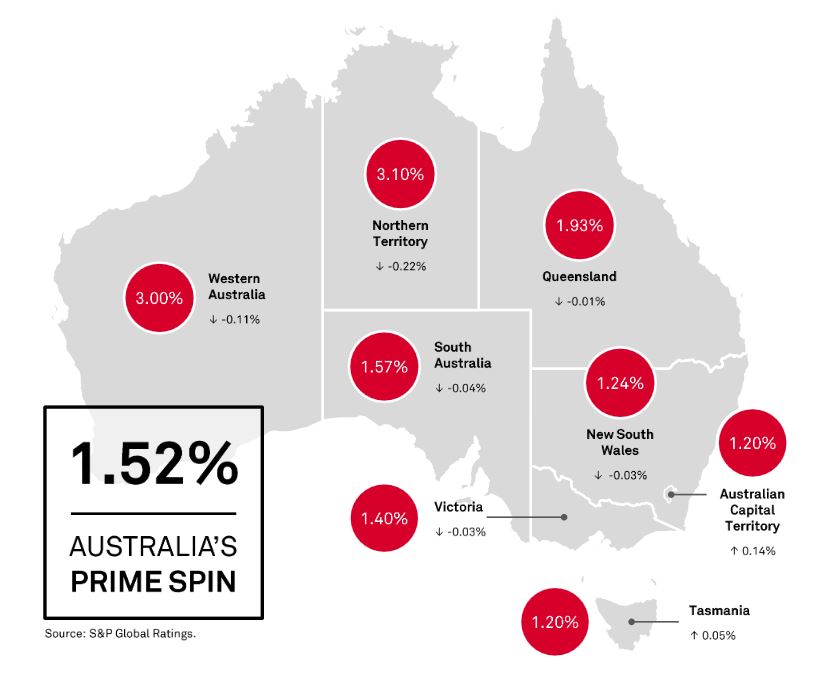

Moody’s released their SPIN index for May 2019. Their overall score slid just a little to 1.52%, though with significant regional variations.

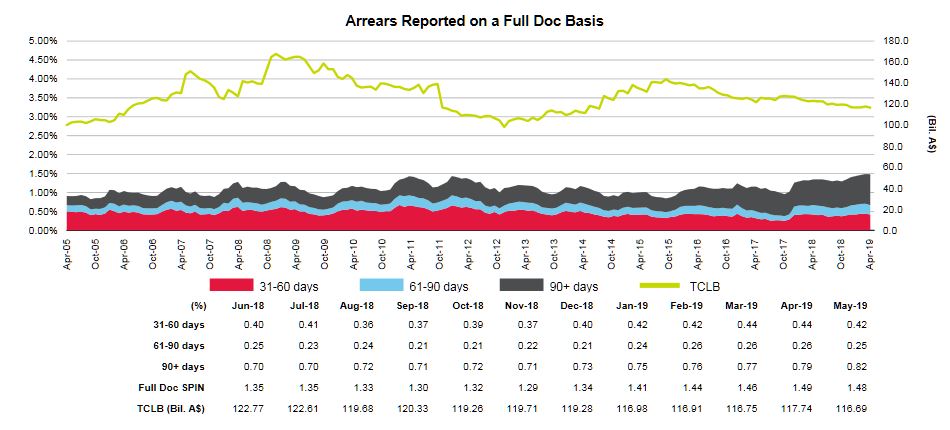

However, 90 days+ default rates continued higher.

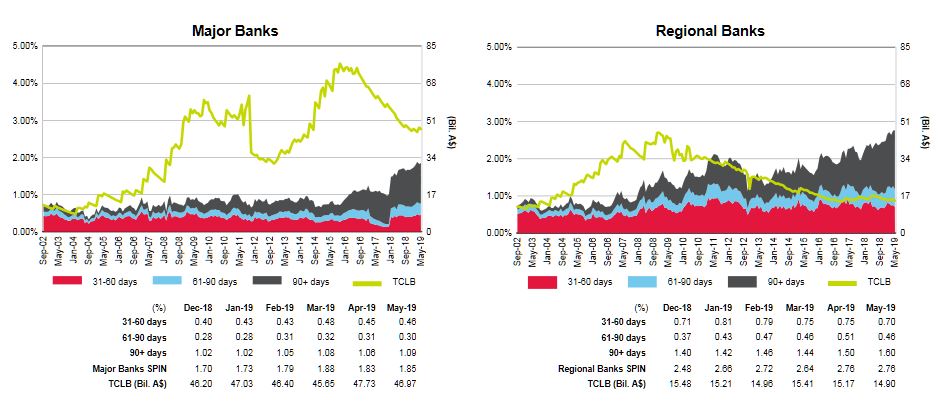

There were rises in 90 day issues in both the regional and major banks books.

A caveat of course is these are mortgages in securitised loan pools, so they may not represent the total market. However, given the current mortgage stress levels we are seeing, it is likely defaults will rise further in the months ahead. That is unless the tax cuts and lower mortgage rates changes the dynamic.