The Australian Prudential Regulation Authority (APRA) has launched a review of the capital treatment of authorised deposit-taking institutions’ (ADIs’) investments in their banking and insurance subsidiaries. It is open for consultation until 31 January 2020. APRA intends to finalise the changes to the Prudential Standard in early 2020 with the updated Prudential Standard to come into force from 1 January 2021.

At first review, this looks like some of the Australian majors will large New Zealand subsidiaries will need to hold more capital (which costs), or shrink their off-shore operations in New Zealand. But more analysis will be required to determine the true impact relative to their Australian businesses and capital holdings.

This review was prompted in part by recent proposals by the Reserve Bank of New Zealand (RBNZ) to materially increase capital requirements in New Zealand. The RBNZ’s proposals and APRA’s processes are a natural by-product of both regulators working to protect their respective communities from the costs of financial instability and the regulators continue to support each other as these reforms are developed.

APRA is proposing to change the capital treatment for these exposures and this particular proposal is the most significant amendment to APS 111. In developing the proposal, APRA has considered long-established trans-Tasman arrangements provided for in the Australian Prudential Regulation Authority Act 1998 and the RBNZ’s enabling legislation, under which the agencies assist each other in the performance of their regulatory responsibilities. This is particularly important given the four major Australian banks are the shareholders of the major banks in New Zealand.

APRA’s capital requirements currently permit ADIs to leverage their investments in banking and insurance subsidiaries, whether domestic or offshore, and as such do not require dollar-for-dollar capital for these investments at the parent company level. This treatment raises the risk that capital held by the parent ADI is not sufficient to support risks to its depositors. Any reforms by other regulators to materially increase their capital requirements, including those proposed by the RBNZ, could exacerbate this risk.

At current levels of equity investment, APRA estimates the existing treatment provides an uplift to the average Common Equity Tier 1 (CET1) Capital ratio across the four major Australian banks of around 100 basis points for their equity investments in New Zealand banking subsidiaries. As a consequence, capital available to support risks to Australian depositors could be overstated.

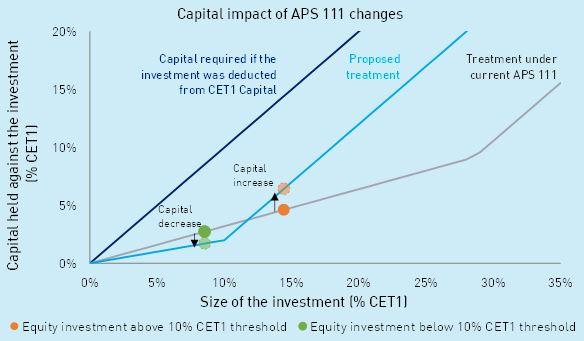

As APRA is more concerned about large concentrated exposures, it is proposing to limit the amount of the exposure to an individual subsidiary that can be leveraged to 10 per cent of an ADI’s CET1 Capital. This means capital requirements are increasing for large concentrated exposures, as amounts over the 10 per cent threshold would be required to be met dollar-for-dollar by the ADI parent company. APRA is less concerned about small equity exposures in banking and insurance subsidiaries and so capital requirements will decrease for small exposures. Amounts under the 10 per cent threshold would be risk weighted at 250 per cent and included as part of the related party limits detailed in APRA’s recently finalised Prudential Standard APS 222 Associations with Related Entities (APS 222).

The diagram outlines the boundaries between a full deduction approach (dark blue line), the current treatment (grey line) and the treatment proposed in this Discussion Paper (light blue line). These represent the boundaries that balance the size of the investment with the capital required under the limits in APRA’s prudential framework for equity investments (APS 111) and related entities (APS 222).

A full deduction approach will result in dollar-for-dollar capital for this investment, regardless of the size of the investment. The treatment under the current APS 111 is a 300 per cent (if the subsidiary is unlisted) or 400 per cent (if the subsidiary is unlisted) risk weight for this investment. The proposed treatment in this Discussion Paper for this investment will depend on the size of the investment; for an equity investment below 10 per cent CET1 Capital, the investment is risk weighted at 250 per cent, with amounts above the 10 per cent CET1 Capital threshold deducted from CET1 Capital. Under the proposed treatment, capital requirements are decreasing for small exposures and increasing for large concentrated exposures.

APRA has calibrated the proposed capital requirements so they are broadly consistent with the Basel treatment of a banking group’s equity investments in non-consolidated financial entities, and also with the current capital position of the four major Australian banks, in respect of these exposures (i.e. preserving most of the existing capital uplift).

APRA is not proposing a full dollar-for-dollar capital requirement for an ADI’s equity investments in these subsidiaries, in recognition of the benefits of subsidiaries that are subject to prudential regulation, and that ownership of banking and insurance subsidiaries generally provides some beneficial diversification. However, as these exposures increase in size, the concentration risk associated such investments start to outweigh the diversification benefits. Requiring dollar-for-dollar capital for amounts above 10 per cent CET1 Capital reduces the risks to Australian depositors of increasing levels of these exposures.

The finalisation of the RBNZ’s proposed capital reforms, will, in all likelihood, require higher capital requirements for banks in New Zealand. Should Australian ADIs fund higher capital requirements in New Zealand by retaining the profits of their New Zealand subsidiary banks in those subsidiaries, no material additional capital, in aggregate, is likely to be required by Australian ADIs.

Other proposed changes to APS 111 include:

- promoting simple and transparent capital issuance by removing the allowance for the use of special purpose vehicles (SPVs) and stapled security structures; and

- clarifying and simplifying various parts of APS 111, which comprise the bulk of the proposed changes.

APRA does not consider its proposal to remove the use of SPVs and stapled security structures as material as these structures have not been a feature of ADI capital issuance since 2013 and, in the case of stapled security structures, less attractive for ADIs under the Basel III capital reforms.

APS 111 is open for consultation until 31 January 2020. APRA intends to finalise the changes to the Prudential Standard in early 2020 with the updated Prudential Standard to come into force from 1 January 2021. APRA is open to working with impacted ADIs on appropriate transition.