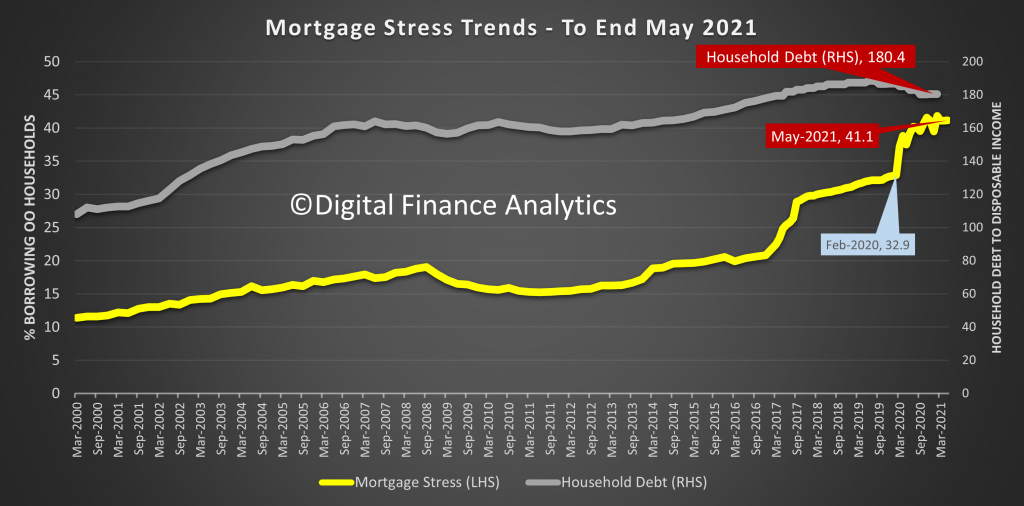

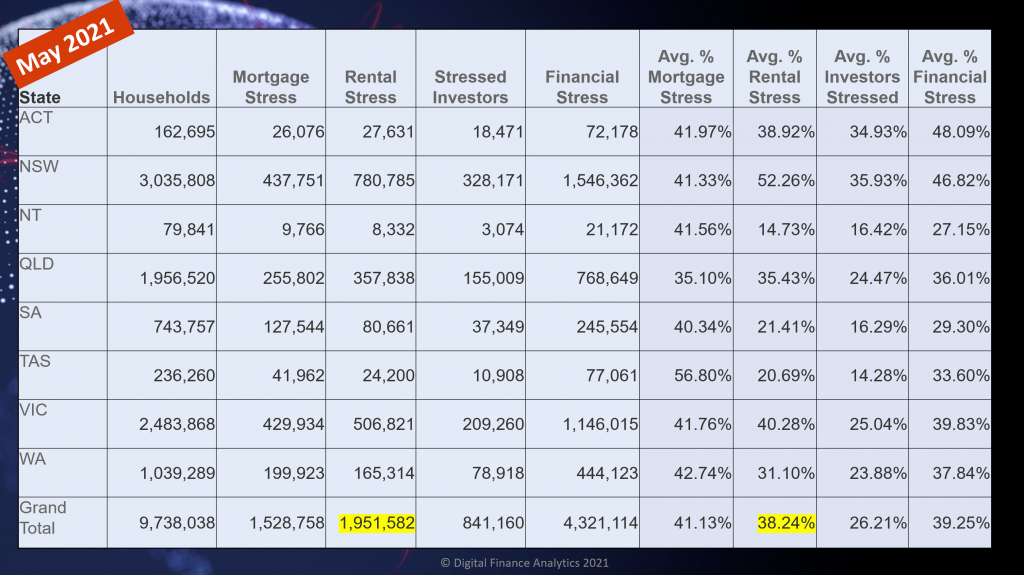

The latest data from our household surveys for May revealed little change in mortgage stress among households – still at around 41%, but there was a shocking rise in rental stress as the JobSeeker and JobKeeper supports were withdrawn, and the random lock-downs continue.

Even Property “experts” accept that affordability has deteriorated recently, as house prices rocket higher in many suburbs, although of course real interest rates are very low, for now, if rising ahead.

