Edwin Almeida, our property Insider and I discuss the latest, and answer a number of questions from followers.

https://www.ribbonproperty.com.au/

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

Edwin Almeida, our property Insider and I discuss the latest, and answer a number of questions from followers.

https://www.ribbonproperty.com.au/

Go to the Walk The World Universe at https://walktheworld.com.au/

The latest edition of our finance and property news digest with a distinctively Australian flavour.

CONTENTS

0:00 Start

0:34 Introduction

0:44 RBA On Property Prices

4:00 Retail Trade Figures

7:24 Home Ownership Pipe Dream

14:30 Over-reliance On Property

18:40 University Jobs Are Going

22:10 US Jobless Claims

26:30 UK Negative Rates And Bank Of England

29:20 Conclusions and Outtro

Go to the Walk The World Universe at https://walktheworld.com.au/

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/

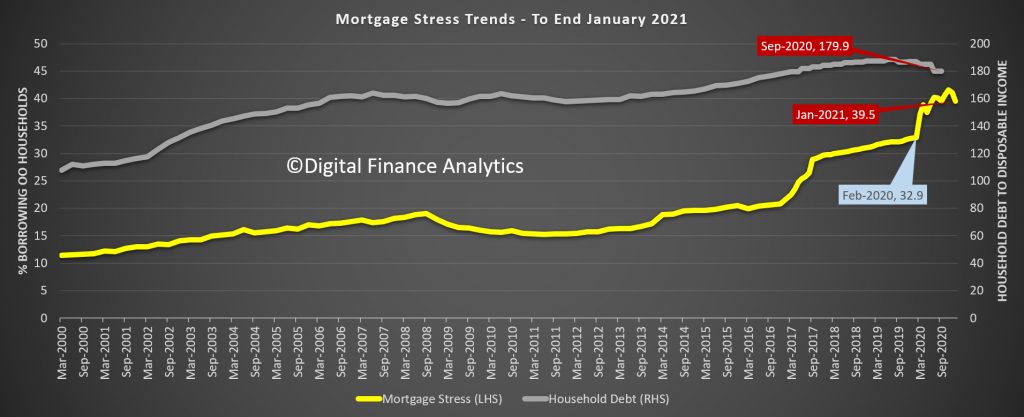

The latest results from our household surveys reveals that by the end of January 2021, overall levels of mortgage stress dropped below 40%, to 39.5% – still well above the level prior to the virus hitting.

This is a consequence of lower mortgage rates following the RBA cash rate cuts, liquidity support and quantitative easing, plus less impact from the virus on lock-downs and employment. That said, whilst many households have grown their savings buffers, a considerable number remain close to the edge, in cash-flow terms. More than 1.4 million mortgaged households remain under pressure

