framework changed because times are changing. For the Reserve Bank to maintain its credibility and relevance, we must change too.

Figure 1: Inflation, and GDP growth across monetary policy frameworks5

Wellbeing of our people

Inflation has been low and stable in New Zealand for nearly 30 years.

There is a greater appreciation that low inflation is a means to an end, and not the end itself. In the fight to lower inflation that was perhaps easy to forget. The end goal is, of course, improving the wellbeing of our people.6

For many in the general public, employment is one tangible measure of wellbeing. Employment can provide an opportunity to earn your own wage, contribute to society, and live a fulfilling life.

It is in this light that the Reserve Bank Act (1989) has been amended to include a dual mandate with an employment objective alongside our price stability goal. Incorporating the objective of supporting maximum sustainable employment, and equally weighting it alongside inflation, emphasises our long-term goal of improving New Zealanders’ wellbeing. This aligns us with the needs of the public. And it helps us renew our social licence to operate – the first building block for maintaining our credibility.

But it is not enough for the public to believe in and understand our objectives. We must also prove to them that they can be achieved. This brings us to the second building block necessary for maintaining credibility: establishing modern governance principles for dealing with modern problems, and translating good governance into good decisions.

Good governance

In preparing for our dual mandate, and a formal Monetary Policy Committee (MPC), we have updated the principles and processes that form our governance framework for monetary policy.

In pursuit of greater transparency, we have also published these principles and processes in a comprehensive Monetary Policy Handbook (the Handbook). 7 This is an essential document, for everyone from school students to MPC members.

Importantly, it is also a living document that will evolve as our understanding evolves.

Principles

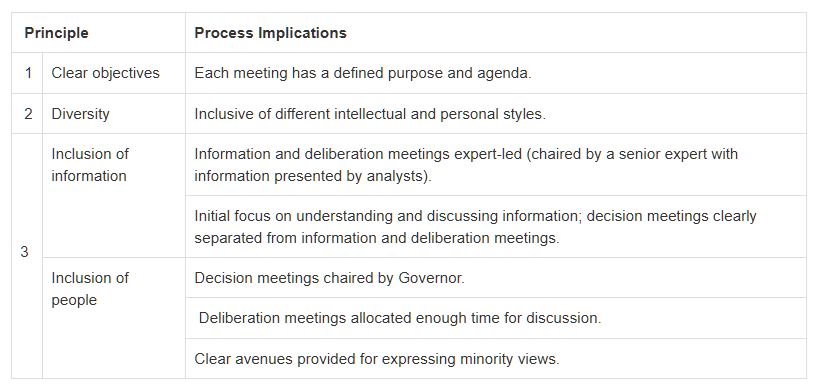

The first part of the Handbook I would like to cover is the section on MPC deliberation principles. 8

Figure 2: MPC deliberation principles

There are three principles which guide the deliberations within the MPC.

I’ve talked already about providing clarity around our objectives – the equal weighting of our employment and inflation goals. This is the first of our three principles.

The second, is diversity – diversity in the skills, experiences, thoughts, and personal characteristics of the MPC members.

The third, is inclusion – inclusion of information and people, ensuring decisions are made on the basis of all the available insights, and reflecting the views of all of the committee members.

Why are diversity and inclusion so important?

The governance literature shows that diversity and inclusion improves the pool of committee knowledge, insures against extreme views, and reduces groupthink.9 These principles drive the committee towards an unbiased policy decision – the best that is possible given existing information.

Think about this from a practical perspective. Modern monetary policy is confronted by diverse issues such as climate, technological, and other structural and social changes. A sole decision maker or uniform committee cannot possibly hope to possess the broad range of insights necessary to consider these issues.

A diverse committee operating in an inclusive environment can. It is these additional insights that improve collective understanding, and lead to better monetary policy decisions.

So you see these principles are not simply rhetorical devices. They are carefully chosen pillars to support our credibility though good decision making in achieving our dual mandate.

