CBA, who is on a different reporting cycle to the other majors, released their trading update to 30th September 2019 today. These are unaudited numbers and included some one-off items, but generally it looks like CBA managed to navigate the complexities of the current market quite well. But its all a matter of relativity as all the banks remain under pressure.

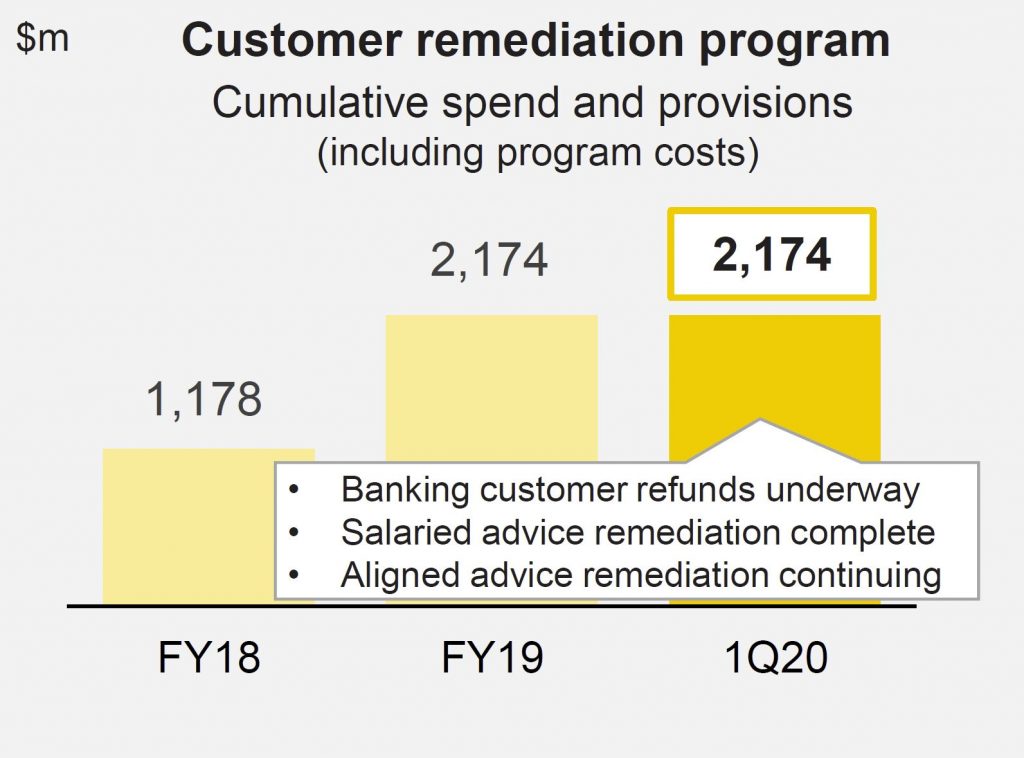

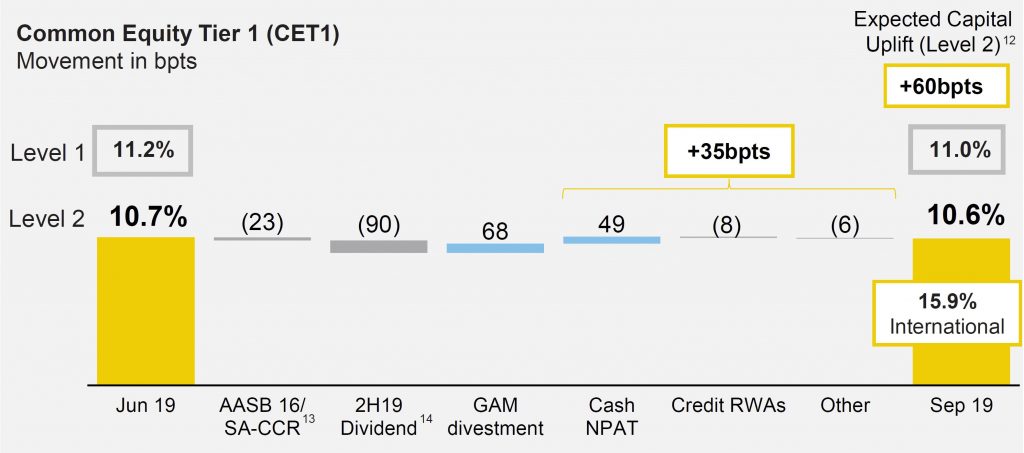

That said, the CET1 ratio was down, there was a considerable increase in corporate troublesome assets (discretionary retail, construction and agriculture), plus pockets of stress across its personal loans portfolio in Western Sydney and Melbourne. The Net Interest Margin was “lower than June 2019 due to headwinds associated with a low interest rate environment, which will continue to impact margins in future periods”. $2.2bn is flagged for customer remediation in program spend and provisions.