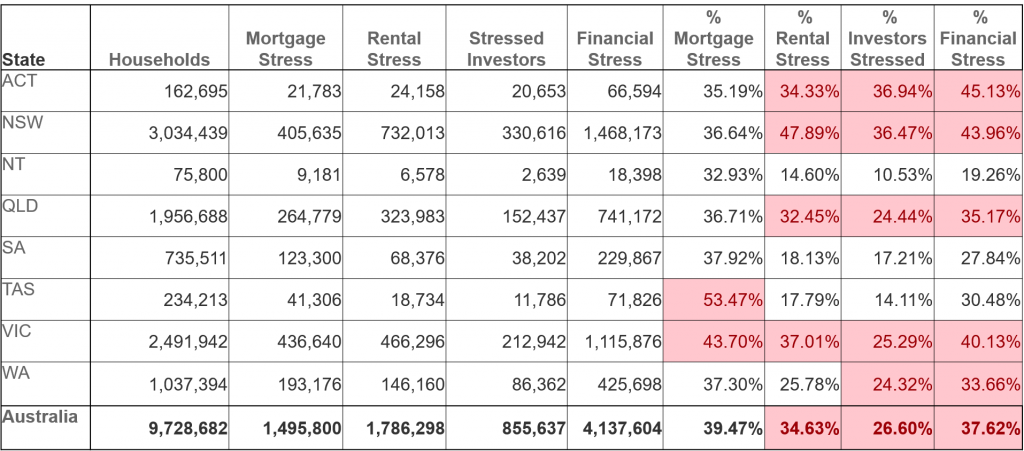

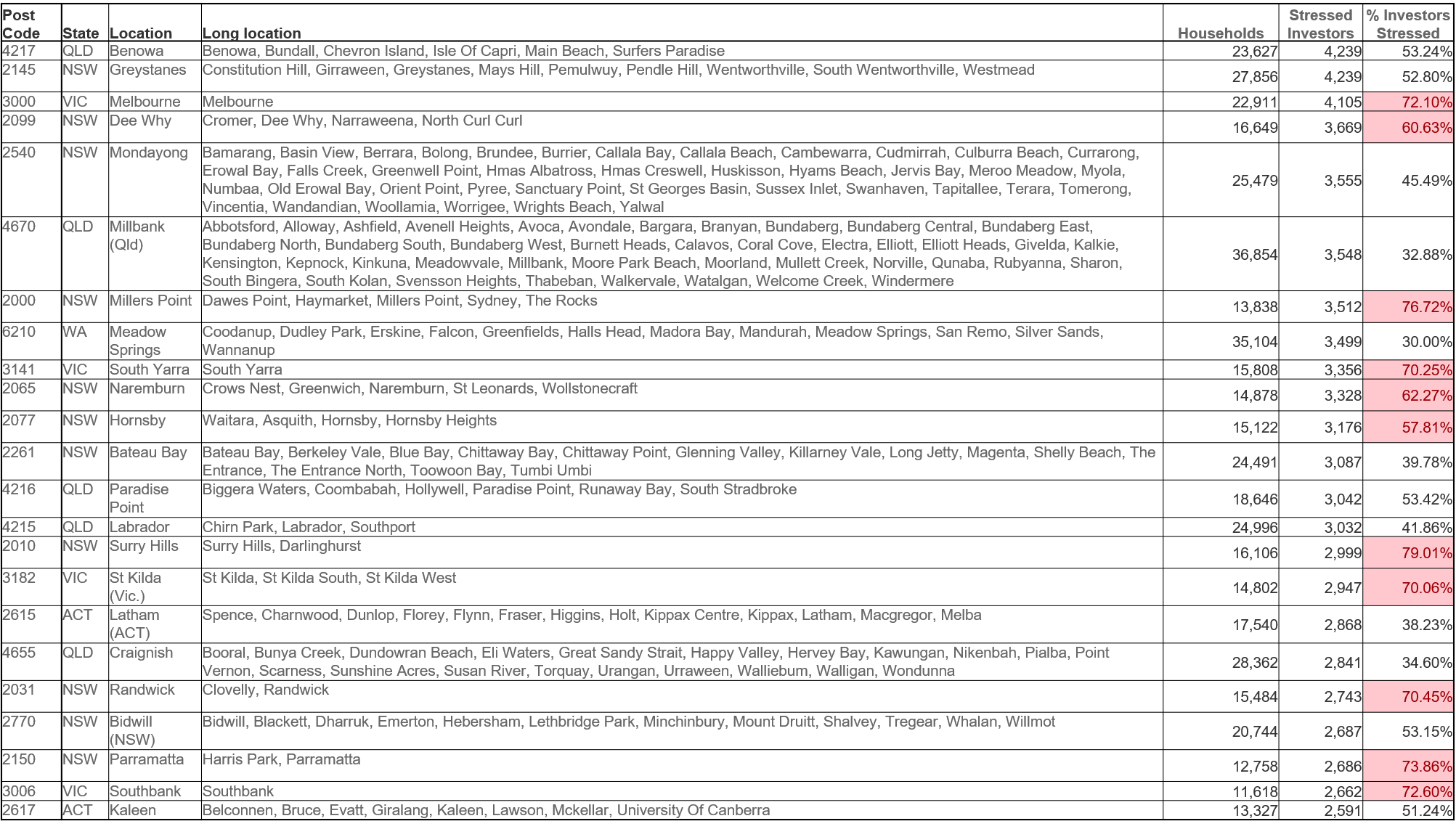

Across the states, mortgage stress fell significantly in VIC, but remains highest in TAS. Rental stress is still elevated, with NSW and ACT having the most significant issues, while property investor stress in also highest in ACT and NSW, thanks to falling returns from rents, and rising vacancy rates in some areas. As a result many property investors are considering selling into the autumn market rise.

