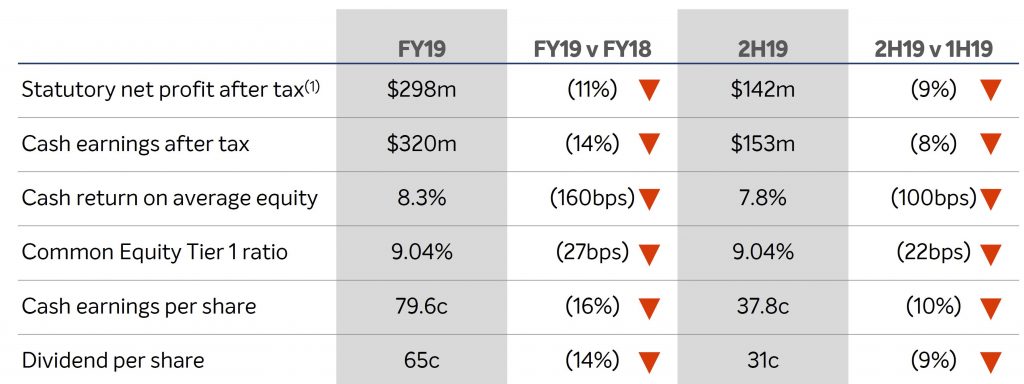

Bank of Queensland today announced FY19 cash earnings after tax of $320 million, down 14 per cent on FY18. Statutory net profit after tax decreased by 11 per cent to $298 million. Basic cash earnings per share was down 16 per cent to 79.6 cents per share. We expect many banks to report a similar story ahead.

The Board has announced a final dividend of 31 cents per share, for a full year dividend of 65 cents per share. This is a reduction of 11 cents per share from FY18. The final dividend payout ratio of 82% was consistent with the interim dividend payout ratio.

They described this as “Disappointing results reflect challenging operating environment”, reflecting a challenging operating environment characterised by slowing credit demand, lower interest rates, a rise in regulatory costs and changes impacting non-interest income.

Total income decreased by $21 million or two per cent from FY18.

Net interest income decreased $4 million, driven primarily by a five basis point reduction in net interest margin to 1.93 per cent. This reduction is attributable to the declining interest rate environment and continued strong competition for loans and deposits.