They made comparisons with the average of the previous two quarters, which might flatter the results a little. And they may have been later to implement the revised tighter HEM, which might have flattered their loan growth. Overall capital risk wights for mortgages sat at 25.8%.

Worth also noting that according to Banking Day:

Commonwealth Bank was the subject of the highest number of complaints to the Australian Financial Complaints Authority over the year to June, with the other big banks not far behind.

CBA was way out in front, with 3,890 complaints. ANZ, at number two, received more than 1,000 fewer complaints.

Unaudited statutory net profit was around $3.8 billion in the quarter, but this included a $1.5 billion gain from the sale of Colonial First State Global Asset Management(CFSGAM) to Mitsubishi UFJ Trust and Banking Corporation, with a post-tax gain on sale of approximately $1.5 billion.

Net cash profit from continuing operations was around $2.3 billion, up 5% excluding one-offs. This is the figure they want you to focus on!

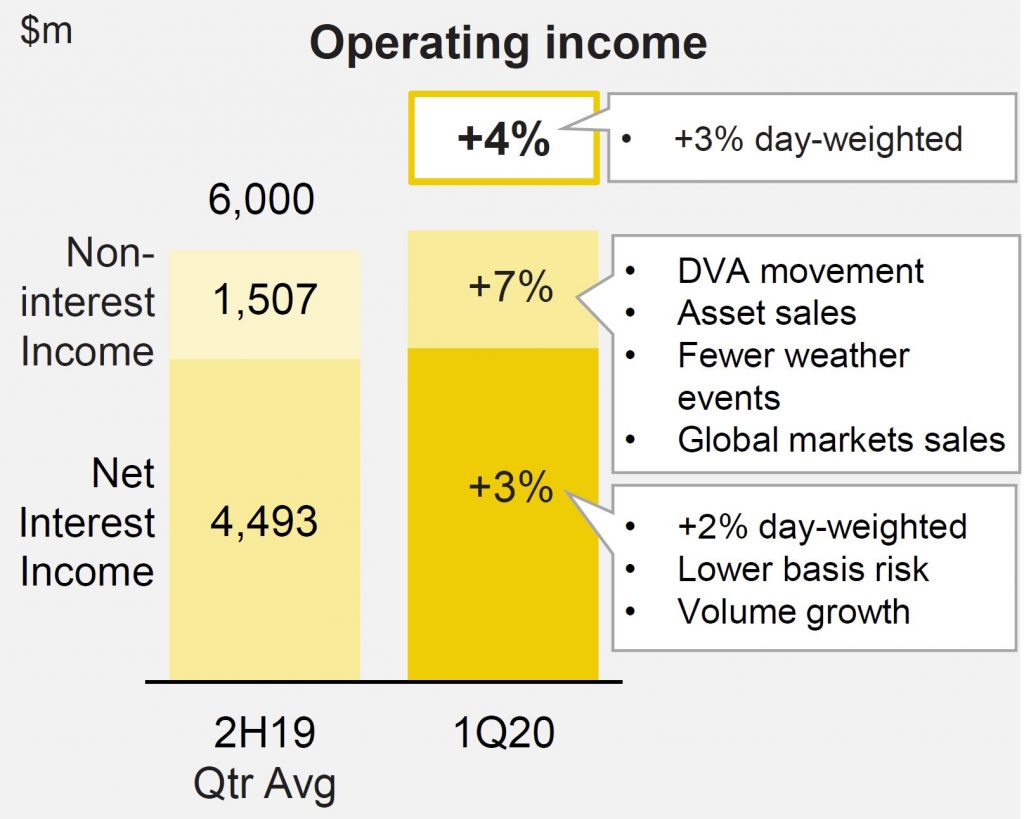

Operating income was up 3% (day-weighted)