Good decision making

Processes

Our principles of good governance have directly influenced the policy-setting process of the MPC. 10 This is a process that has been designed with consensus-based decision making front and centre, consistent with the agreement with the Minister of Finance. 11

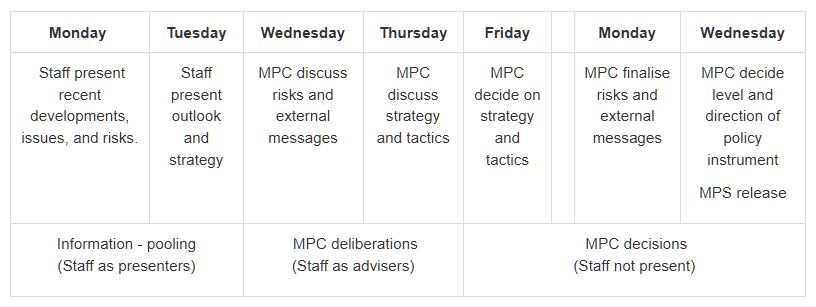

Figure 3: The structure of the forecast week for quarterly Monetary Policy Statements

We begin with information pooling, which flows through to MPC deliberations, and culminates in the final decision making meeting.

As you can see, the policy-setting framework is highly collaborative and deliberate. Deliberate in the sense that the process inspires lively debate, giving MPC members every possible chance to challenge assumptions, critique policy judgements and assess a range of policy strategies to achieve our dual mandate objectives.

A crucial part of this is that the MPC members hold back their views on the decision until the final stages, rather than starting with them. This supports evidence-based decision making and guards against confirmation bias.

The process begins with open information pooling on recent developments and the outlook for the economy. Here, the MPC have the opportunity to investigate and challenge the assumptions made in the staff’s initial forecasts. This is where the MPC member’s judgement enters the picture, and where creative tensions improve collective understanding.

While the MPC members may enter the room with different insights and questions about the economy, at the end of the information pooling stage the committee shares a common reference point for the economic outlook.

There are numerous opportunities to discuss and reflect on key issues, judgements, risks, strategy, and communication throughout the week. There are also a number of anonymous internal surveys we perform to gauge collective opinion among staff and MPC members.12

By the end of the week-and-a-half, the final monetary policy decision reflects the greater momentum of the MPC’s discussion.

We publish the final Official Cash Rate (OCR) decision, a Monetary Policy Statement (MPS), and a Summary Record of Meeting at the same time.

The Summary Record of Meeting captures the key judgements and risks underpinning the central forecasts and decision, as well as indicating where members of the MPC had different views. We identify any differing views, and communicate where the most significant uncertainties lie in our baseline forecasts.13 If consensus cannot be reached, a vote by simple majority would be carried out, and the reasoning behind different stances disclosed in the Summary Record of Meeting.

Our desire is that the transparency provided in the Handbook can help the public understand how the Bank’s collective ‘mind’ works. If the public can see the analytical rigour in our decision making, they should have greater confidence in the MPC’s conclusions, and thus more faith in the Reserve Bank.

Our credibility will be supported in the long run if the decisions made by the MPC are unbiased and effective ones. Our results will speak louder than our words.

Monetary policy strategy and our May decision

So far I’ve talked about the principles and processes we follow in setting policy. Now I’m going to cover how we ‘walk the talk’ in formulating our monetary policy decisions.14

Sound and effective monetary policy strategy requires more than just deciding whether the OCR should go up or down on any given day; instead central banks need to be transparent about their views of the economy over the medium-term and how monetary policy might respond to a changing economic landscape.

In this regard, around twenty years ago, the Reserve Bank became a pioneer in another way. When publishing our interest rate decisions, we also began to publish a forward (and endogenous) projection of interest rates in the future. We use this to capture the overall stance of monetary policy.

This tool remains integral to how the MPC sets monetary policy and understands the potential trade-offs with a dual mandate.

The first monetary policy decision of the new MPC occurred last month, in May. Our starting point was a New Zealand economy where the labour market was operating near maximum sustainable employment, and annual core inflation pressures were within our 1 to 3 percent target range but below the 2 percent mid-point.

We discussed the slowdown in global growth, and how this might affect New Zealand. We also addressed the recent loss of domestic economy momentum since mid-2018, through both tempered household spending and restrained business investment.