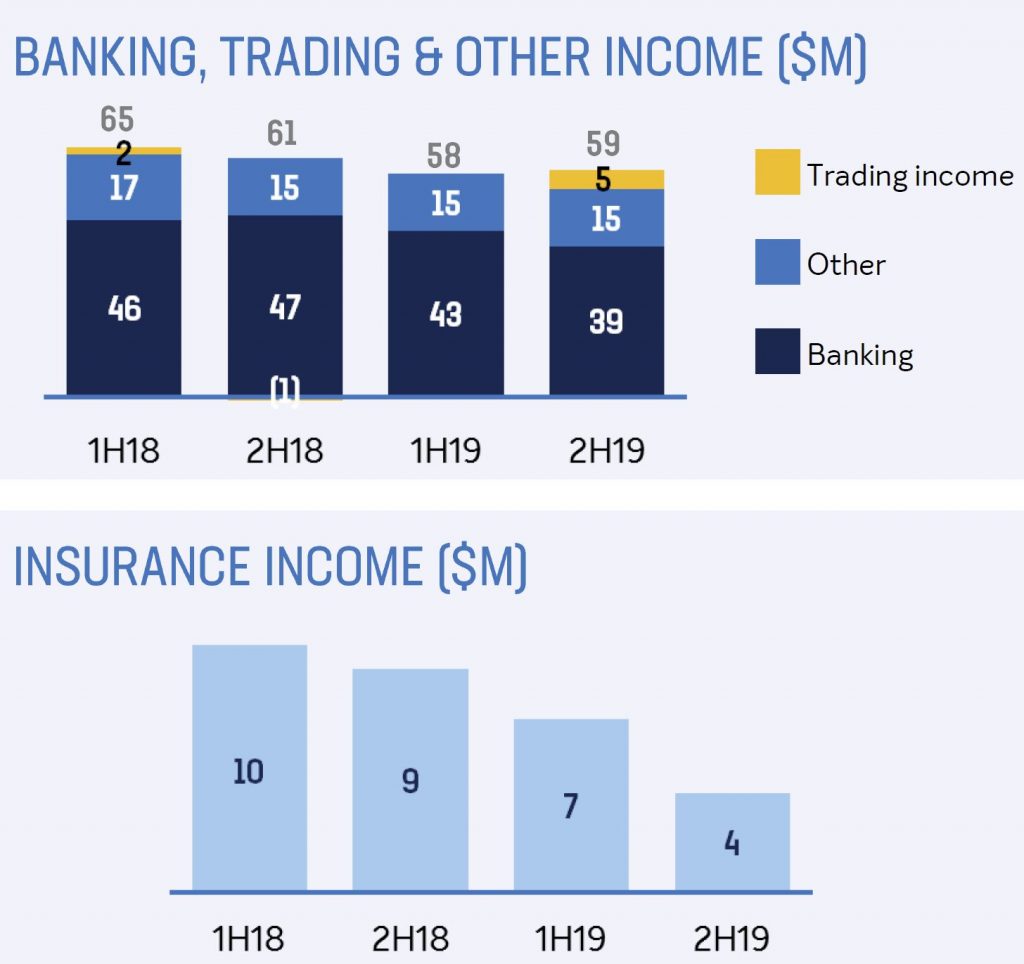

Non-interest income decreased 12 per cent or $17 million, driven by declines in Banking, Insurance and Other income but partially offset by improved Trading income. Banking income reduced $11 million due to lower fee income and a change in arrangements related to BOQ’s merchant offering. Insurance income reduced $8 million or 42 per cent due to changes in the insurance sector which ultimately impacted distribution of St Andrew’s consumer credit insurance through its corporate partners.