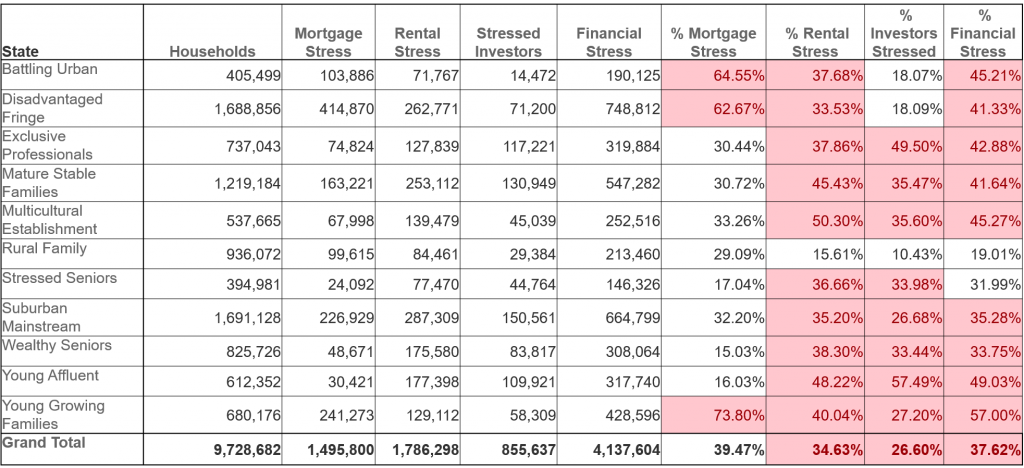

Levels of stress vary across our household segments, with many living on the urban fringe in the high-growth corridors still under pressure. A considerable number of more affluent households, often holding multiple investment properties are also under pressure. Young Growing Families, which include many First Time Buyers remain stretched, with overall Financial Stress (an aggregate of mortgage, rental and investor stress) are the most stressed.