Our approach to measuring stress is unique in that we examine household cash flow – money in and money out. Given that many households saved hard last year though the heights of COVID, it is not surprising to see many now draining down those savings, by spending more. This means that their cash flow will in net terms be negative for now, and so will register as stressed. That said, if spending continues unabated financial difficulties will eventuate.

In addition we continue to see more households reaching for credit (from Buy Now Pay Later, to Pay Day loans) as well as equity release from property. In fact the latest hikes in perceived values has led to a run of refinancing, to try and pay down debt, or to provide funds to offspring for property purchase via the Bank of Mum and Dad. Again these one-off moves can adversely impact household stress measures in our methodology.

And we also note that many prefer not to accept the truth that some households are not home and clear in terms of their finances, given the uncertain part-time work, multiple jobs and zero hours contracts which many are on. But we continue to analyze households in net cash flow terms. If more funds drain away, compared with income, they are classified as stressed.

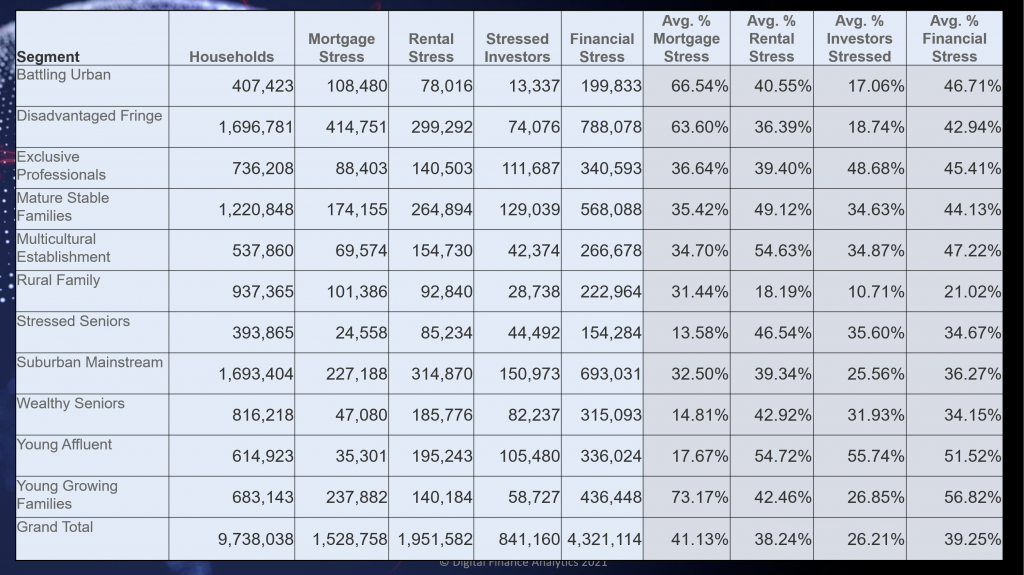

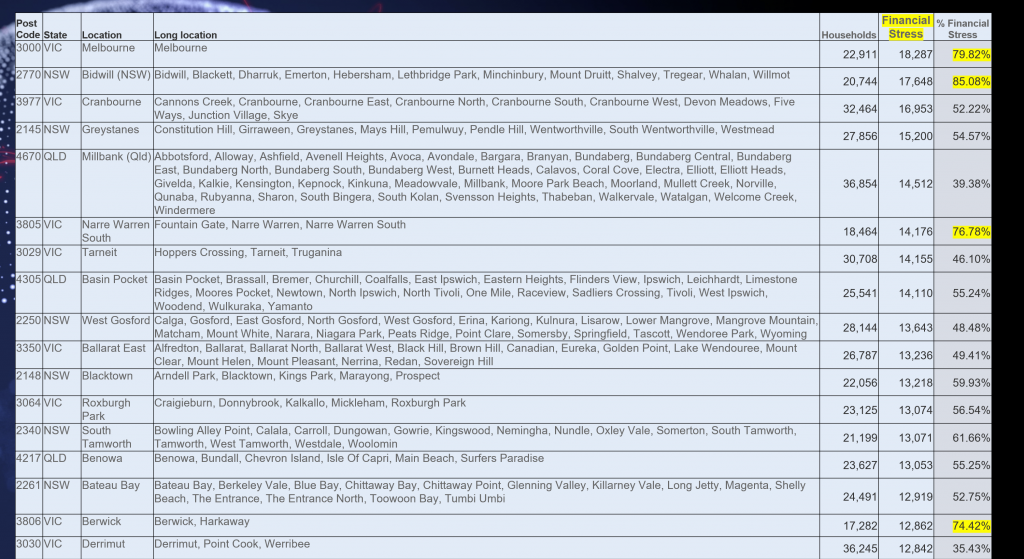

Across our segments we continue to see quite different dynamics emerging, with many younger households (often first time buyers) impacted, alongside the high growth corridors containing many first generation Australians, as well as some more affluent groups. Financial Stress takes no prisoners.