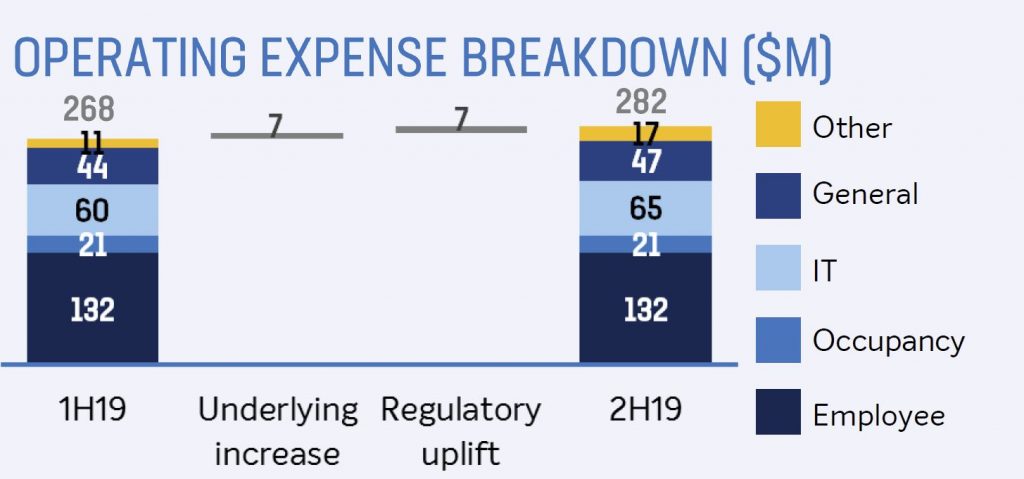

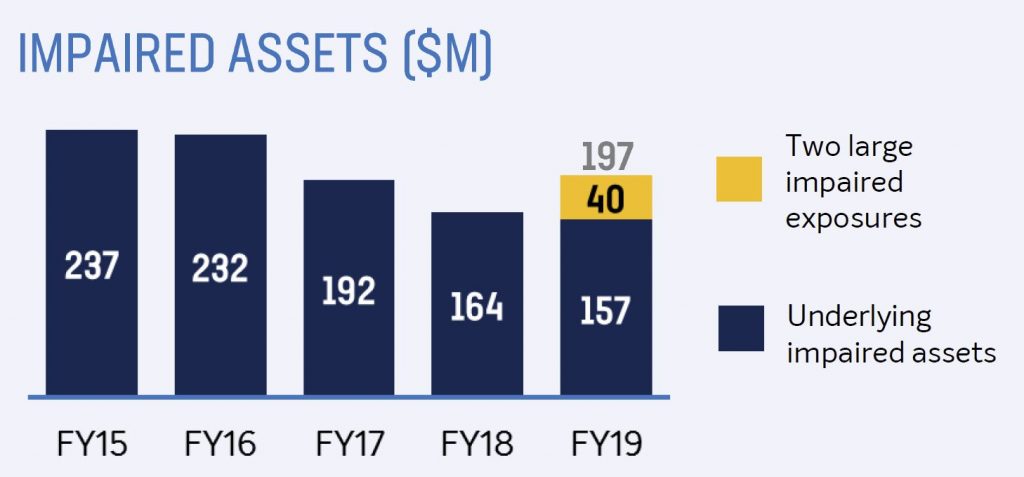

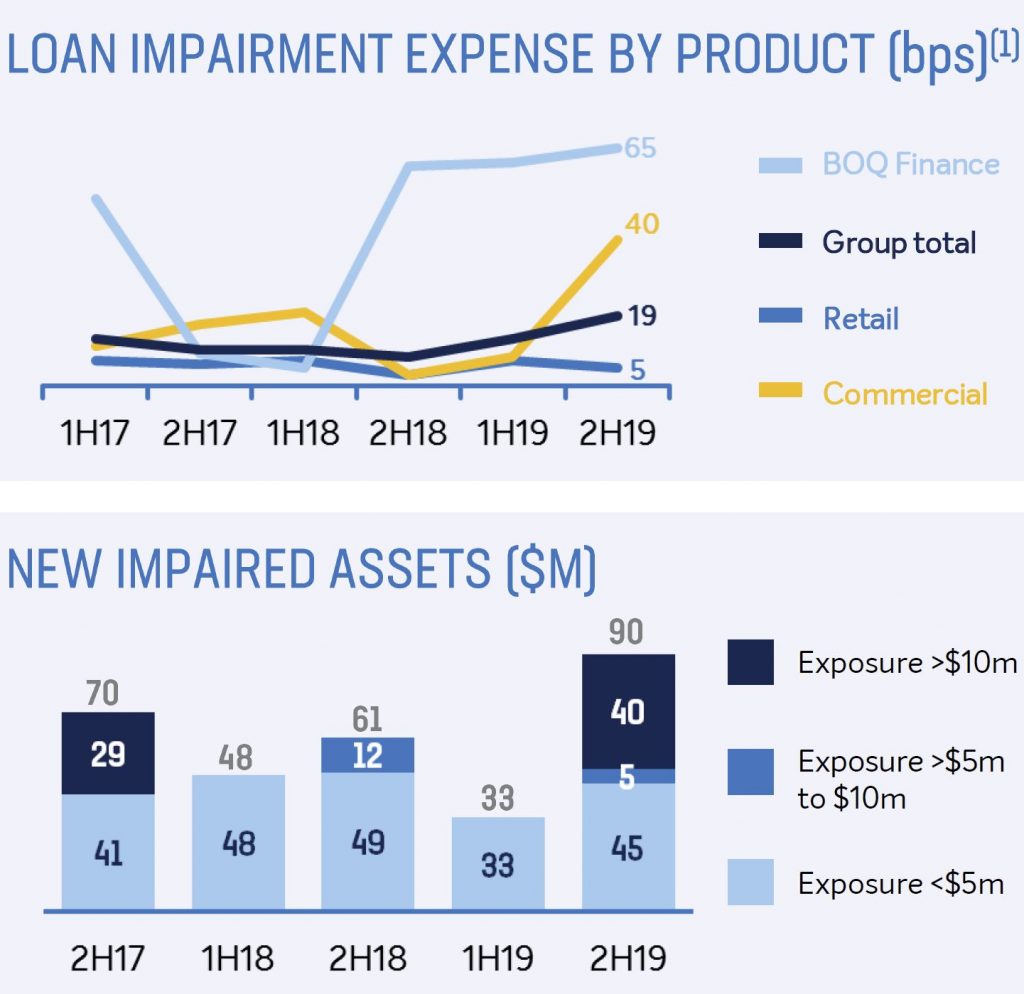

In line with the guidance provided at the 1H19 result, operating expenses increased by $23 million or four per cent from FY18. The increase in expenses was more pronounced in the second half, due to an increase in business deliverables addressing regulatory and compliance requirements. While loan impairment expense increased $33 million to $74 million, equivalent to 16 basis points of gross loans, underlying asset quality remains sound with impairments and arrears remaining at low levels.