In order to continue achieving our policy objectives, we agreed that additional monetary stimulus was needed to help bring inflation back to the 2 percent mid-point and support maximum sustainable employment. We then turned to the question of the magnitude of stimulus we wanted to adopt (the stance) and the timing and means by which we would try to deliver this (the tactics).

Figures 4–6 show how different OCR paths could have been used to achieve our objectives. While each path was consistent with meeting our objectives, they each offered different trade-offs.15

Figure 4: Official Cash Rate (OCR) paths to achieve alternative monetary policy stances

Figures 5-6: Inflation, and employment gap under alternative OCR paths

If we kept rates unchanged (the higher OCR path), our projections suggested that it would have taken a number of years for inflation to return to target, and employment would have fallen below the maximum sustainable level. If we lowered the OCR by around 75 basis points over the next 12 months (the lower OCR path), our projections suggested it would result is a situation where both inflation and employment would be overshooting their targets.

By contrast, the baseline (our final published projection), with the OCR around 40 basis points lower over the next 12 months, brought inflation back to target in a reasonable time period, with employment remaining near the maximum sustainable level. We decided this path captured our preferred strategy, and was robust to the key risks we had discussed.

After agreeing on the appropriate stance of monetary policy, MPC turned to the tactical decision of where to set the OCR at the May meeting, and decided to cut the OCR by 25 basis points to provide a more balanced outlook for interest rates.

This brings us to discuss the future.

Maintaining credibility in the future

Our central view is that New Zealand’s interest rates will remain broadly around current levels for the foreseeable future. However, we need to be ready to adapt to changing conditions, to meet our objectives even when confronted with unforeseen developments.

An issue that policymakers and academics are grappling with around the world is the role of both monetary and fiscal stimulus in a world of low interest rates.

There is emerging consensus that coordination is necessary for an optimal response of broader macroeconomic policy.16 For central banks, operational independence does not have to mean operational isolation. Rather, collaboration with government can be done in a way that builds and reinforces the social licence to operate, by showing a willingness to work with other partners to do whatever is necessary to achieve the broader objective—improving public wellbeing.

Even with coordination between monetary and fiscal policy, if further macroeconomic stimulus is needed quickly, the first line of defence will still inevitably fall upon central banks.17

In New Zealand, we are in the strong position of having further room to provide conventional monetary stimulus if required (using the OCR).

Having effective unconventional policy options expands the toolbox of a central bank, which is naturally more relevant in a low interest rate environment. In this spirit, we published a Bulletin article last year on the practicalities of unconventional monetary tools in a New Zealand context, and we continue to learn from the lessons of our central banking cousins.18

It’s better to have a tool and not need it, than need one and not have it.

Conclusion

In the Handbook, we explore the history of central banking objectives, and see how dramatically they have evolved over time. 19 We haven’t always had a mandate to support maximum sustainable employment, or to achieve price stability, or even control over interest rates or the money supply.

Nothing lasts forever, and it is possible that the role of central banks may change again in the future. Our Handbook will inevitably change. We need to be ready to adapt when changes beckon.

And it is not enough to grudgingly adapt. In order to maintain credibility, central banks must embrace change and prove to the public that they are capable of delivering on their objectives. To remain credible is to remain relevant. Central banks should keep their eyes open, and be ready to change tack. Our destination—a world with improved wellbeing for our citizens—may not change, but the best route for getting there may.

We must adapt. We must continue to improve the wellbeing of our citizens. We must remain credible.

Meitaki.

Thank you.

– The RBNZ now focussed on “improving wellbeing” ?? Does the RBNZ fear riots in the streets of e.g. Auckland or Christchurch (hint, hint) ? Well, there is a very simple recipe to “improve wellbeing”: 1) Make the banks write off a very sizeable amount of the outstanding debt. 2) make sure wages increase at a healthy pace.

– Yes, inflation was low in the last 30 years but that is the result of wages remaining “stagnent” as well. And ask yourself: Do the RBA or RBNZ determine the level of wages ?

Mindful forward thinking attitude by the kiwis. We desperately need more transparency here.