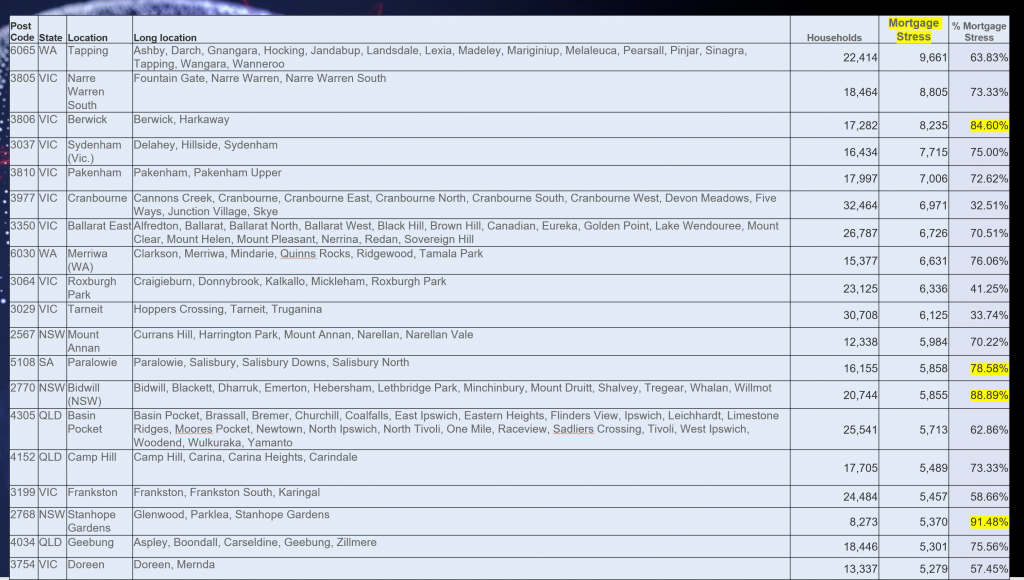

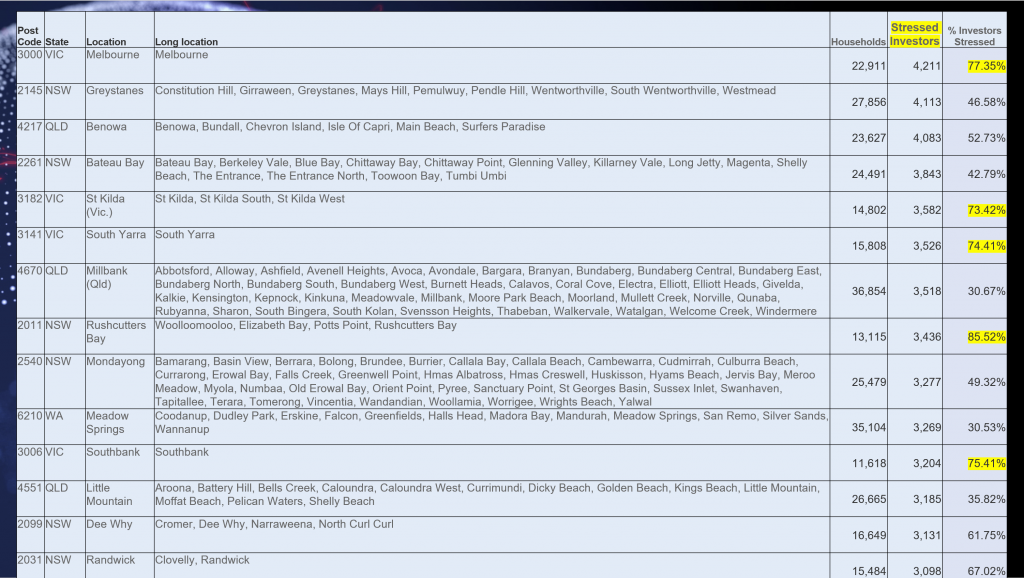

The mortgage stress counts are highest in high growth corridors in WA and VIC – where in some cases more than 80% of households in the area have cash flow issues.

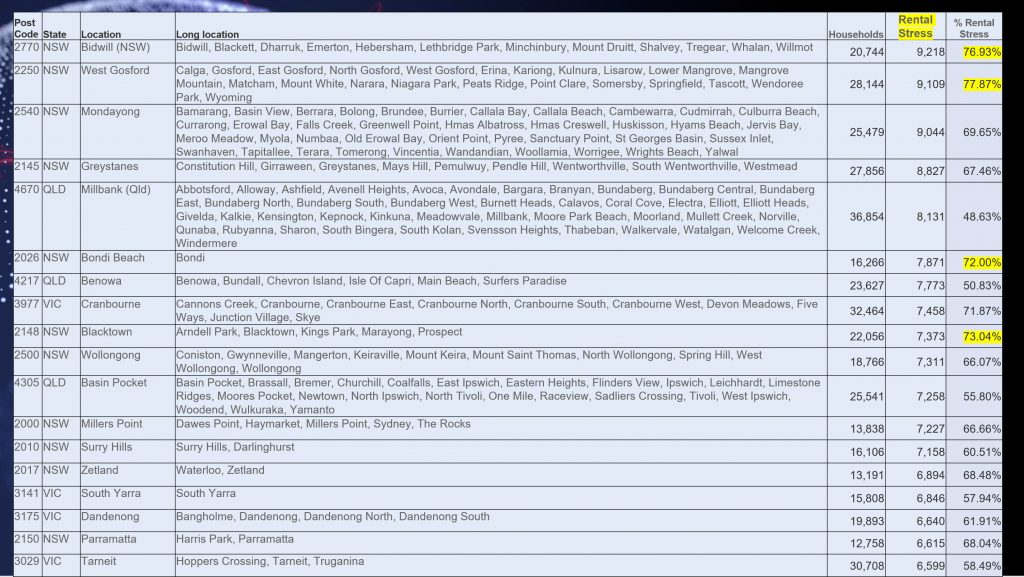

Rental stress is more strongly registered in NSW and QLD, with Western Sydney and the Central Coast and Bundaberg in the top 10.

Property investors are having difficulty in Melbourne 3000, thanks to the lack of students and ongoing lock-downs. A number of VIC suburbs are impacted thanks to high vacancy rates, negative net yields and falling apartment values.

Overall financial stress, our aggregate measure reveals that Melbourne 3000 has the highest stress levels. That is followed by a number of the high growth corridors.

The continued pressure on households from low income growth, and rising living costs will persist, while the risks of interest rate rises grow with the competition of the Term Funding Facility at the end of June.

Households continue to wait for a magic bullet to solve their financial flow issues, and while some can draw on savings and equity, or reach for more credit, unless spending patterns are understood (half have no budgets), we think these trends will continue to bubble away.

Of course, financial stress is not the same a mortgage default, but those with cash flow issues are more likely later to end up having to sell their home, unless remedial action is taken.

Households in financial stress should certainly speak to their lender, prioritise spending, and be cautious about further loan commitments. There is no income growth “get out of jail card” for now.