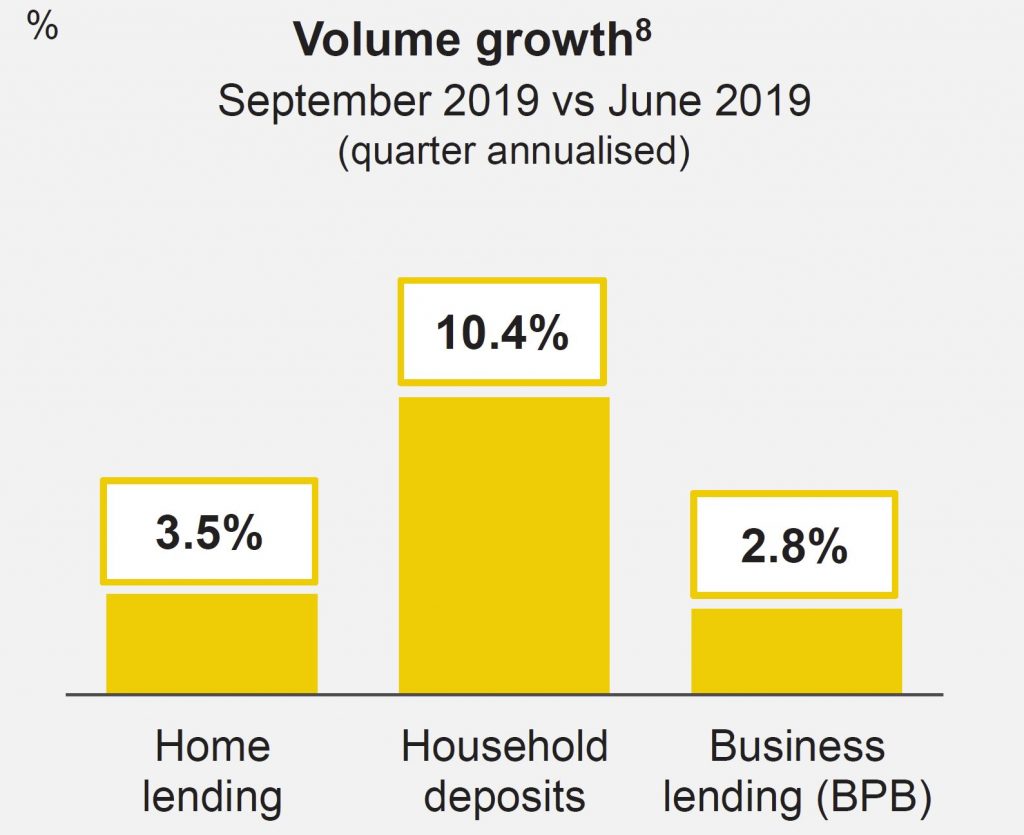

Net interest income increased 3%, benefiting from 1.5 additional days in the quarter. On a day-weighted basis, Net Interest Income was 2% higher, underpinned by volume growth in core markets of home lending, business lending and household deposits.

Excluding a 4 bpt benefit from lower basis risk, the Group’s Net Interest Margin was lower than June 2019 due to headwinds associated with a low interest rate environment, which will continue to impact margins in future periods.

Non-interest income increased 7%, benefiting from timing differences and one-off items including a favourable movement in the derivative valuation adjustment (DVA), asset sales in Structured Asset Finance (SAF), higher insurance income from fewer weather events/claims and higher global markets sales. These were partly offset by lower Funds Management income and the ongoing impact of the Bank’s Better Customer Outcomes program, which continues to deliver customer savings equivalent to annualised income forgone of $415m.