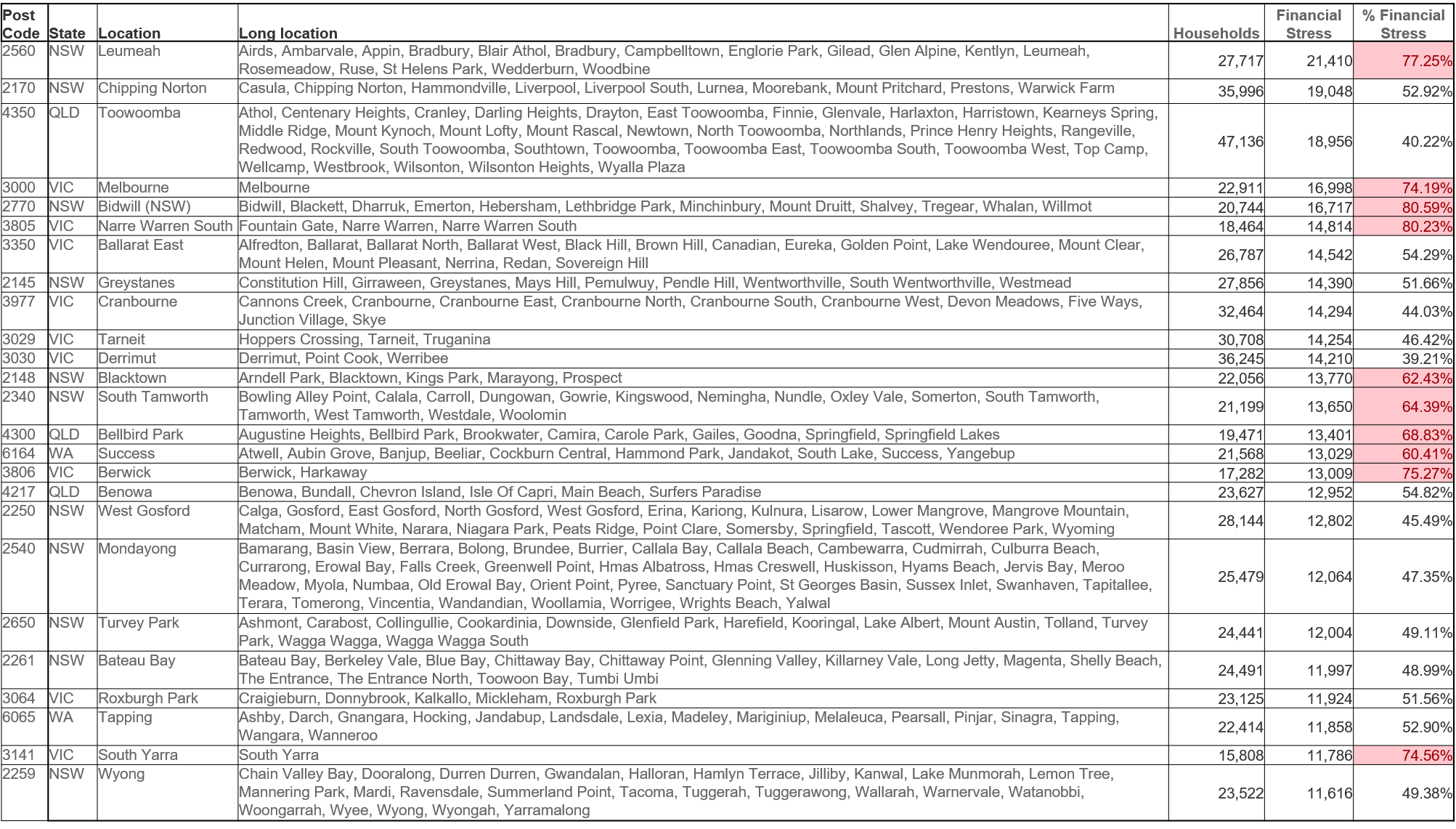

Looking at specific post codes – mortgage stress is highest (by count of households) in Narre Warren 3805, Cambelltown (2560) and Tapping/Wanneroo (6065). All high growth corridors.