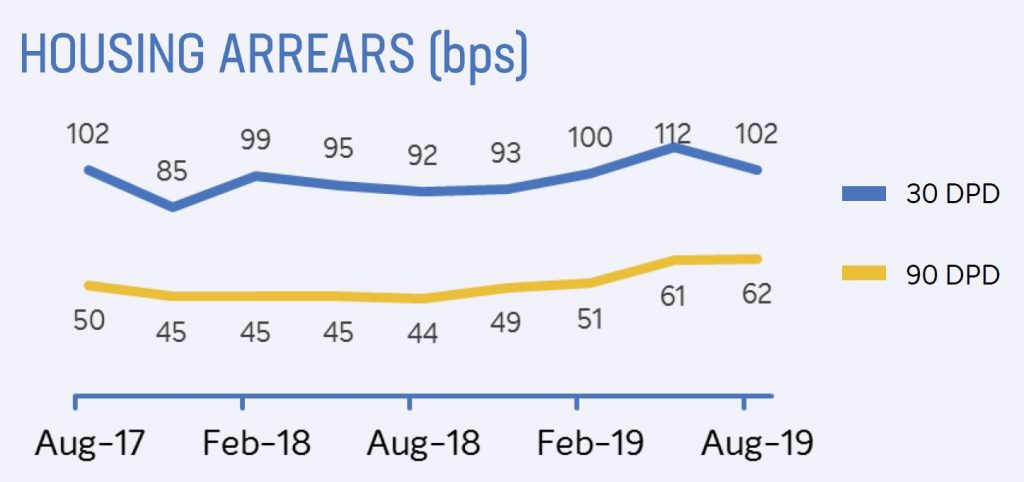

Housing loan arrears over 90 days rose, while 30 day fell.

Implementation of BOQ’s new AASB 9 collective provision model drove an increase in collective provisions due to changes in BOQ’s portfolio and a weaker economic outlook. The increase in collective provisions contributed $22 million of the loan impairment expense uplift.

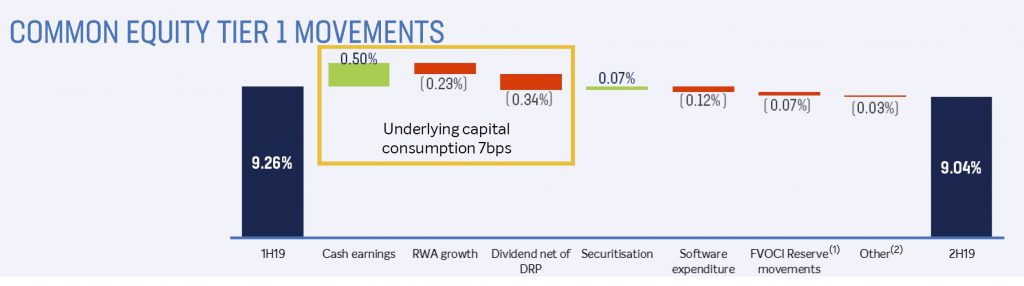

BOQ remains appropriately capitalised with a Common Equity Tier 1 ratio of 9.04 per cent, which is a decrease of 27 basis points from FY18. The reduction was driven by a combination of asset growth being tilted to more capital intensive business lines, increased capitalised investment, reduced earnings and lower participation in the dividend reinvestment plan.

Overall lending growth of two per cent was achieved over the year.

Continued growth momentum was evident in BOQ’s niche business segments. The BOQ Finance portfolio achieved growth of $667 million or 15%, while BOQ Specialist grew lending balances by $756 million across its commercial and housing loan portfolios which are focused on the medical segment. Virgin Money also delivered a consistently strong level of housing loan growth, with the portfolio growing by $914 million to over $2.5 billion.

A key imperative remains rebuilding the foundation for growth in BOQ’s retail bank, which saw a further contraction of $1.4 billion in its residential housing loan book.

Solid progress has also been made across a number of key foundational investments during the year. BOQ’s core technology infrastructure modernisation program has continued to track to plan, with implementation continuing through FY20. This will deliver a more modern, cloud-based technology environment which will allow for improved change capability.

During the year, work began on development of a new mobile banking application for BOQ customers, with a launch expected in 2020. Lending process improvements have also been a key focus to improve customer experience, particularly for home loan applications. A number of regulatory projects have also progressed during the year to address various regulatory and industry changes. These are all critical investments that will support BOQ’s transformation and future aspirations.

Investment in the implementation of a new Virgin Money digital bank has also progressed during the year, with a customer launch planned for 2020. This will require $30 million of capitalised investment during FY20 to complete the phase one build which will deliver a transaction and savings account offering to customers. This is an investment in long term value creation for this iconic brand which has demonstrated success in attracting customers across its existing product suite. It is also anticipated that this investment in a new digital banking platform will be leveraged across the Group in the years ahead.

Commenting on the results and outlook for BOQ, new Managing Director & CEO George Frazis said that there are challenges ahead, however fundamentally, BOQ is a good business.

“Our capital is well positioned for ‘unquestionably strong’, we have a good funding position and our underlying asset quality is sound.

“There are numerous opportunities ahead for a revamped BOQ and I will be working closely with the executive leadership team to complete our strategic and productivity review, with a market update on our plans in February 2020,”