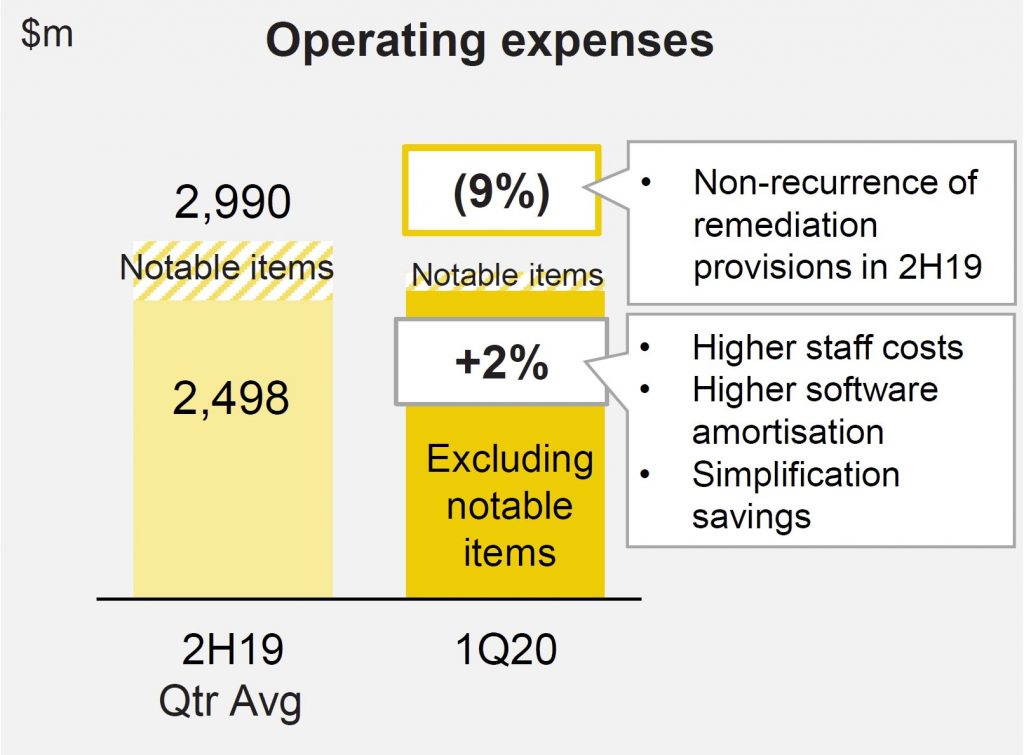

Operating expenses were up 2% (excluding notable items), reflecting higher staff costs and IT amortisation.

Customer remediation continues to drag the results. Of the $2.2bn in total program spend and provisions, $1.2bn relates to customer refunds of which approximately $600m has been paid to banking and wealth management customers to-date (ex aligned advice). Salaried adviser ongoing service remediation is now complete and represented a refund rate of 22% (ex interest). Aligned advice remediation work relating to ongoing service fees charged between FY09 and FY18 is continuing. The aligned advice remediation provision recognised in FY19 of $534m included program costs of $160m, $251m in customer refunds and $123m in interest. This assumed a refund rate of 24% (ex interest) and36% (incl.interest).

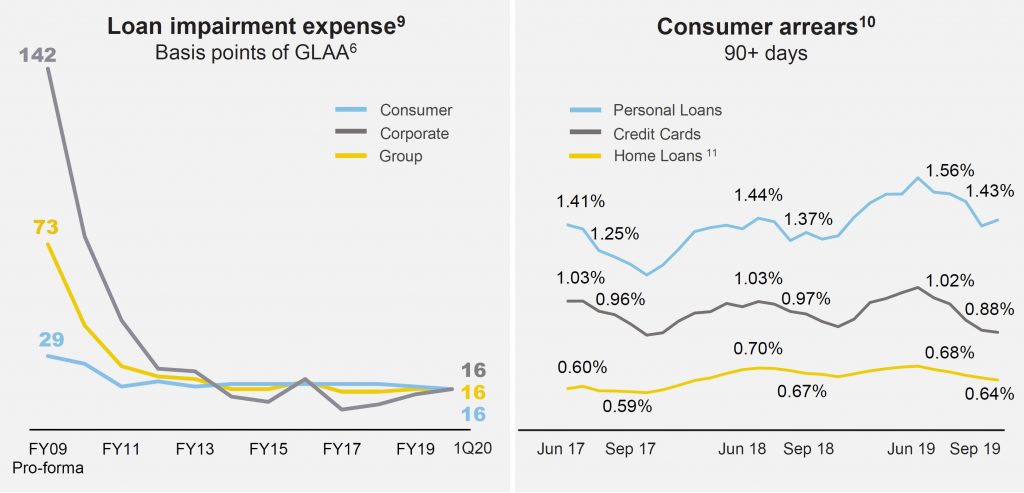

Loan Impairment Expenses were $299m in the quarter equated to 16bpts of Gross Loans and Acceptances, unchanged onFY19.

Consumer arrears improved in the quarter due to seasonality and the benefit of higher tax refunds. Personal Loan arrears rates remained elevated due to lower portfolio growth and continued pockets of stress in Western Sydney and Melbourne.