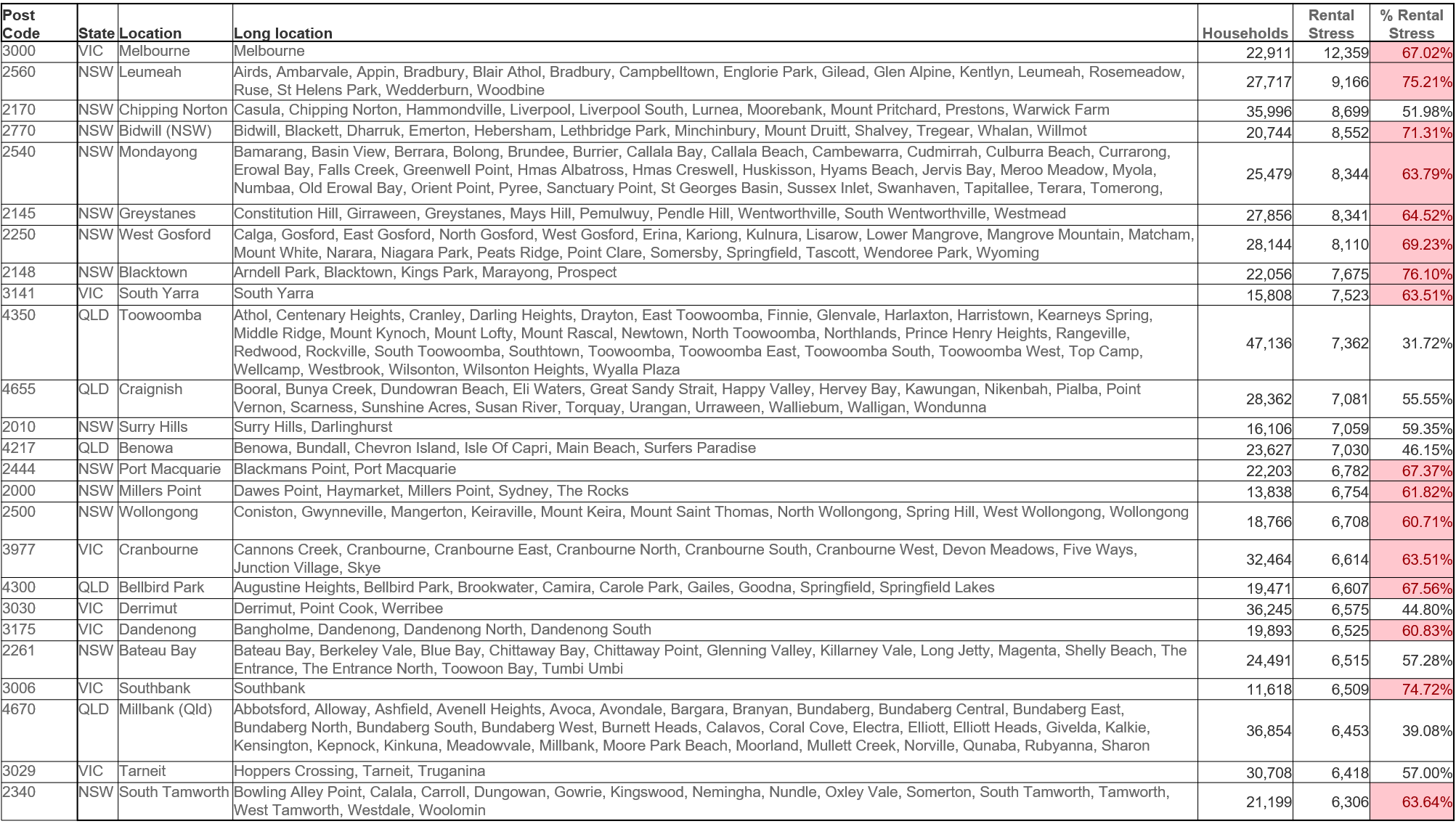

Rental stress is highest in central Melbourne (3000), Cambelltown (2560) and Liverpool (2170). Much of the pressure is from high-rise occupants, as well as in the high growth corridors.

Property investor stress is highest in Surfers Paradise (4217) where tourism is well down, Central Melbourne (3000) and Northern Beaches (2099).

Finally, overall financial stress, our aggregate measure is highest in Cambelltown (2560), Liverpool (2170), Toowoomba (4350) and Central Melbourne (3000).

We discussed this data in detail on our live show last night.

We also updated our scenarios, reflecting the more positive economic news – though retain alternatives where the virus remains less contained. The path of the virus, and its control is clearly directly linked with economic performance and the trajectory of mortgage stress, and home prices ahead.

Join us tonight for our latest live show. You can ask a question via the YouTube Chat, as we examine the latest data, scenarios, and the RBA statement. We will also have our post code data base on line, plus our mapping software. Should be fun!

Edwin Alemida our property insider and i discuss the latest property news.

https://www.ribbonproperty.com.au/

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/

My latest Monday chat with our property insider. Today we deep dive on under-quoting.

https://www.ribbonproperty.com.au/

Go to the Walk The World Universe at https://walktheworld.com.au/

And remember our live show tomorrow with Tony Locantro….

The latest from our property insider Edwin Almeida

https://www.ribbonproperty.com.au/

Go to the Walk The World Universe at https://walktheworld.com.au/

And join us tomorrow for our live stream:

I caught up with George Rousos from ITC to discuss the thorny issue Continuing Professional Development for Real Estate Agents In NSW.

Time is running out…

https://www.itc.nsw.edu.au/our-team

Go to the Walk The World Universe at https://walktheworld.com.au/