Since the Great Financial Crisis, central banks in the major economies have adopted a whole range of new measures to influence monetary and financial conditions. The measures have gone far beyond the typical pre-crisis mode of operation – controlling a short-term policy rate and moving it within a positive range – and have therefore come to be known as “unconventional monetary policies.” To be sure, some of these measures had already been pioneered by the Bank of Japan roughly a decade earlier in the wake of that country’s banking crisis and uncomfortably low inflation. But no one had anticipated that they would spread to the rest of the world so quickly and become so daring, testing the boundaries of the unthinkable.

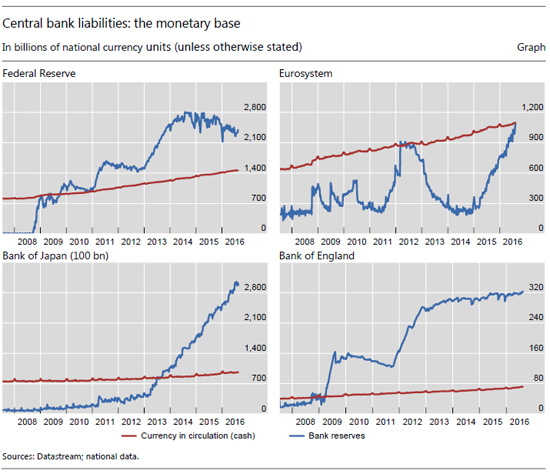

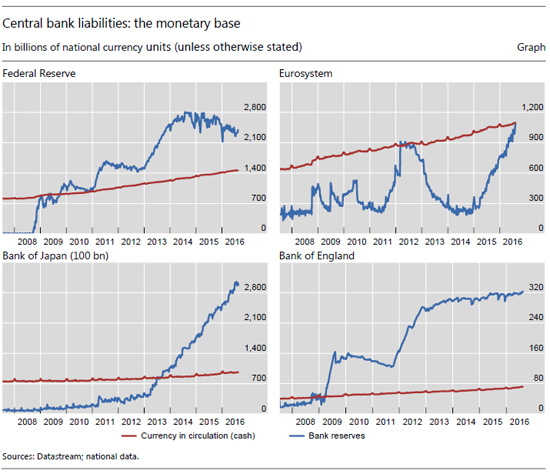

As growth has remained disappointing and inflation stubbornly below targets, the range and size of these measures have increased. Hence the growing use of long-term liquidity support, large-scale asset purchases, sizable increases in bank reserves (so-called QE) and, of late, even the introduction of negative policy rates. In the wake of these measures, the central banks’ monetary base (cash and bank reserves) has ballooned in step with the overall size of their balance sheets (see graph).

With central banks delving further down into their box of unconventional tools, calls for them to take a deep breath and pull out “helicopter money” have intensified. What was just a thought experiment designed to shed light on how money affects the economy is now threatening to become a reality. Proponents of this tool – more soberly described as “overt money financing” of government deficits – see it as a sure-fire way to boost nominal spending by harnessing central banks’ most primitive power: their unique ability to create money at will. But can helicopter money work in the way its proponents claim? And is the balance of benefits and costs worth it? Our answer to both of these questions is no.

With central banks delving further down into their box of unconventional tools, calls for them to take a deep breath and pull out “helicopter money” have intensified. What was just a thought experiment designed to shed light on how money affects the economy is now threatening to become a reality. Proponents of this tool – more soberly described as “overt money financing” of government deficits – see it as a sure-fire way to boost nominal spending by harnessing central banks’ most primitive power: their unique ability to create money at will. But can helicopter money work in the way its proponents claim? And is the balance of benefits and costs worth it? Our answer to both of these questions is no.

Proponents argue that helicopter money is special because it amounts to a permanent increase in non-interest bearing central bank liabilities (“money”) as the counterpart of the deficit. This form of financing is most effective because money is free and debt is not. Permanent monetary financing means less government debt and thus lower interest payments forever. All else equal, this saving should boost nominal demand, as there would be no need to raise additional taxes. Moreover, the argument continues, the central bank is then free to increase interest rates again whenever it wishes while the lower amount of debt outstanding will still yield savings. This is the best of all possible worlds: Demand is boosted without the collateral damage of prolonged exceptionally low interest rates.

Devil in the details

Or so it seems. But the devil is in the details.

As we have argued elsewhere, the reasoning may be correct in the stripped-down models people have in mind, but not in reality. In fact, the central bank faces a stark choice: Either helicopter money results in interest rates permanently at zero, so that control over monetary policy is lost forever, or else it is equivalent to either debt or to tax-financed government deficits, in which case it would not yield the additional boost. Since losing monetary policy control forever is not a feasible option, helicopter money is just fiscal policy dressed up.

The reason is hidden in an obscure but critical corner of the financial market. Contrary to what the stylized models suggest, it is not the amount of cash that determines interest rates but what the central bank does with bank reserves (commercial banks’ deposits at the central bank), over which it has a monopoly. Monetary deficit financing will, in effect, amount to an equivalent increase in bank reserves. If the central bank issued more cash than people demanded, the amount in excess of desired balances would inevitably be converted into bank deposits and then switched by banks into reserves (see in the graph how steadily and slowly cash grows, reflecting the demand for it). If the government issued checks, the same would happen. If the reserves are non-interest bearing – as they must be for helicopter money – the increase will inevitably also drive the short-term (overnight) rate to zero. This is because when the system as a whole has an excess of reserves, no one wants to be left holding it but someone must.

The problem arises once the central bank decides to raise interest rates again, as this, alas, would not be consistent with helicopter money. To do so, the central bank has only two options. Either it pays interest on those reserves at the policy rate, in which case this is equivalent to debt financing from the perspective of the consolidated public sector balance sheet – there are no interest savings. Or else it imposes a non-interest bearing compulsory reserve requirement to absorb the reserves, but this is equivalent to tax financing – someone in the private sector must bear the cost. While the tax would in the first instance fall directly on banks, they could decide to pass it on to their customers — for example, in the form of higher intermediation spreads.

Thus, either helicopter money comes at a prohibitive price – giving up control over monetary policy forever – or else, choreography and size aside, in its watered-down version it is not very different from what some central banks have already been doing: engineering temporary increases in reserves which may happen to coincide with increases in government deficits (a form of QE). Views about QE’s effectiveness differ, but we would be talking about “more of the same.” Such a policy already exploits the synergies between ultra-low interest rates and fiscal policy so as to enhance any expansionary impact that fiscal policy may have.

That said, choreography and size do matter. And they don’t speak in favor of the tool. Imagine policymakers went down this route, announcing that they were embarking on a “new” policy and explicitly linking the increase in reserves with higher public sector deficits. They could hide the inconvenient truth and renege on their promise not to raise rates. But this would hardly be an example of good policy, and in any case its effectiveness would at best be doubtful – the private sector would surely anticipate this possibility to some extent, thereby tempering the impact of the signal. Alternatively, policymakers could hope that the fanfare surrounding the tool would induce people to spend more. This is a possible but by no means obvious outcome. And in any case, unless the exercise is repeated over and over again on a large scale, its impact is likely to be only temporary.

And therein lies the danger. It is hard to imagine helicopter money not ending up in fiscal dominance, the outcome that would obviously be inevitable in its purest form, where interest rates are kept at zero forever. Sooner or later this could indeed erode the value of money, but at the cost of losing the public’s confidence in our monetary institutions – a trust so painfully gained over the years – and with unpredictable consequences. It would be a Pyrrhic victory.