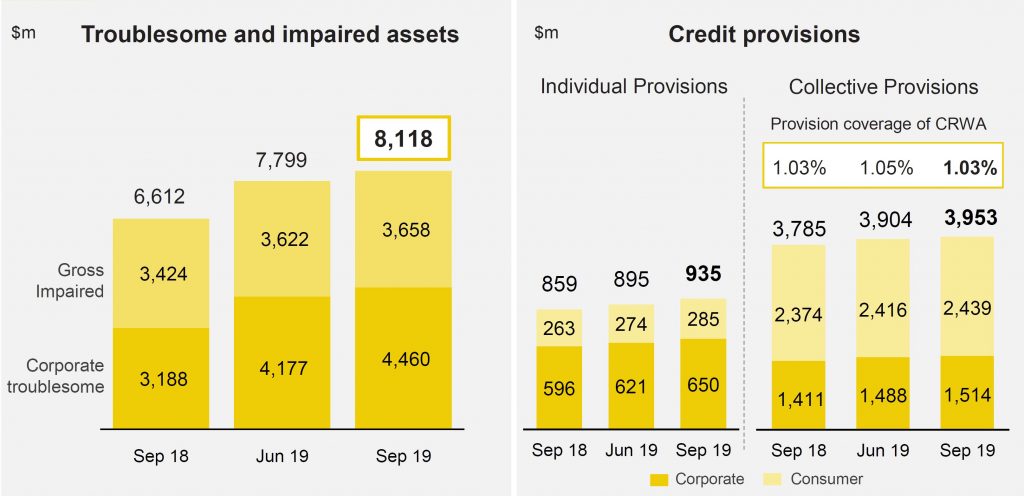

Troublesome and impaired assets increased to approximately $8.1bn. Corporate Troublesome assets continued to reflect weakness in discretionary retail, construction and agriculture,as well as single name exposures.

Total provisions increased by $89m to approximately $4.9bn.

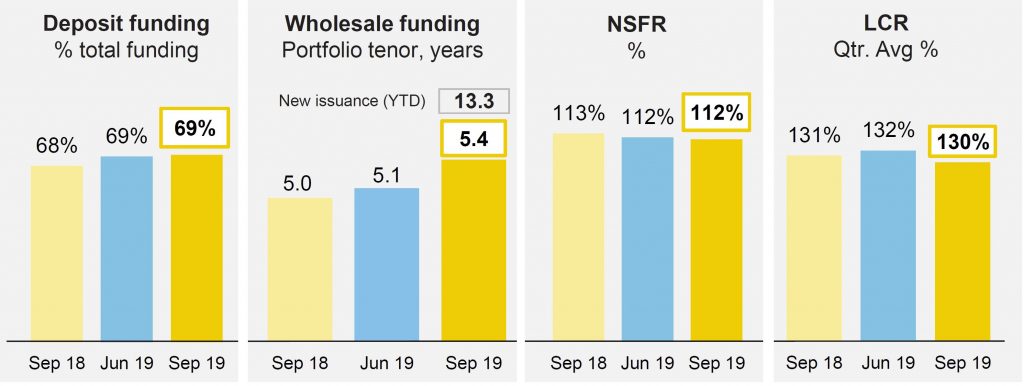

Customer deposit funding was at 69% and the average tenor of the long term wholesale funding portfolio at 5.4 years. The Group issued $5.8bn of long term funding in the quarter, including two long-dated Tier 2 transactions following the release of APRA’s loss-absorbing capacity proposal in July2019, contributing to a weighted average maturity of new issuance in the quarter of 13.3 years.

The Net Stable Funding Ratio (NSFR) was at 112%, the Liquidity Coverage Ratio(LCR) at 130% and the Group’s Leverage Ratio at 5.5% on an APRA basis (6.4%internationally comparable).

The Common Equity Tier 1 (CET1) APRA ratio was 10.6% as at 30 September 2019. After allowing for the impact of the 2019 final dividend and one-off impacts from regulatory changes and the CFSGAM divestment, CET1 increased 35bpts in the quarter. This was driven by capital generated from earnings, partially offset by higher Credit Risk Weighted Assets driven by revised regulatory treatments and lending volume growth. As at 30 September 2019, the Level1 CET1 was 11.0%, 40bpts above the Group’s Level2 CET1 Ratio.

The Group’s remaining previously announced divestments are expected to collectively provide an uplift to Level2 CET1 of approximately 60bpts. As outlined in the Group’s FY19 results, a strong expected capital position creates flexibility for the Board in its consideration of capital management initiatives.

The CBA is not OK!

Bring back the original public people’s bank!

Keep our common wealth in the Commonwealth.